Summary:

- Microsoft investors are likely facing similar perils of lofty expectations as those in the 2000 dot-com bubble.

- In the 2000 episode, investors bid up its P/E to a level that it took ~15 years for the investment to break even.

- Its current P/E, although far below the 2000 bubble level, is sufficiently high to lead to years of diminished or even negative returns.

- To further compound the valuation risks, consensus EPS projections imply overly optimistic margin expansion despite the intensifying competitive pressure.

Jan-Schneckenhaus

Thesis

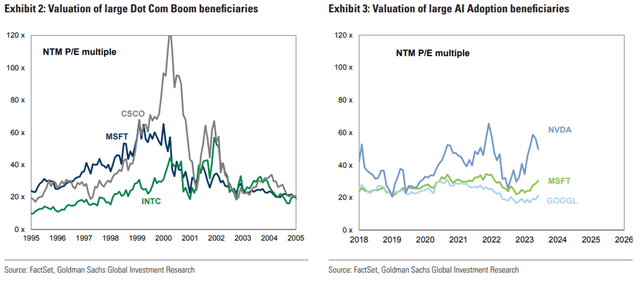

Goldman Sachs’ equity strategy team recently published a report projecting AI’s impact on the productivity boost. One figure in the report (shown below) compared the valuations of the largest leading AI beneficiaries today to those of the beneficiaries of the Dot Com Boom. Microsoft (NASDAQ:MSFT) was/is one of them in both cases. The report commented that although the valuation of today’s perceived AI beneficiaries is not as extreme as those seen during the Dot Com bubble,

“…historical precedent from the Dot Com Boom shows the perils of high expectations. Even though most (tech, media, telecom) companies were still able to generate strong sales growth between 2000 and 2002, the failure to meet lofty investor forecasts led to a sharp 50%+ contraction in P/E multiple and a plunge in share prices.”

Source: Goldman Sachs’ equity strategy team

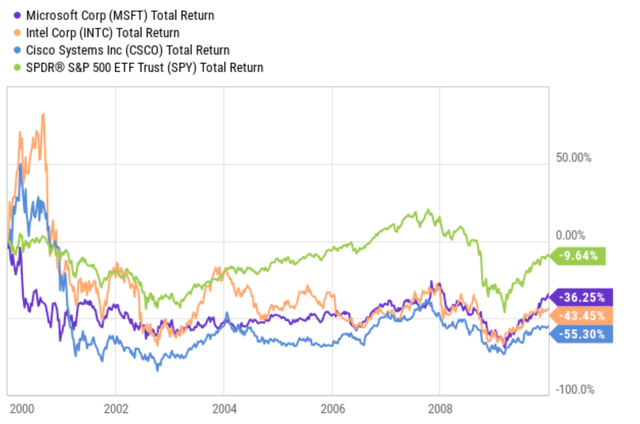

Against this background, this thesis argues that under current conditions, MSFT investors are facing similar perils of high expectations as those in 2000. In the dot com bubble, investors were excited about the potential for growth in the technology sector. Many investors believed that the Internet would revolutionize the way we live and work, and they were willing to pay high prices for their stocks. Many investors were simply speculating on the future price of stocks, losing touch with the underlying value of the companies. Such speculation did not end well (see the chart below). All the 3 major perceived beneficiaries during the dot com boom (Microsoft, Intel, and Cisco) suffered maximum drawdowns of more than 70% shortly afterward. Even 10 years later, investments in these stocks were still suffering large total losses and lagging the overall market by a large margin. In MSFT’s case, investments made in 2000 would only break even till about 15 years later in 2015.

Even for investors who are more levelheaded at that time and take the effort to analyze the fundamentals, their assumptions and projections tend to be biased towards the more optimistic side. And this is what I will argue next for the perceived AI benefits on MSFT stock today.

EPS and valuation projections

Before going further, I am a GARP (growth at a reasonable price) investor to the core. My view, at a constitutional level, is that valuation always matters – no matter what business we’re talking about. This disclosure is important because I understand that other constituents of the Seeking Alpha platform have different investment philosophies and styles. And certain styles consider P/E irrelevant in the analysis of tech companies. I am open to both sides of the views (and I hope you can too), and I look forward to reading your comments.

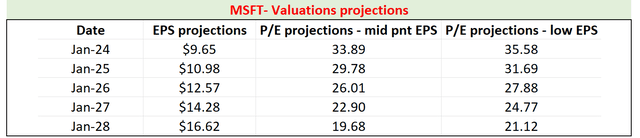

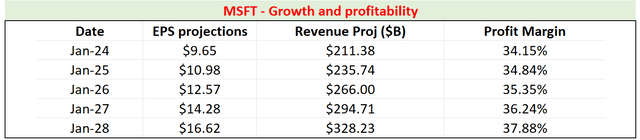

According to consensus estimates, Microsoft’s EPS (mid-point projection) is expected to grow from $9.65 in 2023 to $16.62 in 5 years, translating into an annual growth rate of almost 12%. This growth projection is being driven by a few key factors and AI is a main one. Microsoft is investing heavily in AI, and it is expected to be a leader in this market in the coming years. In particular, investors are excited about Microsoft’s partnership with OpenAI, which was perceived to offer the potential to ignite a wide range of changes. MSFT’s multibillion-dollar investment in OpenAI (the organization that launched ChatGPT) is viewed as a move that could rival and replace current search engines.

There is no doubt that these expectations have merits. Plus, besides AI, MSFT also has other growth engines including the growth of its cloud computing segment, its SaaS products, and also its gaming department.

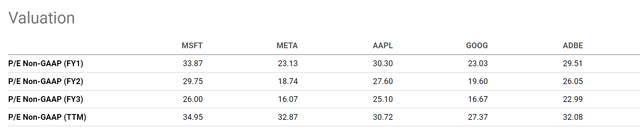

However, such high expectations have bid up the valuation to a very elevated level in my view. As shown in the chart below, at the current price level, its FY1 P/E stands at 33.89x based on the mid-point EPS projection. And its FY1 P/E stands at more than 35x based on the low end of the EPS projection. Its valuation multiples are entering at unjustifiable levels either by horizontal or vertical comparison in my view. And such elevated valuation could lead to years of diminished or even negative returns as in the 2000 episode. To wit, its P/E ratios are substantially higher than its close peers such as Google, Apple, Meta Platforms, and Adobe by a sizable margin in many cases. While as argued in a recent article, all of these stocks are strong competitors both in existing products and also future AI products.

Next, I will also argue that consensus is overestimating its margins too.

Source: author based on Seeking Alpha data. Source: Seeking Alpha data

Margin projections

In addition to high P/E and rosy EPS growth projection (~12% per year for 5 years), I am also concerned that the analyst consensus reflects overly optimistic assumptions about margins.

The following chart was made based on consensus estimates of its projected EPS (those used above) and its projected revenues between 2023 and 2028. In tandem with the EPS projection, consensus also expect revenue growth from $211B in 2023 to $328 in 2028. More importantly, consensus estimates of EPS and revenues would imply a margin expansion as well, as shown in the 4th column of the table below. As seen, the implied net profit margins (“NPM”) in the next 5 years are in the range of 34.15% to 37.88%, with an average of 35.7%. Note that to convert projected EPS and revenues into NPM, I assumed its number of outstanding shares to remain constant at the current count of 7.48 billion shares.

Source: author based on Seeking Alpha data.

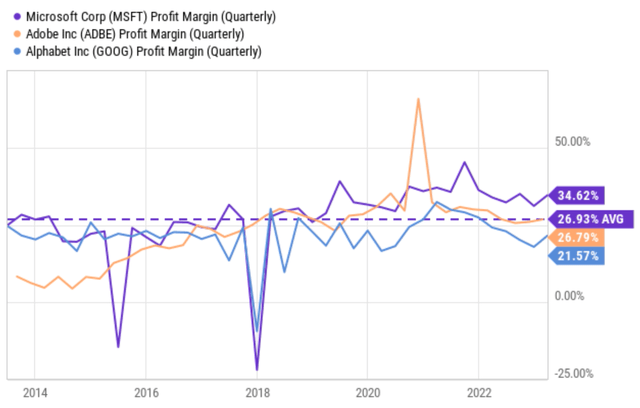

The above projection certainly agrees with the long-term trend historically. As shown below, MSFT has been slowly but gradually improving its NPM in the past decade, from about 26% in 2013 to the current level of 34.6%.

However, I do not think the past trend can be extrapolated indefinitely. An expansion of NPM beyond a certain threshold is always an invitation for more competition and more regulatory scrutiny. In my mind, the expected NPM expansion implied in the consensus is either A) overly optimistic or B) close to this threshold if it indeed materializes. And I think A is the more likely scenario by vertical and horizontal comparison. Historically, MSFT’s NPM has been below 34% except for a few outlier quarters as seen in the chart below. Its average NPM has been 26.9% “only” in the past decade. The quotation mark here is meant to highlight the context. An average NPM of 26.9% is remarkable already. As seen, the NPMs from close peers like Google and Adobe have been averaging around or below this level in the long term. As a result, the consensus expectation that MSFT’s NPM would steadily expand in the next 5 years, to a level that is far above MSFT’s past average and its peers, seems overly optimistic to me.

Segment deep dive

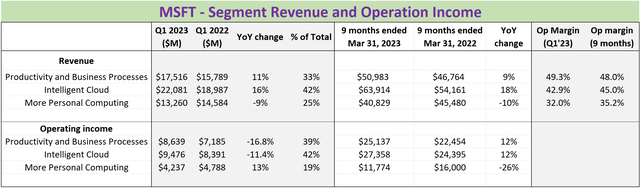

To illustrate the optimism embedded in the EPS growth and margin expansion analyzed above, I will next examine the growth potential related to AI on a segment basis. I will anchor my analysis with the following segment’s results taken from its most recent earnings report (“ER”) for the quarter that ended on March 31, 2023. Note its FY quarter is shifted from the calendar FY. And in the remainder of this article, I will be referring to the calendar quarter for consistency. Current bullish sentiment expects generative AI to benefit all of Microsoft’s segments. However, in my view, I think many of the benefits may be too distant. And the segments that can expect the most benefits in the near term are the following in my mind:

- Its Azure Cloud business. Its CEO Satya Nadella repeatedly commented that Azure will remain the primary growth engine and generative AI could catalyze further opportunities.

- The integration of its search business (a part of its “More Personal Computing” segment) with generative AI.

Source: author based on MSFT ER.

I agree with the Bulls on the potential on both fronts. But I will argue that the benefits to both segments are overestimated judging by its current valuation.

The Azure Cloud business has been indeed maintaining good growth as seen in the chart above. Its revenues have been growing at rates far higher than the other two segments. However, the growth is decelerating (and quite rapidly in my view). To wit, its sales growth was 18% on 9 monthly bases YoY and slowed to 16% for the quarter that ended on March 31, 2023. In terms of operating income, the growth was slower on a 9-month basis (12% only) and negative on a quarterly basis (-11.4%). Looking ahead, the continued integration of generative AI and Azure faces a few key challenges. Competition is intensifying. Other cloud providers, such as Amazon Web Services and Google Cloud Platform, are also investing heavily in generative AI. Microsoft must find ways to differentiate its generative AI offerings from those of its competitors. Large-scale deployment of generative AI can be computationally expensive, requiring both heavy CAPEX and R&D investments. MSFT must find ways to scale these models to handle the large volume of requests that are processed each day, and it remains unclear to me if MSFT can outspend and/or outsmart other competitors. Finally, note that the operation margin from this segment actually shrank from 45% in the past 9 months to 42.9% in the March 2023 quarter, echoing my above concerns regarding the overly optimistic margin projections.

Onto its search and ad business. This is indeed a bright spot in the More Personal Computing “MPC”) segment. As seen, the MPC segment has been suffering large declines in the topline (-9% for the quarter and -10% for the past 9 months). However, revenues from search and news advertising (with traffic acquisition costs excluded) climbed 10% in the past quarter. When currency exchange rates are adjusted, the growth is even better at 13%. Thanks to such growth, the operating income in the MPC increased 13% YOY for the March 2023 quarter despite the sales decline. However, I am also doubtful that the potential growth of its search and ad business can justify its current valuation risks. The top risks as I see are:

- The contribution from its current search and ad business is just too minor at this point. Its recent ER reported that, thanks to market share gain in its search business (the AI-powered Bing), its Search & News advertising revenues grew 10% YOY as mentioned. It is certainly a strong demonstration of the potential of AI in the search segment, especially against the overall backdrop of the shrinkable in the overall digital ad budget in recent quarters. However, the entire MPC represents only a minor fraction of MSFT’s revenues and profit streams. Its $13B of total revenue in the March quarter represents only 25% of the total revenue, and its $4.2B of total operations income is only 19% of the total. The fraction contributed from search and ad business would be even smaller.

- As a user of AI-powered Bing searches myself, I share some of the public concerns. The public hype over the past few months could be temporary. And long-term acceptance could face challenges such as bias, interpretability, and also regulations. Results from generative AI models can be difficult to interpret, and human nature tends to be cautious when we don’t understand how they arrived at their results.

Other risks and final thoughts

Besides the risks mentioned above, there are a few other risks worth mentioning, both upside and downside. Microsoft overexpanded in the past few years (like many other tech giants). It recently decided to lay off roughly 10,000 employees. The layoff could signal ongoing cost-control pressure and profitability headwinds. But on the positive side, it could lead to a leaner and more focused business. This amount represents roughly 5% of the company’s headcount. A key expansion plan involved the planned acquisition of video game maker Activision. There are currently some roadblocks preventing the closing of the transaction. A lawsuit filed by the Federal Trade Commission (“FTC”) expressed concern that Microsoft’s acquisition could stifle competition. MSFT owns the Xbox brand, and it could make Activision’s games exclusive to its Xbox if the acquisition is completed. The uncertainty surrounding this sizable acquisition could impact the stock prices in the near term depending on the ultimate outcome.

To conclude, my thesis is that MSFT investors are currently facing similar perils of high expectations as those in 2000. Investors bid up its P/E to more than 60x in 2000 and suffered a large total loss in the next 10 years that is far worse than the overall market. Its current P/E, although far below the 2000 bubble (“only” about ~34x), is sufficiently high to lead to years of diminished or even negative returns. To further compound the valuation risks, the EPS projections are made on overly optimistic margin projections despite the intensifying competitive pressure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.