Summary:

- Microsoft trades at over a $3 trillion market cap but I see more upside ahead.

- The company has shown stellar enterprise and cloud growth, likely driven by AI tailwinds.

- The company offers a rare blend of secular growth, high profit margins, and high returns of cash to shareholders.

- I reiterate my buy rating and outline the path to more upside.

Ethan Miller

Microsoft (NASDAQ:MSFT) trades at an incredible ~$3 trillion market cap, but I still see more upside ahead. The company has been an early generative AI beneficiary, as its investment in OpenAI has been a slam dunk and it has quickly integrated generative AI across its wide product suites. The company is a cash cow with a net cash balance sheet. While growth is likely to eventually slow, if only due to the law of large numbers, the risk-reward looks compelling given the recurring revenue base. I see a clear path to double-digit forward returns, which is an attractive return position in light of the strong financial position. I reiterate my buy rating for this tech giant.

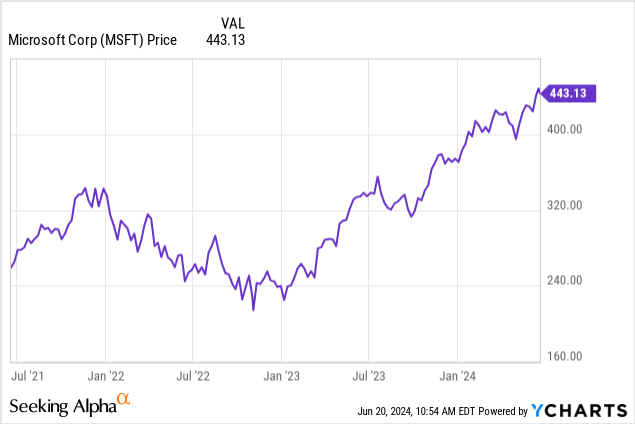

MSFT Stock Price

I last covered MSFT in April, where I explained why my prior hesitance was misguided and why I was upgrading the stock to buy. The stock has performed solidly since then.

It can be tempting to assume the rally is over, or even overdone, but the company’s strong execution suggests that more upside is in store ahead.

MSFT Stock Key Metrics

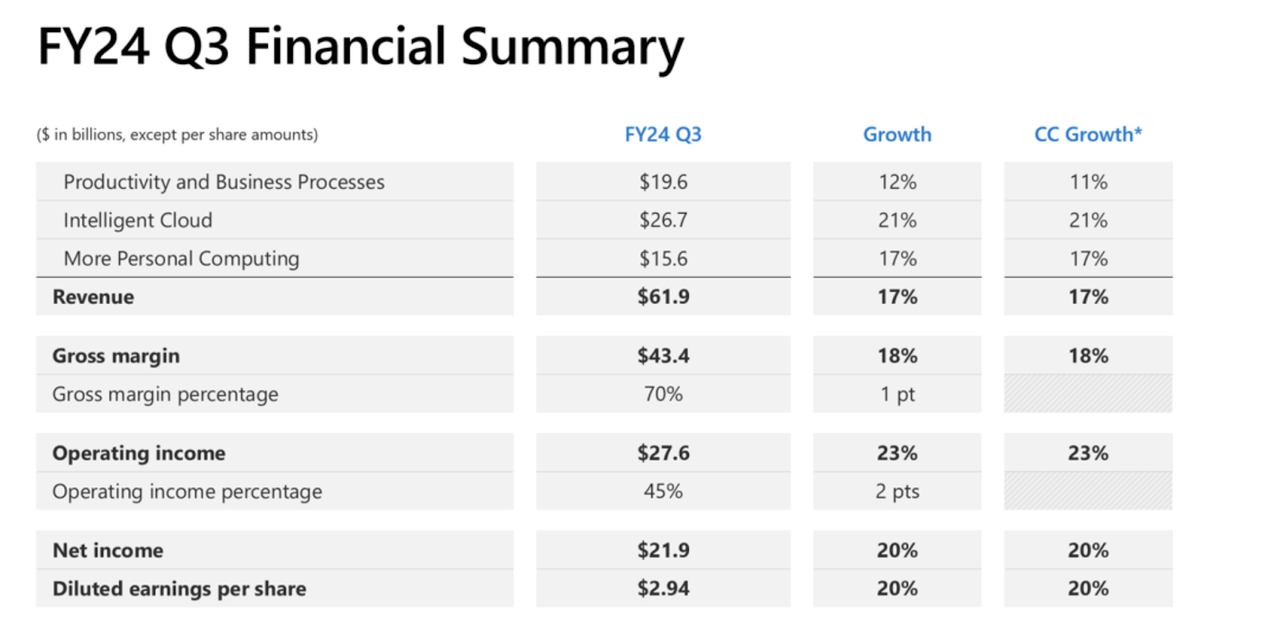

In its most recent quarter, MSFT delivered 17% YoY revenue growth, and 20% earnings per share growth (due to both operating leverage and share repurchases).

FY24 Q3 Presentation

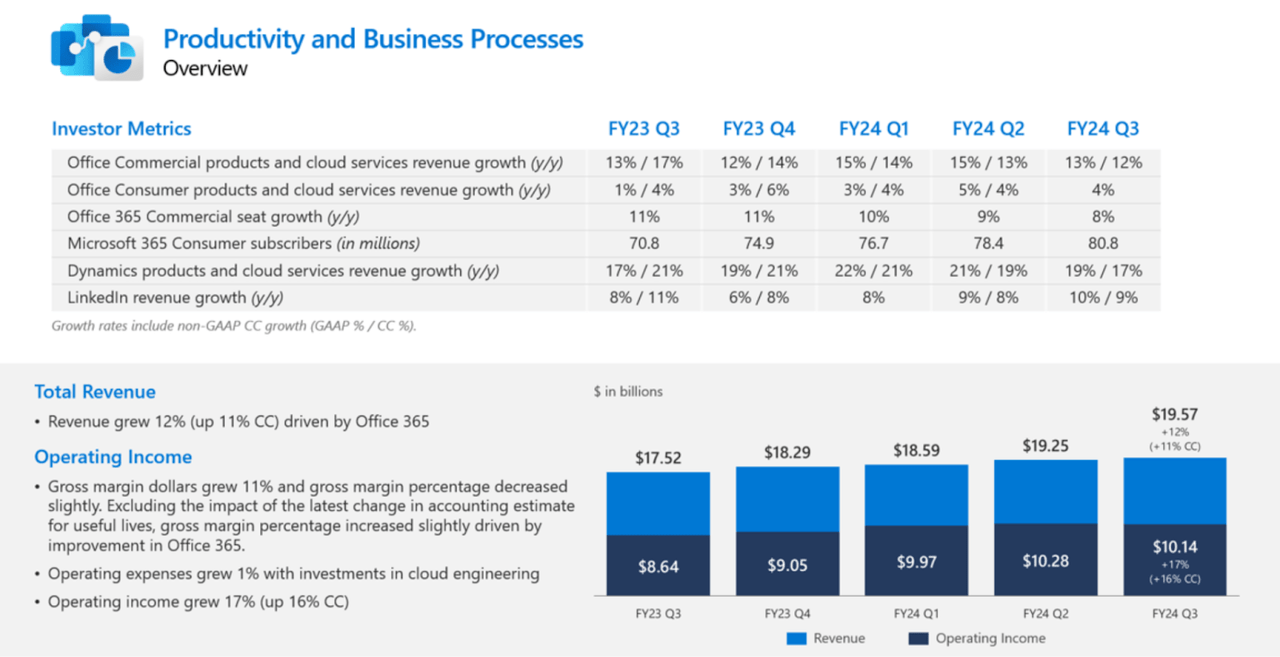

Productivity and business processes, which includes the company’s Office 365 products, grew 12% YoY, coming in at the high end of guidance for between 10% and 12%.

While investors are seemingly focused more on the Azure cloud business, I note that productivity and business processes looks like a high quality recurring revenue business with secular growth and high 51.8% operating margins.

FY24 Q3 Presentation

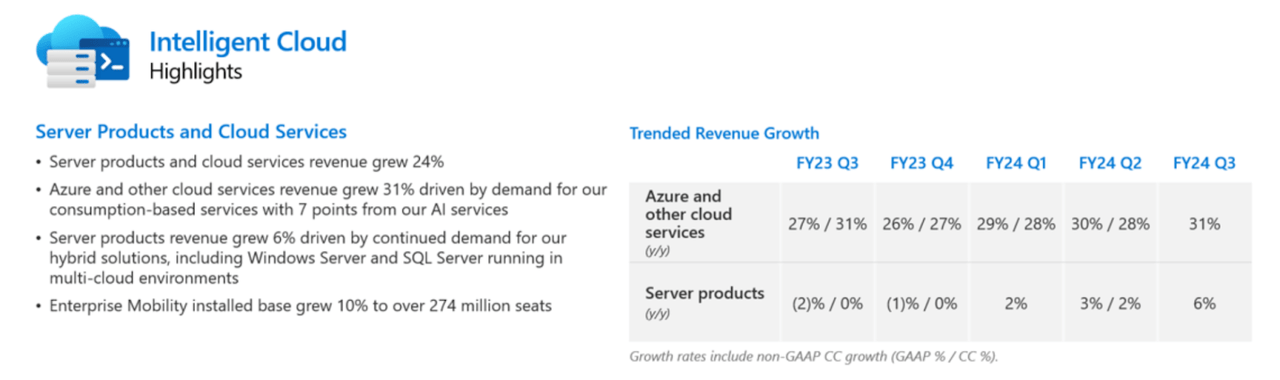

The company saw Azure growth accelerate sequentially to 31%. The company has been a clear generative AI beneficiary, benefitting from both increasing OpenAI workloads as well as potentially a reputational boost from that partnership.

FY24 Q3 Presentation

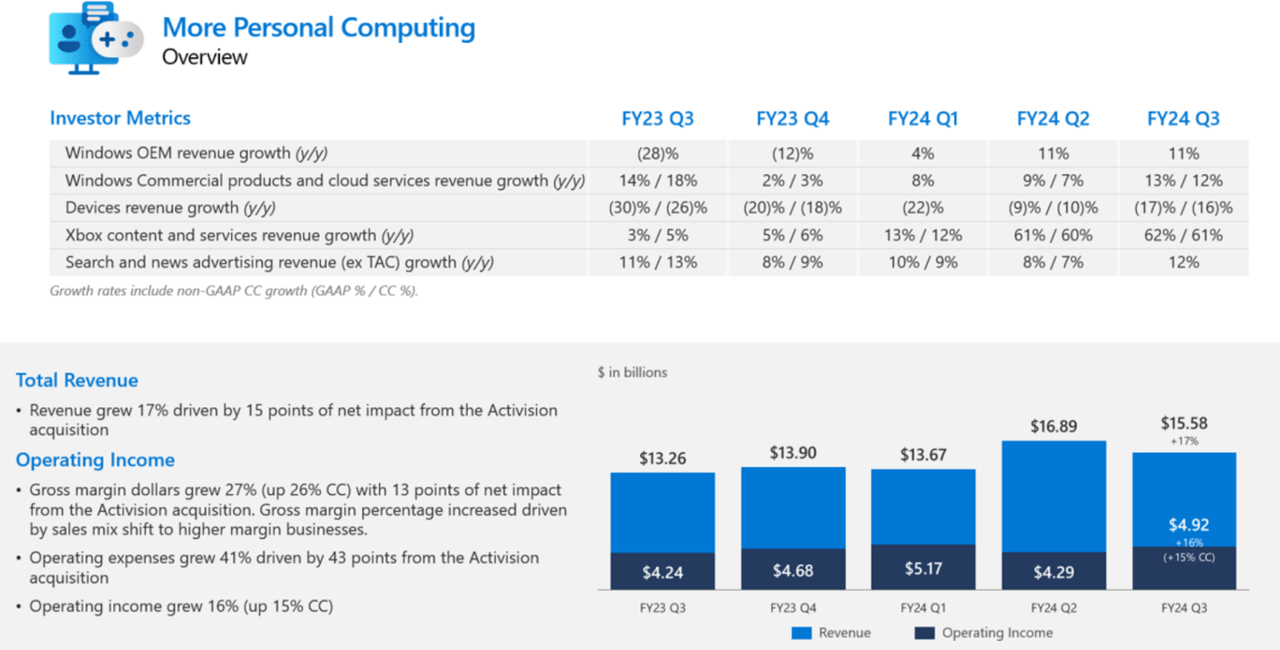

The company saw its more personal computing segment deliver 11% YoY revenue growth. I view this segment to be the lowest quality in the company due to the high amount of cyclicality, and for this reason, have lukewarm feelings about the company’s costly acquisition of Activision Blizzard.

FY24 Q3 Presentation

MSFT ended the quarter with $80 billion of cash and $14.8 billion of equity investments versus $65.4 billion of debt, representing a strong net cash balance sheet. On the conference call, management noted that the net cash position declined sequentially, in part due to accelerated investments in capital expenditures. Management also noted that commercial current remaining performance obligations (‘cRPOs’) grew 20% YoY, accelerating sharply from the 15% rate in the sequential quarter. The strong cRPO growth might be indicating that productivity and business processes growth may be resilient moving forward. This is notable given that many seat-based peers have expressed macro-related headwinds.

Even so, management guided for productivity and business processes to grow by 9% to 11% YoY in the upcoming quarter. Crucially, management expects Azure growth to remain strong at 30% to 31%.

Is MSFT Stock A Buy, Sell, or Hold?

MSFT has earned Wall Street love by combining secular growth with high profit margins and shareholder returns. This is evidenced by the stock’s 38x earnings multiple.

Seeking Alpha

Consensus estimates call for the company to sustain a couple more years of double digit top-line growth.

Seeking Alpha

With markets right around all-time highs and the tech sector leading the way, it is possible if not likely that consensus estimates prove too optimistic. But in my view, this is not a quarter-by-quarter story. I see MSFT sustaining a 25x to 30x earnings multiple as top-line growth slows to the 6% to 8% range, on account of the net cash balance sheet and highly recurring revenue base. Together with my projection of 40% to 45% net margins over the long term, this equates to a 10x to 13.5x sales multiple over the coming years. That implies gradual multiple compression from here, if at all, with investors being able to expect stock returns to come from top-line growth and the earnings yield. These might total around 15% to 18% in the near term, and 12% to 15% over the medium term. Given the company’s strong financial performance across the cycles, I view that return proposition as being attractive.

MSFT Stock Risks

It is possible that MSFT faces the risk of being disrupted. For example, Google Docs (GOOGL) appears to offer stiff competition against Microsoft Word, and my coverage of the cybersecurity space suggests that the company faces stiff competition from the likes of CrowdStrike (CRWD) and SentinelOne (S). Wall Street appears to be of the view that MSFT is to software as Amazon (AMZN) is to e-commerce, with its wide product portfolio threatening to consolidate the space. That view might be too optimistic – if and when this is proven to be the case, the stock might face some volatility. Management might choose to invest heavily in its Bing search, even at the expense of margins.

MSFT Stock Conclusion

MSFT isn’t cheap, but the company has a high quality business model and balance sheet. The company is a clear generative AI winner, but I am not of the view that generative AI is needed for satisfactory returns. The company’s ongoing growth and cash generation may be enough to allow for market-beating returns. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, S, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!