Summary:

- Microsoft reported resilient Q3 earnings and provided strong Q4 guidance.

- Its partnership with OpenAI will help it maintain a competitive edge.

- Microsoft’s valuation remains relatively low, despite AI’s growth potential.

- Failure of the Activision Blizzard deal could hurt Microsoft’s interests.

Robert Way/iStock Editorial via Getty Images

Thesis

In its most recent earnings, Microsoft Corporation (NASDAQ:MSFT) reported strong earnings that were beyond analyst expectations. In addition, it also provided strong Q4 guidance that also topped estimates. Its cloud business is also showing a resilient growth rate despite slightly dropping from the previous quarter. However, the spotlight today is on its AI efforts and Microsoft is doubling down on its AI ambitions as it is rapidly adding AI tools to its product offerings. Even with strong earnings and so much growth potential from AI, its valuation remains quite attractive in my view and therefore I initiate Microsoft at a BUY rating. The main risk that Microsoft faces today would be the failure of the Activision Blizzard deal as the FTC and the UK’s CMA are threatening to block the deal.

Earnings

Overview

On April 25th, CNBC reported that Microsoft released earnings that beat on the top and bottom lines. Microsoft reported EPS of $2.45 vs. a Refinitiv estimate of $2.23 and reported revenue of $52.86 billion vs. a Refinitiv estimate of $51.02 billion. The quarterly guidance they provided also beat expectations. In addition, Azure and other cloud services growth beat estimates despite dropping from 31% in the previous quarter to 27%. The next day, Microsoft stock surged 7% at open as a result of earnings and even news of the British regulator blocking the Activision Blizzard deal could not dent the rally. I believe the market reaction to earnings was highly justified given that Microsoft’s earnings beat expectations in key areas as well as providing strong guidance.

In its Q3 earnings release, Microsoft reported revenue of $52.9 billion representing 7% growth. Its Productivity and Business Processes segment reported revenue of $17.5 billion, which reflects 11% growth, while its Intelligent Cloud segment showed $22.1 billion of revenue, representing growth of 16%. The only decline in revenue was in the More Personal Computing segment as revenues of $13.3 billion reflect a 9% decline. Net income was reported to be $18.3 billion, which is growth of 9%. In my view, it is clear that earnings were strong and resilient even though the More Personal Computing segment continues to be weighed on by consumer demand slowdowns.

Segment Analysis

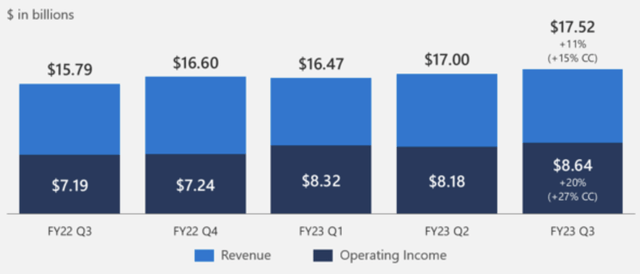

2023 Q3 Earnings Call Slides

In the Productivity and Business Processes segment total revenues were up 15% in constant currency terms with growth mainly driven by Office 365. Its gross margin dollars were up 14% and gross margin percentage also increased. Operating expenses increased by 4% but it was mainly due to investment into LinkedIn. Operating income was up an impressive 20%, 27% in constant currency. Within this segment, for their Office Commercial unit, Office Commercial Products and cloud services had revenue growth of 13%, Office 365 Commercial had growth of 14%, but Office Commercial Product revenues were down 1%. For the LinkedIn unit, their revenues were up 8% which was driven by Talent Solutions. In addition, LinkedIn sessions had growth of 15% and had record engagement. In their Office Consumer unit, Office Consumer products and cloud service had revenue growth of 1% as Office 365 consumer subscribers were up 12%, totaling 65.4 million. Lastly, their Dynamics unit reported Dynamics products and cloud revenue growth of 17% and Dynamics 365 revenue growth of 25%. I believe these results demonstrates strength and resilience in this segment as growth was present throughout the units. In my view, results were impressive as operating income had significant increases.

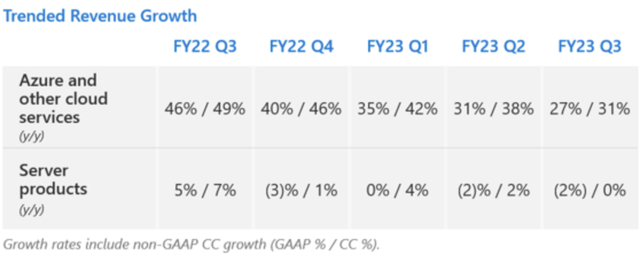

2023 Q3 Earnings Call Slides

For the Intelligent Cloud segment, total revenues were up by 19% in constant currency terms. Gross margin dollars were up 15% but gross margin percentage had a slight decline. Operating expenses were up but it was mainly due to Azure investments. Operating income was reported to have increased 13%. Within this segment, their Server Products and Cloud services unit, the growth in Azure and other cloud services was attributed to strong consumption-based services demand. In addition, server products showed a revenue decline of 2%. Lastly, in the Enterprise Services unit, revenue was up 6%. From my analysis, the mixed results from this segment were less spectacular than the Productivity and Business Processes segment. I believe that although Azure beat expectations as described above, the continual deceleration of growth as shown above could be potentially concerning as Azure has driven Microsoft’s growth for many years. Although current growth is still robust, it is much less than growth seen in past years. For example, in 2017, quarterly growth figures were at least 90% and in 2018 the quarterly growth ranged from the mid-70s to the low-90s. Even in 2019, we were still seeing quarterly growth rates in the high 60s and low 70s. Today’s growth of less than 30% is a significant deceleration in growth and is concerning in my view. Nonetheless, as a whole, results were resilient in this segment.

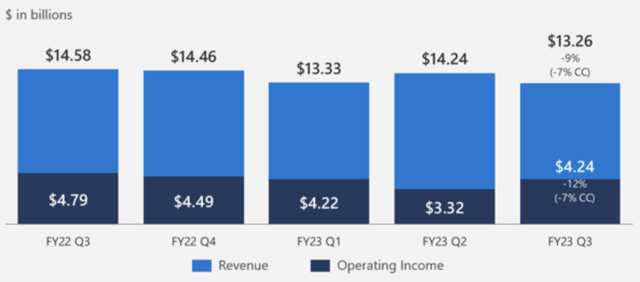

2023 Q3 Earnings Call Slides

Lastly, their More Personal Computing segment reported revenue declines of 7% in constant currency as a result of its Windows and Devices units. Gross margin dollars were down 9% but gross margin percentage increased slightly. Operating income was reported to be down 12%. Within this segment, their Windows unit had mixed results as Windows OEM revenues plunged by 28% as a result of elevated channel inventories. Windows Commercial Products and cloud service revenue showed a revenue increase of 14%. In their Gaming unit, revenues were down a mere 4% as the Xbox hardware revenue drop of 30% was highly offset by Xbox content and services revenues increase of 3%. The Device unit suffered major declines as revenue was down 30% as a result of elevated channel inventory. Lastly, Search and News Advertising had revenue increases of 10% as they reported higher search volume and the Xandr acquisition. From my analysis, this segment reported the weakest results of the three but it was mainly expected due to consumer demand issues. Even though their Windows OEM and Devices revenue were crushed, I believe Gaming demonstrated resilience as growth in Xbox Game Pass helped to offset slow hardware sales. With the current tough consumer market, a decline of 12% in operating income is acceptable in my view.

Q4 Guidance

As discussed above, Microsoft provided guidance that beat expectations. For Productivity and Business Processes they provided a revenue range of $17.9-18.2 billion. For Intelligent Cloud, the range was $23.6-23.9 billion with Azure growth unchanged from Q3. Lastly for More Personal Computing the range is $13.35-13.75 billion. Windows OEM and Device revenues declines are projected to moderate as they are both expected to decline in the low to mid 20s range, which is better than in Q3. I believe these are strong projections as Azure’s growth is not projected to slow further and Window’s OEM is starting to show signs of a turnaround as declines slow. From my analysis, the worst may be already behind Microsoft even as a potential recession looms.

AI Leadership

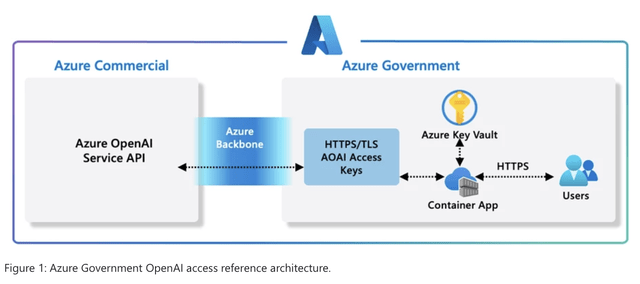

Microsoft Azure Blog

There is no question that OpenAI’s ChatGPT is an industry leader. Its release last fall took the world by storm and companies are rapidly trying to adopt its technologies into their products. No company is closer to OpenAI than Microsoft. Both an investor and a partner, Microsoft is set to highly benefit from OpenAI’s LLMs and Generative AI models. Microsoft has already announced an abundance of upcoming AI integrations. On June 7th, Reuters reported that Microsoft has started to offer government cloud customers OpenAI’s GPT models. Microsoft is reported to be bringing the language-producing models to Azure for U.S. Federal Agencies. They are adding LLMs support, the tech that powers GPT-4, to Azure Government. Reuters reports that Microsoft will become the first major company to offer chatbot technologies to governments. Microsoft has said that these tools will help the government agencies improve efficiency, enhance productivity, and get new insights. They have also created a new architecture so that access to LLMs can be secure and meet security requirements. These tools can be accessed using REST APIs, Python SDK, or the Azure AI Studio. The main uses for these tools will be in accelerating content generation, streamlining content summarization, optimizing semantic searching, and simplifying code generation. In addition, it peers into the commercial Microsoft Azure network and so extra protection was provided to limit exposed surface. Lastly, all Azure traffic will be encrypted with MACsec.

In addition, Engadget reports that Microsoft is adding voice chat to desktop Bing. It is reported that voice input is now available on desktop as it was already available on the mobile version. The new feature will also support the chat reading replies out loud to users. Currently, it supports English, Japanese, French, German, and Mandarin with many more languages coming.

Microsoft’s AI Leadership is shown as it is applying tech in various important fields. For example, on June 11th, Marktechpost reported that Microsoft just unveiled LLaVA-Med which is a large language and vision model for the biomedical field. It is reported to use self-instruct strategies, GPT-4, and external knowledge to create data curation pipelines. Training is then done through a high quality biomedical language-image instruction-following dataset. Marktechpost reports that it is showing strong conversation ability and also domain knowledge. This technology has the potential to revolutionize biomedical inquiry and demonstrates Microsoft’s AI leadership. I believe the application of AI into other fields such as biomedicine and Microsoft’s ability to innovate in these areas shows that Microsoft has an edge over competitors in AI.

Another example of Microsoft’s AI leadership is the recent release of Orca. On June 13th, Marktechpost reports that Microsoft AI introduced Orca which is a 13 billion parameter model that learns explanation traces from GPT-4. It is reported to be a breakthrough in advancing instruction-tune models. Orca does explanation tuning, scales tasks and instructions, and conducts rigorous evaluation which is a big step for AI system capabilities. Marktechpost reports that the potential of Large Foundation Models can be unlocked by using step-by-step explanations and it can also increase progress in natural language processing. This once again demonstrates Microsoft to be at the forefront of AI technology.

I believe Microsoft’s continuing partnership with generative AI industry leader OpenAI will continue to benefit Microsoft. In my view, no company is closer to OpenAI than Microsoft and this will enhance Microsoft’s competitive edge in many industries like Search and Cloud Services. In addition, I believe Microsoft’s AI Leadership can go beyond traditional areas into sectors such as biomedicine. In my view, its innovation in these new areas demonstrates Microsoft’s AI superiority to competitors. From my analysis, it is clear that Microsoft’s growth driver in years to come will be AI.

Valuation

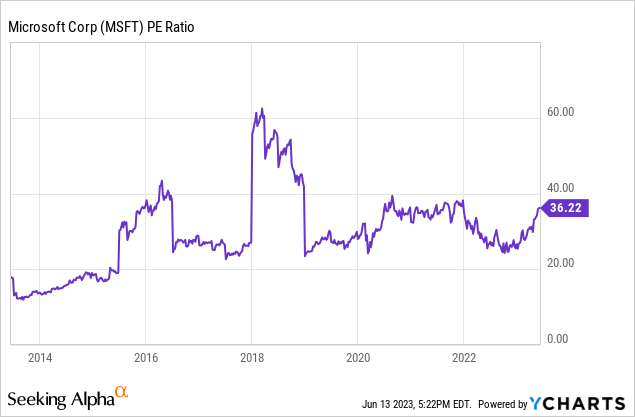

Currently, Microsoft has a P/E ratio of 36.22. Although it has significantly rebounded from the near-term low in the low 20s, the P/E ratio is nowhere near the high levels seen in 2018. Even though Azure’s growth has been slower than in prior years, the promise of AI’s growth potential highly compensates for that. I believe Microsoft’s AI leadership makes it deserve a higher P/E valuation than current levels as the adoption of AI could reaccelerate growth in many of its different segments. For example, the new Azure Government AI adoption could reaccelerate growth for Azure and the new Bing AI Search could gain market share. Although the P/E ratio is not particularly low currently, I believe successful AI adoption could cause significant multiple expansion for Microsoft. In my view, with so many AI tailwinds Microsoft would be correctly valued with a P/E ratio of approximately 45. Therefore, I initiate Microsoft with a BUY rating and a price target of $385.

Risks

The largest risk to Microsoft currently would be the failure of the Activision Blizzard acquisition. On June 12th, Yahoo Finance reported that Xbox and Activision Blizzard were highly important to Microsoft. It is reported that Microsoft Gaming CEO Phil Spencer says Microsoft is “very committed” to getting the Activision Blizzard deal approved despite the legal challenges. It is also very clear the Microsoft sees high strategic value in this acquisition. Spencer was quoted saying “we think there’s a real capability that Activision-Blizzard-King has specifically in mobile and PC, just growing our portfolio that will help us find more players, reach more players.” Also on June 12th, Bloomberg reported that the Federal Trade Commission filed to block Microsoft from closing the deal. The FTC sued Microsoft in federal court to prevent the deal from going through before the July 18th deadline as it wants to review the deal. Microsoft is also appealing the UK’s CMA decision to block the acquisition. In my view, with Microsoft seeing such high strategic value to buying Activision Blizzard and the increasingly large legal obstacles to the deal, it would be harmful to Microsoft’s interests if the deal was to fail. I believe the acquisition would have strengthened Microsoft’s gaming unit and that could have benefited shareholders. However, Phil Spencer did mention that the gaming business is already performing well currently and that they had the largest non-holiday quarter for gaming in the previous quarter. Therefore, Microsoft still has a strong gaming business even if the deal was to fail.

Conclusion

Microsoft’s recent earnings were positive as results beat expectations and showed strength and resilience. Its guidance was also impressive with Azure’s growth deceleration projected to stop and Windows OEM and Devices showing signs of a turnaround. Its AI leadership is also becoming more and more evident and Microsoft is rolling out AI tools for a variety of customers including governments, commercial use, and consumers. Its partnership with industry-leader OpenAI promises to keep Microsoft’s AI ambitions on the forefront of technology. While its AI leadership is increasingly evident, Microsoft’s stock is still undervalued in my view with its P/E nowhere near historic highs. AI could reaccelerate growth in many areas of Microsoft’s business and that could easily push Microsoft’s multiples higher. In addition, even though the Activision Blizzard deal is hitting large obstacles, the current gaming business is no slouch. Therefore, as stated above, I initiate Microsoft stock at BUY with a price target of $385.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.