Summary:

- Microsoft Corporation’s strong financial performance, diversified revenue streams, and impressive results could attract more investors, and push the stock price higher.

- The dominance of Microsoft Azure in the cloud computing market as well as early-mover advantage in AI could be a significant driver of stock price growth.

- Microsoft’s strategic acquisitions, investments in innovative technologies, and consistent dividend payout and buyback program could contribute to stock price appreciation.

- I think Microsoft‘s business model deserves a P/E multiple of 30x against the company’s FY 2025 earnings, suggesting an implied target price of approximately $415 per share.

jewhyte

After decades of strong growth and financial profitability, Microsoft Corporation (NASDAQ:MSFT) is still outperforming most tech companies on multiple considerations, including innovation, growth, margins and competitive moat. Looking ahead, I view Microsoft as a company with a continued, exceptionally promising commercial future. And accordingly, I strongly believe that the software giant is poised to deliver more financial gains to investors.

In this article, I highlight 5 reasons why I think Microsoft is a “Buy and Hold” for the next decade: (1) Strong financial profile and performance; (2) subscription-based, asset-light business model; (3) tech dominance and continuous innovation; (4) successful “buy & build” through acquisitions track; and (5) share buybacks. Microsoft stock is a Buy.

Strong Financial Profile and Performance

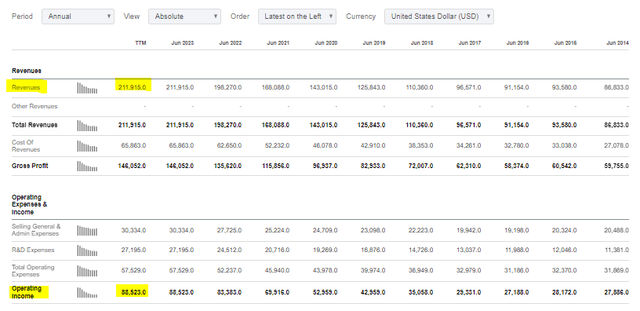

Microsoft has a long and solid track record of strong financial performance, including steady revenue growth and value accumulation. For context, during the trailing twelve months, Microsoft generated about $212 billion of revenues, which is approximately 142% higher than what the company achieved a decade ago (CAGR of ~10%). During the same period, Microsoft’s earnings from operations more than tripled, to $88.5 billion (CAGR of almost 12%). That said, Microsoft’s financial success is built on the backdrop of well-moated software products, which are by now considered staples for many businesses and individuals alike. Moreover, the software portfolio’s monetization strategy through subscription-based models has created both a steadily growing, as well as recurring revenue stream.

Also notable, although not surprising, is that Microsoft operates on a net cash position, with the company’s Q4 FY24 disclosing $111.3 billion of cash and short term investments, against $79.4 billion of financial debt.

Subscription-Based, Asset-Light Business Model

Microsoft operates a very asset-light business model, which deeply anchors on a software-based value proposition (as the name Microsoft implies). In fact, almost everything Microsoft does involves a high percentage of both software and subscription, including Windows, Office, Azure, LinkedIn, and Gaming (Xbox). The software-heavy, and thus asset-light business model, allows Microsoft to commercialize efficiently, scale rapidly, and stay competitive in the ever-changing software tech ecosystem. More specifically, it enables Microsoft to focus on innovation and respond quickly to customer needs while minimizing the risks and costs associated with physical assets. Moreover, Microsoft doesn’t need as much CAPEX to cover asset depreciation, which positions Microsoft to pay-out a very high share of earnings to investors (will be discussed later in the article).

Tech Dominance & Innovation

Whatever exciting tech trend an investor can think of, Microsoft likely has skin in the game through one or more products, or R&D projects. In cloud computing, Microsoft Azure is one of the leading platforms globally, offering a vast array of services that enable businesses to build, deploy, and manage applications through Microsoft’s global network of data centers.

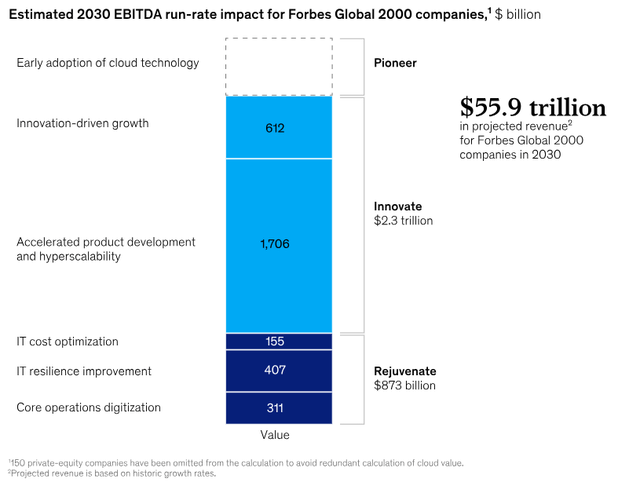

In that context, Azure caters to a wide range of needs, from hosting websites and applications to handling complex data analytics and machine learning workloads. This, paired with Microsoft’s openness and ability to engage in strategic partnerships with, for example OpenAI, will likely ensure that Microsoft maintains a dominant position in the cloud market for years to come, if not decades. In fact, going forward, Microsoft is poised to benefit from the growing availability of data, declining cost of infrastructure, and expanding capabilities of software, which could bring the cloud market to a $3 trillion EBITDA run rate by 2030, according to McKinsey.

Related to the Azure/ cloud commentary, it is also noteworthy to point out how committed Microsoft is to leveraging Artificial Intelligence applications. In the past, Microsoft has developed products like Azure Cognitive Services and Microsoft AI for Earth. More recently, and perhaps most noteworthy, Microsoft has partnered with OpenAI to leverage the startup’s highly popular ChatGPT language model for several applications, as well as the company’s Codex, and DALL-E2 models.

Overall, I see Microsoft in the pole position to capture the likely enormous commercial growth tailwind from the global generative AI race, not only because Microsoft will likely be a leader in developing the technology, but also because the company has. A vast opportunity set to commercialize AI for Microsoft’s broader productivity-driven software portfolio.

Successful “Buy & Build” Through Acquisitions

Microsoft has a proven track record history of executing on strategic acquisitions, helping the company to capture growth tailwind in key technologies and industries. Specifically, the acquisition of LinkedIn and GitHub stand out.

Microsoft acquired LinkedIn in 2016 for approximately $26 billion. The deal not only gave Microsoft access to a vast professional, social network, with about 850 million members as of September 2023, but also enabled Microsoft to broaden the company’s footprint in the enterprise space, through talent management and corporate employer brand advertising. Today, LinkedIn has been seamlessly integrated into Microsoft’s productivity suite, with features like LinkedIn Resume Assistant in Word and LinkedIn Sales Navigator in Dynamics 365. Moreover, Microsoft has been able to leverage LinkedIn’s data and insights to enhance its broader ecosystem of products and services, particularly in the fields of talent recruitment and professional networking, as LinkedIn runs on Microsoft Azure, and the company has used AI to improve LinkedIn’s user experience.

Also notable as an example for successful “buy & build” through acquisitions is Microsoft’s acquisition of GitHub in 2018, for $7.5 billion. The deal reinforce Microsoft’s standing in the developer community for open-source software. Following the acquisition, like LinkedIn, Microsoft has maintained GitHub’s independence while integrating it into its broader ecosystem. Developers still enjoy the same level of access and collaboration as before, but GitHub has been linked with Microsoft’s Azure cloud services, which improves developers’ software experience through access to a seamless platform for building, testing, and deploying applications.

Microsoft’s latest growth vertical through “buy & build” relates to the company’s takeover of Activision Blizzard (ATVI). While Microsoft must yet fully disclose and prove the strategic rationale behind the acquisition, I have no doubt that the deal will give Microsoft a pole position in capturing the Metaverse growth tailwind through best-in-class cloud gaming experience — by combining the Xbox’ ecosystem with Activision’s content and IP.

Dividend and Share Buybacks

Finally, investors should consider that Microsoft’s strong financial performance and commercial success accumulate in attractive shareholder returns through dividends and share buybacks. Specifically, because Microsoft’s asset-light and subscription-based business model requires little CAPEX investments, Microsoft is quite unrestricted in returning the business’ strong cash inflow directly to shareholders, with buybacks potentially boosting the stock price over time.

For context, during the trailing twelve months, Microsoft generated about $87.6 billion cash from operations, of which the company distributed close to 50% to equity holders — $19.8 billion in the form of dividends and $22.2 billion in the form of stock buybacks. This is quite attractive; however, I think the shareholder distributions do not yet fully reflect Microsoft’s steady state potential. In fact, companies like Google and Apple frequently pay out 80-100% of their earnings. Given Microsoft’s asset-light, software heavy business model, a similar payout ratio should be in the cards, once Microsoft doesn’t need as much cash for growth projects anymore.

Conclusion

Microsoft operates an exceptionally high-quality business model, which combines a leading, diversified position in software engineering, with a strongly subscription-based monetization strategy. Moreover, with commercial activity in Cloud, AI, as well as the Metaverse (both with infrastructure, and consumer interface through gaming), I see Microsoft well positioned to sustain an above 10% CAGR through the next decade, at least.

Personally, I think Microsoft‘s business model deserves a P/E multiple of 30x against the company’s FY 2025 earnings, suggesting an implied target price of approximately $415 per share, according to consensus EPS estimates collected by Refinitiv. Microsoft is a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.