Summary:

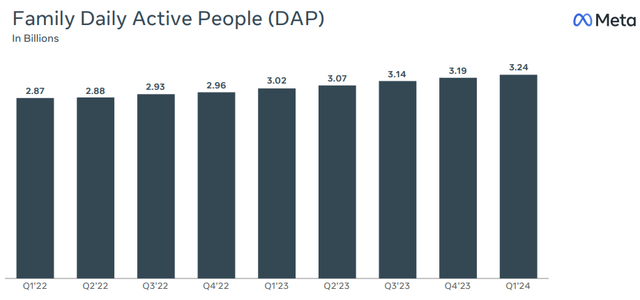

- Meta Platforms, Inc.’s massive installed base of 3.24 billion daily users makes it a monopoly-like business.

- In Q1 the business delivered 27% sales growth. Q2 is expected to show slowing growth due to hard comparisons from the prior year.

- Increasing CAPEX spending pressures profit margins, but Meta is already monetizing its AI-integrated applications, with more to come.

- Even with moderate growth Meta’s stock remains a good balance of growth and value for investors, valued at 25x its FY24 earnings.

- I see the stock as a great opportunity anywhere below $500.

J Studios

Meta Platforms, Inc. (NASDAQ:META), with its widely popular family of apps such as Facebook, Instagram, Whatsapp, and Threads, needs little introduction thanks to its wide reach among consumers.

A staggering 3.24 billion users use one of the apps daily. That is close to 40% of the world’s population, up 7% on a YoY basis with more growth expected.

Through their social media services and engagement, Meta collects data of its users, helping advertisers on the platforms to better target specific audiences and custom-tailor marketing campaigns to maximize reach.

Chinese retailers Temu and Shein are two great examples who have been recently pouring billions of dollars in marketing into Meta, partially responsible for Meta’s 140% price appreciation in the last 5 years, to establish their footprint in the North American market, with success.

One could argue that Meta’s position on the market is monopoly-like. Personally, as someone soon turning 30, I am not using any other messaging platform in my free time outside of Messenger or WhatsApp and very few I know use the closest competitor Tik-Tok or Snap Inc. (SNAP), whose usage is more limited to younger generations.

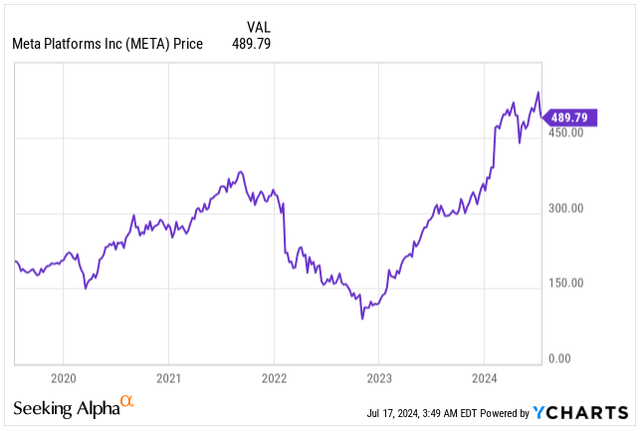

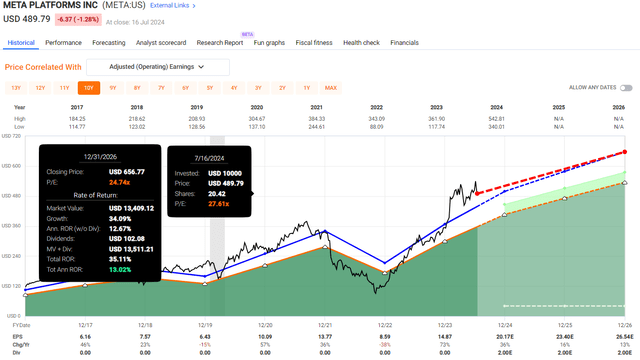

Holding onto Meta’s stock in the last few years might have proved to be difficult, thanks to the 70% share price slump in 2022 partially triggered by its venture into the unproven Metaverse amidst slowing advertising spending, yet in the last 10 years, the stock is up 623%, rewarding shareholders handsomely.

Let’s take a closer look at the business.

Business Update

Meta’s astronomic price appreciation, particularly from its $88 bottom back in November 2022 caught many by surprise, including myself.

Yet, investors should not worry as the price appreciation is well-supported by a significant improvement in fundamentals, with EPS clawing back from $8.59 in 2022 to an expected $20.17 by the end of 2024.

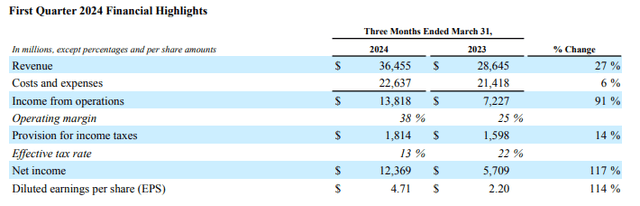

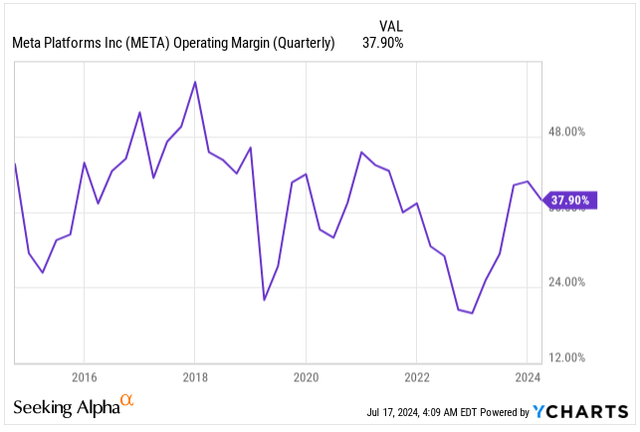

Looking back at the Q1 2024 earnings, reported back in April, the company delivered a strong quarter, with revenue up 27% YoY, reaching $36.5B and Operating Income almost doubling from a year ago, thanks to 1,300 basis points of margin expansion with COGS kept in check.

The profit margin expansion is highly welcome, following years of arguably reckless spending, after which Meta had to reduce its workforce by 22%.

Yet, even with a 38% Operating Margin, there is room for more growth in the following quarters, especially as Meta better monetized its recent AI investments.

Operating Margin (Seeking Alpha)

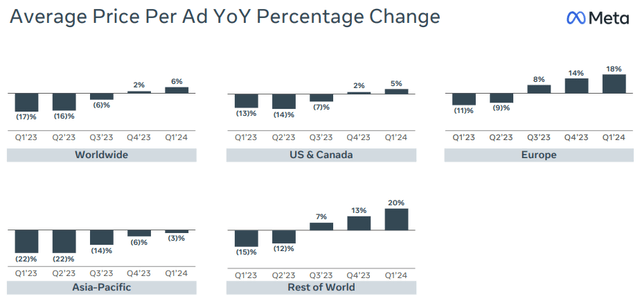

In Q1, the volume of ads increased 20% on a year-over-year basis, signaling a full recovery to the advertising market and strong engagement growth as a result of improving content recommendations thanks to Meta’s AI integration.

In fact, Meta is one of the first examples of successful AI monetization, with up to 50% of Instagram’s content being recommended by AI and 30% on Facebook.

Following almost two years of falling ad pricing, in Q1 the pricing trend has reversed, growing 6% YoY, a positive departure for the advertiser.

One Achilles heel for the company has been the ever-increasing CAPEX spending, now expected to land anywhere between $35B to $40B in 2024, buying Nvidia Corporation’s (NVDA) H100 GPUs to build state-of-the-art data centers on which Meta is planning to further develop its AI applications, which will be key to content engagement and monetization in this decade.

The elevated spending surprised investors as the original guidance was $30B to $37B, making Meta the largest spender on AI hardware from the Mag 7 companies, partially dampening the stock’s appreciation this year as this will be a drag on profit margins.

Meta’s push to AI predominantly revolves around its large language model (LLM) Llama which is open-source, available to developers to build applications on, and power chatbots across Meta apps.

Even though AI integration is a long-term project with multiple monetization avenues, Meta is working relentlessly to keep innovating. The company recently launched AI-powered advertising and messaging tools for businesses for easier access to customers.

Meta’s VR product line-up with integrated generative AI applications will increase user engagement, driving more growth and increasing advertising revenue.

Indeed generative AI presents a major opportunity for Meta. Outside of more accurate ad-targeting and content recommendations, it sees the opportunity to collect fees from 3rd parties using Meta’s technology for automated sales messaging, advertising, customer service, and access to the LLM’s latest models to build their own applications.

It’s not all a walk in the park

Yet, let’s not forget Meta’s history of venturing outside of its core competence, advertising, has not always been successful and we may see a few bumps on the way.

On another note, Meta’s revenue stream is entirely dependent on advertising and its social networks. If advertising growth slows or instead takes a downturn, Meta’s share price could tank, thanks to a lack of other revenue streams.

Take for instance Alphabet, Inc. (GOOG), (GOOGL), another advertising juggernaut, yet the company has multiple revenue streams, including its Cloud Unit and streaming platform YouTube with subscriptions, positioned better to withstand turbulent times.

Meta’s Q2 Expectations

Meta is set to report its Q2 2024 earnings on 31st July, expecting to deliver $38.2B in sales with 19.5% YoY growth.

The expected growth rate is a significant departure from the 27% growth delivered last quarter, but we need to be mindful of the tougher comparison as Q2 2023 has been the first quarter where the advertising significantly recovered.

The EPS is projected to hit $4.7, growing 57% YoY, again significantly lower compared to 114% delivered in Q1.

The key information every Meta investor is likely waiting for with the Q2 release is the commentary around AI integration, and most of all, CAPEX spending, as this will mainly determine the stock’s reaction in my view.

If the stock price drops, thanks to further revision of CAPEX spending upwards, I will be buying the drop relentlessly.

Valuation

Meta’s stock is no longer the bargain it was back in 2022 during the slump when the price hit $88 price and the stock was trading at 9.7x its earnings.

Those who bought the shares at the low are now sitting on a very comfortable 4x gain in a span of less than 24 months, unfortunately, I am not one of them.

Instead, Meta’s shares are trading now at a Blended P/E of 27.6x, below the average of 32x its earnings since the IPO, however, slightly above the 24.7x average of the last 10 years.

In the last 10 years, the EPS grew at an annualized rate of 20.2% and the growth is not expected to significantly slow down in the following years either:

- 2024: Expected EPS of $20.17, 34% YoY growth.

- 2025: Expected EPS of $23.40, 16% YoY growth.

- 2026: Expected EPS of $26.54, 13% YoY growth.

Thanks to the expanding profit margins, better engagement driving the ad revenue growth, and new ventures, Meta is poised to keep growing its bottom line, for the remainder of the decade.

I am expecting the company will be able to deliver around 12% – 15% EPS annual EPS growth beyond 2026, as long as their business is not disrupted.

Having said that, when buying the shares anywhere below $500, which I consider fair value based on 2024 expected EPS of $20.2, valuing the company at 25x its forward earnings, I see a good potential for investors for ROR of around 13% annually.

Takeaway

Meta is no longer the bargain it was during the 2022 market downturn, yet the company presents a good balance of growth and value for investors looking to earn market-beating returns.

The company is planning to invest up to $40B this year in partnership with Nvidia in AI data centers to boost its AI-driven engagement, which in turn drives higher ad revenue spend.

Being able to monetize AI-recommended content is key to shareholder satisfaction in my opinion, and Meta is among the first ones to showcase its success.

Even though the growth is expected to slow down in Q2, thanks to hard comparisons from the previous year, if Meta does not fail to deliver on the top and bottom lines and the CAPEX spend does not further balloon, I am expecting a positive market reaction.

On the other hand, if we see CAPEX-spend-induced selling I will be buying, as buying the shares anywhere below $500 presents a good long-term value at 25x its FY24 earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, NVDA, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.