Summary:

- MSFT is not traditionally cheap, but it has been very resilient. And I can’t argue with the quality here.

- My investment style limits how aggressive I will be, but I do see an opportunity to earn strong yield and some upside via MSFO, a buy-write ETF on MSFT.

- I added a starter position in MSFO based on a trio of technical and quantitative observations detailed and pictured here.

HJBC

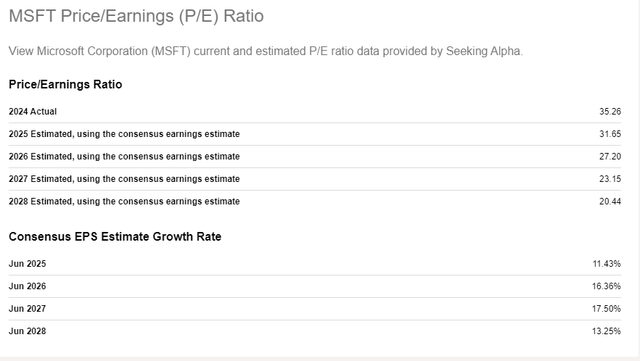

Here’s what investors may not realize about the giant, iconic Microsoft (NASDAQ:MSFT), proud member of the Magnificent 7, and the reason I was able to create a very nice PowerPoint presentation for my Yield At a Reasonable Price (YARP™) earlier this week, and have fun doing it. MSFT might be “too big to fail,” but it might also be just too inexpensive to ignore. How can that be at this very moment, with the stock trading at 35x trailing earnings? As shown below, it is growing those earnings nicely, but at not even half the P/E Ratio.

Seeking Alpha

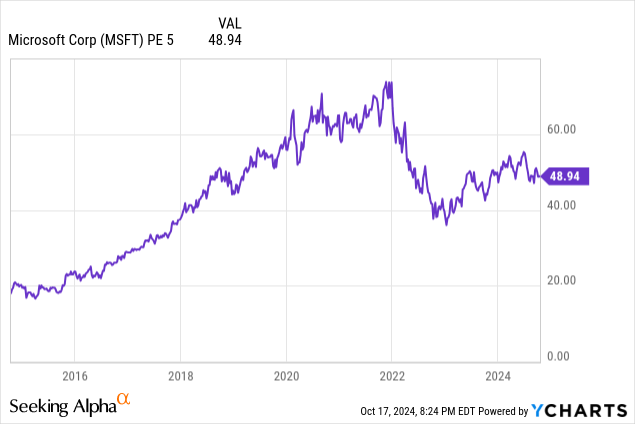

And when we smooth the earnings, so that the past 5-year average is the denominator, it is down from where it has been, but still a hearty 49x multiple. Not cheap!

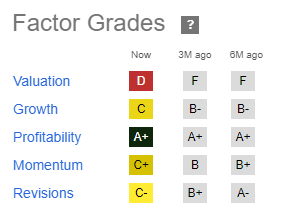

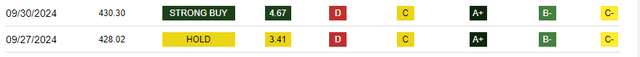

I am a fan of the Seeking Alpha Quant Grades, but this high-level view shows a valuation grade of D. Although that is up from F, but that’s not a slam dunk quantitative buy signal by any means. And relative to its sector, that growth grade of C is also slipping, along with some serious slippage in the Revisions grade. No easy signs of cheapness here.

Seeking Alpha

But I’m not a fundamental analyst. Never have been. Somehow, I survived without CFA-like skills for a few decades and lived to tell about it. But that’s also why I truly respect those who have mastered that aspect of securities analysis. But I’m about price analysis, and related aspects of sizing up stocks. And while most of my work is dividend-focused, MSFT is one of those companies that we all keep an eye on. I have my eye on it, and here’s what I see.

There’s no doubting the size and strength here. And its investment in Open AI, leadership in the cloud business and long-term trust of its clients are clearly competitive advantages. Those mean something, regardless of what the recent earnings, sales, and cash flow multiples look like. Monopolies are hard to come by, and MSFT is nearly one in some parts of its business.

But none of that is what I’m looking at here. Because if modern markets have shown us one thing, it is that stocks can go up, stay up, and stubbornly stay up, longer than any bear can imagine. Or, as my late father, who taught me to chart stocks at age 16 (1980) told me as his very first rules of investing:

1. You never know how high a stock will go

2. You never know how low a stock will go.

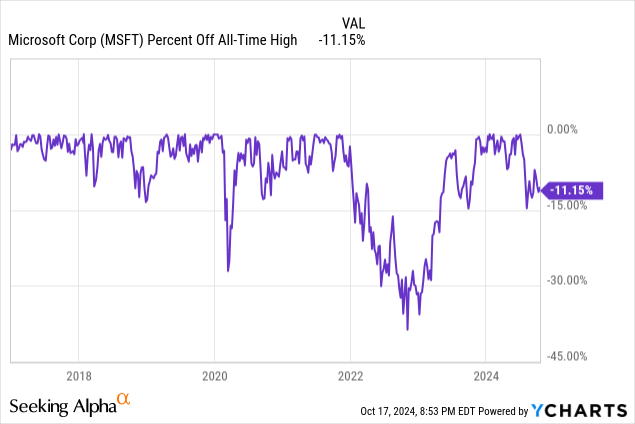

Let’s start with this. MSFT is about 11% below its recent all-time high, reached back on July 5 of this year. That was a month before the Yen carry trade mess shocked the market lower, but only briefly.

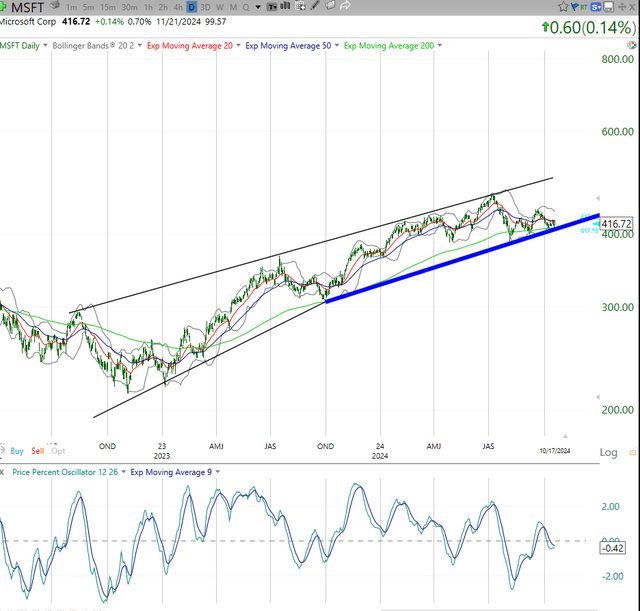

This is a more traditional “technical” view. But I see something that lends credence to my belief that while MSFT and other mega-cap stocks don’t tower atop my list of “steals at the current price,” I’ve adapted over the years to a simple state of affairs in today’s stock market: there’s so much liquidity chasing fewer and fewer stocks, they have what amounts to a fortified put option under them.

TC2000 (SungardenInvestment.com)

And, while it can break at any time (which is why I limit position sizes in such stocks within my portfolio), a trend is in place until it is broken. And that’s why I was impressed when MSFT bent but didn’t break late last year, then again this past summer. I drew the rising trend in the thin black lines at the top of the chart above, but then adjusted the lower boundary to account for the “save” the stock made when it could have easily fallen through. I’ve seen it a thousand times, but not here. So that matters to me.

And thus, the heavy blue line to remind me that this is one tough stock to break. $390 has been a landing spot for MSFT in April, August and September this year. So that level, about 6% below where it closed Thursday, is one “line in the sand” to point to going forward.

That’s one peg of my 3-legged stool that prompts me to take another step into the YieldMax ETF world, via a modest starter position in the YieldMax MSFT Option Income Strategy ETF (NYSEARCA:MSFO), as I did with the Nvidia version of that security I included in my review of that stock recently.

More on that specific decision below. I have two more legs of the stool to discuss first. Because even a stubborn Mag-7 skeptic like me can appreciate something: when these great businesses, no matter how overvalued by traditional measures, bend but don’t break, with all the liquidity-driven, S&P 500 index-loving buying power behind them, I’d rather have a modest long position than be aggressively betting against them.

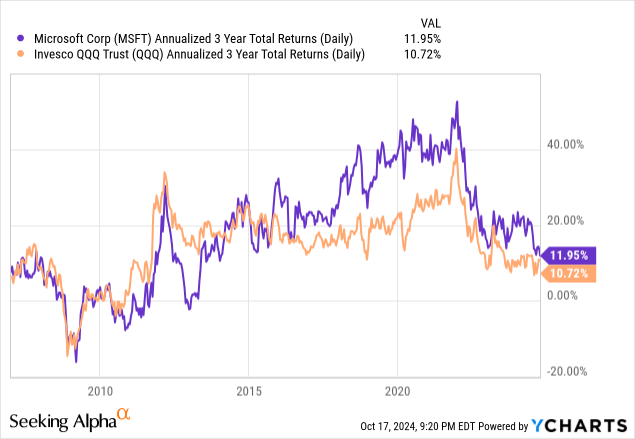

Here is a chart of 3-year rolling returns for MSFT. At “only” 12% per year, it is in line with QQQ, which historically speaking is not common. It hasn’t outperformed by this narrow a gap since about nine years ago. Cheap to the max? No. But notable.

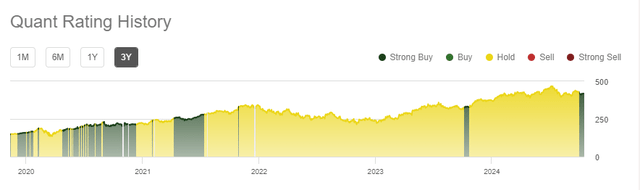

The last leg of that proverbial stool is the bottom-line quant rating history. The past few times MSFT’s grade rose to Strong Buy, the gains were strong in the 6-9 months to follow.

Seeking Alpha

And what just happened as last month was ending? This. A big boost to Strong Buy from Hold.

Seeking Alpha

Now, I’m not “wedded” to this type of analysis for all stocks. But I can’t do a credible YARP analysis on a stock yielding 0.80%. And MSFT without a yield is a hold for me. But as noted below, add in that covered call income, and my willingness to hedge against stock market calamity through owning put options on SPY or QQQ or both, and this is more like a customized part of my portfolio that helps complete an “option collar.”

That is, the macro market put options provide the protection (and MSFT is a big part of both indexes), and this is how I am comfortable owning Mag-7 stocks. I’ve missed enough mega rallies due to my conservative nature, that I’m game to take a small position in something that allows me to participate and get my “fair share” of these types of stocks, without risking the house doing so. After all, I’ve managed assets through an 80%+ drop in QQQ (2000-2003).

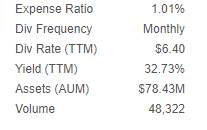

MSFO: far less famous than its underlying stock

When I wrote earlier this month about NVDA/NVDY, I noted that the latter, the covered call version of it from YieldMax ETFs, was a $1 billion ETF. For some reason, that is not the case with MSFT. Maybe because it “only” has a trailing yield of 30%. As noted in that earlier article, I’m not counting on 30% yield. I just want to try to capture some income for as long as this liquidity-driven run in MSFT and its tech peers continues. And importantly, if it stalls but does not crash, that covered call writing mechanism is a great cushion. So to me, it makes it “over the bar” for a modest allocation in my YARP portfolio.

Seeking Alpha

YieldMax ETFs

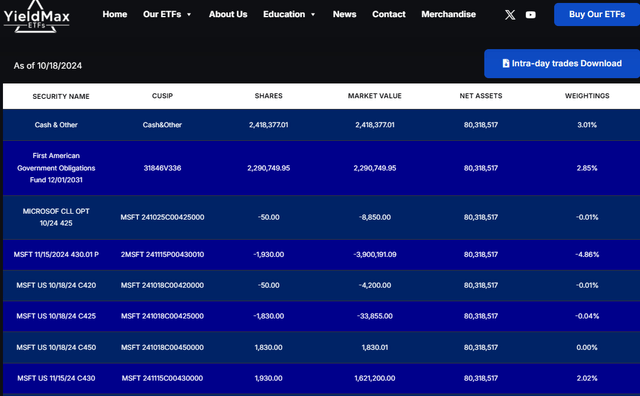

With MSFO, the call option combination looks like this currently (I’ve posted above only the section of the holdings that include the put contracts, as the rest is essentially T-bills).

* A pair of options rolling off (expiring) the day this article posts to Seeking Alpha. Those are the 10/18 calls.

* A week ago, those were essentially replaced as they are monthly, and so the true core driver of this portfolio now is the pair of options expiring on 11/15/24. First are long calls struck at $430 (cash paid for those creates a simulated position in MSFT, using what is now only 2% of the portfolio value. Second are the short puts (sold to receive cash) which are of equal/opposite share value to the calls described above. If MSFT rises to about $430, MSFO could be forced to buy the stock there.

Translation: if MSFT stays below $430, not much happens except the ETF keeps the premium received. If it spikes, the calls will benefit up to that point, but then the puts will force a sale at that level. Bottom line: upside limited, downside limited, cash flow solid. Each month, wash, rinse repeat.

Here’s the kicker

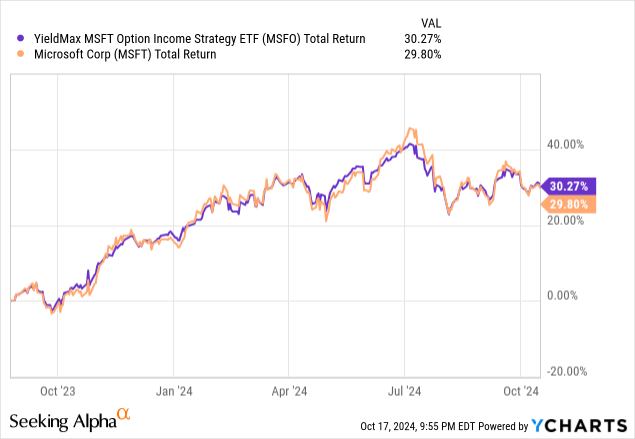

Note of interest, at least to me: that sub-header immediately above matches the name of a horse I own a very small ownership piece in. More importantly, the “kicker” to the MSFT/MSFO story for me is that in a year plus of existence, MSFO has participated in the ups and downs of MSFT, and it has been a good experience generally.

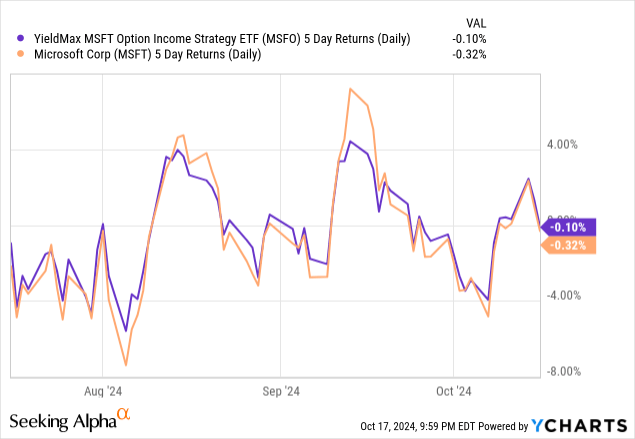

But that second chart above shows that something is going on to limit the losses, however moderate they’ve been, when MSFT starts to dive. This is the key to the structure of those ETFs. They don’t prevent all loss, but they do have limits. So all things considered, I’m adding MSFO to my portfolio alongside NVDY (NVDA version of the YieldMax line of ETFs), and will track the progress. And enjoy the cash flow.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I don't own MSFT. MSFO is what I own, so that has a buy rating, as my preferred way to be exposed to MSFT is through MSFO.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.