Summary:

- Despite a short-term slowdown in revenue and earnings growth, Microsoft is expected to capitalize on the upcoming technology investment cycle.

- Microsoft’s management has shown their willingness to continually improve the business through actions such as investing in OpenAI, acquiring Activision, and building out AI and computing infrastructure.

- We believe Microsoft’s management can continue to strike the right balance between shareholder returns and investments in growth, making shares reasonably valued at these levels.

Jeenah Moon

Thesis

After a massive YTD rally, Microsoft (NASDAQ:MSFT) may be seen by some market participants as being overvalued. We believe the current valuation is more than justified by Microsoft’s fundamentals and risk profile. Microsoft is a large and diversified company with high amounts of FCFE. The company is relatively insulated from geopolitical risks. Microsoft is positioned to benefit from AI adoption, and the company has the potential to capture efficiency gains down the road.

Large and Diversified Company

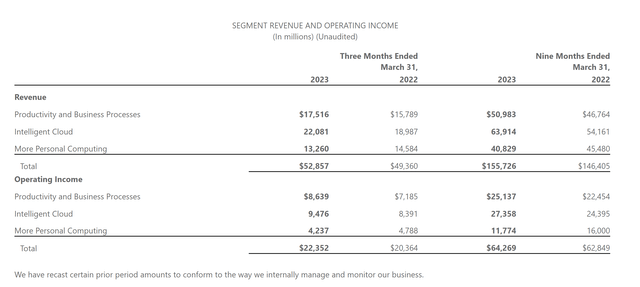

Microsoft breaks out their revenue in three different segments. These segments are classified as productivity and business processes, intelligent cloud, and more personal computing.

Productivity and Business Processes: Office Commercial products and cloud services, Office Consumer products and cloud services, LinkedIn, and Dynamics products and cloud services.

Intelligent Cloud: Server products and cloud services (this includes Azure).

More Personal Computing: Windows OEM, Devices, Windows Commercial products and cloud services, Xbox content and services, and Search and news advertising.

Microsoft’s Earnings Release FY23 Q3

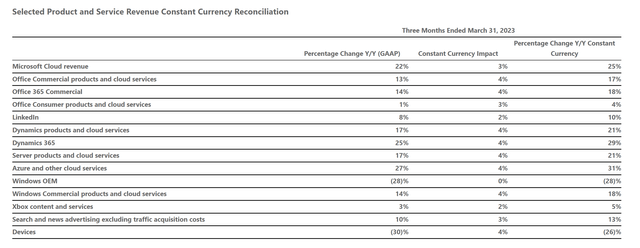

As we can see below, the company saw a reasonable level of Y/Y growth in many of their business segments. The major areas of weakness were Windows OEM and Devices, while Azure and other cloud services continued to grow over 30% Y/Y on a constant currency basis.

Microsoft’s Earnings Release FY23 Q3

The benefit of Microsoft’s scale and diversification is that they have many levers to pull for growth in both revenue and operating income. If one area of their business is going through a difficult period, it’s likely that other areas of their business will be able to continue growing. This results in Microsoft being able to sustain a moderate level of revenue and operating income growth over long periods of time.

High Levels of FCFE

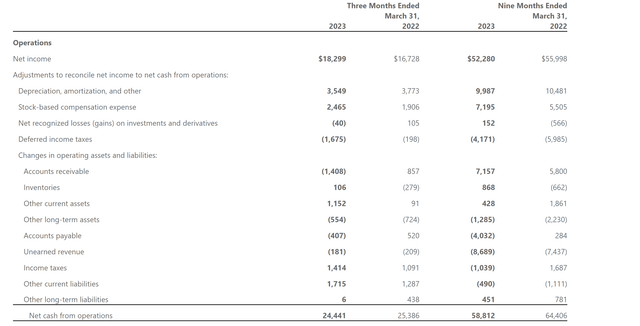

Microsoft earns a large portion of their revenue through software, cloud computing services, and advertising. All of these revenue sources have relatively low capital intensity and high amounts of operating leverage. This results in every point of incremental growth translating into a large amount of free cash flow that can be made available to shareholders.

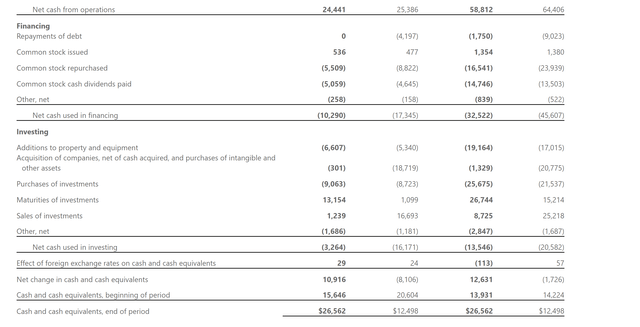

A big risk with large and established technology companies is the potential for management to become complacent and focus too much on shareholder returns. This in turn leads to underinvestment and the company being disrupted over the long term. Fortunately for investors, it seems that Microsoft’s management is well aware of this and is willing to make big investments to strengthen their business. Their investment into OpenAI, pending acquisition of Activision, and continued buildout of computing and AI infrastructure is evidence of a management team that understands the risks at play and that their future position within the marketplace must be earned. Microsoft’s management appears to strike a good balance between shareholder returns and reinvestment.

Microsoft’s Earnings Release FY23 Q3 Microsoft’s Earnings Release FY23 Q3

Relatively Insulated from Geopolitical Risks

While Microsoft would be negatively impacted from geopolitical disruptions, their business model shields them from taking catastrophic damage. Microsoft does earn a sizeable amount of revenue from the sale of devices and Windows software on new devices, but for the most part, their business does not revolve around selling (and by extension manufacturing) a physical product. Supply chain disruptions would impact them less than companies that rely on multinational manufacturing of a physical product. In this way, Microsoft is relatively safer than the popular big tech peer Apple (AAPL). As such, their multiple reflects a bit of a geopolitical safety premium.

Positioned to Benefit from AI Adoption

Microsoft’s investment into OpenAI shows that management understands where the puck is going when it comes to technological trends. Whether OpenAI is a winner long-term remains to be seen, but what’s important is how this comes across to business decision-makers, employees, and the general public. There is a case to be made that, as a tech company, it’s important to be perceived as leading technological development forward. This reputation of technological excellence and experimentation can help to retain employees and land contracts. For the time being, Microsoft appears to be doing better in this regard than a peer such as Google (GOOGL), at least in the eyes of the investing public.

Microsoft is heavily investing in AI infrastructure in order to give their customers access to software and computing solutions that will lead to better business outcomes. Microsoft is positioning themselves to be able to help their customers adapt to the changing technological landscape. A focus on driving customer value is what helps a business grow revenue/earnings while also retaining their competitive edge, and Microsoft appears to be investing heavily now to provide the maximum amount of future value to their customers in the future. If all goes well, these future customers will reward the company with growing revenue and earnings, and Microsoft’s employees and shareholders will reap the benefits.

Opportunities for Efficiency Gains

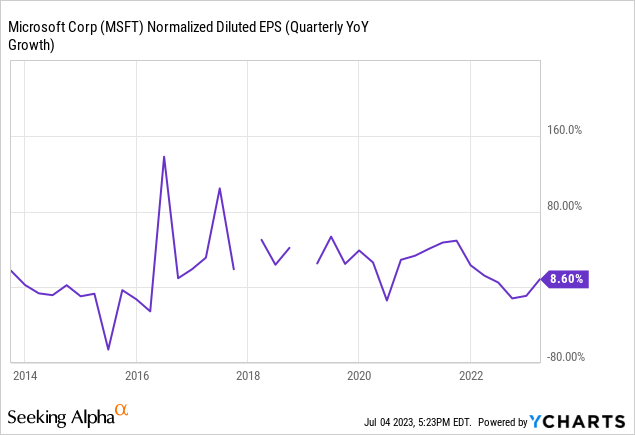

Due to the software and cloud driven nature of Microsoft’s business, it’s likely that they will be able to realize efficiency gains from AI and the solutions they are developing for their own customers. These efficiency gains could lead to Microsoft growing the bottom line far faster than the top line, surprising analysts and investors. We believe there is a lot of upside to what most investors would estimate Microsoft’s earnings power to be in 2030.

Price Action

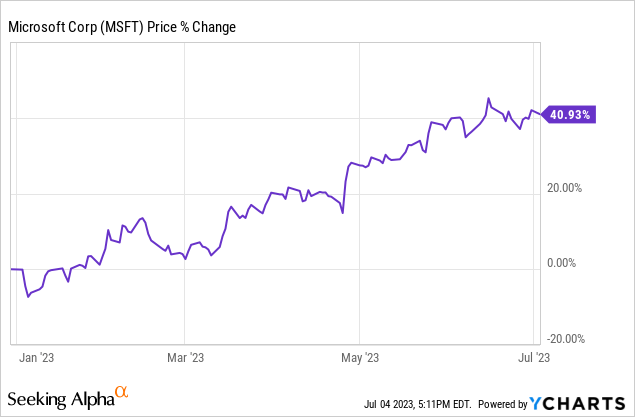

Microsoft has had an impressive rally YTD, up 40.93%. We believe that the company remains reasonably valued and that long-term investors shouldn’t be scared away just because the stock has had a hot 2023.

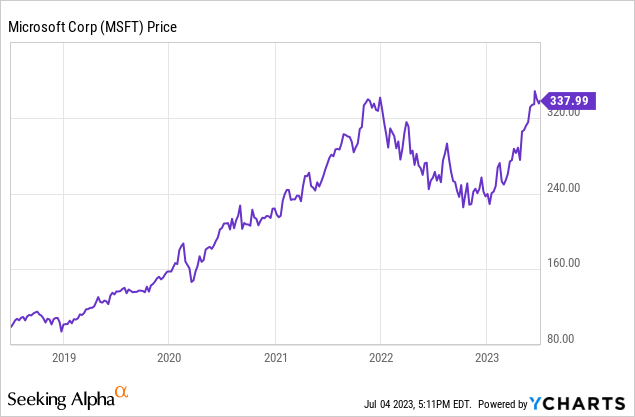

Over the past five years, Microsoft has been rewarded by the market for their execution. The company was able to make the most of spending on technology during the pandemic and will likely be able to continue this momentum into the upcoming AI spending cycle.

Valuation

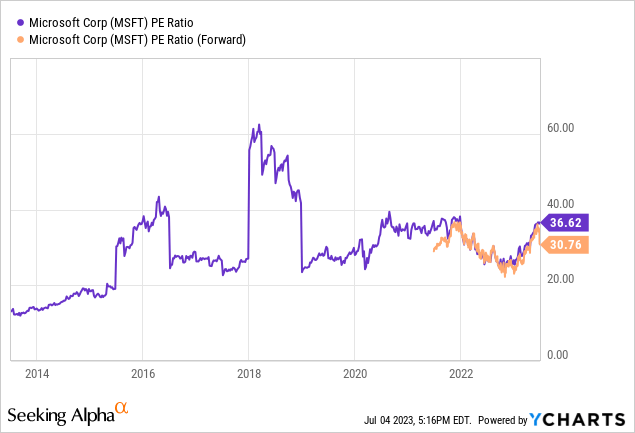

Microsoft is trading near the higher end of their recent PE range. We believe that Microsoft will be able to grow their earnings at an above-market rate for the next decade or longer and that the current valuation premium is justified by the consistency of their business as well as their growth prospects.

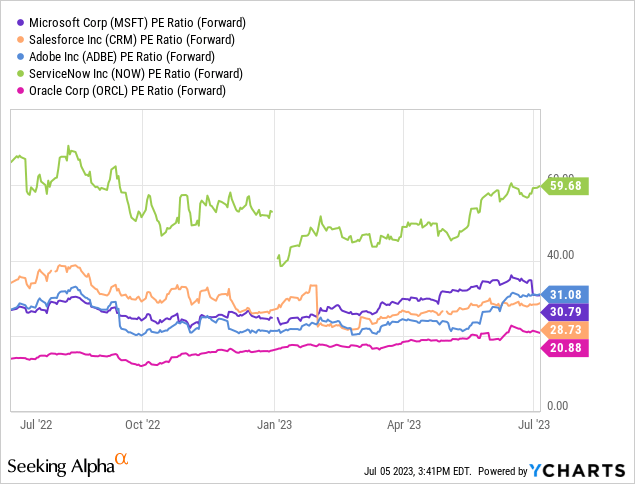

We believe that a valuation for Microsoft under a 36 forward PE is reasonable and wouldn’t look to sell until either that valuation is reached or the company’s growth prospects deteriorate. This reflects our opinion that Microsoft should roughly trade at a premium to their closest S&P 500 software peers of at least 20%.

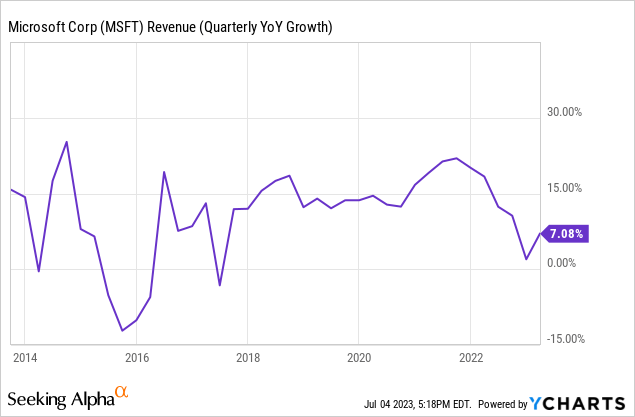

Microsoft is experiencing a short-term slowdown in their revenue and earnings growth, but we believe that the company will be able to capitalize on the upcoming technology investment cycle and reaccelerate growth going forward.

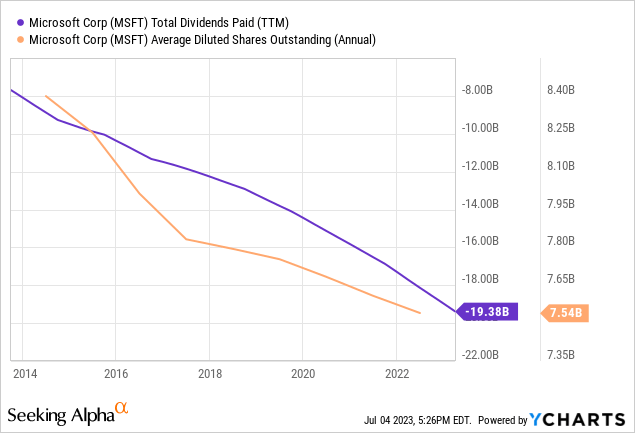

Microsoft has continued to return a growing amount of capital to shareholders through buybacks and dividends. This trend will likely continue over the coming decade unless Microsoft sees an opportunity to reinvest back into the business at a higher rate than they already are.

Risks

Microsoft may be unable to compete with upcoming AI solutions in the marketplace. They may find themselves unable to win against their big tech peers and/or new market entrants. They may be unable to sustain their consistent levels of revenue growth. If any of this were to materialize, it’s likely that the stock would see a material re-rating downward regarding their valuation.

We view the risk/reward as being reasonable for long-term investors.

Key Takeaway

If an investor is seeking the absolute highest level of capital appreciation, it isn’t going to come from Microsoft. That being said, the company is well-positioned to take advantage of future technology spending and has a strong track record of execution. Despite what some view as a lofty multiple, we believe the company remains reasonably valued due to their scale advantage and diversified business segments, as well as future growth prospects.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AAPL, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to MSFT, AAPL, and GOOGL.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.