Summary:

- Despite strong 1Q FY2025 earnings, Microsoft’s 2Q FY2025 guidance points to a sharp slowdown in total revenue, with Azure growth expected to decelerate further.

- Its commercial bookings and remaining performance obligations continued to accelerate in 1Q FY2025, supporting strong growth in cloud revenue going forward.

- While gross margin experienced some contraction, operating margin has remained resilient and is expected to expand further YoY in 2Q, driven by ongoing cost optimization efforts.

- Management anticipates that Azure growth will reaccelerate in 2H FY2025 as expanded AI infrastructure alleviates demand constraints.

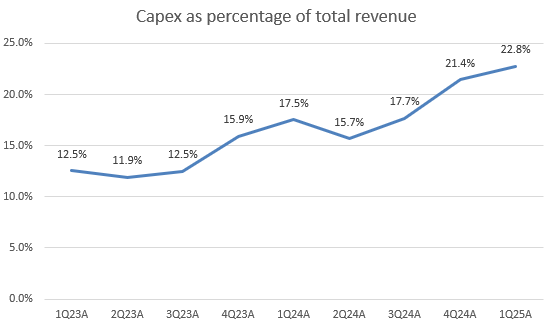

- Capex as a percentage of total revenue is expected to continue trending higher, anticipating a growth acceleration to 64% YoY in 2Q FY2025, impacting FCF.

Jean-Luc Ichard

What Happened

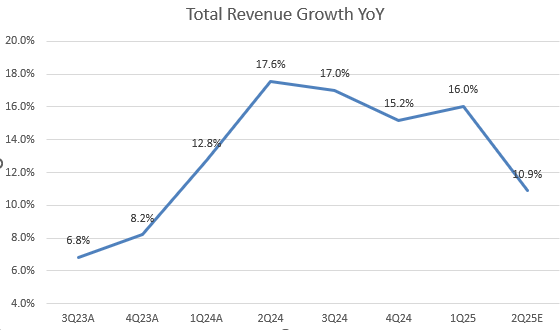

Microsoft’s (NASDAQ:MSFT) stock dropped 6% following its 1Q FY2025 earnings report. The company beat expectations on both revenue and GAAP EPS in 1Q but guided weaker-than-expected Azure growth for 2Q FY2025. MSFT still maintains strong total revenue growth; however, it seems the growth acceleration phase has peaked. Additionally, the company’s gross margin saw a slight sequential decline in 3Q, but this was offset by higher operational efficiency, resulting in an expansion in operating margin.

In my previous analysis, I maintained a buy rating on MSFT, as the company remains a bellwether in the AI cloud and SaaS markets, demonstrating solid growth momentum. I believe investors are overly focused on Azure, which has recently shown slight growth deceleration. However, as management has previously noted, Azure’s growth is expected to reaccelerate in 2H FY2025 as a result of monetization from the prior AI investments. Meanwhile, the stock is currently trading close to the Nasdaq’s P/E multiple, which suggests its valuation in general is not overly stretched. Therefore, I reiterate my buy rating on MSFT.

Azure Growth Anticipates a Continued Slowdown in 2Q FY2025

The company model

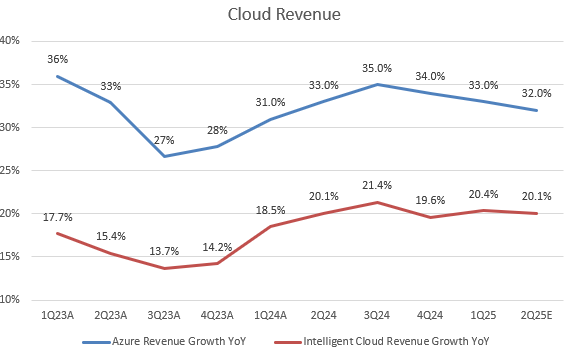

MSFT’s cloud business growth acceleration peaked in 3Q FY2024 and has been gradually slowing. In 1Q FY2025, the company reported a 33% YoY increase in Azure revenue, driven by strong demand for AI services, which exceeded the company’s guidance of 28% to 29%. Better-than-expected Azure revenue lifted growth in the Intelligent Cloud segment to 20.4% YoY, reflecting a sequential improvement over 4Q FY2024.

The company model

The company foretastes a further slowdown in Azure for 2Q FY2025, guiding between 31% and 32% YoY. Its 2Q FY2025 guidance suggests that total revenue growth will range between 10.1% and 11.7% YoY, indicating a significant deceleration both YoY and QoQ, which disappointed the market. During the 1Q FY2025 earnings call, management noted that capacity constraints and demand for AI services in 2Q will likely mirror those of the prior quarter. Therefore, I believe MSFT can reach the high end of its guidance, achieving at least 32% YoY growth in Azure revenue for 2Q. Additionally, management reiterated that Azure growth is expected to accelerate in 2H FY2025 as higher capex from previous quarters increases AI capacity to meet rising demand. I anticipate a gradual rebound in total revenue growth in 2H FY2025, but the full-year revenue growth may still experience a YoY deceleration.

Commercial Business Demand Remains Robust

The company model

According to its 10k, MSFT’s Commercial segment primarily includes revenue from Office 365 Commercial, Windows Commercial, Azure, and other cloud services, which are key drivers of the company’s overall growth.

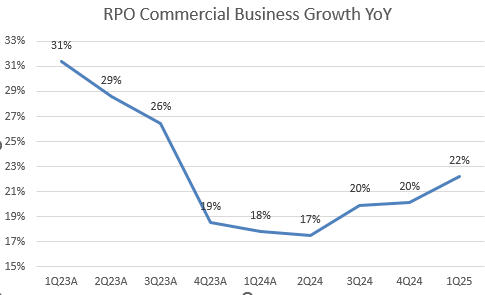

During the earnings call, management noted, “Commercial bookings were ahead of expectations, increasing 30% and 23% in constant currency,” and “Commercial remaining performance obligation increased 22% and 21% in constant currency to $259 billion. Approximately 40% of this amount will be recognized as revenue over the next 12 months, up 17% year-over-year, while the remaining portion, to be recognized beyond the next 12 months, increased 27%.”

Bookings and Remaining Performance Obligations (RPO) are key metrics for software companies. Bookings represent additional demand, which increases a company’s backlog value (RPO) that will translate into future billings and, sequentially, be recognized as revenue. The growth in MSFT’s commercial bookings is largely driven by contracts for Azure and Microsoft 365. Additionally, Commercial RPO growth accelerated in 1Q FY2025 to 22% YoY from 20% in 4Q FY2024, as shown in the chart.

Let’s take a look at the history. While MSFT’s Intelligent Cloud and Microsoft 365 Commercial Cloud revenue growth significantly decelerated in FY2023, its Commercial RPO showed strong growth, boosting revenue growth in FY2024. It’s likely that the acceleration in Commercial RPO growth suggests more revenue will be recognized in 2H FY2025 and 1H FY2026, with 40% of the backlog set to be recognized within the next 12 months. This aligns with my expectation that MSFT’s total revenue will experience modest sequential growth acceleration in the coming quarters.

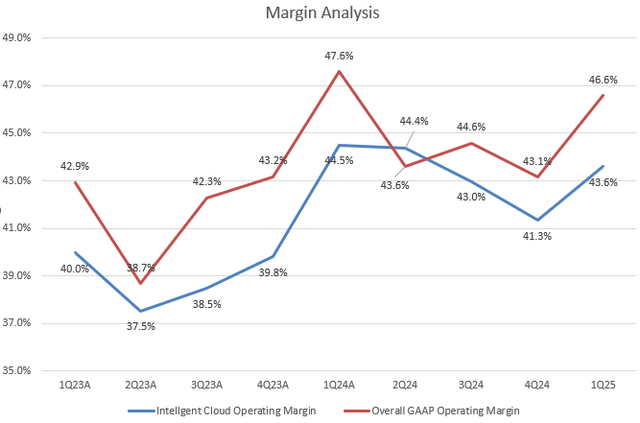

Improved Cost Efficiency Drives Up Operating Margin

Despite a slight contraction in gross margin, driven by the expansion of its AI infrastructure, the company’s GAAP operating margin grew strongly, primarily due to lower “sales and marketing expenses” as a percentage of total revenue. Excluding non-recurring costs related to the Activision acquisition, GAAP operating margin would have been 100 basis points higher at 47.6%, which is consistent with the margin in 1Q FY2024.

For 2Q FY2025, the company anticipates continued gross margin contraction to approximately 67.9%, down from 68.4% in 2Q FY2024. However, GAAP operating margin is expected to be 30 basis points higher than the same period last year. This indicates that the company will continue to optimize its operating costs.

Capex as Percentage of Revenue Continues Growing in 2Q FY2025

The company model

MSFT has been expanding its AI infrastructure to relieve capacity constraints caused by increased demand, leading to a growth acceleration in capex, which rose to 22.8% of total revenue in 1Q FY2025. While rising capex can support long-term growth as demand for GenAI computing continues to grow, the return on these AI investments will take time, potentially impacting gross margin and FCF. In 1Q FY2025, FCF dropped nearly 7% YoY, marking its first YoY decline since 3Q FY2023.

For 2Q FY2025, the company anticipates a sequential increase in capex. Assuming this increase matches the dollar rise seen in 1Q, capex in 2Q could reach approximately $15.97 billion, indicating a 64% YoY growth. This shows a growth acceleration from the 51% YoY in 1Q FY2025, implying that its capex as percentage of total revenue will increase further from 22.8% to 23.2% in 2Q.

Valuation

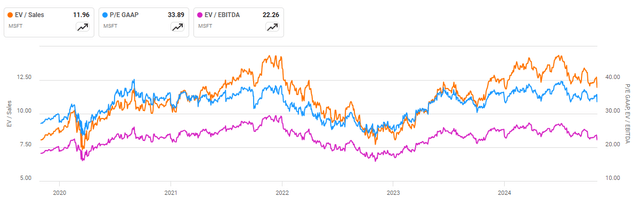

The stock is currently trading at a “reasonable” valuation. Although its EV/sales multiple is relatively at a premium level, strong RPO commercial growth indicates robust demand, suggesting that investors expect MSFT to accelerate its revenue growth or at least sustain its current momentum as elevated AI-related capex continues to monetize. This optimism is reflected in the premium multiple.

Additionally, MSFT’s operational efficiency has led to expanding operating margins, which should drive down MSFT’s EV/EBITDA and P/E multiples. Both forward 12-month multiples are currently trading slightly below their 5-year averages according to Seeking Alpha. Its non-GAAP P/E fwd is currently at 31x, close to the Nasdaq 100 index’s P/E of 29.8x. Given these factors, I believe MSFT’s current valuation multiple is justified by its long-term growth driven by elevated AI spendings.

Conclusion

In summary, MSFT’s 1Q FY2025 results demonstrated resilience across its cloud business segment, but there was an initial negative reaction to the guidance suggesting a slower growth trajectory for 2Q. Nonetheless, I believe the company’s long-term growth outlook remains strong, supported by momentum in commercial bookings and an expanding backlog that improves revenue visibility next year. As capex as a percentage of revenue continues to trend higher to bolster AI capacity, Azure growth is expected to reaccelerate in 2H FY2025. MSFT’s valuation, currently trading at over 30x P/E, reflects optimism surrounding its AI infrastructure expansion aimed at addressing increasing demand, making its current multiple reasonable in comparison to broader indexes. Therefore, I consider the post-earnings selloff to be a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.