Summary:

- Meta continues to make massive losses in the Reality Labs segment with trailing twelve months showing a loss of $16 billion.

- Over the entire decade, we can expect Meta to spend $200 billion on Reality Labs if it maintains the current momentum.

- Despite the losses, Meta will gain a big advantage from Reality Labs by owning the device, platform as well as the social features.

- Reality Labs will be a key advantage for Meta in its battle with Apple which is trying to squeeze Meta’s advertising capabilities through changes in its platform.

- Most of the negative news from Reality Labs has been priced in the Meta stock and even a modest performance by this division could be a boost to Meta in the long term.

Justin Sullivan

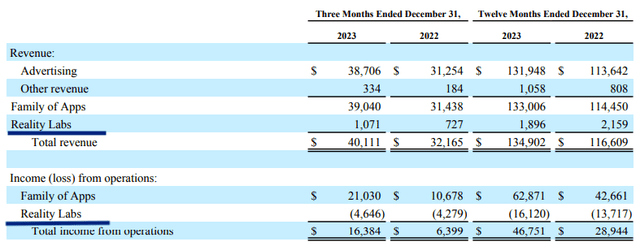

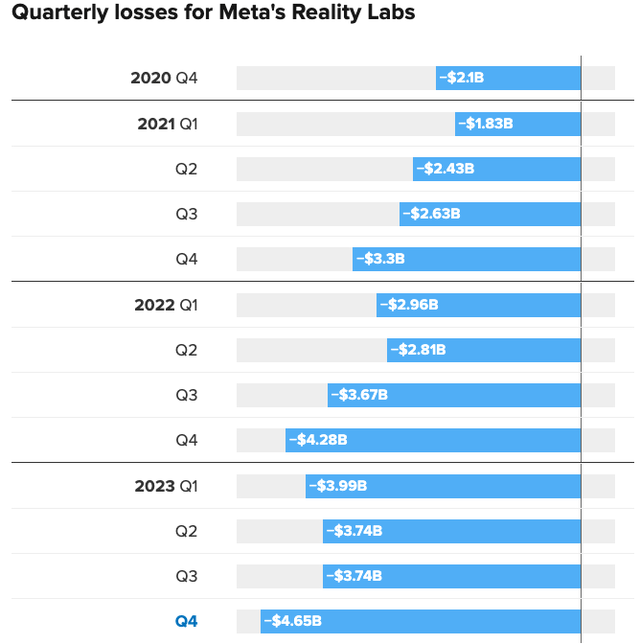

Meta (NASDAQ:META) has reported strong earnings results with massive growth in revenue and earnings. However, there have been concerns over the loss rate in the Reality Labs segment. The management also announced that the next few quarters could see a higher investment in Reality Labs, which should increase the losses in this segment. The loss in this segment is by no means small. In the recent quarter, Meta announced revenue of $40 billion and a loss of $4.6 billion in Reality Labs, which is equal to 11.5% of the total revenue base. Meta has lost more than $42 billion in Reality Labs since the last quarter of 2020, when it started to publish the results of this segment separately. In this decade, we could see the total investment in Reality Labs exceed $200 billion, which is a massive amount even for Meta. The company is showing promise in other segments, but Reality Labs continues to be very important for future stock trajectory, especially after the entry of Apple’s (AAPL) Vision Pro.

Despite the losses accumulated by Reality Labs, there is a big advantage for Meta, which is not reported in-depth. Reality Labs provides Meta with a device, platform, and social connections in a single business. Till now, Meta has seen major headwinds from platform owners like Apple who changed the privacy terms which hurt Meta’s advertising capabilities. Reality Labs will provide Meta with an ecosystem in which it will control all aspects, including the device, platform, subscriptions, payments, and social connections. Meta has already started monetizing Reality Labs, and we could see better revenue numbers in the next few quarters.

I believe most of the headwinds due to Reality Labs’ expenses have been priced in to Meta’s stock. Even a modest performance in terms of device sales and monetization of Reality Labs can change the long-term growth trajectory for Meta and improve the bullish sentiment towards the stock.

Is it a money pit?

Meta has been investing heavily in Reality Labs to gain customer traction and build a better ecosystem. The bill for this segment is staggering, to say the least. Over the last twelve months, Meta has lost close to $16 billion in this segment. Hence, investors are quite concerned over the long-term spending trend in this business.

Figure: Revenue and losses in Reality Labs continue to increase. Source: Meta Filings

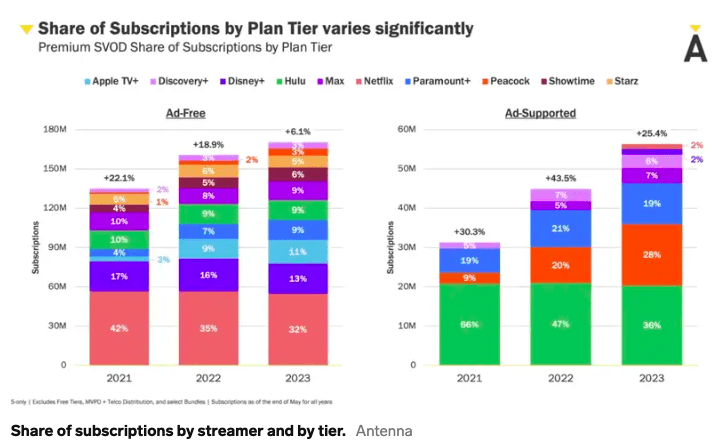

We can compare the investment in this segment to the streaming business, in which many companies have invested billions of dollars. Apple has also invested billions of dollars to build its streaming business. Despite this investment, the churn rate for Apple and many other streaming companies continues to be very high. It is estimated that Apple has a mere 20 million paid subscribers on its TV+ platform, which would cover only a fraction of the total budget.

Business Insider, Antenna

Figure: Subscription market share within the streaming industry. Source: Business Insider, Antenna

Over this decade, Apple could end up spending more than $100 billion to build its streaming business. The jury is still out over the future of streaming market share for Apple and other companies. However, we know that there is a lot of competition with Netflix (NFLX), Disney (DIS), and other companies spending massively to increase their own subscriber base. Customer streaming budget is also limited, which increases the churn rate as streaming players increase their price. It is certainly possible that Apple will end up spending tens of billions of dollars in this decade without seeing a big jump in subscribers or a strong retention rate from customers.

Meta’s expense on Reality Labs looks like a better strategy in this situation. There are very few companies who can invest heavily in VR, and Meta will have a massive first-mover advantage in this segment.

Owning the entire ecosystem

A big issue with Meta is that it does not have any control over the device and operating system used by customers. Apple has already used its privacy terms to cause a big headwind for Meta. Google (GOOG) (GOOGL) also pays a massive amount to Apple to be a default search engine on Apple’s devices. This amount is estimated to be a massive $19 billion annually, and Google pays 36% of search revenue on Safari to Apple.

The biggest advantage for Meta by investing in Reality Labs is that it will be able to control the entire ecosystem. It will own the device, platform, subscriptions, privacy terms, social connections, and every other part of this ecosystem. This gives Meta a massive advantage over the long haul in terms of its monetizing ability and the flexibility to launch new products and services.

Figure: Losses reported in Reality Labs in the last few quarters. Source: Meta Filings, CNBC

This investment is a better option than spending money on streaming content or paying a massive amount like Google to get favorable terms from Apple.

Is it worth $200 billion?

If Meta was reporting losses of one or two billion dollars annually in Reality Labs, it would not have caused a big concern on Wall Street. However, the scale of losses on Reality Labs is truly staggering. Despite the headcount reduction, Meta is reporting annualized losses of $16 billion, with a warning that this might increase in the near term.

Meta has already spent close to $42 billion on Reality Labs since the last quarter of 2020, and it could end up spending $200 billion in this decade. This is equal to a big chunk of its total market cap. Few analysts have suggested that Meta could use the extra cash to reward investors with a better buyback pace or even a dividend.

Meta has started monetization options for Reality Labs. It is unclear what the future trajectory of Reality Labs will look like. However, looking at the investment required in this division, it is highly likely that Meta will have very few competitors in this segment, and it will corner a big market share in this business. Even Apple might not be able to match the investment scale of Meta in this segment.

Bad news has been priced in

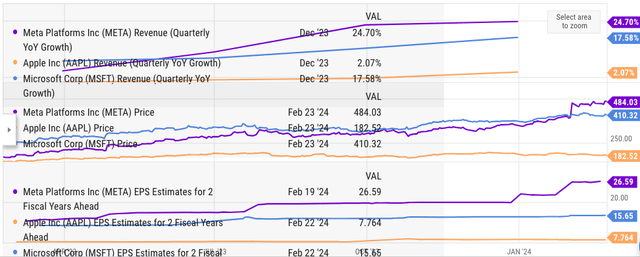

Most of the negative news regarding the Reality Labs has already been priced in the stock. Unless the management significantly increases the investment in Reality Labs, we should see few issues with the stock performance. Meta’s core social platform revenue is very strong, and it is showing the highest YoY revenue growth among big tech companies. The company has also delivered good optimization in the workforce, which has improved the EPS trajectory.

Figure: Comparison of Meta’s YoY revenue growth and forward EPS with other big tech companies. Source: Ycharts

Meta’s revenue growth trajectory is stronger than other big tech companies. The EPS estimate of Meta for 2 fiscal years ahead is $26.5. This shows that the stock is trading at 18 times the EPS estimate of 2 fiscal years ahead. On the other hand, Microsoft (MSFT) is trading at 26 times and Apple is trading at 24 times the EPS estimate of 2 fiscal years ahead.

All of these big tech companies have a lower YoY revenue growth compared to Meta. We have already seen good performance of Meta in Reels and this could be replicated in Threads due to recent troubles at X (formerly known as Twitter). While the expense on Reality Labs is staggering, it also ensures a high barrier to entry and provides Meta with a strong ecosystem, which the company lacked previously.

Investor Takeaway

Reality Labs will continue to be a big expense for Meta, but it is a better option than investing in streaming content or paying massive traffic acquisition costs like Google. Meta will gain control of the entire ecosystem, which should be a massive driver for an increase in monetization capability.

Meta has already started launching subscriptions on Reality Labs, and this should increase as more devices are sold and customer engagement increases. Most of the negative numbers from Reality Labs have been priced in the stock, and it is unlikely that Wall Street will be surprised by any reports from this segment in the near term. Even a modest performance of Reality Labs in terms of customer engagement and monetization could improve the valuation multiple of the stock and deliver better long-term returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.