Summary:

- Meta Platforms has strong growth catalysts in Meta AI and AR eyewear, driving growth and potential margin accretion going into eFY26.

- Meta’s user base is growing, with 3.29 billion daily active users and significant adoption of Meta AI, enhancing ad revenue through enhanced content curation and sequence analysis.

- Reality Labs sees 29% YoY growth, with high demand for Ray-Ban Meta AI glasses; I anticipate Orion AR glasses being an eFY26 story.

- Despite higher operating losses in Reality Labs, investments in AI and AR are expected to yield significant future growth and profitability.

NanoStockk/iStock via Getty Images

Meta Platforms (NASDAQ:META) has two major catalysts at play that can generate scaled growth throughout the next two years. Meta is realizing strong user adoption of Meta AI for both content generation and search with GenAI, providing a strong runway for growth in its advertising business. In addition to this, Meta announced its visually appealing AR eyewear, Orion, at its September 2024 Connect event, furthering the path for functional wearables for everyday use. Given the growth trajectory at hand, I recommend META shares with a BUY rating and a price target of $697/share at 18.17x eFY25 EV/EBITDA.

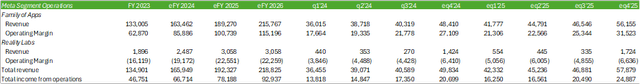

Meta Operations

Meta is continuing to realize growth across its platforms, with 3.29b daily active users across all applications with an average ARPU of $12.29, up 12% on a year-over-year basis in q3’24. Accordingly, daily calls made on WhatsApp have surpassed 2b. In addition to this, Meta’s Threads platform is nearing 275mm monthly active users.

Meta AI is also realizing strong adoption with over 500mm monthly active users. Meta AI is being used for “how-to” tasks, content search, and image generation. In order to build a more robust data set, Meta integrated both Microsoft Bing (MSFT) and Google (GOOG) (GOOGL) to expand on its capabilities.

Meta realized significant growth within the Facebook video player with time spent increasing by 10% on a year-over-year basis. Management will remain focused on improving the user experience for videos by releasing a standalone video tab for a full-screen viewing experience. Accordingly, Meta will roll out these features in the US and Canada before enabling the global market in early 2025.

Online commercial was the largest contributor to growth within the advertising segment. Ad impressions grew by 7% on a year-over-year basis with an increase of 11% in the price per ad. Meta is making strides in improving its advertising platform by mapping out the user sequences relating to ad viewing and actions taking place before and after viewing the ad. Accordingly, this has provided a 2-4% improvement in conversions based on testing within certain segments.

Reality Labs realized a 29% year-over-year increase in q3’24 with an improved margin from the previous year. Eyewear & headsets are also experiencing strong user adoption. Management noted that the Ray-Ban Meta AI glasses are realizing healthy demand with the new clear edition selling out at its Connect event.

In addition to this, management laid out their plan to release Orion, their first fully holographic AR glasses. Orion will utilize Micro LED projectors and optical-grade silicon carbide for the lenses, allowing for users to view AR features with a 70-degree view. The glasses will also come with lightweight wristbands to allow for freedom of movement while interacting with the display content. Since announcing Orion in September, the product will only be available for internal users and a select audience to continue testing and developing the product. Given the low profile of the product and its concealable capabilities, I anticipate Orion to realize strong adoption if released for purchase. Given that Meta’s Ray-Ban glasses run in the range of $329-379, I suspect Orion to come with a significantly higher price tag, potentially in the range of today’s AI smartphones at $999-1,199.

I can see Orion providing many use cases, both for professionals and casual users. The AR glasses can potentially be used for training purposes in a manufacturing facility or an oil rig, at warehouse distribution facilities, or for editing Excel models on the fly. For casual retail purchasers, Orion could be used to stream videos, communicate with others, actively translate foreign languages, or catch up on the news feeds. Given the more appealing features when compared to the Apple (AAPL) Vision Pro, Meta may find more success in user adoption.

Meta is also realizing improvements to user activity through its AI-driven feed and video recommendations, leading to an 8% increase in time spent on Facebook and 6% on Instagram. Meta also introduced the ability to speak with Meta AI as well as the ability to edit and upload images using a text prompt on Instagram.

On the advertising side of the business, customers are leveraging Meta’s GenAI tools to develop ads across the platforms. Accordingly, more than 15mm ads were created with GenAI in the last month. Llama adoption is also gaining momentum across enterprises and government agencies with the release of Llama 3.2. Llama may continue to realize strong adoption with Amazon.com (AMZN) hosting the models on its cloud platform. Meta is currently in the process of developing Llama 4, training the models on a 100,000 Nvidia (NVDA) H100 cluster. Llama 4 is expected to bring forth additional modality capabilities as well as more powerful reasoning; it will also run faster than its predecessor.

Meta Financial Position

Looking out to eFY24, management anticipates higher operating losses as it relates to Reality Labs due to increased investments for product development as well as scaling its ecosystem. Depending on the success of the Orion testing period, I have reason to believe that these investments will provide significant upside potential to the segment’s growth in the coming years. Given that Orion does not have a release date and just began field-testing, I do not expect this product to be released before eFY26.

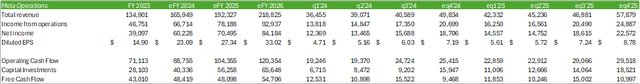

I’m forecasting Meta to report $66.7b in net revenue, with a diluted EPS of $23.09/share for eFY24. Looking out to eFY25-26, I’m forecasting Meta to realize scaled growth through the use of AI, both internally and through external sales. I anticipate advertisers to more heavily leverage Meta AI for ad creation and distribution as Meta continues to improve ad targeting.

Meta invested $9.2b in q3’24, primarily going towards servers, data centers, and network infrastructure. Q3’24 capital investments were impacted by the timing of server deliveries, which will be moved back to eq4’24. Management is anticipating capital investments for eFY24 to come in the range of $38-40b, up from their prior guidance of $37-40b. Looking out to eFY25, management anticipates a continued ramp-up of spending for infrastructure.

I’m forecasting free cash flow to remain relatively flat in eFY25 as a result of the acceleration of investments to support its AI ecosystem. I anticipate that free cash flow will scale with operations as the firm releases its AR glasses, potentially leading to an improved operating margin for Reality Labs.

Meta has a cash & equivalent position of $70.9b and total debt of $28.8b for a net cash position of $42b.

Risks Related To Meta

Bull Case

Customer adoption of Meta AI will likely drive improved user experience for both consumers and advertisers. In addition to this, Meta’s Reality Labs may realize significant growth as the firm releases more visually appealing eyewear, potentially leading the segment closer to profitability.

Bear Case

Consumer discretionary spending is in decline as inflationary pressures have led to tighter budgetary constraints. This may lead to more selective spending and potentially fewer purchases of Meta’s headsets. Meta is also investing heavily into supporting infrastructure for its AI development, potentially leading to narrower free cash flow generation in the coming quarters. If AI adoption doesn’t continue to scale, Meta may be left with more compute power than necessary to maintain its operations.

Valuation & Shareholder Value

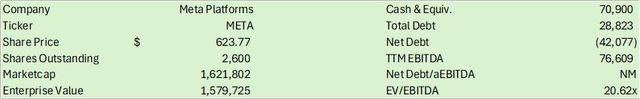

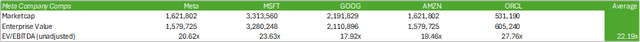

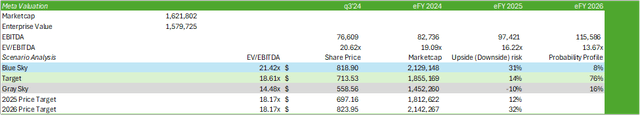

META shares currently trade at a discount to its peer hyperscalers at 20.62x EV/EBITDA on an unadjusted basis. Given the high degree of growth potential Meta has through both the adoption of Llama AI models for advertising and other applications, and the potential runway for Orion, I have reason to believe META shares may realize some upside potential through growth.

Using an internal valuation model based on my eFY25 EBITDA forecast and META shares’ historical trading premium, I believe shares should be priced at $697/share at 18.17x eFY25 EV/EBITDA. Looking out to eFY26, I believe shares could price higher growth at $823/share. Given the high-growth potential and various catalysts at play, I recommend META shares with a BUY rating and a price target of $697/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.