Summary:

- Microsoft’s Copilot development showcases its commitment to AI, offering customers convenience, efficiency, and productivity benefits.

- OpenAI’s LLM models, particularly GPT-4o, lead in strength and competitive advantages, enhancing Microsoft’s segments like Office, Dynamics, and Server Products.

- Microsoft’s integration with OpenAI boosts its cloud business, productivity software, and ERP segments, supporting revenue growth projections and competitiveness over its competitors.

lcva2

In our previous analysis, we believed Microsoft Corporation’s (NASDAQ:MSFT) Copilot development highlights the company’s commitment to infuse AI capabilities across its products and services offering benefits to customers such as convenience, efficiency and increased productivity. We expected Copilot to be impactful for its Office Products and Cloud segments and expect Copilot integration to solidify its market leadership as well as enable upselling opportunities.

In this analysis, we revisit the partnership between OpenAI and Microsoft to assess whether it provides Microsoft with unique competitive advantages. Firstly, we evaluate the strengths of OpenAI’s AI models, particularly in terms of their LLM capabilities relative to other AI models. Next, we examine how the integration of OpenAI’s AI models enhances the competitiveness of Microsoft’s segments such as Office, Dynamics, and Server Products exclusively by compiling OpenAI’s integration partnerships with the top technology firms and software and services companies, identifying specific advantages in the utilization of LLMs within each segment, and creating a ranking table with competitive factor scores. Finally, we analyze how the integration of OpenAI’s technology benefits each segment of Microsoft, integrating these rankings across all segments to calculate overall competitive factor scores and forecast growth rates.

OpenAI LLM Strength

Firstly, we determine the strengths of OpenAI’s AI models, particularly in terms of their LLM capabilities relative to other AI models. LLMs are massive deep learning models being massive deep learning models pre-trained on extensive data, using transformers which are neural networks to understand and generate human-like language.

LLM Comparison

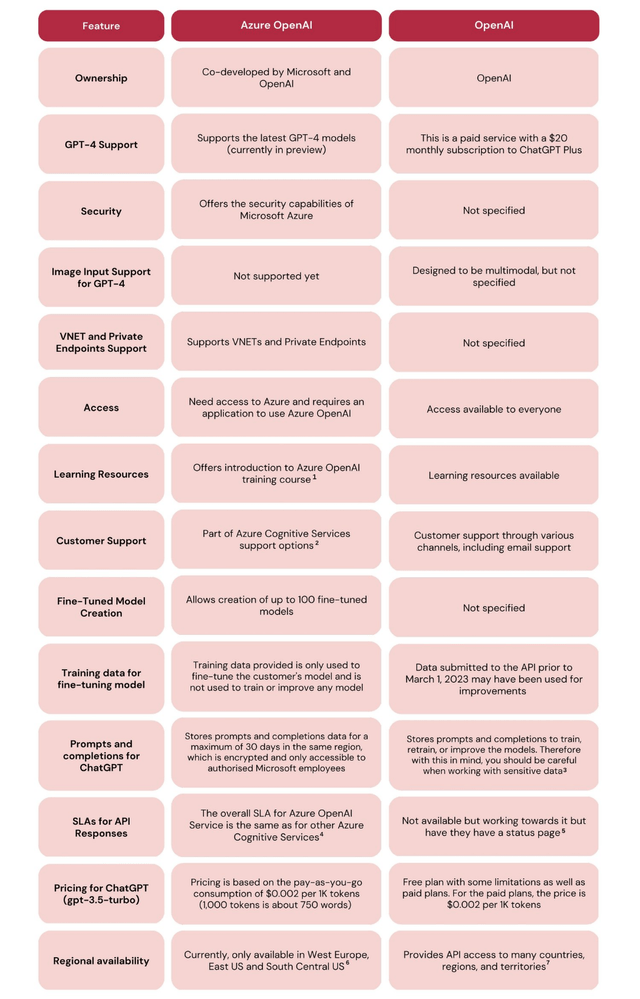

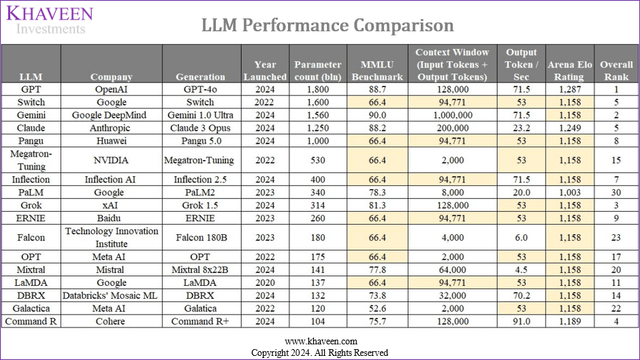

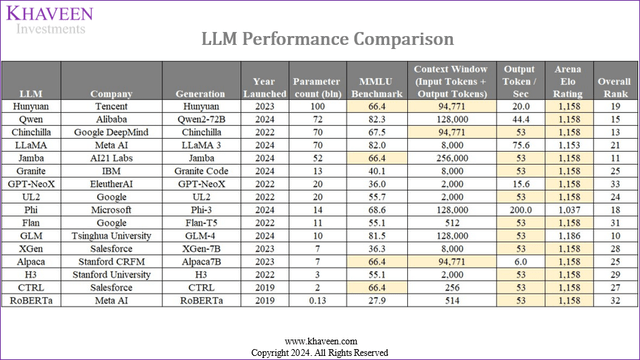

In our previous analysis, we compared OpenAI models with 17 other LLMs and found OpenAI leading with GPT-4 with the highest parameter count and MMLU benchmark score. In this analysis, we updated this comparison with an additional 18 new AI models from OpenAI such as GPT-4o as well as other companies such as Google (GOOG)(Gemini), Anthropic (Claude 3), and Meta (META) (LLaMA 3) as well as other new players such as xAI (Grok), Technology Innovations, Mistral and Cohere. We analyzed the AI models in terms of parameter count and MMLU benchmark scores which are the same as previously, as well as included other metrics such as Context Window, Output Token/Second, and Arena Elo. Context Window is a “textual range around a target token that a large language model (LLM) can process at the time the information is generated” while Output Token per Second measures the “average number of tokens received per second, after the first token is received”. Finally, Arena Elo Rating is a benchmark platform that features crowdsourced public ratings of pairwise direct comparison between LLMs.

Company Data, Papers with Code, LMSYS, Khaveen Investments Company Data, Papers with Code, LMSYS, Khaveen Investments

*Orange cells are based on the average of available data of LLMs in the chart

Based on the table, we obtained the most data for parameter count although some were third-party estimates. This is followed by MMLU benchmark scores which are standardized benchmark scores that were available for most of the compiled LLMs. Additionally, we obtained context window metrics for most of the LLMs. However, standardized output tokens per second and Arena Elo ratings were unavailable for most LLMs. Arena Elo ratings were mainly available for newer AI models only.

Overall, the most critical observation based on our data indicates GPT4o, OpenAI’s newest model as the top LLM. OpenAI had not disclosed the parameter count of GPT4o publicly and third-party estimates vary significantly. However, the previous GPT 4 model had 1.8 tln parameters according to the Semianalysis study as highlighted previously. Compared to GPT 4, GPT 4o also shows a marginally higher MMLU benchmark score by 2.6%, a 4x higher context window allowing for larger input and output, twice higher speed based on output per second, and a higher Arena Elo score.

The most significant new AI model competing against GPT is Gemini 1.0 Ultra, by Google DeepMind with 1,560 bln parameters, slightly fewer than GPT-4o’s 1,800 bln, but achieves a higher MMLU score of 90 compared to GPT-4o’s 88.7. Moreover, Gemini 1.0 Ultra supports a vast 1 mln token context length, surpassing GPT-4o’s 128,000 tokens, and matches GPT-4o in speed with 71.5 teraflops. However, the Arena Elo rating is unavailable for Gemini Ultra.

Another significant new model is Anthropic’s (Amazon) Claude 3 which has 1,250 bln parameters. In terms of the MMLU benchmark, GPT-4o scores slightly higher at 88.7 compared to Claude 3 Opus’s 88.2. GPT-4o features a context window of 128k, which is shorter than Claude 3 Opus’s 200k, providing Claude 3 Opus with a superior ability to handle longer contexts. Additionally, Claude 3 Opus has a lower output token rate of 23.2 tokens per second compared to GPT-4o’s 71.5 tokens per second. Despite these differences, GPT-4o has a higher Arena Elo rating of 1,287, indicating a slight edge in overall performance compared to Claude 3 Opus’s rating of 1,249.

The remaining new AI models fall flat compared to GPT4o, which are Meta (LLaMA), xAI (Grok), Technology Innovations, Mistral, and Cohere which have lower parameters and MMLU scores compared to GPT 4o. The context window for these models is also generally on par with GPT4o’s 128k while Arena Elo rating is mostly unavailable for these models.

LLM Ranking

Furthermore, we ranked the AI models to determine the most competitive LLM based on parameter count, MMLU benchmarks, maximum context window, output token per second, as well as the Arena Elo Rating on Artificial Analysis. A higher parameter count indicates the larger scale of the model and the potential to understand more complex patterns of data whereas higher MMLU benchmarks indicate higher accuracy in terms of language comprehension and problem-solving abilities across 57 subjects. Furthermore, a higher context window for LLM refers to a higher ability for the model to consider a larger amount of text at once during its processing. In terms of output tokens per second, this metric defines the speed of language models in processing and generating outputs. We compared the latest generation of each class of LLM and ranked it below for each metric to derive the overall average ranking. Additionally, we used an average across all models toward specific information that was unavailable, which allowed us to conduct a more comprehensive comparison.

All in all, we rank OpenAI’s GPT the highest overall with an average of 2.4 due to its massive parameter count, high MMLU benchmark score, output speed as well as the highest Arena Elo Rating which defines the level of quality index. Trailing behind OpenAI’s GPT is Google’s new Gemini model, which we ranked as the overall second-best LLM due to its highest MMLU benchmark ranking but lower than OpenAI’s GPT in terms of number of parameters ranking. Google also has the largest breadth of LLMs with a total of 7 separate LLM families with Switch ranked as the next best LLM by Google. In third place, we ranked Grok’s new model from xAI as the third-best AI model with a relatively high ranking across all metrics. However, although Anthropic’s Claude is overall ranked as the fifth best due to a slow output of tokens per second, it ranked in the top 3 across most of the metrics including MMLU benchmarks, context window size, as well as the Arena Elo Rating.

Outlook

All in all, we ranked OpenAI’s GPT as the top LLM followed by Google’s Gemini due to its massive parameter count, high MMLU scores (which indicates an improvement compared to the previous GPT 4 model with the newest GPT4o), output speed, and Arena Elo rating. Meanwhile, we ranked Google Gemini second behind GPT due to its lower ranking in total parameter count as well as in Arena Elo Rating. Going forward, the pace of development within LLMs has been rapid with a surge in AI models over the past few years, though we expect OpenAI to remain a key player in LLMs. OpenAI’s development pace is rapid, the company is relatively new as it was founded in 2015 and first introduced the GPT-1 concept in 2018 and released a new model yearly with GPT3- in 2020, scaling up its parameter by 100x compared to the previous model and updates to GPT-3 before launching GPT-4 in 2023 featuring a larger dataset and parameters with improved processing capabilities. OpenAI already confirmed future LLM model developments with GPT5 and GPT6 expected to further raise its LLM performance capabilities with Life Architect estimating GPT5 to have 52 tln parameters which would be 29x larger than GPT4. Furthermore, OpenAI has had the backing of Microsoft since 2019, which enabled the development and deployment of GPT models as Microsoft provided compute infrastructure including 10,000 GPUs for training. Besides, it is also reported that Microsoft has been investing in a total of approximately $13 bln in OpenAI since the beginning. Microsoft reportedly has a plan to provide more infrastructure for OpenAI through 2030 in phases that could cost up to $100 bln. In comparison, Google’s pace of development had also been rapid, with an average number of LLMs introduced of 2 in the past 4 years compared to 1 for OpenAI, however in the past 4 years, we believe Google has only recently been closing the gap on OpenAI with its new Gemini model which is expected to be released this year and significantly surpasses GPT4 in parameter count, thus we expect could pull ahead of Google with a stronger lead.

Microsoft OpenAI Advantages

Moreover, in this point, we examined how the integration with OpenAI’s AI models benefits Microsoft’s segments such as Office, Dynamics, and Server Products and determined whether it provides any benefits to competitiveness exclusively.

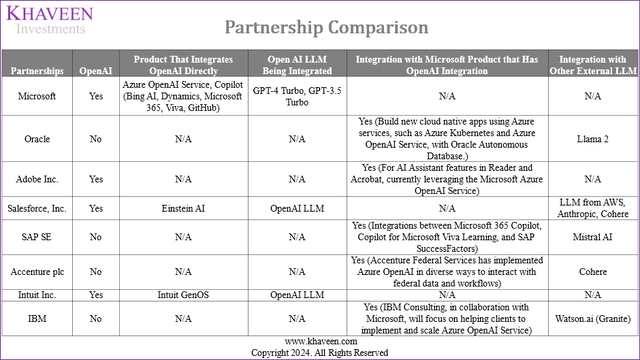

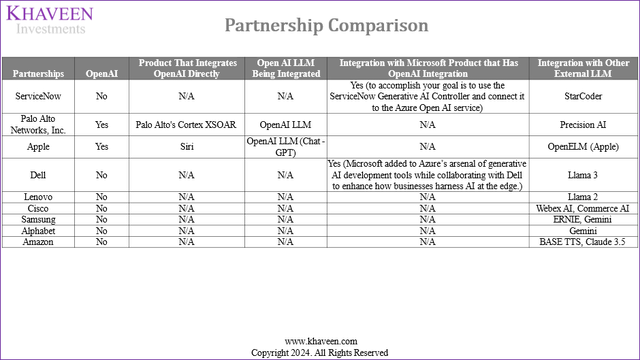

We compiled the partnerships of OpenAI with the top tech companies and top Software & Services companies including Apple (AAPL), Microsoft, Amazon (AMZN), Alphabet, Samsung (OTCPK:SSNLF), Cisco (CSCO), Oracle (ORCL), Adobe (ADBE), Salesforce (CRM), SAP (SAP), Accenture (ACN), Intuit (INTU), IBM (IBM), ServiceNow (NOW) and Palo Alto (PANW).

Company Data, Khaveen Investments Company Data, Khaveen Investments

In our previous analysis, we highlighted the benefits that the OpenAI partnership brings to Microsoft including integrating its GPT LLM into products and services such as Copilot virtual assistant into Bing AI, Dynamics, Microsoft 365, Viva, and GitHub as well as Azure OpenAI Service as a cloud platform enabling the integration of OpenAI’s GPT-4 models.

Based on the list above, we see that only 4 companies which are Salesforce, Intuit, Palo Alto, and Apple besides Microsoft have announced a partnership to integrate OpenAI’s LLMs with its products. For example, Salesforce integrates OpenAI LLM into its Einstein AI to enhance its CRM capabilities. Salesforce is the CRM software market leader and Microsoft has Dynamics which also has some CRM functionalities such as Copilot for Customer Service, but it mainly focuses on the ERP software market. Intuit integrates OpenAI’s LLM into its Intuit GenOS. Intuit is the accounting software market leader while Microsoft does not have a presence in. Palo Alto is also another leader in the cybersecurity software market and integrates OpenAI’s LLM with Cortex XSOAR where it competes against Microsoft Sentinel which has been integrated with Copilot for Security. Finally, Apple recently announced it is integrating OpenAI’s ChatGPT into Siri. However, these companies did not specify which generation of GPT model the companies would be using while Microsoft.

On the other hand, other companies integrate with Azure OpenAI service rather than with OpenAI directly. Azure OpenAI Service allows integration of OpenAI through Azure, benefiting Microsoft’s cloud business. Microsoft announced partnerships with 7 companies, Oracle, Adobe, SAP, Accenture, IBM, ServiceNow, and Dell to integrate Azure OpenAI with their products and services. Therefore, these companies are customers of Microsoft.

Google and Amazon do not have integration with OpenAI directly or through Azure Open AI. This is because Amazon has investments in Anthropic and uses its Claude LLM while Google has various LLMs which it uses. It is also noted that Microsoft is the “exclusive cloud provider” of OpenAI. OpenAI will reportedly support Apple integration on Azure.

According to the diagram above by Advancing Analytics, both Azure OpenAI Service and OpenAI provide access to GPT4 models as well as provide several advantages for customers using Azure OpenAI Service, including leveraging Microsoft Azure’s robust security capabilities, and providing VNET and private endpoint support, offers extensive learning resources, part of Azure Cognitive Services support options, and enables creating fine-tuned models. This in turn benefits Microsoft as well, supporting its Azure growth as customers require Azure as well as providing Microsoft with data from prompts and output generated as well as allowing Microsoft more control over the usage of OpenAI models by customers. Furthermore, none of the major cloud service providers has OpenAI integration, therefore, highlighting Microsoft’s strength in the cloud over other competitors due to its exclusiveness as well as enabling customers using Azure OpenAI Service to benefit from features of Azure such as its security and support features through the co-development between Microsoft and OpenAI.

Search Engine (Bing)

In search engines, Microsoft integrates Copilot powered by GPT-4 into Bing AI which was rebranded from Bing Copilot as highlighted in our previous analysis. Copilot’s seamless integration with webpages allows users to access Copilot’s features via real-time access to page-by-page content. Furthermore, other third-party search engines that also have OpenAI integration include Perplexity AI and GPTGO. Both platforms offer access to GPT-4, similar to Bing AI. However, we believe Microsoft’s advantage in search engines is its popularity as Bing is more established compared to Perplexity AI and GPTGO. Additionally, Perplexity AI uses Azure OpenAI Service to integrate with OpenAI models, providing Microsoft with control over the integration.

ERP (Dynamics)

In Dynamics, Microsoft integrates Copilot for Dynamics powered by GPT-4. On the other hand, other ERP software such as Oracle Netsuite and Workday ERP do not provide direct integration between OpenAI and their ERP platforms. Instead, users have to use external third-party software such as Patchworks and Adenin which provides API to support the integration of ChatGPT with Oracle and Workday ERP systems. Therefore, we believe Microsoft has an advantage due to its Copilot being natively integrated into its Dynamics platform, offering greater convenience and seamless integration with OpenAI models, as well as having a strong reputation.

Productivity Software (Office)

In productivity software, competitors such as Libreoffice and Zoho have integration with ChatGPT as extensions to their software. In comparison, Microsoft uses Copilot, which is natively integrated into Microsoft 365, providing similar advantages such as with the ERP tool as Copilot does not have a knowledge cutoff date as it has access to the internet, unlike ChatGPT which is trained to a specific date, enabling Copilot to provide real-time answers. Also, Copilot Pro offers “priority access to GPT-4 and GPT-4 Turbo during peak times”.

Programming Software (GitHub)

In GitHub, Microsoft Copilot offers several advantages compared to other programming software that integrates ChatGPT. Copilot GitHub is natively integrated into Microsoft’s GitHub, providing features such as seamless integration, code completion suggestions, and real-time code suggestions based on a dataset of code. On the other hand, ChatGPT “may not always meet the precision standards of specialized coding tools”.

Operating System (Windows)

In operating systems, Microsoft has Copilot for Windows which is free to all Windows users. Other operating systems that have integration with ChatGPT include Linux and Arca OS. One of the advantages of Copilot for Windows is its direct integration with Bing and online search, providing users with seamless access to conduct searches within the Windows interface, unlike Linux and Arca OS which integrates ChatGPT which has a knowledge cutoff date. On the other hand, Apple will mainly integrate ChatGPT 4o into Siri, allowing Siri to improve documents, photos, and query understanding and provide more advanced GenAI prompts for Apple users.

Outlook

|

Segment |

Superior Company |

|

Cloud |

Microsoft |

|

Search Engine |

Microsoft |

|

ERP |

Microsoft |

|

Productivity Software |

Microsoft |

|

Programming Software |

Microsoft |

|

Operating System |

Microsoft |

Source: Khaveen Investments

All in all, we believe that Microsoft benefits from its partnership with OpenAI through the integration of OpenAI LLMs into its products and services while deriving specific benefits, especially from its cloud business where it hosts Azure OpenAI Service which other competitors integrate with, which we believe is beneficial for Microsoft as its exclusive cloud provider. We believe this benefits Microsoft’s cloud business due to the demand for its cloud hosting services to support the Azure OpenAI integration with each company’s application and software. Furthermore, we expect this could provide an edge to Microsoft, having access to data through the partnerships and may provide greater control over the usage of OpenAI models by Microsoft. Furthermore, OpenAI’s direct integrations with companies are in markets where Microsoft does not have a main business focus such as CRM, Accounting, and Cybersecurity, which may indicate Microsoft could be controlling the access to OpenAI models. Additionally, we believe Microsoft has an advantage over competitors in terms of integration of OpenAI models across search engines, ERP, productivity software, programming software and operating system as believe Microsoft’s advantages generally include its seamless integration of Copilot powered by GPT4 across its products offering convenience, stronger company reputation as well as priority access to usage of OpenAI models during peak periods.

Revenue Growth Projections

In the final section, we examined how the integration of OpenAI could benefit each of Microsoft’s segment revenue growth.

Based on the segment that Microsoft has OpenAI integration with, we compiled various metrics to compare the company with its competitors including our ranking of the companies based on AI model integration, and to derive a competitive factor score to determine its excess market growth.

Azure Cloud (Server Products)

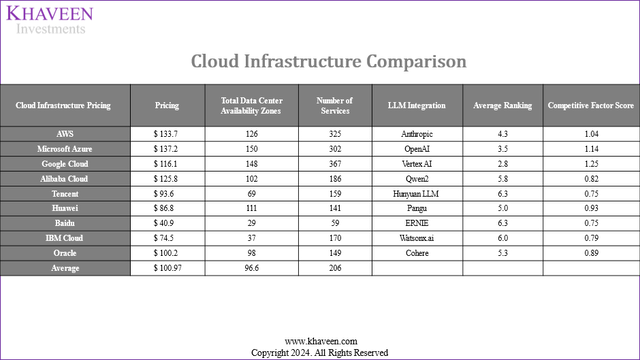

For cloud, we updated our comparison of the companies based on our previous analysis, including metrics such as pricing, total data center availability zone, number of cloud services, and LLM integration, and ranked the companies to derive a competitive factor score.

Company Data, Khaveen Investments

Based on the table above, we continue to rank Google Cloud as the best in the cloud with the highest average ranking due to its highest breadth of services and is also tied with Microsoft in AI. Compared to our previous analysis, Google has a slightly lower competitive factor score of 1.25 vs 1.26 previously, due to the inclusion of the AI integration factor. Whereas for Microsoft, we ranked the company at an overall average of 2nd place which is in line with our previous analysis, though with a higher factor score of 1.14x compared to 1.02x, due to the inclusion of the AI interaction metric where we ranked Microsoft as tied with Google due to its superior GPT-4 LLM integration. We applied our competitive factor score of 1.14x on our cloud market projections which has a forward average of 34.5% and forecasted the company’s cloud revenue growth at 39.44%.

Microsoft 365 Productivity (Office Products)

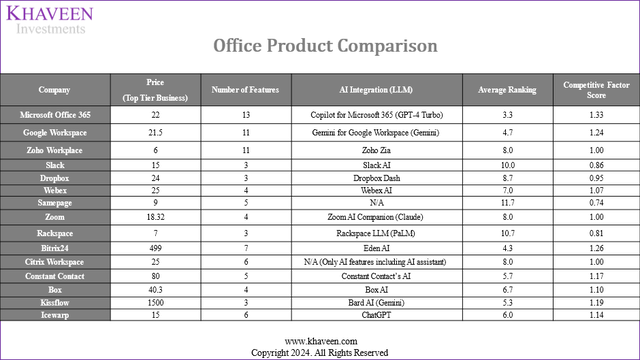

Furthermore, for Microsoft productivity software, we updated our comparison of the companies based on our previous analysis, in terms of price, number of features, and LLM integration, and ranked the companies to derive a competitive factor score.

Company Data, Khaveen Investments

Based on the table, we ranked Microsoft top in terms of features and AI integration due to Copilot leveraging GPT-4. However, we ranked it as tied with Google Gemini due to our analysis in the first point. Furthermore, most of the productivity software competitors have generative AI features announced, but only Icewarp specifically mentioned ChatGPT. However, we ranked it lower as an external integration compared to Microsoft, as we believe Microsoft has advantages in terms of its seamless integration and stronger reputation. Overall, we believe Microsoft ranks as the best in productivity software with a factor score of 1.33x, which we applied in our revenue projections on the market forecast CAGR of 7.73% for a total revenue growth of 10.3%.

Dynamics ERP (Dynamics)

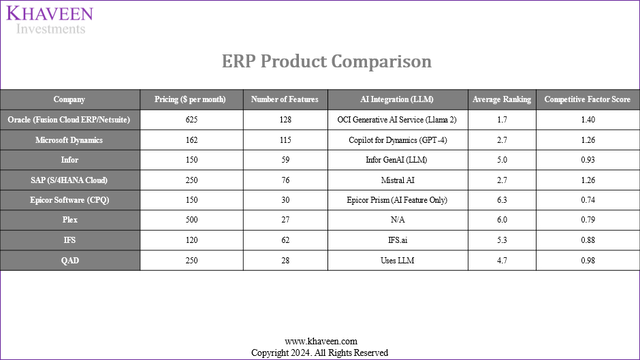

Finally, for Microsoft ERP software, we compiled its top competitors in the ERP market in terms of pricing, features, and LLM integration, and ranked the companies to derive a competitive factor score.

Company Data, Khaveen Investments

Based on the table, we ranked Microsoft as the second best in ERP. Although it falls behind with higher pricing than competitors, its feature breadth is second only to Oracle, which we determined as the best with the highest average factor score overall. However, we ranked Microsoft as the best in ERP software for AI integration due to its Copilot for Dynamics which leverages GPT-4, while the other competitors use other LLMs which we believe are inferior to GPT-4. Overall, we believe Microsoft ranks as the second best in ERP software with a factor score of 1.26x, which we applied in our revenue projections on the market forecast CAGR of 11% for a total revenue growth of 13.9%.

Outlook

Overall, we rank Microsoft highly across cloud and software services. We ranked Microsoft second overall in cloud services with an improved competitive factor score of 1.14x, boosted by its strong AI integration, particularly its superior GPT-4 LLM integration through Copilot. In productivity software, we believe Microsoft ranks the highest here, with a top factor score of 1.33x and our projected revenue growth of 10.3% based on a market forecast CAGR of 7.73%. Additionally, we ranked Microsoft second in ERP software overall due to its AI integration with Dynamics Copilot powered by GPT-4, thus we calculated a factor score of 1.26x, which results in a revenue growth projection of 13.9% based on the 11% market forecast CAGR. Overall, our latest forecasts for Office Products are fairly in line with our previous analysis (11.6%), whereas it is higher for Dynamics (10.1%) and Server Products (22%) as we believe Microsoft’s AI integration could support higher growth prospects in the ERP software and Cloud market.

|

Segment Revenue Projections ($ mln) |

2023 |

2024F |

2025F |

2026F |

|

Office Products |

48,728 |

53,738 |

59,262 |

65,355 |

|

Growth % |

8.6% |

10.3% |

10.3% |

10.3% |

|

Dynamics |

5,437 |

6,191 |

7,049 |

8,026 |

|

Growth % |

16.0% |

13.9% |

13.9% |

13.9% |

|

Server Products |

79,970 |

102,670 |

132,540 |

171,174 |

|

Growth % |

18.8% |

28.4% |

29.1% |

29.1% |

Source: Company Data, Khaveen Investments

Risk: Competition Between Amazon and Google

We believe one of the major risks for Microsoft is the competition between it and Google and Amazon. We highlighted in our analysis that Gemini is a new highly capable LLM of the company, which we now see tied with OpenAI’s GPT-4. Furthermore, Amazon has further increased its investment in Anthropic at $4 bln and has integrated its LLMs into its cloud services. Comparatively, Microsoft has invested $13 bln in OpenAI and has integrated OpenAI’s LLM models into various products including Azure OpenAI, allowing users to opt for OpenAI within Azure Cloud services. Therefore, we expect Microsoft to face intense competition due to the rapid pace of innovation within AI models especially among its top cloud competitors which also have the infrastructure required to support the advancement of AI models.

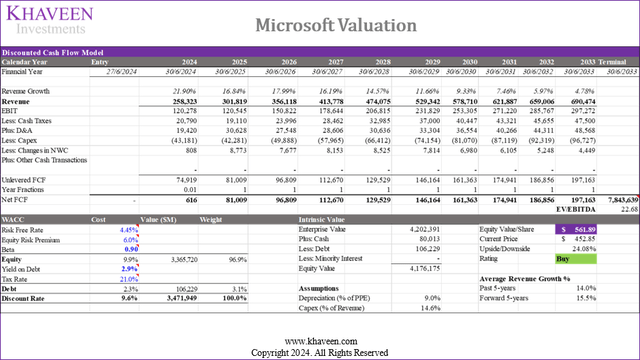

Valuation

We updated our valuation with our latest revenue projection as highlighted in the third section for a 5-year forward average growth of 15.5%. Based on a discount rate of 9.6% (company’s WACC), terminal value based on the company’s 5-year EV/EBITDA of 22.68x, and interest-bearing debt totaling $106.2 bln, we derived an upside of 24.08% for the company.

Verdict

Overall, we continue to believe OpenAI’s GPT remains the top LLM due to its superior average ranking score supported by its massive parameter counts and high MMLU benchmark scores, which also reflect significant improvements over its older models. Despite rapid development in the LLM space, we expect OpenAI to remain a key player with future models like GPT-5 anticipated to have a large increase in parameter count and we believe its partnership with Microsoft is critical with Microsoft providing significant computing infrastructure while Microsoft benefits from integrating OpenAI’s LLMs into its products and cloud business. Furthermore, we believe Microsoft’s integration with OpenAI supports its competitiveness in cloud services as well as productivity and ERP software segments through Office and Dynamics segments, leveraging GPT-4 for advanced AI features through Copilot, which we expect to support its growth outlook with a projected growth of 10.3% and 13.9% respectively. All in all, we continue to rate Microsoft as a Buy with a price target of $561.89, which is slightly higher compared to our previous analysis of $529.39, due to a favorable increase of its 5-year average EV/EBITDA to 22.68x.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.