Summary:

- Microsoft’s AI platform is rather insulated from widespread competition outside of Google Cloud and AWS, and the company’s software assets are particularly well suited for AI advancements.

- To provide context, Azure and Office 365 helped Microsoft add almost $100 billion in revenue over the past four years. It increased from $110 billion to $198 billion in revenue.

- Our current bull case price target is $440. As the story unfolds over the next few quarters, we see additional upside.

Jean-Luc Ichard

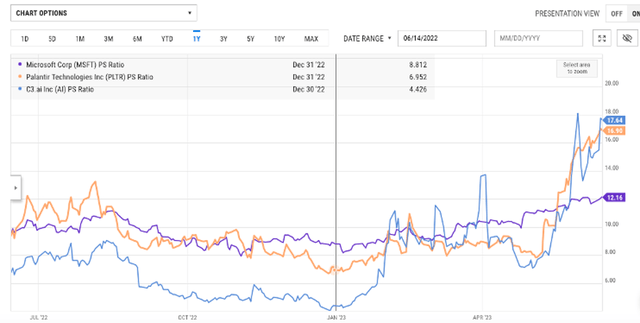

Given the run-up in AI-related valuations, separating the real deal from companies that are merely AI wannabes is critical. The first few things to consider are, will this company see revenue from AI and, if so, how soon.

Pictured Above: Some AI-related cloud stocks have surged in valuation by 4X in the matter of a few months (YCharts)

Although many AI stocks will not report enough AI revenue to survive the fierce, competitive battle the tech industry faces due to AI/ML, Wall Street investors can reasonably assume that Microsoft will be a leader in this space. Microsoft’s AI platform is rather insulated from widespread competition outside of Google Cloud and AWS, and the company’s software assets are particularly well suited for AI advancements, such as Office 365.

In April 2022, our firm re-entered Microsoft with a note to our premium research members about the company’s dominance in AI before Chat-GPT3 was released. We repeated this in October 2022 when we called Microsoft a “sleeping AI giant”:

Microsoft is a sleeping AI/ML giant. Google gets a lot of attention here yet I think they are equally prepared to serve this market […] To help Microsoft rival Google, the company has been investing in OpenAI, which is a large R&D operation that is breaking ground with AI algorithms that help computers to create images from text, reduce the amount of code that developers need to write, and to also help robotics think and act like humans, among other things […] DALL-E is a “12-billion parameter” version of GPT-3 that creates images from text. The partnership with Microsoft will bring DALL-E to apps and services, including the Designer app and Image Creator tool in Bing and Microsoft Edge – this was announced earlier this month at Ignite.”

Analysts have been raising their price targets to the high $300s with an Evercore analyst raising his price target to $400 stating:

The infusion of AI across Microsoft’s product portfolio represents a potential $100 billion incremental revenue uplift in 2027.

To provide some context, Azure and Office 365 helped Microsoft add almost $100 billion in revenue over the past four years. It increased from $110 billion to $198 billion in revenue. The stock appreciated 180% over that time frame. At the time, the market did not comprehend the revenue potential in these two businesses. We believe that history will repeat itself and the market is underestimating the impact AI will have on MSFT’s future sales growth across its business lines.

However, valuation poses a risk to Microsoft’s current stock price, and as outlined below, our firm prefers to wait before we add again to our position.

6 Ways Microsoft Can Drive Another $100 Billion with AI

Open AI APIs

The OpenAI opportunity extends beyond Microsoft’s installed base, which is an important change to Microsoft’s market position. This is because OpenAI APIs run on Azure even if the customer isn’t directly an Azure customer. Management commented on this in the earnings call:

Second, even Azure OpenAI API customers are all new, and the workload conversations, whether it’s B2C conversations in financial services or drug discovery on another side, these are all new workloads that we really were not in the game in the past, whereas we now are.”

Generative AI for Government

One market that gets overlooked in terms of its AI impact is the Federal Government. It is currently undergoing a major shift into the cloud. In a blog post, the company CTO Bill Chappell wrote:

Microsoft continues to develop and advance cloud services to meet the full spectrum of government needs while complying with United States regulatory standards for classification and security. The latest of these tools, generative AI capabilities through Microsoft Azure OpenAI Service, can help government agencies improve efficiency, enhance productivity, and unlock new insights from their data. Many agencies require a higher level of security given the sensitivity of government data. Microsoft Azure Government provides the stringent security and compliance standards they need to meet government requirements for sensitive data.

Many years ago, I wrote about the Pentagon contract and why Microsoft would be a front-runner when it was widely reported AWS was the sole Big 3 contender for the contract. This analysis pointed toward the long-standing history Microsoft has in being favored by government entities.

Microsoft Copilot

The company introduced Microsoft 365 Copilot last month. It is the productivity tool that combines large language models (LLMs) with the data in Microsoft Graph and Microsoft 365 apps. The use cases of Copilot in Word include giving the users the first draft while saving the time on sourcing, writing, and editing the content. Similarly, Copilot in PowerPoint will help to create presentations based on previous content. Copilot in Excel can analyze trends from the data, create charts, and helps to make informative decisions.

To have a suite of productivity products that can see an immediate impact from AI-related R&D is a large part of the $100 billion that Microsoft can potentially add to the top line by 2027.

Edge/Telecom Partnerships

Another important driver is Microsoft’s close partnerships with many of the telecom and data centers around world which will further cement its strong position in edge computing.

In February, Microsoft announced it had previewed two AI-powered services that are designed to manage telecom networks. Jason Zander, executive vice president of strategic missions and technologies at Microsoft said,

What we’re doing is taking our native cloud work and making it specific to this telecom operator network space. I think a really great example of that is all the AI ops work that we are introducing into the system.

Microsoft Bing

In the most recent quarter, Microsoft announced that the new AI-powered Bing and Edge has seen a positive response. The company crossed 100 million daily active users of Bing. This is how Microsoft described the early impact of ChatGPT:

Of the millions of active users of the new Bing preview, it’s great to see that roughly one third are new to Bing. We see this appeal of the new Bing as a validation of our view that search is due for a reinvention and of the unique value proposition of combining Search + Answers + Chat + Creation in one experience.

Notably, Microsoft Bing has 3% market share and for every additional 1%, Microsoft will make an additional $2 billion.

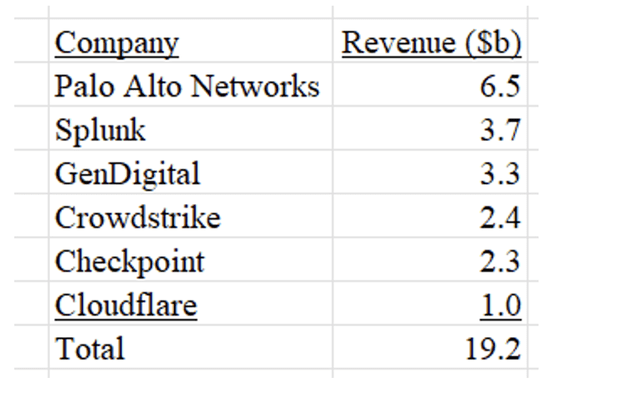

Microsoft is one of the largest cybersecurity companies

Microsoft’s cybersecurity segment reports more than $15 billion in revenue. The company was also the only Big 3 cloud vendor to not only build a multi-cloud product but also multi-cloud security. Today Microsoft’s cybersecurity sales dwarf the revenue of many cybersecurity best-of-breed products combined.

Installed customer base provides cross-selling opportunities for new AI/ML based products and functionality

In the spring of 2022, I wrote about how reducing cloud costs was going to be a key trend in 2022 and beyond. We believed that Microsoft was uniquely positioned to benefit from this trend as it aggregates cloud services to help drive down costs. This is especially attractive for the Fortune 500 whereas startups, SMBs and mid-sized enterprises are likely to seek out and manage a larger portfolio of cloud services from various vendors.

Among the Big 3, Microsoft dominates the Fortune 500 with 95% running on Azure. Retaining the Fortune 500 in the migration to the cloud was accomplished through hybrid computing where Microsoft was first-to-market on serving a mix of on-premise, private and public clouds for their large enterprise customers. As the leader in on-premise systems, Microsoft was perfectly positioned to win with hybrid architectures. The company took this a step further and undercut other services on prices across its suite of software and platforms to win aggregate, long-term contracts.

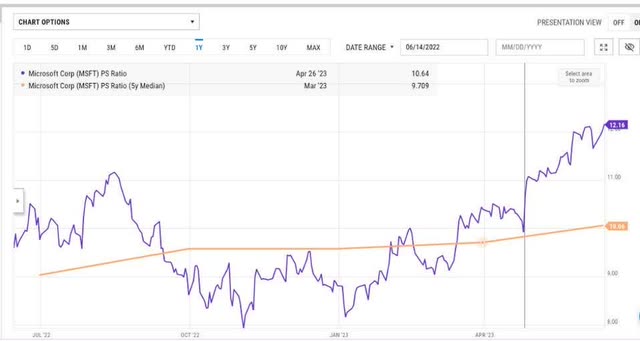

Microsoft’s Risk is Valuation

Microsoft business model is low risk compared to many other AI stocks. However, there is certainly risk in the company’s valuation. The risk is compounded when market exuberance front runs a trend and overshoots the mark of what a company can realistically report in the coming years. Microsoft’s valuation is high relative to its 5-year median. If you look at the 5-year median prior to the current run-up, the stock has a historic valuation of 9x PS Ratio and is currently trading at a 12x PS Ratio. Similarly, the 5-year median PE Ratio at the start of the year was 25 and the stock is currently trading at 36.

Conclusion

AI will be a constantly evolving space and while many investors are rushing in at overstretched valuations, we prefer to be patient. Over time, we agree with the analyst that Microsoft’s competitive moat has positioned it to monetize the AI opportunity, much like with Azure and Microsoft 360, across its business lines so that its revenue will increase by $100B in the medium-term.

Microsoft is a real-deal AI stock and the increase in valuation has clearly factored in some of this. However, our updated sum-of-the parts analysis indicates there is still upside. Our current bull case price target is $440. As the story unfolds over the next few quarters, we see additional upside. However, in light of the strong rally from the Jan 2023 lows, we believe incorporating technical analysis to attempt to get the stock lower is important in determining optimal entry levels. In other words, the risk the stock sells off is much higher than usual right now. Sure, the stock price could continue to climb higher, but the world’s best investors favor being patient and buying when the market is in a state of fear rather than a state of greed. When we do add to our key positions, we issue real-time trade alerts.

Recommended Reading:

- Why Microsoft (Not Amazon) Could Win The Pentagon Contract

- May Stock Pick: Perion Network – Google Anti-Trust Beneficiary Plus AI Tailwinds

- Microsoft: Eyeing For LTBH Position

- Microsoft Stock: Azure Growth Proves Resilient

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.