Summary:

- Meta’s open-source AI strategy is key to its long-term growth, promoting collaborative AI development and Western leadership in AI technology.

- Financial implications of Meta’s open-source AI approach are significant, enhancing reputational, brand value, and operational power rather than immediate profits, potentially leading to AGI development first.

- Risks include reducing the West’s AI moat and empowering bad actors; a cooperative approach with law enforcement and security is essential for managing these risks.

yuriz/iStock via Getty Images

I last covered Meta (NASDAQ:META) in April; at the time, I put out a Buy rating, even though I mentioned valuation concerns that I had. Since then, the stock has gained 2.71% in price. In this thesis, I am reiterating my Buy rating based on my sentiment that Meta could be one of the multipolar corporate leaders in AI in the unipolar global economic system that I believe will continue in the long term to be led by the West. Crucial to my sentiment is that Mark Zuckerberg has begun to be vocal and pioneering in advocating for open-source AI as a method to increase security and growth for dominance in the West in AI. I think this is a crucial strategy to cultivate economic order, and I think his operational stance is likely to be accretive to the company’s long-term growth.

Open-Source AI: Fundamental To Western Leadership

Meta has made AI its top priority for 2024, marking a significant strategic shift that is common across all big tech companies right now. This included the acquisition of compute power equivalent to 600,000 Nvidia H100 GPUs to support the development of Meta AI.

Zuckerberg has been an advocate for open-source AI, and his letter on the topic published on July 23 reads to me like a call for unification in big tech toward collaborative competition in an effort for the West to lead in AI. As a result of such an open-source initiative, it is conceivable that artificial general intelligence (‘AGI’), also sometimes referred to as artificial superintelligence, becomes a multipolar technology that is unified by the collaboration of the corporations that have the most significant moats in it. As Zuckerberg has mentioned, he believes the future of AGI will not be unipolar, and I think this is correct. In addition, what must not be forgotten is how significant Elon Musk was in transforming the world from unipolarity in AI, led by Alphabet (GOOGL) (GOOG), to multipolarity with the birth of OpenAI. Ironically, OpenAI is now closed-source as of GPT-3 and GPT-4, but it provides some access to these models through commercial APIs. What Zuckerberg is calling for, and which I think is likely to propel Meta very hard ahead of its closed-source competition, is a willingness to compete in the open field, which contrasts with Sam Altman’s guarded approach. This makes me bullish on Meta.

Zuckerberg mentioned that open-source AI has the following core benefits:

- Allows for personalization of models.

- Allows for independent control.

- Better data protection.

- More efficient and affordable to run—50% cheaper compared to closed models like GPT-4o.

- Open source allows us to advance faster.

In many respects, I see this as a corporate paradox. Those who cling too much to the power that their AI systems promise are likely to fall further behind in the race than those who let go of control and allow AI to evolve and develop naturally and organically, which is essentially what open source espouses.

Zuckerberg also made a crucial point about open source as a benefit to the safety of AI, something which I think could significantly bolster the long-term reputation of Meta and prevent it from facing bad press for negative events related to AI misinformation, particularly in highly sensitive use cases like healthcare.

…open source should be significantly safer since the systems are more transparent and can be widely scrutinized. – Mark Zuckerberg, July 2024 Open Source Letter

Furthermore, Zuckerberg made crucial points on how AI will be deployed by larger actors to control the potential maleficence of smaller actors in the AI field:

I think it will be better to live in a world where AI is widely deployed so that larger actors can check the power of smaller bad actors. – Mark Zuckerberg, July 2024 Open Source Letter

This ties in closely with his next sentiment, which I also think is critical and is why I am bullish on Meta. Zuckerberg notes that we can develop a lasting “first-mover advantage” in open-source AI, as nation-states like China are renowned for a closed ecosystem approach and are much more controlling. Hinged on the foundational ethos of the West, which is a democracy, such democracy can arguably be instilled in our approach to AI, which, in my analysis, will help to bolster the West’s lead economically as well as promote the inclusive advancements of all participants who choose to utilize the tools. In other words, Meta’s approach to open-source AI is both a selfless and selfish act, and, in my experience, these are often the best kinds. Unfortunately, the closed-source approach may be more akin to selfishness, and I think such an approach to AI at this time could leave us vulnerable to global conflict by disrupting our position in the global order as states like China and India grow more powerful. The use of open-source AI has the potential, in my estimation, to develop a cataclysmic power benefit to Western big tech companies, and I think many Chinese and Indian companies will grow reliant on our advancements as a result of this initiative. It is a very clever sentiment from Zuckerberg, and one I firmly support and hope other big tech companies also integrate.

Financial Implications & Valuation Analysis

The implications of Meta’s approach to open-source AI financially are likely to be quite large, in my opinion, but I do not think the results will be immediate. In many respects, I see this open-source strategy from Meta as a long-term bet with reputational and brand accretion more than profits in any directly translatable sense. That being said, the quality of the apps and the ability for Meta AI to reconfigure, iterate, and even pivot certain parts of Meta is unquantifiable but likely exponentially larger in net benefit compared to if Meta used a closed-AI approach, in my opinion. Crucial to understanding why Meta can do this with more financial ease than other pure AI firms is this:

…a key difference between Meta and closed model providers is that selling access to AI models isn’t our business model. That means openly releasing Llama doesn’t undercut our revenue, sustainability, or ability to invest in research like it does for closed providers. (This is one reason several closed providers consistently lobby governments against open source.) – Mark Zuckerberg, July 2024 Open Source Letter

This is why Meta may become the leader in AI because other providers like OpenAI and Alphabet are trying to sell access to their models, but Meta is approaching this with much more strategic shrewdness. It is focusing on the quality and power of AI rather than the financial benefits of selling AI directly, and as a result, it is not inconceivable that Meta will become the first company in the world to develop AGI. The crucial reason for this thesis is that Meta is committed to open-source AI and that it also isn’t reliant on selling access to its AI for financial stability.

Quantifying the financial benefits of accessing AGI is next to impossible—not only that, but the timeframes of when such AGI could be actualized are also difficult to predict, as the growth is exponential. In my estimation, I do not think it is unreasonable for Meta to have developed AGI in 10 years’ time. I also think at that point it is quite likely that Meta operates a very lean workforce, and I think it will experience high margin expansion as a result of its AGI efforts, as well as potentially sustained growth if it begins to monetize aspects of its AI infrastructure later, once its moat is solidified and difficult to dispute.

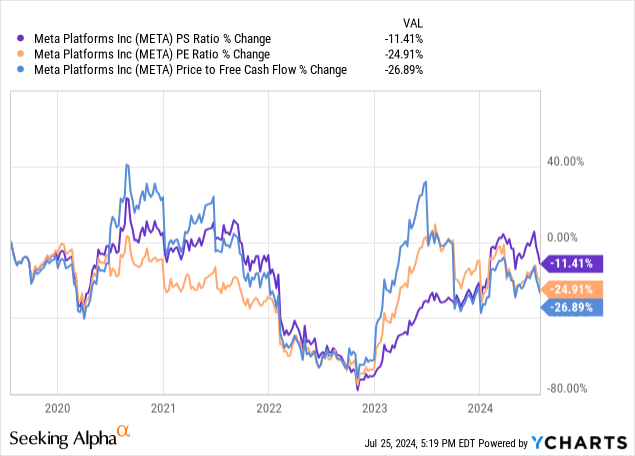

Despite the benefits of AGI, which are likely to accrue to Meta, the valuation at the moment is still high, and I think some short-term volatility in sentiment and stock price could make itself present. That being said, based on historical valuation ratios, Meta isn’t too expensive, and each of its valuation multiples still shows a 3Y contraction, even after the large rebound from the 2022 collapse.

If Meta has a PE ratio of 30 in 2029, expanding from the current ~26 based on growth and margin expansion from AI and automation benefits, and grows its EPS at 25% over the period, the stock could be worth approximately $1,600 in 2029, indicating a potential 29% CAGR in this bull-case outcome. I think this is not inconceivable with the new open-source AI strategy, as I think the margin expansion opportunities for companies who are heavily involved in coding, like Meta, are being underestimated by most analysts.

Risks To Open-Source AI

I think there is a risk that open-source AI as the norm in the USA and other Western countries closes the gap significantly between the West and global counterparts like China. Zuckerberg has mentioned this himself multiple times in recent interviews, and I think he is correct to identify that this is likely to manifest from an open-source approach to AI in Western big tech companies. However, this is also paradoxical because, by open sourcing, the USA can ensure that it develops the most powerful AI the fastest. In effect, open-source will reduce the moat the West has in AI, but it will ensure that it retains the lead. A failure to open source in the West could mean China adopts an open-source strategy at scale first, potentially closing the gap and, in a worst-case scenario, taking the lead.

That being said, a global norm for AI to be open-source creates an egalitarian nature in the technology ecosystem, where the barrier to power is much lower than it ever has been before. This is arguably good and bad, and I think Zuckerberg may be undervaluing the negative implications of such a strategy, even though he has raised recognition of the potential unintended empowerment of bad actors. I think it is paramount that if an open-source approach to AI is adopted by big tech companies at scale, they ensure, with law enforcement and defense, that protective AI systems are both developed and prepared for deployment to deal with bad actors that arise. I think the negative use cases of AI have the capability to be very severe, and I think that monitoring of intent of use, i.e., some barrier to entry of access to source code, could be more beneficial than completely free market access. There is also perhaps the underrepresented truth that smaller malpractice use cases may go unnoticed by authorities and big tech companies, and questions of surveillance from big tech companies could also become problematic if this is one of the tools they use to monitor use cases of open-source AI.

To reiterate, I think Zuckerberg is right about open-source AI, but I also wonder how much of his approach to this is one he is adopting because it will propel Meta to AGI first—in other words, it is a strategic tool the company can use in the AI arms race that other companies which rely on selling their AI to consumers directly cannot utilize. I think it is important for Meta to consider the negative consequences of such a strategy and to begin to take responsibility in advance by developing security systems in partnership with other companies and security bodies within the USA and abroad. Considering the unintended consequences that Meta had on young people through addiction to its apps through dopamine release, I think management needs to be careful this time around that intent and outcome are more aligned. This means a more staggered, cooperative, and perhaps sandboxed and iterative approach at first before deploying the strategy at scale—although Meta has already made its AI technology open-source, I don’t think it’s a bad idea for management to continue to adapt its open-source strategy based on the broad impact this has on society.

Conclusion

In my opinion, it is not inconceivable that Meta is the first company to develop AGI with its new open-source approach to AI. I think it has the potential to significantly outcompete its main competitors, namely Alphabet, which does not release its frontier models as open-source, and OpenAI, which does not release its newer models as open-source; Meta, on the other hand, will be deploying its frontier models as open-source. In effect, this makes me bullish on Meta stock for the long term, despite present risks in the valuation and long-term challenges that could arise with reputation regarding AI malpractice by bad third-party actors made unintentionally possible. I think Meta’s strategy needs to be executed patiently and with care, but I think, by and large, it is the correct strategy to maintain the lead in the field for both Meta and the West. For these reasons, my rating for Meta is a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.