Summary:

- MSFT has the most profitable cloud computing segment worldwide.

- MSFT can become the leading cloud computing company in the world and take advantage of the growing global cloud computing market.

- MSFT has a well-diversified portfolio of products and services, which could be bolstered by its planned investment in OpenAI.

NicolasMcComber

Investment Thesis

Microsoft (NASDAQ:MSFT) is one of the biggest and leading technology companies worldwide with services including licenses, and sale of software, consumer electronics, personal computers, cloud computing services, etc. The company is best-known for its products which include the Windows operating system, the Microsoft Office Suite, Microsoft Azure, and the Xbox gaming console. The company is also one of the top 5 most valuable companies in the world with its peak market valuation reaching approx. $2.6 trillion, however as many technology companies, it has seen its value drop to its current market valuation of $1.8 trillion.

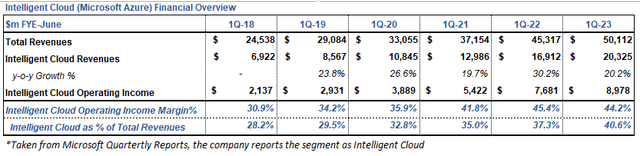

The drop in valuation has made MSFT a very attractive long term investment opportunity as the company has opportunities for growth in different markets. One of these opportunities comes from its cloud computing segment which has seen explosive revenue growth during the last years and is the most profitable cloud computing company among other tech giants like Amazon (AMZN) and Alphabet (GOOG) (GOOGL). To provide context, the Intelligent Cloud segment (Microsoft Azure) has increased revenues from $32 billion in FYE 2018 to $75 billion in FYE 2022. Further to this, the segment generates a remarkable operating income margin close to 45%. More on this at a later stage.

In this article, I will provide a broader look at MSFT. Within this, I will review in more detail its cloud computing segment and its search and news advertising potential as I believe management is focusing on this revenue stream to see incremental revenues year on year. Finally, I will address the potential growth prospects of MSFT, specifically highlighting the significant move the company has made in the artificial intelligence industry through planned investment in OpenAI, a leading company in the field. Additionally, this move has the potential to enhance MSFT search engine, Bing, through potential synergies. With a diversified product and service offering and a recent decrease in valuation of nearly 30%, I believe MSFT presents an attractive investment opportunity and consider it as a buy.

Business Overview

MSFT operates three main segments: Intelligent Cloud, Productivity and Business Processes, and More Personal Computing. The Intelligent Cloud segment includes the company’s cloud-based products and services, such as Azure and Windows Server. The Productivity and Business Processes segment includes products such as Office, LinkedIn, and Dynamics. The More Personal Computing segment includes the Windows operating system, Surface devices, Xbox gaming console, and Bing search engine. In summary, MSFT is a leading technology firm with a diversified revenue stream across multiple segments. The company has reported strong financial performance, with TTM revenues of $203 billion, cash flow from operations of $87.7 billion, and free cash flow of $63.3 billion. Additionally, MSFT has a rapidly expanding and highly profitable cloud computing division. Furthermore, the company has recently planned to make a significant investment in the field of Artificial Intelligence, specifically in ChatGPT, which has the potential to compete with Google’s search capabilities. Overall, it is likely that MSFT will continue to expand its global influence in the technology industry. Let´s jump into the financials!

Financial Overview

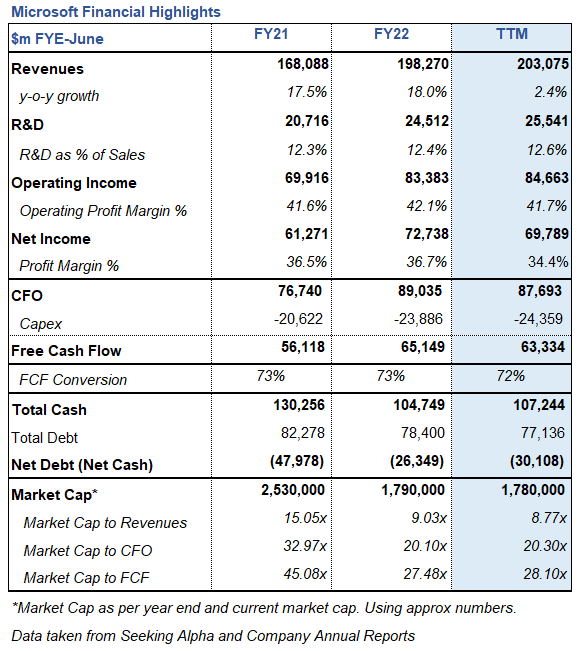

Financially speaking, MSFT has very robust fundamentals generating TTM revenues of $203 billion, cash flow from operations of $87.7 billion, and free cash flow of $63.3 billion. Further to this, the company has a strong balance sheet supported by a massive cash in hand balance of $107 billion. As previously mentioned, MSFT generates revenue from three main segments: Intelligent Cloud (Microsoft Azure), Productivity and Business Processes, and Personal Computing. As of the latest quarterly report, the Intelligent Cloud segment, which includes Microsoft Azure, accounted for 40% of total sales. The Productivity and Business Processes segment, which includes Microsoft Office subscriptions, LinkedIn, and other services, accounted for 33% of total revenues. Finally, the Personal Computing segment, which includes Windows, gaming, search, and news advertising, accounted for 27% of total revenues.

Microsoft Financial Highlights (Seeking Alpha & Company Annual Report)

Cloud Segment

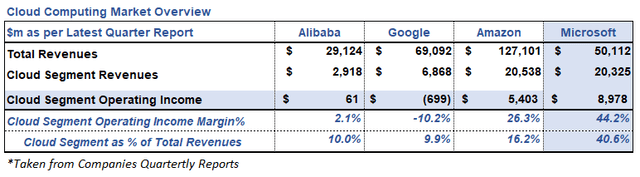

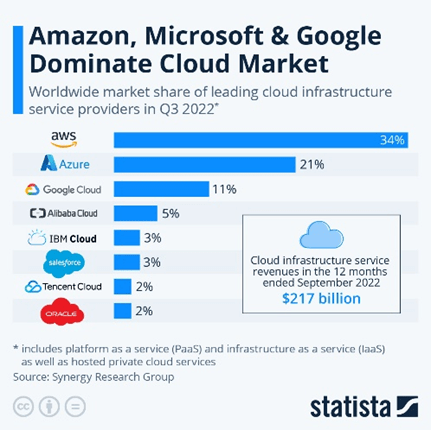

Microsoft competes in the global cloud computing market with major players such as AMZN, GOOGL, Alibaba (BABA), and Tencent (OTCPK:TCEHY). The competition in this market is intense, with each of these companies offering a range of cloud-based services and trying to gain market share. The cloud computing market is clearly dominated by US companies, with Amazon AWS latest quarterly reported revenues standing at $20.5 billion and Google Cloud reporting revenues of $6.9 billion. The Chinese companies are well behind these numbers with Alibaba Cloud which is the biggest cloud provider in China, and which has over 35% of the market share reporting revenues of $2.9 billion. One final note before we dive into MSFT cloud segment is the fact that Google Cloud along with the Chinese companies have just recently started operating their cloud segments profitably or are still in the hunt for profitability. Please see table below. The only two companies generating a substantial profit from their cloud computing segments are Amazon and Microsoft.

Cloud Computing Market Overview (Companies Quarterly Reports)

MSFT Intelligent Cloud segment has been growing rapidly during the last years and has become a significant contributor to the company’s total revenue. As of the first quarter of FYE 2023 the segment accounted for 40% of total revenues with an operating income of 44.2%, which is truly outstanding for a company with this size. The table presented below displays the revenue growth, as evidenced by the FYE 2023 first quarter and prior periods. The substantial growth experienced by the segment is clearly visible and with the market continuing to grow, the segment could continue seeing double digit growth rates.

Microsoft Cloud Computing Segment Financial Overview (Company´s Quarterly Reports)

An increasingly important revenue stream for MSFT is its search and news advertising revenue stream which has doubled in size since 2016 when it reported total revenues of $5.4 billion to $11.6 billion during FYE 2022. Management has been vocal that it wants to ramp up this business to $20 billion. Taking into consideration the growth rate and management commitment combined with the company’s recent plans to invest an additional $10 billion in OpenAI, the creator of ChatGPT, it is clear that MSFT is positioning itself to challenge the dominant web search market currently held by Google. While MSFT’s search engine, Bing, currently holds a relatively small share of the global market, this investment in OpenAI and the capabilities of ChatGPT should not be overlooked. To provide context, it is worth noting that Open AI’s ChatGPT has achieved significant traction in a short period of time, with over 1 million users in just five days and more than 266 million visits to the ChatGPT website in December 2022. Additionally, ChatGPT supports over 95 languages, providing a strong global presence.

Shareholder Returns

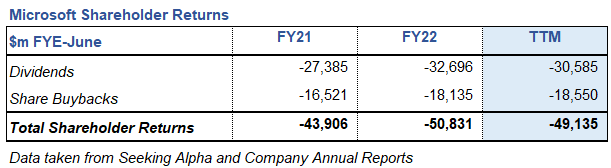

MSFT management has demonstrated a clear commitment to maximizing shareholder returns, as evidenced by the distribution of over $49 billion to shareholders through dividends and share buybacks in the preceding twelve months. Furthermore, the company still has $36.1 billion available under its authorized share repurchase program of $60 billion, suggesting that management may continue to repurchase shares in the near future. Important to note here that MSFT outstanding shares have decreased by nearly 1 billion shares since 2013. This aggressive shareholder return policy is made possible by the company´s robust cash flow from operations and strong balance sheet, which includes $107 billion in cash and cash equivalents.

Shareholder Returns (Seeking Alpha & Company Annual Reports)

Growth Opportunities

MSFT has a significant growth potential opportunity in the global cloud computing market, which is projected to reach $1.2 trillion by 2027. The company currently holds the second position in the global cloud market with a market share of approximately 21%. As a dominant player in the market, MSFT is well-positioned to capitalize on this expanding market. Additionally, the company’s high operating income margin allows for high profitability without being the leading cloud provider in the world. In fact, MSFT currently has the most profitable cloud computing segment in the world. As long as the company maintains growth in line with the market, it will be able to sustain profit growth.

Cloud Computing Market Overview (Statista)

Digital Advertising and Artificial Intelligence

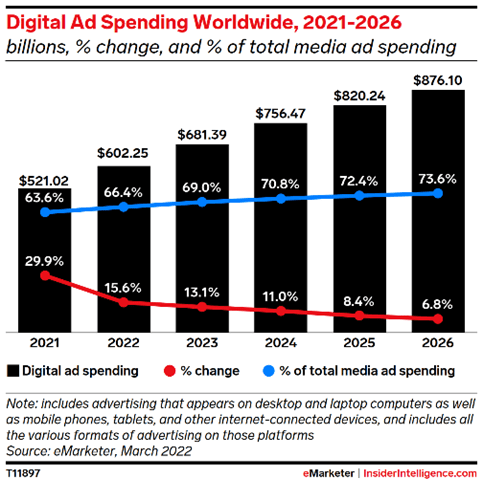

As previously mentioned, MSFT is actively seeking to expand its presence in the search and advertising industry through various means, including the utilization of its powerful search engine, Bing, and its planned investment in the cutting-edge natural language processing technology ChatGPT. Management is aiming to generate annual ad revenues of $20 billion, utilizing its diverse range of ad properties, including Bing search, Xbox, MSN, etc. In the first quarter of FYE 2023, Microsoft reported a 16% increase in search and news revenue, indicating positive momentum in achieving this goal. Additionally, the global digital ad spending market is projected to reach $876 billion by 2026, providing ample opportunity for MSFT to capture a significant share of this growing market.

Digital Ad Spending Worldwide Forecast (eMarketer)

MSFT decision to invest $10 billion in OpenAI is a strategically calculated move to solidify its position in the rapidly expanding artificial intelligence industry. This investment will enable MSFT to leverage the expertise and cutting-edge technology of OpenAI and will possibly help MSFT efforts to advance its own AI capabilities, and potentially develop new business opportunities. This investment will allow MSFT to access OpenAI’s research and technology, and potentially integrate it into its own products and services, such as its search engine Bing. Additionally, it will give MSFT the opportunity to expand its global influence in the field of AI which is a market forecasted to grow to $400 billion by 2027.

Note that I will not touch upon gaming as MSFT acquisition of Activision Blizzard Inc. is yet to be finalized. I will provide an update at a later stage.

Valuation

As mentioned earlier MSFT has seen a drop on its market valuation since it was at its peak $2.6 trillion and is now trading at a market valuation of $1.8 trillion. This puts the company multiples at cash flow to price slightly above 20x and sales at approx. 8.8x.

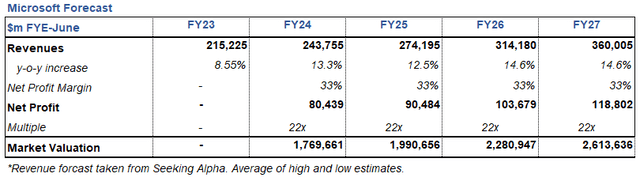

For the valuation of the company, I have used the market multiple method, using future forecasted earnings to a 22x multiple. I have obtained the analysts’ revenues forecast from Seeking Alpha data and have applied net profit margin of 33%, which is below the average of the previous 3 years at 34.7%. I have done this because I am assuming that management will be able to continue operating the Intelligent Cloud segment at an operating income margin above 40%. Using this method, I have arrived at a market valuation for MSFT of $2.6 trillion by FYE 2027.

Microsoft Forecast (Seeking Alpha and Author´s Estimates)

Risks

Fierce competition from other technology companies: MSFT faces intense competition from other technology companies, such as Google, Apple, and Amazon, in various markets, including personal computing, cloud services, and artificial intelligence. The company will need to continue enhancing its technological capabilities if does not what to lose market share against any of these competitors.

Regulatory risks: MSFT operates in a highly regulated markets and is subject to a wide range of laws and regulations. The company has already been slapped with fines in the past from the US and EU regulatory bodies, the increasingly changing laws and regulations, or increased enforcement, could have a material impact on the company’s financials.

Bottom Line

In conclusion, MSFT has strong financials with a growing cloud computing business which is becoming an increasingly larger portion of the company’s total revenues and primary source of profits. The company continues to make significant investments in order to enhance its technological capabilities and maintain a competitive advantage in its respective markets. With strong fundamentals coupled with the opportunity of being a dominant player in growing markets such as the global cloud computing, search and news advertising, artificial intelligence, etc. MSFT presents an attractive long-term investment opportunity.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.