Summary:

- Microsoft’s stock experienced a moderate sell-off despite strong Q4 earnings, but I think that there are no reasons to be less bullish than three months ago.

- Revenue and EPS beat estimates in Q4, with strong operating leverage and FCF generation, positioning the Company well for future growth and acquisitions.

- Valuation analysis suggests MSFT is undervalued by 21%, making it a compelling investment opportunity.

FinkAvenue

Investment thesis

My previous bullish thesis about Microsoft (NASDAQ:MSFT) kept up well as the stock was ahead of the broader market before the Q2 earnings season started. However, the sell-off which started a few days ago diminished all previous gains achieved since mid-May.

Today, I want to explain why I remain bullish and believe that the market’s reaction to fiscal Q4 2024 earnings was unfair. All three of the company’s segments maintain robust growth momentum, led by the stellar Intelligent Cloud business. The operating leverage is still resilient, and MSFT is still an FCF machine, even despite aggressively ramping up R&D and CAPEX spending. The valuation looks extremely attractive at current levels, according to the DCF model. All in all, I reiterate “Strong Buy” rating for MSFT.

Recent developments

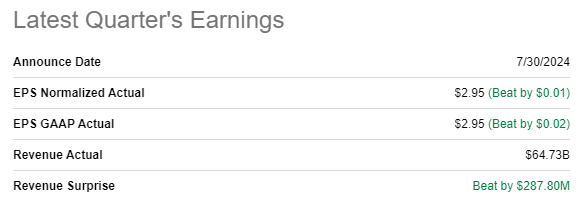

Microsoft delivered another strong quarter on July 30, beating revenue and EPS consensus estimates. Revenue grew by 15.2% YoY in fiscal Q4 2024. The adjusted EPS expanded from $2.69 to $2.95 and operating leverage was one of the key factors to the bottom-line success. Microsoft’s operating margin was approximately flat on a YoY basis, but it is explained by the increased R&D spending while the SG&A to revenue ratio shrank from 14.95% to 14%. Therefore, I think we can say that the company continues exercising solid operating leverage, which is a bullish sign.

Seeking Alpha

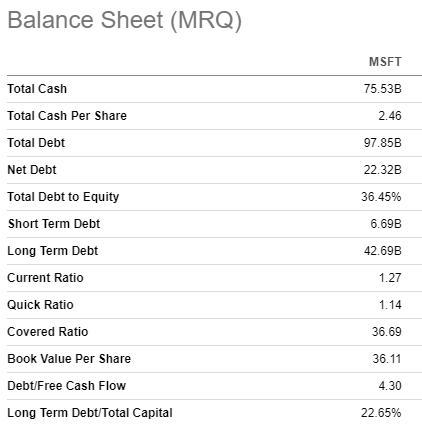

As a result of the solid operating leverage, Microsoft’s generated $12.4 billion in levered free cash flow [FCF] during the quarter, even despite a $5 billion YoY increase in CAPEX. As a result of strong FCF, the company’s balance sheet continued fortifying and MSFT currently has a $75 billion cash pile. This reserve provides MSFT with robust financial flexibility and makes it well-positioned for large acquisitions. To add context which will help understand how big Microsoft’s cash reserve is, the company acquired Activision Blizzard for $69 billion in 2023.

Seeking Alpha

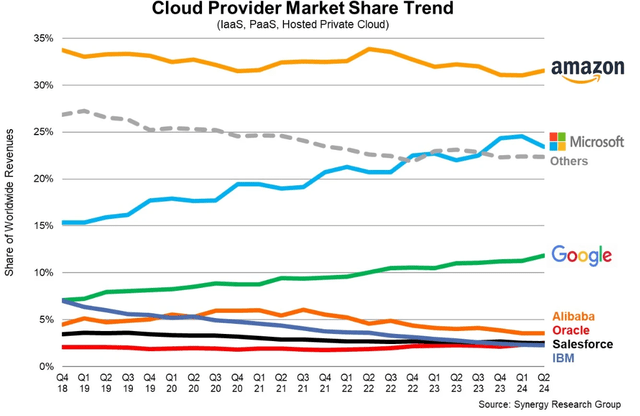

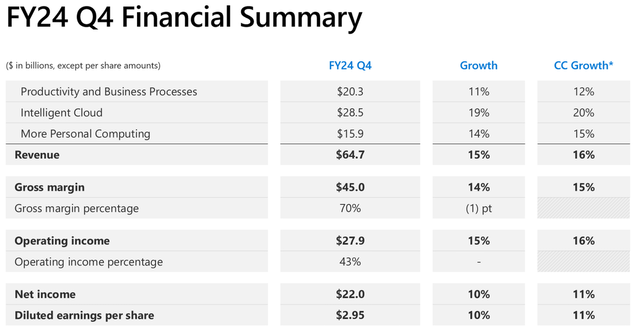

The company continues witnessing strong demand for Intelligent Cloud offerings, including artificial intelligence [AI] features and services. This business line outpaced consolidated revenue growth with a 19% segment’s topline increase on a YoY basis. Azure grew by 29% YoY, which indicates that the momentum for MSFT’s cloud and AI capabilities is still strong. According to Digital Information World, calendar Q2 2024 was the quarter when Microsoft’s market share in the global cloud infrastructure market narrowed. On the other hand, growth is never linear, and the below chart clearly demonstrates that the calendar Q2 pullback in market share aligns with MSFT’s historical trajectory, and it looks like a normal pullback before the growth continues.

Microsoft is willing to keep strong momentum for its Cloud and AI business for longer, which I see from investments into this area ramping up rapidly. The company plans to invest billions of dollars in data centers and AI hubs across the world. A 2.2 billion euros investment in data centers in Spain was officially announced by the company. The company has also recently announced a partnership with Lumen Technologies (LUMN) to expand its network capacity to support rising demand on data centers.

This aggressive pace of pouring billions of dollars into AI infrastructure indicates the management’s strong conviction in this bet. Microsoft likely does not want to miss out on a potential $1.3 trillion market opportunity, and the decision to invest aggressively in data centers appears to be a sound move.

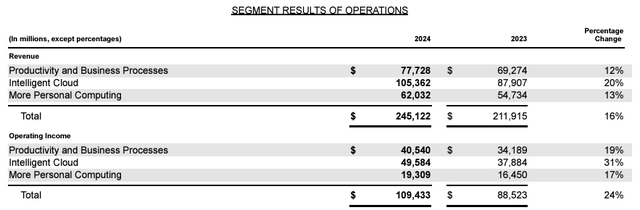

My optimism is also backed by the fact that Intelligent Cloud is not the only Microsoft’s business that demonstrates growth. Productivity and Business Processes, and More Personal Computing also demonstrated solid revenue growth both in fiscal Q4 and for the full year. The same applies to the operating income, as both segments contributed substantially to the consolidated operating leverage.

MSFT’s latest earnings presentation

With all three business segments demonstrating double-digit revenue growth led by its jewel in the crown, the Intelligent Cloud business, I think there are no reasons to be less bullish. The operating leverage potential is still solid, and MSFT is still an FCF machine, even despite aggressive growth in CAPEX spending.

Valuation update

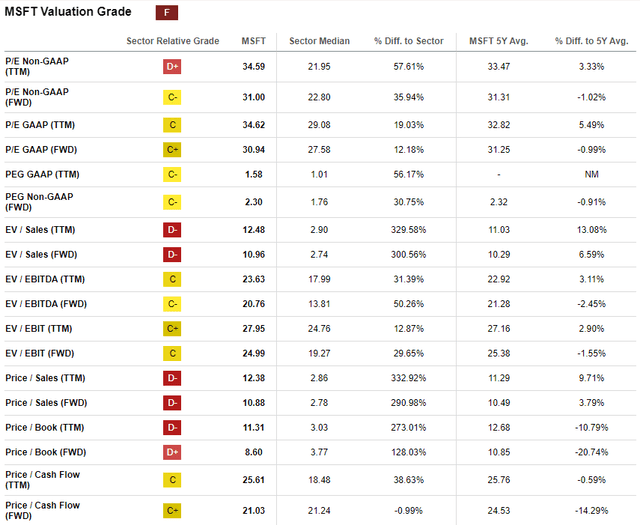

Microsoft’s stock rallied by around 20% over the last twelve months and delivered a 5% return YTD. Valuation ratios are inherently high compared to the sector median because of Microsoft’s unmatched scale and strategic positioning. For companies like MSFT, I usually look at the comparison between current valuation ratios and historical ones. From this perspective, MSFT looks attractively valued, as its current multiples are close to the last five years’ averages.

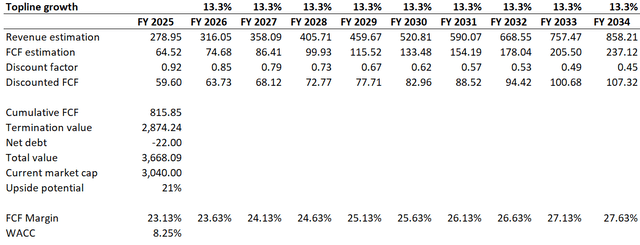

To figure out my target price, the discounted cash flow [DCF] approach was selected. I use the same 8.25% WACC as I did in my previous simulation, which is in line with the recommended range by valueinvesting.io.

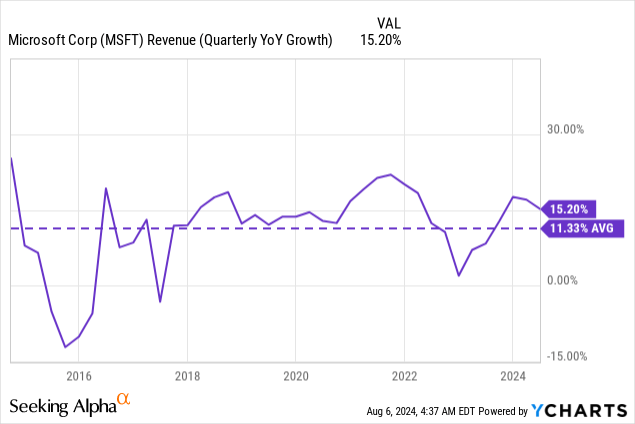

Revenue growth is a crucial assumption which significantly affects the fair value. Consensus estimates forecast revenue CAGR for the next decade to be 11%. This assumption appears to be too pessimistic, in my opinion. According to the below chart, MSFT demonstrated 11.3% revenue CAGR over the last decade when there was no comparable digital revolution which we evidence nowadays. I believe that given MSFT’s positioning in the AI revolution, upgrading the last decade’s CAGR by at least two percentage points will be fairly conservative. Therefore, I implement a 13.3% revenue CAGR for the next decade.

For the base year, I implement a TTM levered FCF margin of 23.13%. Considering MSFT’s strong track record of profitability improvement and bright revenue growth prospects, I incorporate a 50 basis points yearly FCF expansion.

With all the above underlying assumptions, the business’s fair value is $3.67 trillion. It is 21% higher than the current market cap, indicating the stock is substantially undervalued. A 21% discount to the fair value looks like a compelling investment opportunity for a behemoth like MSFT.

Risks update

A few weeks ago, we all witnessed a global outage in Microsoft’s services. Despite it appears that the outage was not due to Microsoft’s problems but due to updates in CrowdStrike’s (CRWD) software update, I think that this situation damaged Microsoft’s reputation as well. Investors should understand that they face significant cybersecurity risks, and outages can happen even with such behemoths like MSFT.

The competition to be the leading company in the current AI revolution is fierce. Not only does Azure improve its strategic position, but Google’s Cloud also demonstrates robust momentum. Google Cloud revenue jumped by 28.8% in Q2, indicating that the competitor which was considered as a laggard compared to AWS and Azure is gaining its recognition in the market. Moreover, Google plans to keep this momentum as the company is pouring billions of dollars into new data centers to fuel further cloud and AI growth. AWS plans to make the largest capital investment in the state of Indiana’s history, with its $11 billion planned to be invested into new data centers.

Being the world’s largest company with a massive footprint across several industries means that antitrust risks might be inevitable for Microsoft’s investors. Recent news suggests that Microsoft has been charged by the EU with anti-competitive behavior by bundling its Teams app with its Office suite. Investors should understand that due to its massive footprint and dominance in the market, there are always risks that MSFT might face multi-billion antitrust fines which will adversely affect the bottom line.

Bottom line

To conclude, MSFT is still a “Strong Buy”. The recent pullback looks like a good buying opportunity, as the stock currently trades at a substantial discount to its fair value. The company continues delivering staggering revenue growth across all segments, and its operating leverage is still strong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.