Summary:

- Generative AI market, including ChatGPT, has potential to surge to $1.3 trillion by 2032, with major players like Microsoft and Google leading the integration.

- Microsoft’s OpenAI could generate a revenue of $56 billion by 2032, according to our estimates, but the company’s growth is slowing down in other segments.

- We suggest a Sell rating for Microsoft stock, as the integration of AI in slow-growing segments may not significantly boost the company’s revenue and profit.

jewhyte

Investment Thesis

We don’t expect that Azure OpenAI Service and the integration of AI in slowly growing segments will give a significant boost to the company’s revenue and profit over the medium term the same way it boosted the Microsoft (NASDAQ:MSFT) stock, pushing it close to an all-time high. Rating is Sell.

Generative AI landscape

The public release of the ChatGPT technology in December 2022 not only caused widespread discussion of the technology and its popularity, but also gave a strong push to the broader adoption of generative AI. ChatGPT attracted 1 million users over 1 month of 2022, and that number topped 100 mln people by February 2023, making ChatGPT the fastest growing service in terms of user additions. By that time, the valuation of OpenAI (ChatGPT’s owner) surged from $20 to $29 bln.

There are currently around 450 startups of various sizes in the generative AI market. Despite economic uncertainty, the valuations of these startups continue to rise.

Generative AI is a type of technology that can produce various types of content, including text, music, imagery and 3D models, based on prompts from the user, such as a word, a phrase, an image or some other input. Generative AI imitates human thinking by relying on algorithms that have been annotated with millions of images, texts, and other media.

The generative AI technology has started to be widely used in creative industries for generating texts and images. The technology has prospects in the financial services sector for automating various processes and protecting against fraud. Generative AI is also capable of creating synthetic data to supplement real-world data. However, the application of synthetic data is still in its early stages as the technology requires further adaptation.

One negative case of using generative AI occurred in the US, where a lawyer representing a defendant submitted filings to a court that cited six nonexistent cases, which were all invented by ChatGPT. In another negative case, a video game studio allegedly laid off its department of artists, only to end up facing a backlash from the gaming community over generating a character with six fingers.

The adoption of generative AI has just started. Many companies have accelerated the race to apply and improve the technology, understanding its potential.

ChatGPT earned $10 mln in 2022. OpenAI anticipates that it will earn about $200 mln in 2023, and rake in as much as $1 bln in 2024.

Generative AI market outlook

OpenAI is currently the most well-known generative AI company, which was the origin of all the hype around the issue. But OpenAI is not the only player in this realm. The market can be divided into two parts: those who provide infrastructure for AI development (cloud computing services and devices) and those who create and adapt AI models for specific purposes.

To date, Microsoft and Google appear to be the leaders in integrating generative AI, as they have large platforms for integrating tools, are engaged in AI research and development, and have the money to spread the application of the technology. However, besides Microsoft’s OpenAI and Google’s DeepMind, there is also BlenderBot from Meta and similar technologies from Amazon and Baidu. That makes it important to understand the size and scope of the AI market.

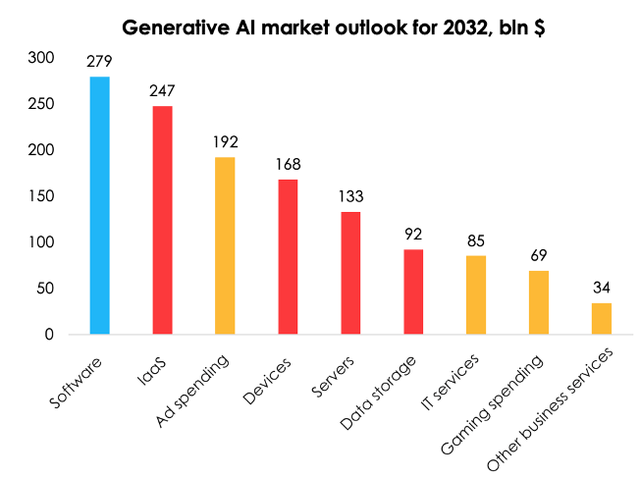

According to Bloomberg Intelligence, the entire generative AI market was estimated at $40 bln in 2022. Spending on infrastructure and devices – collectively labeled as hardware – made up $38 bln, while spending on software solutions, such as ChatGPT, made up a mere $2 bln.

Again according to Bloomberg Intelligence, the generative AI market has the potential to surge to $1.3 trillion by 2032, of which $640 bln will be hardware (a CAGR of +33%), and $280 bln software solutions (a CAGR of +69%), while the remainder will be other business services. IaaS products will make up most of the hardware segment ($250 bln, a CAGR of +60%), with vendors providing technological infrastructure to users.

ChatGPT opportunities

The competitive landscape is fairly wide ranging. In addition to the aforementioned major players, there are many smaller generative AI platforms that are based on open-source solutions. For example, in March, the LLaMa language model from Meta (Meta has been designated as a terrorist organization and banned in Russia) was leaked to the Internet, and the AI research community started using the technology to train their own neural networks. There were releases of the Koala and Open Assistant models in April, which were rated by users as not worse than GPT. The neural networks were trained on publicly available data and are free to use.

Also, it costs less than $100 to train your own neural network and it does not require huge computing power. There are examples of how the open-source community created multimodal neural networks (text + images) that have shown good results compared to industry leaders.

At any rate, at first it will be the companies that integrate generative AI as a native part of their current products with a high user base, such as search engines, cloud services, and optimizers of all sorts, that will benefit the most from the generative AI technology. The thesis that free technologies will eventually kill the potential of products created by large companies hasn’t been proved over time, given what happened in similar situations, such as Word vs Open Office.

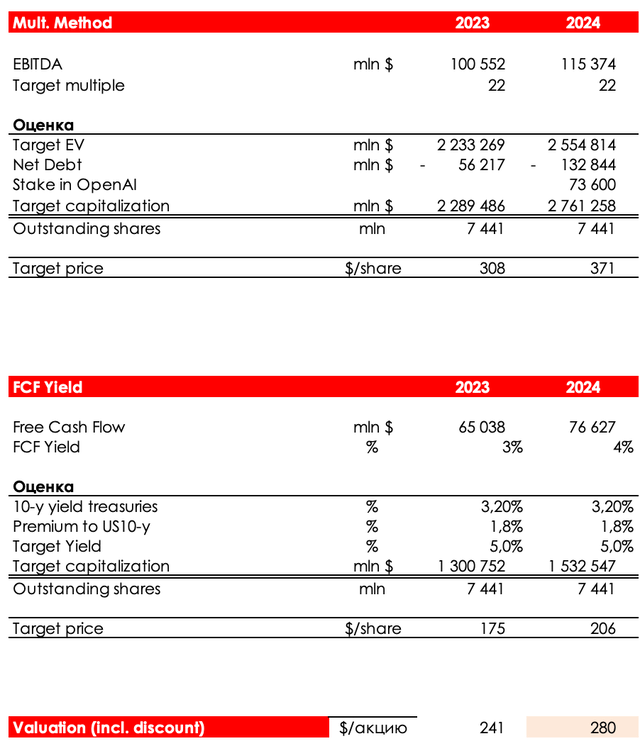

Considering Microsoft’s solid access to cloud technology (Azure makes up about 23% of the market), its Bing search engine, the Windows operating system, GitHub and the Office workspace, we estimate that OpenAI has the potential to gain a 20% share of the market, which means OpenAI could generate a revenue of $56 bln by 2032. We evaluate OpenAI using the EV/Sales method and the average multiples of major growth companies over the past decade. The average fair multiple was 6.2х, pushing OpenAI valuation to $347.2 bln. Microsoft owns 49% of OpenAI, so the fair value of the company’s investment, based on the year 2032, has been estimated at $173.6 bln. Factoring in a discount of 13% per annum, the fair value of Microsoft’s investment has been estimated to reach $73.6 bln by 2025.

Microsoft without OpenAI, or the fight for growth

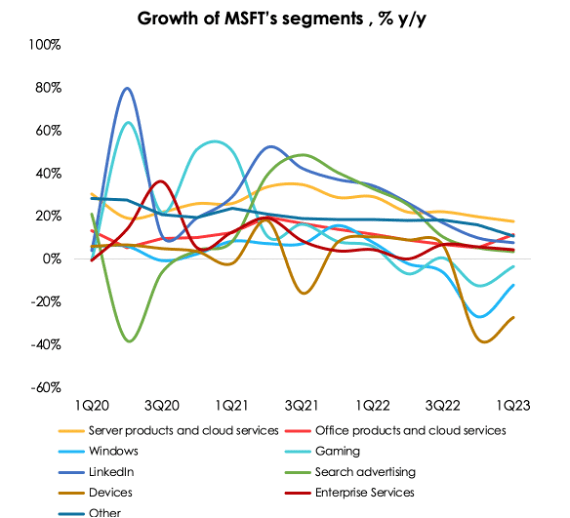

What is Microsoft without its cloud? It’s a slowly growing business that develops only through acquisitions and rare releases of new products. Some of the exceptions were a powerful recovery in the segment of advertising, search and gaming during the COVID-19 quarantine restrictions, the e-commerce boom and LinkedIn.

Invest Heroes

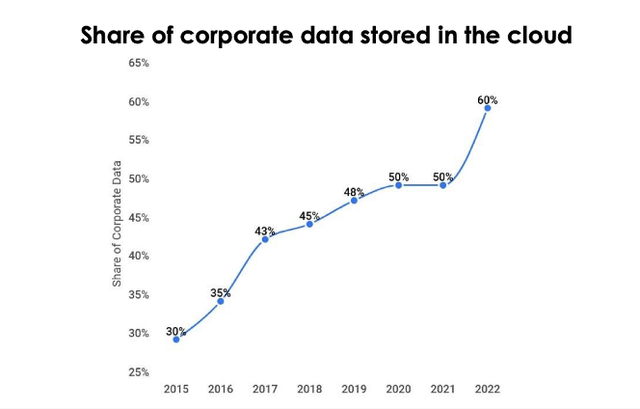

The cloud computing segment continues to be the driving force of revenue and profit growth, but there are signs that the explosive growth of the cloud technology market, which took place in 2018 to 2021, is slowing. That’s largely because the largest potential B2B customers are already using cloud infrastructure. According to Zippia, around 90% of US companies were cloud infrastructure users in 2022, and about 60% of corporate data was stored in the cloud.

MSFT isn’t an exception. The growth of its cloud business in 3Q 2023 was the slowest ever, measuring 17.5% y/y, with the business volume reaching $20 bln.

The other major players in the cloud infrastructure market, Amazon and Google, whose combined market share is around 55%, are also reporting a deceleration in demand and expect the trend to continue in 2023. That’s because the extensive decline in profits is pushing companies that are cloud users to start giving up plans to digitize some of their business units or putting them off, which is the reason why the forecasts for the future growth of the market have been cut.

Valuation

Our MSFT’s fair value price for the next 12 months is $280 due to:

- reflecting the valuation of OpenAI;

- the decrease of the premium to the yield of US 10-year Treasuries from 2.6% to 1.8% due to a revision of the period, for which the premium is calculated, so the valuation better reflects the current macroeconomic environment and the hype around AI.

The status for the shares is SELL.

Conclusion

The increased interest of investors in the topic of artificial intelligence led to a sharp acceleration of Microsoft shares, while the real situation of revenue and profit growth leaves much to be desired. We are sure that investors were too optimistic about the prospects of introducing artificial intelligence into the slow-growing segments of the company’s business. Rating is SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.