Summary:

- Microsoft is likely to have a strong Q1, with Azure and AI services being the core growth drivers to look out for.

- The company is establishing a clearer AI ROI horizon. As a result, I expect this to sustain and increase market sentiment over the coming years.

- However, geopolitical factors are likely to severely impact Microsoft if current conditions escalate. Big tech valuations are not appealing in light of this.

- As a result of my comprehensive analysis, I still consider Microsoft a Buy, with a 12-month price target of $480+. However, strategic portfolio diversification is crucial at this time.

Just_Super

My last three articles on Microsoft (NASDAQ:MSFT) have all been Buy ratings, primarily as I consider Microsoft reasonably valued with a stable long-term growth trajectory. Since my August Microsoft analysis, the stock has gained 6% in price. Leading into Microsoft’s Q1 earnings, I expect to see continued strength from Azure, and I’ll also be carefully monitoring the capex and ROI horizon outlined by management on the earnings call. At this time, I see it likely that the stock will trade above $480 in 12 months’ time despite vulnerability from the macroeconomic environment.

It’s Crucial to Assess Azure, AI & Capex at Q1

Azure’s revenue growth has been notably strong for Microsoft recently, with a 30% increase YoY in recent quarters. This is an area that I expect will continue to prove highly accretive in the Q1 FY25 report. This is primarily driven by AI services, which are foundationally supported by its partnership with OpenAI. Demand for Azure is so strong that the company has faced capacity constraints, limiting its ability to fully capitalize on the market opportunities here. To combat this, management is increasing capital expenditures, adding further weight to the notion that 2025 is going to be another high-investment period for data center expansion and GPU sales from Nvidia (NVDA). Azure is gaining market share from AWS (AMZN) and Google (GOOGL) (GOOG) Cloud, and I expect the partnership with OpenAI is fundamental to Microsoft’s ability to consolidate its position faster than its peers. I expect Azure to be strong in Q1; however, the high-growth narrative surrounding Azure and Microsoft’s AI services means that the valuation has remained high. Investors should be careful about allocating based on AI growth, given the underlying recession risks at the moment that could reduce consumer and enterprise demand for AI and cloud services.

Management has recently invested $2.9 billion in Japan and $3.16 billion in the UK for infrastructure development, including a new data center campus. Furthermore, management is investing $4.3 billion in France to enhance data centers with up to 25,000 GPUs by the end of 2025 and $3.3 billion in Wisconsin for cloud computing and AI infrastructure. Moreover, the company has formed a partnership with BlackRock to raise up to $100 billion for AI data centers and energy infrastructure. This is a trend that is unlikely to slow down, and so I expect much higher capex in FY25. Therefore, this raises concerns about the ROI of these investments. It is clear that the capital expenditures are necessary, not only for Microsoft’s competitive positioning in big tech, but also vital for American leadership in AI to support the West geopolitically at the moment. That being said, companies are having to be careful about not over-allocating. According to IDC research commissioned by Microsoft, companies investing in AI are realizing an average of $3.50 for every $1 invested; 5% of adopters are seeing higher rates of conversion than this, with returns as high as $8 per $1 invested. In 2024, Microsoft spent ~$16 billion in capex on generative AI in data centers, but by 2027, this is likely to far exceed $20 billion. The ROI is on the horizon; after ~$5.3 billion in generative AI revenue in 2024, the company could hit $35 billion or more in AI revenue by 2027.

Core strategies that are helping management cultivate this ROI include integrating its AI features into Microsoft 365, including tools like Copilot. Management is considering revising the pricing plans for Microsoft 365 to incorporate AI features to increase revenue. Both GitHub Copilot and Microsoft 365 Copilot have seen rapid adoption; GitHub Copilot alone accounted for over 40% of GitHub’s revenue growth in 2024, with adoption up by 180% YoY. It seems likely to me that the current network effects of AI are being somewhat underrated. There is likely to be a high level of further innovation to come, including a more developed suite of automation tools and AI-enabled robotics software, which are not currently in the near-term or medium-term horizon but will likely be exceptionally accretive to Microsoft over the long term. Management’s decision to build the infrastructure in AI now exposes it to medium-term growth catalysts and underlying long-term ones that could deliver high stock price growth. In Q1, we might not hear much of these long-term growth catalysts, but indications from management that it is on the path to successful ROI from its AI capex investments are vital to monitor.

Valuation Analysis: $480+ 12-Month Price Target

In my last analyses of Microsoft, I outlined EPS and price targets for 2034 and 2044. These included a $1,650 price target for 2034 and a $2,900 price target for 2044. While I understand these are very long-term projections, they are also appropriate given the company’s stable long-term growth trajectory, which shows much lower volatility than a company like Tesla (TSLA), which is more difficult to provide 10 to 20-year price targets for. Furthermore, I have also provided a five-year price target of $820.

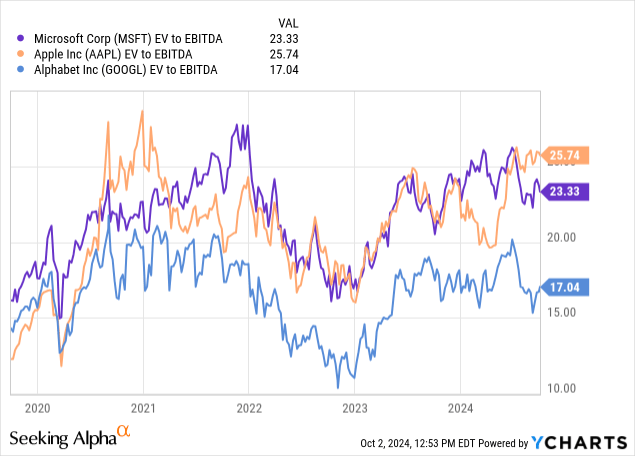

Leading up to Q1 earnings, it’s worth comparing Microsoft to other Big Three members on valuation, namely Apple (AAPL) and Google:

| Microsoft | Apple | ||

| Three-to-five-year EPS CAGR estimate | 13.3% | 8.6% | 16.6% |

Based on the above, Microsoft is considerably less appealing than Google in terms of valuation, with Apple being notably overvalued right now. This presents the core reason why I am a Google shareholder and not a Microsoft shareholder, but I also think the case for holding Microsoft remains strong. Microsoft has reliably strong free cash flow generation, with free cash flow growth rates that are expanding. Its historical five-year average forward free cash flow growth rate is 12.7%, but it is currently 14.8%. This should be compared to Google, which has contracting forward free cash flow growth rates (20.7% as a five-year average and 15.2% today).

Based on this nuance of Microsoft having better free cash flow generation than Google, I believe Microsoft is fairly valued. This is especially true given its exceedingly strong position in AI at the moment, which I believe will only further compound its free cash flow generation in time once its moat is reliably established. I consider Google to be somewhat weaker than Microsoft in AI right now, primarily related to Microsoft’s significant equity stake in OpenAI.

Given this analysis and continued growth from Azure, which will be the primary growth driver for Microsoft in 2025, I believe we are likely to see a roughly in-line 13% EPS growth over the next 12 months. Given the TTM $11.86 EPS, that would put the 12-month EPS at roughly $13.40. If the company’s P/E ratio is roughly 36 at the time, we will be looking at a stock price of $482.40, indicating a price increase of 15.5% over the period from the current price of $418. However, with sentiment from Azure likely to compound positively over the coming years, I would not be surprised if we see the P/E ratio expand higher.

Geopolitical Risk Analysis: China

With the AI data center ROI risk factors already addressed above, I believe it is worth outlining the vulnerability that Microsoft shareholders may face at the moment from macroeconomics. Amid growing geopolitical tensions between the U.S. and China, Microsoft has offered relocation opportunities to 700-800 employees based in China, primarily those involved in AI and cloud computing. This is vital during the current tense geopolitical environment, but Microsoft still maintains a large R&D center and partnerships with local companies like Li Auto (LI) and Xiaomi. I find it unlikely that the company will seek to remove itself from the region significantly without direct pressure from the U.S. government. However, the risk remains that Microsoft stock could face downside volatility due to a weakened market opportunity in China, primarily a result of regulatory inhibitions and strategic redirections.

Furthermore, we’ve already seen U.S.-China trade tensions resulting in tariffs and export controls that are complicating supply chains and manufacturing opportunities in China. This is likely to lead to a higher cost for components sourced from China, and it could impact Microsoft’s profit margins in the medium term, especially if more severe import tariffs are placed on Chinese goods by the next U.S. President. I see the biggest macroeconomic risk currently facing the West and big tech companies being inflation, which is likely to reduce demand in the medium term, potentially also leading to a period of stagflation. This is a serious macroeconomic concern for big tech investors to contend with, and the valuations of most of the Magnificent Seven are very high at the moment related to AI sentiment. Therefore, I believe moderation in portfolio allocation and diversification are crucial strategies to adopt.

Conclusion

Microsoft is likely to have strong Q1 results, with continued strength in Azure being the core area to focus on. The ROI horizon has now been established related to this, which is a further reason that I believe positive sentiment will continue to build for Microsoft in the near term. However, given the current macroeconomic environment, investors should be careful because even though Microsoft is likely fairly valued, this depends on maintaining a similarly stable macroeconomy as seen in historical levels. As it stands, the macroeconomic environment looks vulnerable, so I am not looking at holding big tech substantially in my portfolio. That being addressed, I believe Microsoft will continue to grow in the near term, including a likely $480+ stock price in the next 12 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.