Summary:

- The AI battle between MSFT and GOOG is just heating up, with the former taking on the offensive, integrating GPT-4 capabilities in most of its product offerings.

- With GOOG preferring the safer route, it remains to be seen who may emerge as the winner, given the nascency of generative AI and its impact on search engines.

- Nonetheless, Mr. Market has already awarded MSFT’s stock with an AI premium, attributed to the widening gap in its valuations/stock prices to GOOG’s.

- It seems that MSFT’s aggressive approach has prompted GOOG, “the 800-pound gorilla,” and Mr. Market to “dance.”

Deagreez/iStock via Getty Images

The Generative AI Competition Has Only Started

Microsoft (NASDAQ:MSFT) spared no efforts in building up its AI capabilities upon the popularity of ChatGPT, after integrating GPT-4 into its Bing search engine. The company went as far as adding a Bing search box/ shortcut into Windows taskbars, after the new Windows 11 update.

It was unsurprising that MSFT saw the opportunity to onboard more users to its search engine, since Windows commanded 74.1% of the global operating system for desktop PCs by January 2023. With 1.6B of users globally, the company’s strategy might continue to work as well, especially given its aggressive push into smartphones.

By February 2023, the company had rolled out Bing Chat through Apple’s (AAPL) App Store and Alphabet’s (GOOG / GOOGL) Play Store, with the two mobile operating systems comprising a market share of 99.4% globally. This demonstrated its ambition in growing its search engine market share across PCs and smartphones/ tablets, which stood at 2.81% as of early 2023, compared to GOOG’s at 93.37%.

In addition, MSFT also integrated GPT-4 into Skype, allowing users to directly translate conversations to multiple languages, while also adding a voice function to Bing Chat. It seems like the company might be eyeing the virtual assistant technology market currently dominated by Amazon’s (AMZN) Alexa and AAPL’s Siri, potentially breathing new life into the defunct Cortana as well.

Interested readers may also refer to this interesting article by Deep Tech Insights, where a series of ChatGPT APIs/ Plug-ins may further serve as OpenAI/ MSFT’s tailwinds.

In the meantime, it seems that the two companies are learning from each other. Similar to MSFT’s strategy of embedding GPT-4 into Office products, including Excel, PowerPoint, Outlook, and Word, GOOG is similarly looking to add generative AI features into Google Docs and Gmail, amongst others.

MSFT’s ambitions do not seem farfetched, in our opinion, given the massive opportunity in boosting its market share and user adoption ahead. Naturally, these come with the eventual aim of growing its advertising revenues.

By FY2022, GOOG reported revenues of $162.45B (+9% YoY) for the Google Search/ Others segment, commanding up to 62% of the US search market share and 30% of digital ad revenue. In comparison, MSFT only reported approximately $11.5B (+25% YoY) of search and news advertising revenue in FY2022.

For now, given the multi-pronged strategies, it was unsurprising that MSFT had reported over 100M Daily Active Bing Users by early March 2023, increasing tremendously by six-fold within a month after the release of Bing Chat. In addition, approximately 30% of these users were new to the platform, suggesting market losses for GOOG.

Yusuf Mehdi, VP of MSFT’s Modern Life, Search, and Devices, highlighted that Bing Chat’s early success validated that the “search (engine) was due for a reinvention and of the unique value proposition of combining Search + Answers + Chat + Creation in one experience.”

If anyone was concerned about the chatbots’ “hallucinations” previously highlighted here, MSFT had added a toggling feature allowing users to calibrate between creative, balanced, and precise answers, according to their specific needs. In addition, the company imposed restrictions to six questions per session and 60 questions daily, since longer chats typically led to “hallucinations.”

On the other hand, GOOG had preferred to take the safer route, highlighting that Bard was only meant to complement the search engine as a “creative collaborator.” This approach had rhymed with its modus operandi, previously delaying the launch of its chatbot due to the potential accuracy issues and reputational risks, as highlighted by Sissie Hsiao, VP of GOOG’s Product:

We feel really good that Bard is being safe and actually people are finding those guardrails. (AI-developer-speak for not spouting crazy things about religion, politics, violence or love) We want to make sure that we understand how to bring it in a responsible way to people. (The Wall Street Journal)

Then again, given the nascency of generative AI and its impact on search engines, it remains to be seen which may emerge as the long-term winner, especially since MSFT relies heavily on OpenAI’s platform against GOOG’s internal AI development. Furthermore, 50% of the US public considers AI tools as “more buzzy than business-y.“

In addition, GOOG is already planning to incorporate “conversational artificial-intelligence features into its flagship search engine.” The advertising giant also hints at its market-leading chip design through TPU V4 by April 04, 2023, touting that it is “1.2x-1.7x faster and uses 1.3x-1.9x less power (for Machine Learning Training) than Nvidia’s (NVDA) A100.”

Given that MSFT heavily relies on NVDA’s A100 to train OpenAI’s GPT-3 AI model and H100 for its in-house AI Virtual Machine Training, it remains to be seen if the former may retain its first mover advantage in the intermediate term.

Meanwhile, we reckon the optics may continue to favor MSFT, since “every one point of share gain in the search advertising market is a $2B revenue opportunity.” With a Total Addressable Market of $500B in the digital advertising market, the company has a lot to gain and little to lose during this aggressive market share grab.

This was especially since GOOG’s advertising revenue growth had been decelerating YoY at +7.1% to $224.47B in FY2022, against +42.5% in FY2021, +8.9% in FY2020, and +15.7% in FY2019 at $134.81B. In comparison, MSFT had been gradually growing its advertising revenues by +67% YoY to $11.59B in FY2022, compared to $7.63B in FY2019.

Either way, generative AI may be here to stay, akin to AAPL’s iPhone moment in 2007, permanently changing the search engine landscape for the better or for worse. The AI battle ahead may be one that is long and painful as well, though we reckon the integration efforts made by MSFT seem highly promising, as highlighted by Satya Nadella, CEO of MSFT:

Google is the 800-pound gorilla in search. I want people to know that we made them dance. (The Verge)

In the meantime, anyone interested in the direct comparison between MSFT’s Bing Chat and GOOG’s Bard may refer to this blog post here. The read is interesting, since it highlighted the chatbots’ different approaches toward controversial topics, such as politics, the morality of the Ukraine war, and the potential ban of TikTok.

So, Is MSFT Stock A Buy, Sell, Or Hold?

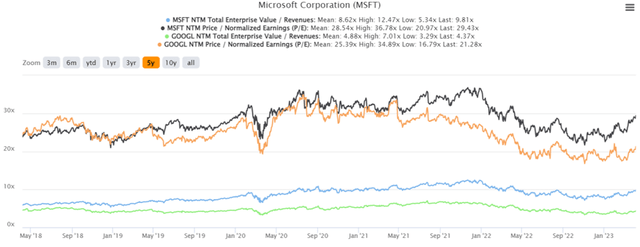

MSFT/ GOOG 5Y EV/Revenue and P/E Valuations

MSFT is currently trading at an EV/NTM Revenue of 9.81x and NTM P/E of 29.43x, higher than its 3Y pre-pandemic mean of 6.06x and 24.48x, respectively. Otherwise, it is still trading optimistically against its 1Y mean of 8.62x and 28.54x, respectively.

Interestingly, MSFT has also retained its premium P/E valuations since April 2021, widening the gap to GOOG’s continuous slide thus far. We reckon this optimism is unjustified, since market analysts expect the former to record a top-line CAGR of 8.4% and bottom line CAGR of 8% through FY2024, compared to the latter at 8.9% and 15.8%, respectively.

While past performance was not indicative of future performance, MSFT’s normalized top and bottom line CAGR between FY2019 and FY2022 at 16.4%/ 24.7% were mostly similar to GOOG’s at 20.4%/ 20.3% as well. These suggest a notable disconnect in the former’s stock valuations and projected performance, in our view.

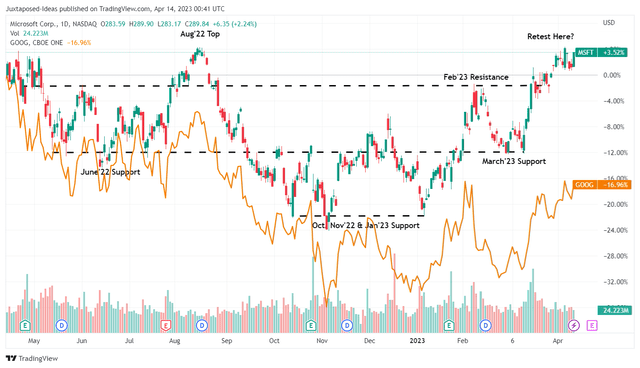

MSFT/ GOOG 1Y Stock Price

The MSFT stock has also been awarded tremendously for its AI and search-engine ambitions, attributed to the tremendous rally it recorded from the January 2023 support levels.

Nonetheless, this has triggered a limited upside potential from current levels to our price target of $304.37, based on its projected FY2024 EPS of $10.74. With most of the optimism already baked in, investors that choose to add here may have a reduced margin of safety, in our view.

Combined with the fact that it is trading well above its 50/ 100/ 200 day moving averages, we prefer to rate MSFT as a Hold here. Do not chase this rally, especially since the stock may be testing its August 2022 resistance level soon with the peaking AI hype.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.