Summary:

- Microsoft has an increasing trend of new AI-related developments including product launches, integration, partnerships, and acquisitions accounting for 57% of its total developments between December 2022 to March 2023.

- Its Server Products have the highest developments accounting for 42% of total AI developments, which we believe is positive for the company’s growth outlook, which represents its largest segment.

- The second largest segment, Office Products, has the second highest AI-related developments (33% of the total), and we believe it will provide various benefits through AI integration in its productivity software.

David Becker

Following the recent release of Microsoft Corporation’s (NASDAQ:MSFT) earnings for Q3 FY2023, we conducted an analysis of the company’s performance for the first three-quarters of FY2023. Our assessment involved a comparison of Microsoft’s revenue breakdown across its segments during the period with the comparable figures from the previous year, the 5-year segment average growth, and our full-year segment forecast. Despite the less-than-stellar results, we noticed many product developments by Microsoft in recent months, more specifically, AI-related product developments.

|

Microsoft Revenue Breakdown by Segments ($ mln) |

Q1 to Q3 2022 |

Q1 to Q3 2023 |

Our 2023 Forecast |

5-Year Average |

|

Office Products |

33,223 |

35,823 |

||

|

Office Products Growth % |

7.8% |

11.7% |

11.9% |

|

|

|

10,104 |

11,236 |

||

|

LinkedIn Growth % |

11.2% |

22.9% |

48.3% |

|

|

Dynamics |

3,437 |

3,924 |

||

|

Dynamics Growth % |

14.2% |

12.1% |

18.4% |

|

|

Server Products |

48,489 |

58,007 |

||

|

Server Products Growth % |

19.6% |

34.7% |

25.5% |

|

|

Enterprise Services |

5,505 |

5,745 |

||

|

Enterprise Services Growth % |

4.4% |

6.0% |

6% |

|

|

Windows Revenues |

18,347 |

15,449 |

||

|

Windows Revenues Growth % |

-15.8% |

-12.8% |

5.9% |

|

|

Devices |

5,482 |

4,160 |

||

|

Devices Growth % |

-24.1% |

1.4% |

7% |

|

|

Gaming |

12,775 |

11,975 |

||

|

Gaming Growth % |

-6.3% |

12.9% |

13% |

|

|

Search and News Advertising |

8,665 |

9,196 |

||

|

Search and News Advertising Growth % |

6.1% |

48.6% |

13.4% |

|

|

Total Revenues |

146,405 |

155,726 |

||

|

Total Revenues Growth % |

6.4% |

19.1% |

15.5% |

Source: Microsoft, Khaveen Investments

The table above shows the revenue by product groups for the first three quarters of 2022 as well as the first three-quarters of FY2023. Server Products is the largest product segment (37.2% of total revenue) and grew the most among other segments (19.6%) but was still lower than our 2023 forecast of 34.7% and the 5-year average of 25.5%. Overall, Server Products revenue came below our forecast due to weaker-than-expected Azure growth. Microsoft Azure grew at a rate of 31% in the 3 quarters, which is below our forecast for 2023 of 49.56% and the company’s 5-year average Azure growth of 60.5%. Enterprise Services grew by 4.4% in the 3 quarters, which is slightly below the 2023 forecast and 5-year average, both of which are 6%.

Windows Revenues is the third largest product category (9.9% of total revenue) and it had a decline of 15.8%, which is larger than our 2023 forecasted decline of 12.8%. From the quarterly report, the biggest driver for this decline is a fall in Windows OEM revenue, driven by continued PC market weakness. In relation, the Devices category had a steep decline of 24.1% in the 3 quarters compared to our 2023 forecast of 1.4%. The company’s quarterly stated that “elevated channel inventory levels continued to drive additional weakness beyond declining PC demand.”.

Moreover, the Gaming category (7.7% of total revenue) had a decline of 6.3% which is a large difference compared to the 2023 forecasted growth of 12.9%. Microsoft’s quarterly report mentioned that it was “driven by declines in Xbox content and services and Xbox hardware.” The decline in Microsoft’s gaming category is also much greater compared to the global console gaming decline of 4.2% YoY.

Lastly, Search and News Advertising (5.9% of total revenue) had slight growth of 6.1%, which is much lower compared to our 2023 forecast of 48.6%. This is as the digital ad market growth in 2022 was forecasted lower at 13% compared to the past 10-year average of 19%. Additionally, based on its quarterly report, traffic acquisition costs impacted Search and News Advertising growth by 6%.

In this analysis, we analyzed how significant AI is to Microsoft’s product development. We compiled a list of developments from Microsoft’s website since December 2022 including its notable acquisitions, partnerships, new product development and integrations, and categorized them whether they are specific to AI applications. We then determined which segments within the company have the most developments targeting AI applications and discussed the benefits of these developments within each segment.

Microsoft’s Focus on AI Development

Microsoft’s partnership with OpenAI began as early as 2019 when the company invested $1 bln to enhance its Azure cloud-computing platform. This also benefitted OpenAI by providing it with “computing resources it needed to train and improve its AI algorithms”. With that initial investment, Microsoft and OpenAI together built their first top-5 supercomputer and “multiple AI supercomputing systems at massive scale”. According to Microsoft, these AI supercomputing systems were used to train some of the breakthrough AI models now available on Azure, such as GitHub Copilot, Dall-E and ChatGPT. Microsoft further increased its investment in OpenAI at a reported value of $10 bln for a 49% stake in the company.

We believe Microsoft’s investment in OpenAI highlights its focus on AI and could provide various opportunities spanning various segments of the company. For example, Microsoft has integrated ChatGPT into Bing (Search and news advertising segment) as well as AI technology into its Microsoft365 applications (Office products segment). With regards to the Server Products segment, the company recently released its new Azure OpenAI service which includes AI models such as “GPT-3.5, Codex, and DALL-E”.

Furthermore, Microsoft’s CEO also highlighted in its previous earnings briefing that it expects to advance and integrate AI capabilities across its entire tech stack of products and services.

And so, we fully expect us to sort of incorporate AI in every layer of the stack, whether it’s in productivity, whether it’s in our consumer services. And so we are excited about it. – Satya Nadella, Chairman and Chief Executive Officer

Patent Analysis

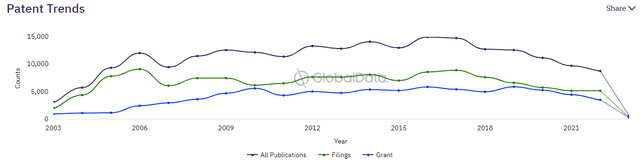

Based on the chart above from GlobalData, Microsoft’s total patent publications had been on an increasing trend from 2003 until 2017. However, since then, the company’s total patent publications have been declining steadily, which could indicate a negative trend for the company. However, given the massive scale of Microsoft, we believe examining its patents alone is not very indicative of its AI developments.

Developments

Furthermore, to understand Microsoft’s level of incorporation of AI, we identified and compiled its developments consisting of partnerships, acquisitions, new product launches, and product integrations by referring to press releases and news from Microsoft’s website between December 2022 and March 2023. We also compiled the developments in the period between August 2022 and November 2022 for comparison. Then, we identified which of the developments were related directly to AI and compiled the AI-related Developments in both periods.

|

Microsoft Developments |

August 2022 – November 2022 |

Dec 2022-March 2023 |

Growth % |

|

Total Developments |

21 |

23 |

9.5% |

|

AI-Related Developments |

5 |

12 |

140% |

|

AI as a % of Total |

23.8% |

52.2% |

Source: Microsoft, Khaveen Investments

Based on the table, we identified higher developments by Microsoft between December 2022 and March 2023 compared to the August to November 2022 period. However, AI-related developments grew substantially by 140% compared to total developments increase of 9.5%. Based on this, Microsoft’s AI developments had increased and at a faster rate compared to its total developments, which indicates it contributed to the increase in total development growth. Thus, we believe AI would support Microsoft’s product development increase going forward.

Furthermore, we compiled our results in a table with each development according to the company’s product segment breakdown.

|

Developments |

Intelligent Cloud (Server Products) |

Intelligent Cloud (Enterprise Services) |

Productivity and Business Processes (Office Products) |

Productivity and Business Processes (Dynamics) |

More Personal Computing (Gaming) |

More Personal Computing (Search and News Advertising) |

Total |

|

Number of Partnerships |

3 |

0 |

2 |

1 |

1 |

0 |

7 |

|

Number of Partnerships (‘AI’) |

2 |

0 |

0 |

1 |

0 |

0 |

3 |

|

Number of Acquisitions |

3 |

0 |

0 |

0 |

0 |

0 |

3 |

|

Number of Acquisitions (‘AI’) |

1 |

0 |

0 |

0 |

0 |

0 |

1 |

|

Number of Product Integrations |

2 |

0 |

3 |

0 |

0 |

0 |

5 |

|

Number of Product Integrations (‘AI’) |

1 |

0 |

2 |

0 |

0 |

0 |

3 |

|

Number of Product Releases |

3 |

0 |

3 |

1 |

0 |

1 |

8 |

|

Number of Product Releases (‘AI’) |

1 |

0 |

2 |

1 |

0 |

1 |

5 |

|

Total Developments |

11 |

0 |

8 |

2 |

1 |

1 |

23 |

|

Total AI-related Developments |

5 |

0 |

4 |

2 |

0 |

1 |

12 |

Source: Microsoft, Khaveen Investments

Based on the table, there are a total of 23 developments and most of it was in the Server Products segment (11 developments) and the Office Products segment (8 developments). For example, this includes its acquisitions of Nuance Communications, hollow core fiber (HCF) solutions company Lumenisity and DPU provider Fungible. The company partnered with companies such as cloud gaming provider Boosteroid to “enable Activision (ATVI) Blizzard PC titles to be streamed by Boosteroid customers” as well as software providers Amdocs and Classiq and dedicated GPU market leader Nvidia.

Of the 23 developments, 12 were targeted toward AI development. We identified that most of its developments were within the Server Products (Intelligent Cloud) and Office Products (Productivity and Business Processes) segments with 5 (42% of total AI) and 4 (33% of total AI) AI-related Developments respectively. We also identified several AI-related developments in other segments including the AI-powered Bing search engine and Microsoft Dynamics 365 Copilot.

All in all, as we identified most of its AI developments were in Server Products and Office Products segments, we looked into these segments further below.

Server Segment Has the Most AI Developments

Based on our compilation of AI developments by Microsoft over the past year, we identified its Server Products segment to have the most AI developments at 5 out of a total of 12 AI developments or 41%. For its Server Products segment, Microsoft’s product development featuring AI includes its Azure OpenAI Service, integration with ChatGPT in Azure OpenAI Service, its Nuance Communications acquisition and partnerships with both Nvidia and OpenAI. We described the benefits of these developments in the following:

- Azure OpenAI Service: Azure OpenAI Service “allows access to OpenAI’s large language models GPT-3.5, Codex and Embeddings through the Azure platform”. Furthermore, Microsoft stated that “customers get the security capabilities of Microsoft Azure while running the same models as OpenAI”. From its recent earnings, the company Azure OpenAI Service customers have increased 10x to 2,500, highlighting its positive reception and adoption.

- ChatGPT in Azure OpenAI Service: According to Microsoft, the integration allows developers to incorporate AI into their applications with various functions including “enhancing existing bots to handle unexpected questions, recapping call center conversations to enable faster customer support resolutions, creating new ad copy with personalized offers, automating claims processing, and more”.

- Acquisition of Nuance: Microsoft acquired Nuance Communications for $18.8 bln in March 2022. The acquisition was done to leverage Nuance’s AI expertise together with Microsoft’s cloud infrastructure to improve workflow mainly in the healthcare sector.

- Partnership with Nvidia: Microsoft partnered with Nvidia (NVDA) for supercomputers “powered by Microsoft Azure’s advanced supercomputing infrastructure combined with NVIDIA GPUs, networking and full stack of AI software”.

- OpenAI Partnership: As mentioned above, Microsoft is expanding Azure’s AI infrastructure for customers. The company plans to use OpenAI’s models in their consumer and enterprise products such as Microsoft’s Azure OpenAI Service. Also, Microsoft is the exclusive cloud provider of OpenAI.

We believe Microsoft’s Server Products had the most AI product development due to several factors including its Server Products segment is its largest segment by revenue accounting for 34% of revenues. This segment is also the second fastest-growing segment for Microsoft based on its 5-year historical growth rate of 25.5%. Another reason we believe is profitability as the segment is under the Intelligent Cloud segment which has the highest operating margin of 43.4%.

In terms of customers, we believe the company’s focus on its Server Products is also due to the large number of customers as Microsoft’s Azure Directory has 722.2 mln users compared to 345 mln Microsoft 365 users for its Office Products, its second largest segment. Finally, Azure is used by 70% of organizations worldwide, we believe the company targets this segment due to the increasing adoption of AI by organizations, according to McKinsey, the % of organizations which has adopted AI has more than doubled from 20% in 2017 to 50% by 2022.

AI, as defined by Gartner, is…

…applying advanced analysis and logic-based techniques, including machine learning (ML), to interpret events, support and automate decisions and to take actions. – Gartner

AI is a broad term that includes subsets of AI such as machine learning, deep learning, natural language processing, computer vision, cognitive computing and neural networks.

The capabilities of AI extend across a wide range of applications of benefits, for example improving the efficiency in data analytics, reducing low-level cognitive tasks machine learning and automation as well as learning complex data patterns with huge computing power.

Cloud computing consists of 3 main types: IaaS, PaaS and SaaS. To summarize broadly, IaaS involves the management of cloud infrastructure by the cloud service provider, PaaS is a “hardware and application-software platform” which allows users to create different applications, while SaaS is software delivered managed and delivered by the cloud providers. Each type differently encompasses 9 components which are resources such as “applications, data, runtime, middleware, O/S, virtualization, servers, storage and networking”.

In the context of the benefits of AI applications in data centers, there are several benefits of AI which include:

- Energy efficiency: Improved energy efficiency for data center operations by leveraging AI through data analytics and energy optimization. For example, Google’s (GOOG) implementation of deep learning capabilities with DeepMind AI reduced energy usage by 40% and resulted in millions of dollars in cost savings. Additionally, Microsoft also stated that AI optimization of processes for increased efficiency enabled the company’s data centers to become “93% more energy efficient” than traditional data centers.

- Cost Reduction: AI also enables the optimization of cloud resources and storage leading to cost reductions. According to Analytics Insights, AI enables cost savings for cloud storage and provided Amazon’s (AMZN) Glacier storage service as an example which “uses Machine Learning to identify and remove duplicate data, which can reduce storage costs by up to 50%”.

- Improved Reliability: According to Equinix, the largest colocation data center provider, AI and ML in Asset Performance Management enables companies to detect operational issues and identify potential problems for maintenance which increases the life of assets, and reduces costs and unplanned outages.

- Enhanced Security: The use of AI and machine learning in data centers also lead to enhanced cloud security. For example, Amazon utilizes machine learning capabilities to “automatically discover, classify, and protect sensitive data stored in AWS”.

To summarize, we identified 4 benefits of AI integration in data centers including increased energy efficiency, cost reductions, improved reliability and enhanced security.

Furthermore, we believe the partnership with Nvidia is significant for Microsoft as Nvidia is the market leader of the AI semicon market. Nvidia’s data center segment has risen to become its largest segment accounting for 45% of revenues in FY2023 due to its immense growth at a 73.8% CAGR.

In our previous analysis, we highlighted Nvidia’s AI leadership where…

We view Nvidia in particular, as not just an AI leader of the semiconductor industry, but as the AI leader of the world – Khaveen Investments

This is as the company seeks to develop AI solutions for every industry from ADAS to its DGX servers used by supercomputers with the “world’s fastest AI workload speeds”.

Furthermore, we also highlighted the presence of Nvidia across all data center classes including supercomputing, hyperscale, enterprise, cloud computing, edge and Factory AI data centers. Moreover, as the market leader in dedicated GPU, we believe Nvidia is poised to strengthen its position as…

GPUs are better suited than CPUs for handling many of the calculations required by AI and machine learning in enterprise data centers and hyperscaler networks. – Network World

Thus, we believe the expected increase in the share of GPUs in data centers against CPUs is likely to benefit Nvidia.

Thus, we believe Nvidia could help Microsoft, the largest tech software company in the world, to become the AI leader in tech software with the highlighted developments related to AI focused on its server and office products. Moreover, Gartner also ranks Microsoft as the top company in its Cloud AI Quadrant. Therefore, we believe this partnership between Microsoft and Nvidia is highly significant due to the leading positions of both companies which we believe should benefit Microsoft’s developments in AI for cloud and growth.

Overall, we determined Microsoft’s focus on the Server Products segment as its largest segment with the highest profitability and second highest growth rate among all segments as well as a massive user base and increasing AI adoption by businesses. We believe the company’s latest developments related to AI could benefit the segment through benefits such as increased energy efficiency, cost reductions, improved reliability and enhanced security could result in increasing competitiveness of its cloud business and revenue growth.

AI Developments in Office Products Segment

Furthermore, besides the Server Products segment, we identified the second segment with the most developments to be its Office Products segment based on our compilation of AI developments by Microsoft over the past year, with 4 out of a total of 12 developments or 33%. Its Office Products segment is its second largest accounting for 24% of revenue for the company, thus highlighting its significance for Microsoft.

Microsoft’s developments for its Office Products segment include product development such as Microsoft 365 Copilot, Microsoft Intune Suite, Microsoft Viva and product integrations with Dall-E from OpenAI. We described the benefits of these developments in the following:

- Microsoft 365 Copilot: It is integrated into the Microsoft 365 apps such as Word, Excel, Outlook and PowerPoint. Examples of its uses are providing a first draft for users to work on in Word and summarizing long email threads in Outlook which could improve speed and efficiency. It also has a “Business Chat” feature that helps streamline workflow when prompted.

- Microsoft Intune Suite: It is integrated into Microsoft Security and Microsoft 365 to help organizations improve and make their security systems more efficient. One example is “Remote Help” which “enables IT helpdesk teams to remotely troubleshoot a user’s desktop and mobile devices based on a user’s existing company identity”.

- Viva Sales: It “helps sellers communicate more effectively with prospects and customers”. It can help in generating email content for a variety of situations as well as help in reminding the seller when it’s time to follow up with a customer.

- Dall-E Integration: It integrates with Microsoft Designer and allows users to generate unique images by simply writing an AI image prompt. It can be used to create original images as well as to depict imaginary people. “By generating images, users can include humans in your creative pieces without them needing to be real”.

Among the several factors why we believe the Office Products segment has the second highest AI developments includes the segment being Microsoft’s second-largest segment by revenue. Furthermore, the productivity software market is dominated by Microsoft with a market share of 89% in 2020 followed by Google and Gartner stated that Microsoft continued to maintain its market dominance despite losing about 1% to 2% share a year to Google. Although its Sever Products segment has more users, its Microsoft 365 still commands a massive user base of 345 mln users, thus highlighting the opportunity for Microsoft to leverage its massive user base. Furthermore, the company’s Office 365 is used by 3.9 mln companies globally according to Enlyft.

Productivity software is tools and solutions used to enhance productivity such as documents, spreadsheets, presentations, project management, communications, time tracking, graphics, database and organization. The benefits of productivity software include improving efficiency and saving time by adopting these tools for workflow management by using digital means instead of manual processes. Project management tools allow users to organize their tasks better and keep track of the project’s progression, and assignments of tasks to teams or individual members and allowing to streamline communication and collaboration between teams.

In the context of productivity software, AI is also used across various ranges. For example, natural language processing usage with tools such as chatbots, data analysis of large amounts of emails, documents and research output. Furthermore, with the combination of deep learning and natural language descriptions, digital image generators including Dall-E allows users to create various artwork.

We describe the benefits of AI within productivity software as follows:

- Improving Productivity: One of the example of improvement in productivity with AI includes AI coding tools. For example, Microsoft’s Copilot integration with GitHub which is trained with data from Microsoft’s open-source code-sharing platform GitHub, enables greater productivity by reducing manual processes. According to Brainspire, coding for software development projects for companies takes between 3 to 8 months, thus we believe AI-powered tools could provide time and cost savings. Based on its latest earnings, the company has attracted a strong customer base of 10,000 organizations for Copilot for Business.

- Maximizing Efficiency: Utilizing chatbots enables companies to allocate resources more efficiently as chatbots can automate various business functions and processes such as marketing, providing support to employees and customer relationship management. According to Digital Signage, chatbots can “increase engagement up to 90% and sales by 67%”.

- Time-Saving: The use of AI in design tools could reduce the time taken compared to traditional marketers who need “over 20 hours per week creating visual content”. AI can automatically produce design ideas almost instantaneously, providing potential cost and time savings.

- Streamlining Communications: AI tools with live voice-to-text transcription capabilities not only enable users to record notes automatically and with “relative accuracy” but is also able to summarize key points which streamline communication in virtual meetings and save time according to Business Insider.

- More Effective Presentations: According to NFON, the use of AI in presentation software with AI analytics could “indicate the success rate of presentations and anticipate the types of interaction that are most suitable”, which enables the presenter in a workplace setting to provide more effective presentations and communication.

All in all, we believe the capabilities of AI complement productivity software and provide benefits in terms of improving productivity, maximizing efficiency, time and cost savings, streamlining communications and enabling more effective presentations. With the developments by Microsoft in this segment including Microsoft 365 Copilot, Intune Suit, Viva Sales and Dall-E integration with Microsoft Designer, we believe this could benefit Microsoft’s customers and could allow the company to increase its sales through upselling opportunities with new products such as Teams Premium and Copilot as well as enable the company to maintain its competitiveness in the software productivity market, which it dominates with a 90% share, with additional features to increase the value offered to customers.

Risk: Competition from Other Players in AI

LexisNexis, Khaveen Investments

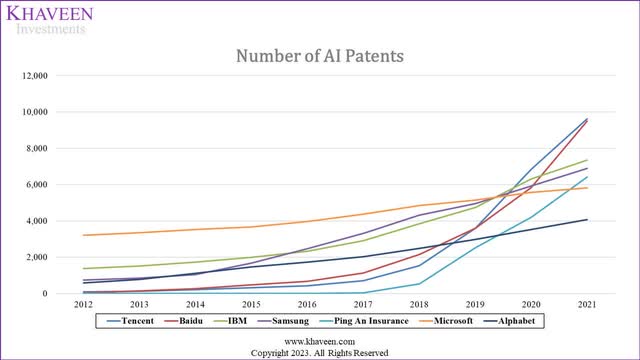

Although the company has had several notable AI developments within the past year, we believe one of the risks of the company’s AI advancement is competition from other firms. Based on Lexis Nexis, Microsoft’s AI-related patents had grown over the past 10 years. Microsoft was also the top company with the highest number of patents for 8 years until 2020 when it was overtaken by other competitors. For example, in the chart below, Tencent (OTCPK:TCEHY), Baidu (BIDU), IBM (IBM), Samsung (OTCPK:SSNLF) and Ping An Insurance (OTCPK:PNGAY) had overtaken Microsoft in terms of the number of AI patents.

|

AI Patents |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

Average |

|

Microsoft |

3,352 |

3,524 |

3,671 |

3,965 |

4,373 |

4,843 |

5,153 |

5,575 |

5,821 |

|

|

Growth % |

4.2% |

5.1% |

4.2% |

8.0% |

10.3% |

10.7% |

6.4% |

8.2% |

4.4% |

6.8% |

|

Increase in AI Patents |

134 |

172 |

147 |

294 |

408 |

470 |

310 |

422 |

246 |

|

|

AI Patents as a % of Grant |

2.8% |

3.2% |

2.8% |

5.0% |

7.5% |

9.4% |

5.2% |

7.9% |

5.5% |

Source: LexisNexis, Khaveen Investments

Microsoft’s AI patents have increased since 2012 at an average of 6.8% with 5,821 patents related to AI as of 2021, indicating its focus on product development within AI. Although Microsoft’s patents had been on a decreasing trend, its AI-related patents continued to grow until 2021 based on Lexis Nexis. Furthermore, we calculated the increase in AI patents for Microsoft and compared it with its total patents to obtain its AI patent increase as a % of total patents. Based on the table, its AI patents as a % of the total had increased in the past 9 years from 2.8% to 5.5% in 2021 but its peak was in 2018 at 9.4%.

Valuation

For our revenue projection of Microsoft, we updated our previous analysis with the company’s Q1 to Q3 FY2023 segment revenues. However, we projected its Q4 FY2023 segment revenues based on our updated full-year 2023 revenue growth forecasts. In total, we see the company’s growth slowing down in FY2023 to 15.3% with lower growth across the board. Notwithstanding, we continue to see Server Products as its highest growth segment and anticipate a recovery beyond FY2023.

|

Microsoft Revenue Projections ($ mln) |

2022 |

2023F |

2024F |

2025F |

2026F |

|

Office Products |

44,862 |

48,822 |

54,509 |

60,858 |

67,947 |

|

Office Products Growth % |

12.5% |

8.8% |

11.6% |

11.6% |

11.6% |

|

|

13,816 |

15,798 |

17,749 |

19,586 |

21,222 |

|

LinkedIn Growth % |

34.3% |

14.3% |

12.3% |

10.3% |

8.3% |

|

Dynamics |

4,686 |

5,324 |

5,943 |

6,514 |

7,010 |

|

Dynamics Growth % |

24.8% |

13.6% |

11.6% |

9.6% |

7.6% |

|

Server Products |

67,321 |

83,368 |

123,847 |

169,696 |

231,286 |

|

Server Products Growth % |

28.0% |

23.8% |

48.6% |

37.0% |

36.3% |

|

Windows Revenues (excluding Search and News Advertising) |

24,761 |

21,042 |

21,328 |

21,618 |

21,912 |

|

Windows Revenues Growth % |

10.1% |

-15.0% |

1.4% |

1.4% |

1.4% |

|

Search and News Advertising |

11,591 |

13,543 |

20,710 |

24,993 |

28,878 |

|

Growth % |

25.1% |

16.8% |

52.9% |

20.7% |

15.5% |

|

Netflix Partnership |

484 |

865 |

1,383 |

2,088 |

|

|

Other Segments |

31,233 |

29,787 |

36,861 |

40,161 |

43,838 |

|

Other Segments Growth % |

4.7% |

-4.6% |

23.7% |

9.0% |

9.2% |

|

Total Activision Blizzard |

10,358 |

11,578 |

12,561 |

14,465 |

|

|

Total Microsoft Revenue (Including Activision) |

198,270 |

228,526 |

293,390 |

357,370 |

438,647 |

|

Growth % |

18.0% |

15.3% |

28.4% |

21.8% |

22.7% |

Source: Microsoft, Khaveen Investments

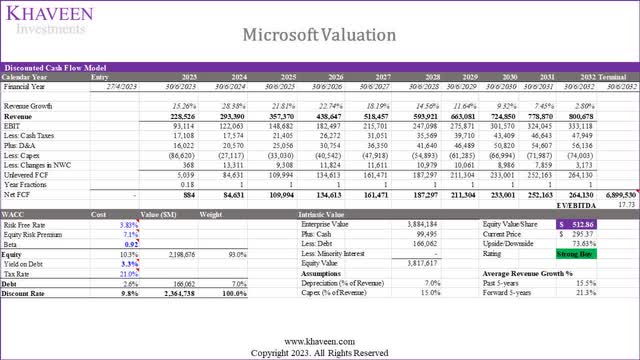

We continued to value the company with an updated DCF analysis. We used a discount rate of 9.7% (Company’s WACC) and terminal value based on an average EV/EBITDA of 17.73x based on the company’s 5-year average. Overall, our model shows its shares are undervalued by 74%.

Verdict

Our analysis indicates that Microsoft has shown a growing trend in new product launches, partnerships, integrations, and acquisitions related to AI in 2023. Among the segments, Server Products and Office Products have had the most AI-related developments. We believe this can be attributed to the fact that these two segments are the largest in terms of size and user base, with the Server Products being the second-highest growth segment.

We anticipate that Microsoft’s AI-related developments for its Server Products would result in increased energy efficiency, cost reductions, improved reliability, and enhanced security, which could enhance the competitiveness of its cloud business and drive revenue growth. For Office Products, we expect AI-related developments to improve productivity, maximize efficiency, save time and costs, streamline communications, and enable more effective presentations. This could lead to increased sales through upselling opportunities with new products and help the company maintain its dominance in the software productivity market.

Overall, we believe that Microsoft’s AI developments in the Server Products and Office Products segments would benefit its growth outlook. We have updated our valuation based on the company’s Q1 to Q3 FY2023 results and projected a total 2023 growth forecast of 15.3%, lower than our previous forecast of 24.4%. However, still anticipate stronger growth beyond FY2024. Despite the revision, our price target of $513.86 remains in line with our previous coverage, and we maintain our Strong Buy rating with a 74% upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Great Content. Thanks for sharing