Summary:

- We maintain our sell rating on Microsoft stock despite the hype over AI tailwinds.

- Microsoft announced 3Q23 earnings, proving to be more resilient than expected, but we still see a correction ahead in cloud business due to tightening IT budgets.

- We’re more constructive on Microsoft’s full-force venture into the AI space, incorporating AI into its search engine and cloud businesses but don’t expect it’ll bring near-term gains.

- Not to mention, the stock is highly valued, trading at 8.1x EV/C2024 Sales versus the peer group average of 4.8x.

- We recommend investors take advantage of the stock rally YTD and look for exit points at current levels.

jewhyte

Microsoft (NASDAQ:MSFT) just announced 3Q23 earning results, and we maintain our sell recommendation on the stock. The stock rose 9% in extended trading after reporting earnings.

The market is on an AI high, and Microsoft seems to be leading the pack with a 49% stake in OpenAI and is now pushing to new fronts by incorporating AI features into its Bing search engine and Microsoft 365. Microsoft entered a third phase of investment in OpenAI this quarter, announcing a new multi-billion dollar investment and reporting it would use AI to enhance Bing and Microsoft 365 productivity software. Needless to say, Microsoft has a lot going for it in the mid-to-long run, but we don’t believe the hype justifies Microsoft’s valuation premium. We also don’t expect the company will see significant gains from its AI investment in the near term. We’re constructive on Microsoft’s TAM expanding due to the new AI features integrated into their solutions and is well-positioned with the OpenAI and Nvidia (NVDA) partnership to reap the benefits of AI space- all of which were thoroughly discussed in the 3Q23 earnings call. Microsoft is definitely leading the AI wars at the moment as Alphabet (GOOG) plays catch up with potential threats that Bing may take over as Samsung’s default search engine. However, we don’t see the generative AI demand meaningfully boosting Microsoft’s top and bottom lines headed into 2H23.

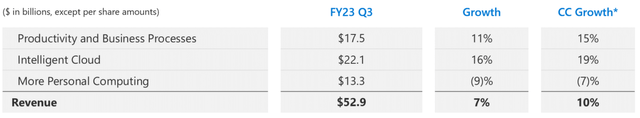

The company’s primary growth driver is still its cloud computing efforts, which are still showing signs of slower growth. Microsoft’s Server Products and Cloud Services put up a fairly resilient front considering the tightening IT budgets amid market uncertainty, with revenue up 17% Y/Y. The company’s Azure and other cloud service revenue grew 27% Y/Y, compared to 31% a quarter earlier, while server products revenue dropped 2%. The company is visibly growing revenue compared to 2022 but still seeing a sequential decline, and we believe this is a red flag. Despite this, peers in the cloud space, Amazon (AMZN) and Alphabet, rose on Microsoft’s better-than-expected cloud growth. But, macro headwinds show no signs of slowing down before 2H23. It’s also crucial not to lose sight of Microsoft’s More Personal Computing segment amid the AI hype; the company reported a 9% decline in the segment this quarter. Windows OEM revenue decreased by 28% due to inventory correction cycles and weaker PC demand. The following chart outlines Microsoft’s 3Q23 financial summary.

We continue to expect more downside ahead in cloud revenue growth as companies trim their budgets and capital expenses due to rising interest rates and inflationary pressures. For the fifth consecutive quarter, the IDC lowered its IT spending forecast for 2023 due to the weakening economy; IDC projects growth this year in constant currency to be 4.4%, down from the previous month’s forecast of 4.5% and the 6% growth forecast last October. We don’t believe Microsoft has an AI shield to protect itself from macro-boogieman. We expect the better-than-expected earnings were driven by the company’s cost-cutting measures earlier this year, with the most recent cuts taking place in March. We recommend investors not feed into the rosy AI narrative in the near term and adjust their perspective to the economic realities of a weaker spending environment and the stock’s high valuation. We recommend investors exit the stock at current levels and revisit it toward the end of the year.

What’s happening with Activision?

Back in January 2022, Microsoft announced plans to acquire Activision Blizzard, a leader in game development and interactive entertainment publisher (and the maker of Call of Duty). The excitement around the acquisition came to a sudden halt earlier this week after the UK competition regulator blocked the $69B acquisition deal. The deal could have made Microsoft the “third-biggest gaming company by revenue, behind China’s Tencent and Japan’s Sony.” The deal was blocked as it “raises competition concerns in the nascent cloud gaming market” as Microsoft could make the games exclusive to its cloud gaming platform and dominate the cloud gaming technology market while still in its infancy. The UK Competition and Markets Authority (CMA) fears that “allowing Microsoft to take such a strong position in the cloud gaming market just as it begins to grow rapidly would risk undermining the innovation that is crucial to the development of these opportunities.” Microsoft and Activision are pushing against the ruling to make things work, as Microsoft provided potential regulatory remedies to allow the deal to go through. Still, it remains unclear how the CMA’s decision will play out and whether the deal is headed for a dead end. This adds another near-term headwind for the company and further cements our sell rating.

Valuation

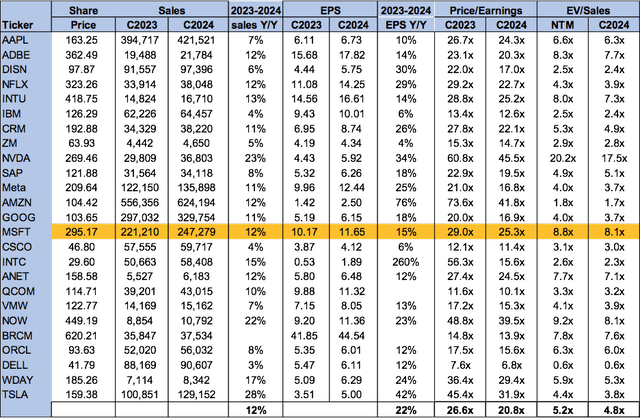

Microsoft is overvalued, trading well above the peer group average for a mature tech stock. On a P/E basis, the stock is trading at 25.3 C2024 compared to the peer group average of 20.8x. The stock is trading at 8.1x EV/C2024 Sales versus the peer group average of 4.8x.

The following chart outlines Microsoft’s valuation against the peer group.

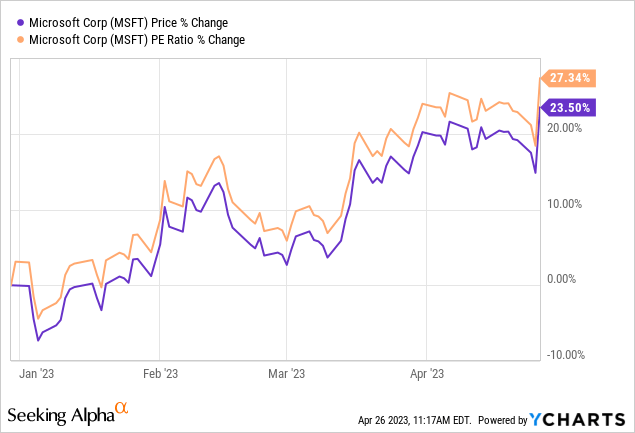

The stock has surged since our last sell rating in late February from $255 to $295, primarily driven by the AI hype. Still, we don’t believe investors should be too worried about missing out on the gains over the past three months. We believe Microsoft is overvalued- despite the company’s successful leading position in the AI space, macroeconomic headwinds will continue to pressure Azure and other cloud businesses’ growth toward 2H23. Microsoft’s P/E ratio factors in future gains in the AI wars, up 23% YTD, but the company is still reporting single-digit revenue growth. A fellow Seeking Alpha contributor’s article shares our sell rating on Microsoft and does well to delve into the valuation specifics further.

The following graph outlines Microsoft’s stock price and P/E ratio change YTD.

YCharts

Word on Wall Street

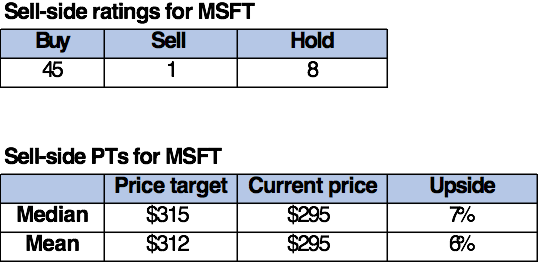

We stand at odds with Wall Street’s overwhelming bullish sentiment on the stock. Of the 54 analysts covering the stock, 45 are buy-rated, eight are hold-rated, and the remaining are sell-rated. It’s pretty easy to be bullish on Microsoft in 2023; the stock is up 23% YTD, significantly outperforming the S&P 500, up 7% during the same period. Still, we see further downside risk for the stock due to the tightening IT spending environment as the Fed is expected to raise interest rates higher, and inflationary pressures show no signs of slowing down. We don’t believe investors should be buying the stock with its high valuation amid market uncertainty.

The following table outlines MSFT’s sell-side ratings.

TechStockPros

What to do with the stock

We continue to be sell-rated on Microsoft. The stock is overvalued, considering the persisting macroeconomic headwinds, and we don’t believe the AI hype justifies the higher multiple. We also see more downside ahead due to companies cutting back on spending amid market uncertainty. The stock is priced at $295 per share, trading well above its 52-week-low of $213.43 per share. We recommend investors take advantage of the stock rally YTD and exit at current levels. Microsoft is a long-time favorite at TechStockPros, and we’ll continue to monitor the stock into 2H23 to upgrade once favorable entry points surface.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.