Summary:

- The UK’s CMA is right to be concerned about Microsoft acquiring Activision. The combination of the two would create a cloud-gaming powerhouse.

- Satya Nadella’s big bet on cloud is paying dividends. Can gaming become Microsoft’s next source of growth?

- I believe we are at the beginning of a massive shift in consumer media taste moving from 2D to interactive, real-time, and 3D experiences.

Sean Gallup

Introduction

More than one year after my original analysis about the proposed acquisition of Activision (NASDAQ:ATVI) by Microsoft (NASDAQ:MSFT) they have yet to close the landmark deal, which would be Microsoft’s largest to date. The delay is clearly not due to a lack of effort as Microsoft and Activision have been battling it out with regulatory authorities worldwide. This week Microsoft suffered a major setback as the UK’s Competition and Markets Authority blocked the sale which may result in Microsoft fully abandoning its efforts to acquire the gaming company.

As a Microsoft shareholder, I would still like to see the deal go through, but based on my analysis I may be one of the few authors on SA who believe the CMA is right to fear Microsoft’s consolidation of the cloud gaming market. More on this later.

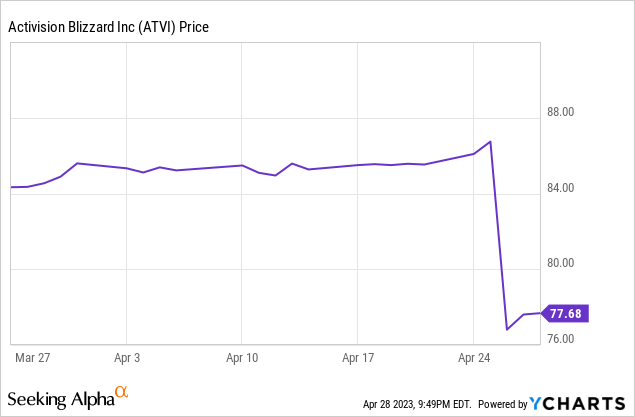

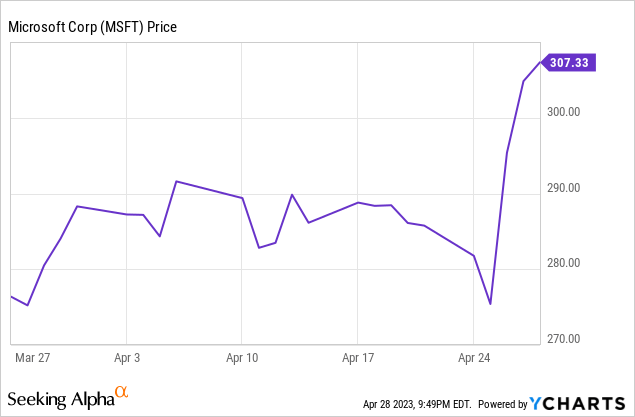

First, let’s take a look at the charts

Following the CMA’s announcement Activision’s share quickly tanked, dropping more than 10% in just a few hours. In the days following the announcement, its shares stabilized at around $77-78 a share but that’s still a far cry from Microsoft’s proposed purchase price of $95 a share.

While Activision’s share price took a dive Microsoft experienced just the opposite, shooting up at a rapid clip due to its upside earnings surprise and renewed strength in mega-cap tech stocks in general.

While I am not an M&A expert, I can add some value by discussing the potential benefits Microsoft and Activision could gain from them finally closing on this deal and help shed some light on why the CMA may be so concerned.

Overview: The Growth of Real-Time Interactive Experiences

To understand why Microsoft was interested in Activision in the first place let’s start with a discussion about the video game industry, what makes it attractive, and what makes it such a challenging space to operate in.

First, on a positive note, the video game industry is massive and growing.

What started as a niche industry targeting children and tech enthusiasts exploded in popularity worldwide as consumers gravitated to new forms of entertainment powered by increasingly powerful technology. Long gone are the days when video games entailed playing Snake on your Nokia, now with just a headset our mobile phones can be used as virtual reality devices where we can interact in real-time with friends from all over the world.

Snake Game (Creative Commons)

Or maybe VR is not your speed, there are other games that are closer to interactive movies whereby the player can make decisions that have the potential to radically change the direction of the story. Detroit Become Human, has the player take the role of a detective where the choices they make determine if key characters live or die.

It’s my fundamental belief that we are moving to a world where entertainment becomes increasingly real-time generated, 3D, and interactive. These are all tailwinds benefiting the industry.

Such a massive shift in consumer preferences will create winners and losers. In my opinion, those that have the most to lose are the legacy providers of popular 2D content (movies + TV).

One of the largest of these companies, Netflix (NFLX), seems to be aware of this threat and is trying to adapt to remain relevant. In years past they launched interactive media experiences like Black Mirror Bandersnatch, a scripted live-action movie where watchers are asked to make real-time decisions about things like what cereal the character eats or what music they should listen to on the bus all the way up to some very big decisions… (which I will not spoil here!)

But beyond interactive movies, Netflix is making other moves in the interactive media space, notably their growing free games offering that is included in your Netflix subscription. But judging by the lack of news coverage, and what I’ve heard about the offering anecdotally I would venture to guess that Netflix’s games offering is off to a challenging start.

But Netflix does have one big head start, a huge customer base paying into a recurring revenue model.

The Power of IP

But a large subscriber base is not all that one needs to run a great media empire. Another challenge that Netflix has no doubt been feeling is the power of strong IP. As great as a huge subscriber base is Netflix simply lacks IP with the same clout as Disney’s Star Wars or Nintendo’s Mario.

The power of strong IP is clear, just look at the new Super Mario Bros movie which is already one of the all-time highest-grossing movies. Releases like Tiger King, Stranger Things, and Love is Blind, just can’t hold a candle to the strength of established IP.

It looks like Microsoft has learned the same lesson, IP is powerful. That’s likely a big part of the reason why they were attracted to Activision which has some of the highest-grossing IP in the industry vis-a-vis Call of Duty, Candy Crush, and many others.

Leveraging strong IP increases your chance of successful launch across all forms of content, from video games, to movies, to TV, to music.

IP is not a Silver Bullet

As essential as strong IP is, it’s not enough on its own to create a sustainable business that generates strong returns for shareholders, at least not usually.

You don’t have to look far for examples of this, even Activision itself has seen wildly fluctuating returns depending on the success of individual call-of-duty launches. Or alternatively, in the movie industry, massive commercial flops can torch hundreds of millions of dollars, even those based on strong IP like several of the latest Marvel movies.

When you are subject to the rapidly evolving tastes of consumers your financial success is dictated by whether you are able to hit that mark or not. And sometimes, despite best efforts, that mark is horribly missed.

The movie industry was slow to adapt, but Netflix forced them to. Now nearly all large movie studios own or have deals with a larger streaming service to get to lose lucrative recurring revenues.

But the video game industry has been even slower to adapt, in many ways it operates close to how it always has. Numerous individual studios invest huge resources into individual game launches and consumers buy the product one time. You can point to in-game purchases/DLC as positive steps in the right direction (at least positive for investors) but in the console market and PC market the industry is still overwhelmingly reliant on cranking out hit after hit.

As a caveat, the same cannot be said for mobile gaming which is largely built on a model of free-to-play games with recurring in-game purchases.

A Microsoft X Activision Combo could fundamentally reshape the industry

That’s where Microsoft and Activision come into the picture, I believe that the combination of these two could fundamentally reshape the industry, and that’s not me being hyperbolic, it’s my genuine belief. Here’s why:

Rolling in all of Activision’s IP into the Xbox Game Pass would combine all secret ingredients, powerful IP, a recurring model, and a massive audience could cement its position as the place to go for gaming.

Let’s take one hypothetical example to illustrate how this could drive value. Imagine a casual gamer, let’s call him ‘Kyle’, he only plays one game, the same game all his friends have, Call of Duty. The game, on its own, costs $70 a year. Let’s imagine Microsoft comes in with an aggressive offering, for $10 a month and you get access to all their games, new releases, and updates across your console, and mobile device. For each ‘Kyle’ that Microsoft can convert to its service, they earn more than 70% more than before ($120 a year vs $70). It becomes easier, and easier to convert more of these consumers as the portfolio of gaming properties on the service grows.

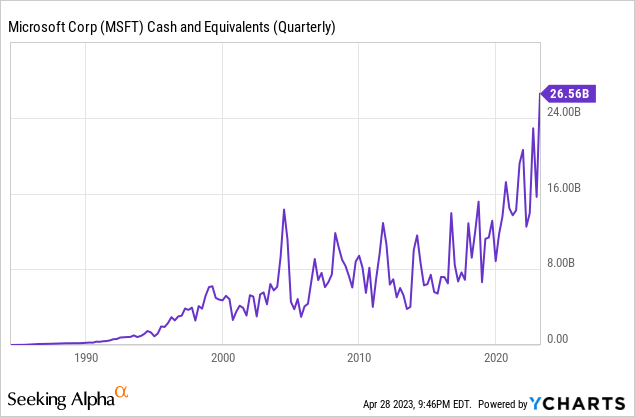

Given the strong profitability of its Azure cloud portfolio Microsoft can afford to invest heavily to make sure that the most important, most desirable games are on its platform. And if they wanted to, they have enough cash to continue the gaming shopping spree. If the deal is ultimately blocked, I think Microsoft will likely shift its sights to another studio.

Apart from Take Two’s Grand Theft Auto, and Nintendo, it’s hard to think of any other company with gaming IP anywhere near the quality possessed by Activision.

If they really wanted to, and I’m not suggesting they would do this, but if Call of Duty were made exclusive to Game Pass I believe they really could crush Sony, perhaps that is why the CMA is so fearful of the deal closing. Microsoft for its part, promises not to do that, but it’s easy to understand the threat that could pose should they go back on their word.

A brief word on the financials

Microsoft continues to execute on its cloud and office suite strategy, its Teams app continues to take share from Slack, showing off the power of the bundle. Azure, another growing category for Microsoft, is firing on all pistons, revenues have been stickier than many expected during the slowdown that started in 2022.

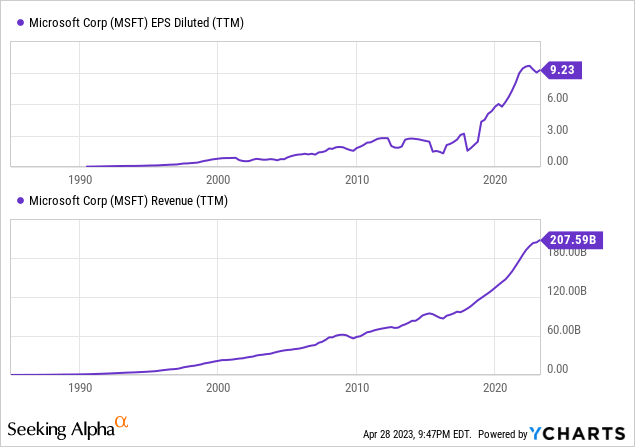

Revenues and EPS

After a slow decade of growth under prior CEO, Balmer, Satya Nadella has ushered in a new era of growth. Both revenues and EPS continue to grow despite macro challenges. Cloud helped Microsoft get to this point, but I believe that gaming could unlock that next leg higher if the Activision deal closes.

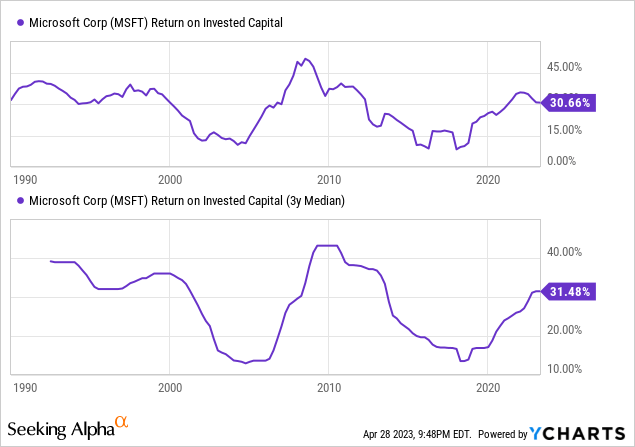

Return on Invested Capital

Unsurprisingly returns on capital have been strong, constantly generating doubt digits returns since the turn of the decade. As the cloud computing market matures I would expect these returns to moderate. Again, cloud gaming and its recurring revenues represent a potential catalyst to juice these levels over the coming decades.

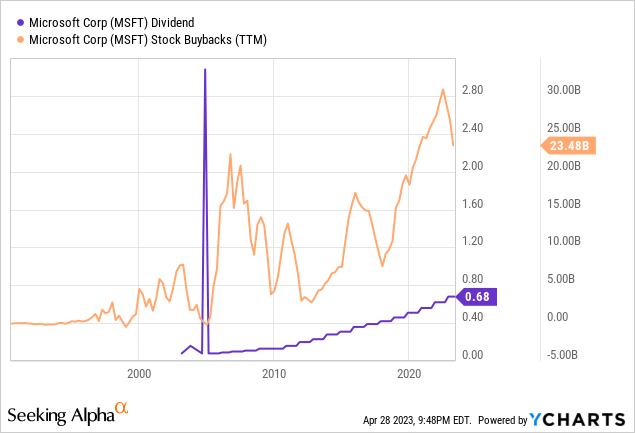

Dividend and Buyback

As someone who is generally neutral regarding capital allocation, I don’t normally pay too much attention to dividends and buybacks as specific indicators in their own right. With that caveat, they can provide some indication to investors that management views the shareholders as owners that should be paid, not just third-party observers. They can also provide a sense of safety during times of increased market volatility and help nervous investors calm their nerves as they see the quarterly dividend check come in.

Conclusion

Microsoft and Activision are winning the competition, the combination of the two would make them the clear leader in the cloud video game subscription market. They could transform an industry reliant on mega-hits, to one based on recurring cashflows as subs become stickier over time.

Now all that’s left is for the transaction to be pushed over the finish line if regulators will get out of the way. Again, I am no legal expert, and this is purely speculation but I believe Microsoft will look to sue to push through the transaction. Given how fragmented the gaming market is it will be hard to prove this transaction is so anti-competitive to the extent that it should be banned. That said, I am not an arb-trader, but I will hold my Microsoft shares for the long term.

I rate Microsoft stock a Buy.

Thank You

I hope you enjoyed reading my article, if you have any questions or have another viewpoint you wish to share feel free to let me know in the comments. Have an amazing day!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.