Summary:

- Microsoft’s strong performance in FY23 demonstrates its potential for future growth through AI-focused product improvements.

- The recent drop in prices has led to a potential 10% undervaluation in the Company shares.

- Microsoft’s expansion into AI and the acquisition of Activision Blizzard have strengthened its economic moat and gaming division.

- Overall, I believe MSFT is an excellent long-term “multi-bagger” with huge growth potential.

- Strong Buy Rating issued.

FinkAvenue

Investment Thesis – Fall 2023 Update

I still like Microsoft Corporation (NASDAQ:MSFT) both as a company and as a stock. I believe the strong performance achieved in FY23 illustrates the potential Microsoft has to achieve significant future growth through AI-focused product improvements.

Furthermore, the recent gulley in prices has led to a potential 10% undervaluation in shares.

Given the company’s now proven ability to harness significant revenue growth and margin expansion from its AI-driven business strategy, I believe that a long-term-oriented Strong Buy recommendation can be made.

Company Background

Microsoft.com | Homepage

Microsoft is an American MNC technology corporation headquartered in Redmond, Washington. Known for its operating system Windows, Surface, and Xbox line-up of personal electronic devices, Office productivity suite, and its Azure cloud computing service, the company is undoubtedly a tech powerhouse in the current market.

Microsoft is one of the most established technology companies in the world and their level of expertise, scale and market penetration is arguably unrivalled in the sector.

The firm’s recent push into AI through significant investment and the partial acquisition of OpenAI’s ChatGPT has created a wave of significant positive sentiment across Wall Street for the company.

Economic Moat – Fall 2023 Update

I conducted a full in-depth analysis of Microsoft’s economic moat back in March 2023. I believe that at the core, little has changed with regard to the firm’s economic moat.

To read a comprehensive analysis of the firm’s incredibly broad and robust economic moat, check out my article.

In this update article, I would like the discuss Microsoft’s massive expansion into AI along with the recent closure of the Activision deal which I believe has added to the firm’s economic moat in a tangible manner.

Office.com

The major integration of AI across Microsoft’s portfolio of 365 (previously Office), Azure, Windows and Search products arguably kickstarted the massive AI-fueled bull market that lifted many tech stocks from late 2022 and early 2023 lows to record highs.

Microsoft started this AI expansion in February 2023 with the integration of OpenAI’s (an AI organization of which Microsoft has 49% ownership) GPT 4 engine into their Bing search engine.

While the initial months saw the updated Bing receive mixed critique from industry experts and regular users alike, Microsoft has worked hard with OpenAI to refine the user experience offered by Bing with more positive feedback being seen now than at the start of the year.

As 2023 has progressed, Microsoft has rapidly expanded the number of products that integrated AI into their function to improve user experiences and fundamentally change the way users interact with these tools.

Microsoft’s Office and Windows product offerings now benefit from the recently launched “Copilot” AI tool which helps users to accomplish previously laborious or time-consuming medical tasks.

Similar integrations of Microsoft’s AI tech into their Windows Server and IaaS service Azure should also allow professional and backend users to simplify workflows significantly thus increasing efficiency both from a time and workflow perspective.

I have refrained throughout the year from writing an update on my investment thesis into Microsoft as I believed it was too difficult to discern any reliable qualitative or quantitative evidence of the effects AI has had on Microsoft’s economic moat as a whole.

However, it is now undeniable that Microsoft appears to be the market leader when it comes to AI integrations across a variety of business segments and use cases.

Microsoft.com | Azure AI Integrations

Their massive and rapid expansion into the space should also help their Intelligent Cloud IaaS and PaaS solutions to gain market share as the efficiency improvements achieved by integrating AI into these products should help differentiate and improve their attractiveness compared to competitors.

However, the recent reports of Microsoft struggling to turn a profit through their Copilot subscription service illustrate the incredibly capital-intensive characteristics associated with the integration of data-intensive AI into their products.

While I do believe that future improvements with regard to the manner in which Microsoft employs AI along with a more lucrative pricing structure will help the firm turn massive profits from the business segment, the timeframe required to achieve this is still unclear.

Nonetheless, I believe Microsoft has achieved a real head start within the AI space which should allow many of its already mature product segments to benefit from a renaissance while further fueling the growth of rapidly expanding businesses such as Intelligent Cloud.

Considering these characteristics, I believe Microsoft’s AI business benefits from significant networking and synergetic benefits which earn the segment a wide moat rating.

Microsoft receiving approval for the Activision acquisition marks the end of a tumultuous 21 months of regulatory blockages and red tape. I believe that the acquisition of Activision increases Microsoft’s exposure to both the lucrative PC/console gaming segment through Activision and Blizzard and the growing mobile gaming market through King.

Activision and Blizzard have developed some of the most popular game franchises to date with titles such as Call of Duty, World of Warcraft and Diablo now falling under Microsoft’s gaming umbrella. King has also produced Candy Crush: the most popular mobile game to date.

I believe that the addition of these iconic franchises along with the skill and IP present at each business division of Activision will cement Microsoft as a leader within the gaming space as a whole. Their new set of assets and IP is truly unrivaled and should help Microsoft to increase the allure and attractiveness of their Xbox and Game Pass products too.

Game Pass in particular is an increasingly lucrative business for Microsoft thanks to the subscription-based business model the firm has built for the service.

Overall, I believe Microsoft’s gaming division has benefitted in a real manner from the Activision deal and sees the segment expand from a narrow to a wide economic moat.

Financial Situation – Fall 2023 Update

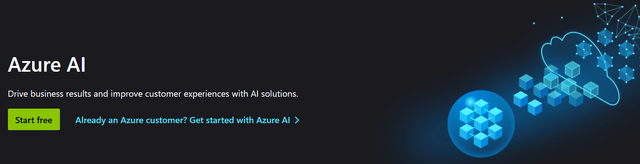

On the whole, Microsoft’s fiscal situation remains mostly unchanged. The firm continues to be an absolute cash flow and profitability powerhouse with its most recent FY23 Q4 and full-year 10-K report supporting this hypothesis.

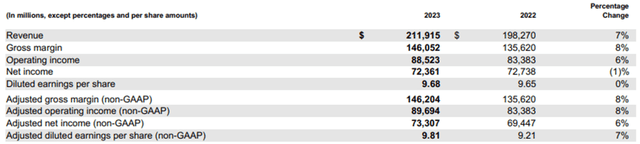

FY23 saw Microsoft grow its revenue by 7% YoY with its gross margin expanding 8% compared to FY22. The firm also saw operating income increase a healthy 6% with the rapid integration of AI into their products being cited as the key growth catalyst.

As discussed in the economic moat analysis, Microsoft’s Intelligent Cloud segment saw rapid revenue growth of 17% in FY23 with improving business economics resulting in a 14% expansion of the business’s gross margin too.

This sees the segment now operate at a gross margin of 72% which illustrates just how lucrative the business is for Microsoft as a whole.

While Microsoft’s Intelligent Cloud and Productivity and Business Processes segments saw strong revenue and margin growth in FY23, their More Personal Computing segment continued to struggle.

Revenues for the segment decreased 9% YoY due to weakening demand of around 13% for Windows OEMs. Total Windows OEM revenue decreased by 25% as elevated channel inventory levels continued to drive additional weaknesses beyond the already floundering PC market as a whole.

Gaming revenues also declined by around 5% YoY due to slower-than-anticipated Xbox hardware and service sales. Game Pass however continued to grow which illustrates that the firm’s transformative shift towards a subscription model service is working well.

While the weaker-than-anticipated personal computing results are less than optimal, the firm’s massive growth in its main two business segments suggests that the firm’s massive expansion into AI drive products is bearing fruits for the firm.

Microsoft saw its net income fall 1% YoY despite the massive revenue and operating margin growth witnessed in FY23. This was primarily due to rapidly increasing staff costs along with unfavorable macroeconomic conditions increasing the firm’s COGS significantly.

The firm still managed to generate a massive $48.52B in FCF in FY23 which illustrates the hugely profitable nature of the firm.

Seeking Alpha | MSFT | Profitability

Seeking Alpha’s Quant continues to derive an “A+” profitability rating for Microsoft which I believe perfectly represents the firm current and future earnings potential.

Microsoft’s balance sheets continue to be in healthy shape despite the massive $68.7B the firm will spend on acquiring Activision Blizzard. Quite simply, the firm’s massive unlevered free cash flows will allow Microsoft to continue paying off its current debenture maturities along with any new obligations derived from the Activision deal.

Moody’s credit ratings agency continues to affirm an excellent Aaa global credit rating for Microsoft’s unsecured domestic notes and affirmed a Prime-1 rating for their domestic commercial paper. The outlook remains stable.

Moody’s classifies “Aaa” global credit ratings as being “Obligations judged to be of the highest quality, subject to the lowest level of credit risk” and classifies “Prime-1” short-term debt ratings as being of the “highest quality”.

Overall, it is safe to say that from a long-term perspective, Microsoft continues to have an excellent fiscal position which should allow them to innovate and expand with ease.

An impressive FY23 from a revenue and gross margin standpoint has not gone unnoticed by investors and illustrates that even in tough macroeconomic conditions, Microsoft is able to produce huge profits.

Valuation – Fall 2023 Update

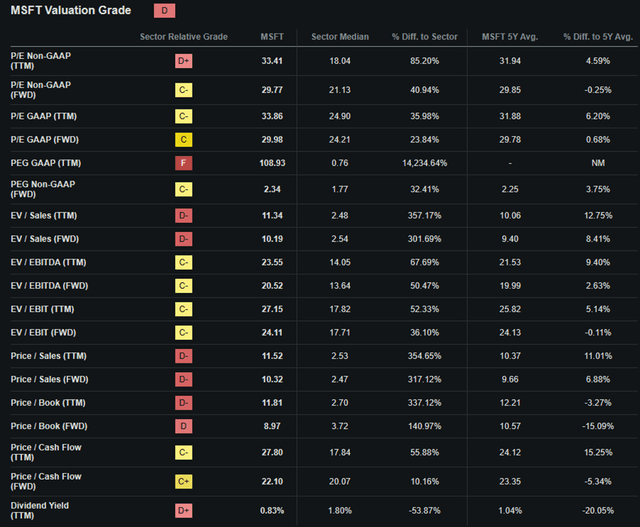

Seeking Alpha | MSFT | Valuation

Seeking Alpha’s Quant has assigned Microsoft a “D” Valuation rating. I am largely inclined to disagree with this assessment as it suggests the firm’s shares are materially overvalued which I do not believe is accurate.

The firm is currently trading at a P/E GAAP FWD ratio of 29.98x and a P/CF ratio FWD of 22.10x. Their FWD Price/Book ratio is 8.97x and the firm’s EV/Sales FWD is 10.19x. While these metrics are certainly quite elevated and not exactly indicative of a deep-value situation, I believe they are mostly appropriate given the firm’s huge growth prospects.

Seeking Alpha | MSFT | Summary Chart

From an absolute perspective, Microsoft’s shares have shown strong performance throughout 2023 with YTD gains of almost 37% being achieved by the stock.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison certainly don’t seem indicative of any value opportunity present in Microsoft, a quantitative approach to valuing the stock is still essential.

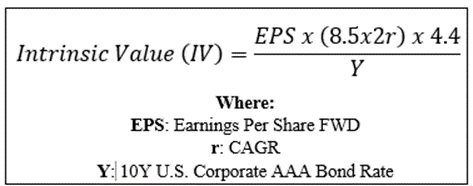

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Microsoft’s current share price of $327.73, an estimated 2024 EPS of $11.01, a realistic “r” value of 0.15 (15%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $363.60. This represents an approximately 10% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.13 (13%) to reflect a scenario where Microsoft struggles to increase net incomes due to their AI expansion failing to achieve the margin expansion desired, shares are still valued at around their current price of $326.00.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe Microsoft is now trading somewhere between a fair value position and a modest undervaluation.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the stock. While the strong future growth prospects are alluring, any short-term catalyst could result in a sudden drop in share prices.

An overall souring in investor sentiments regarding the U.S. economy as a whole could also see Microsoft shares plummet. Given the mixed macroeconomic signals currently being emitted by the U.S. economy, I believe making an accurate short-term prediction on Microsoft shares is impossible.

In the long term (2-10 years), I see Microsoft strengthening its position at the forefront of productivity, cloud computing, and AI markets. Their massive scale and robust economic moat should allow Microsoft to continue innovating at a rapid rate which would be incredibly difficult for essentially any other competitor to match.

While it may take a few years for Microsoft to figure out the best way to profit from some of its more capital-intensive AI products (such as Copilot), I remain confident that the firm will be able to achieve significant profitability within the next three years.

Risks Facing Microsoft – Fall 2023 Update

Microsoft continues to be subject primarily to risks arising from the competitive nature of the business environments in which it operates. However, for the time being I no longer believe the firm faces any immediate threat from the potential for a left-field competitor to emerge and fundamentally disrupt their operations.

Given that Microsoft is currently leading the charge into AI both from an IP ownership perspective and product implementation standpoint, I no longer see the potential for a sudden leap forward by a competitor as a material threat to the firm.

Microsoft’s chief AI rivals continue to be Alphabet (GOOG) and their own AI chatbot and companion Bard.

While Alphabet’s Bard undoubtedly has the potential to match and potentially (depending on how the AI development race proceeds) exceed Microsoft’s Bing and Copilot in the long term, the early-bird advantage Microsoft has obtained by being the first to market seems quite substantial.

I also believe that the sheer rate at which Microsoft has been able to implement its GPT-based AI services into its existing product portfolio is impressive. It is exactly this high rate of implementation combined with excellent execution by the firm that eases my concerns of a competitor overtaking them within the space.

From an ESG perspective, no tangible change has happened at Microsoft, and I continue to believe the firm is a suitable choice for an ESG-conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing if these matters are of concern to you.

Summary

Microsoft has had an impressive FY23 fueled by strong AI-driven revenue growth and gross margin expansion. This has been reflected in shares by a 37% YTD rally boosting valuations to record highs.

The slight drop in valuations since the record highs achieved in late July has left shares trading at around a 10% undervaluation relative to their intrinsic value.

Strengthening of their already massive economic moat thanks to their successful AI integrations and acquisition of Activision Blizzard further helps bolster the future prospects for the tech giant moving forward into 2024, 2025, and beyond.

Given the massive growth prospects, reasonable valuation, and incredibly robust economic moat, I upgraded Microsoft to a Strong Buy recommendation.

While the short-term may see valuations drop should a more bearish macroeconomic environment take over the U.S. economy, I believe that now is a great time to build a position in a long-term “multi-bagger” company at a reasonable price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.