Summary:

- Investors with the foresight to pick Microsoft’s lows in early January have been well-rewarded, proving the tech pessimists wrong as MSFT outshone the Nasdaq with remarkable resilience.

- Its exclusive cloud partnership with OpenAI has driven significant interest in generative AI. Microsoft has also become a magnet for FOMO investors lately as investors rushed in.

- MSFT’s valuation is losing its luster, while its price action suggests trouble for investors as its risk/reward seems to lean toward the downside.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) investors who dared to pick its November and early January lows have been duly rewarded as MSFT outperformed its peers in the Invesco QQQ ETF (QQQ) and iShares Expanded Tech-Software Sector ETF (IGV) since then.

We believe it demonstrated the market’s confidence in the company’s ability to leverage its exclusive cloud partnership with OpenAI to carve out a foothold in search advertising. It has also strengthened its positioning in cloud computing.

Investors are chasing the hype in AI stocks. Microsoft’s partnership with OpenAI has opened up significant opportunities to apply OpenAI’s advanced AI systems to its products.

As such, it has justified Microsoft’s decision to build an advanced supercomputer for OpenAI, as it invested astutely to help OpenAI train and run its AI models.

Google (GOOGL) (GOOG) has also not stood still, as it strengthens its competitive threat against Microsoft’s office products by introducing generative AI into Workspace.

However, both cloud leaders will also need to assess the momentum from Oracle (ORCL). Nvidia’s DGX cloud partnership with Oracle demonstrates the company’s highly competitive product. Auto companies discovered that Oracle Cloud “ran the simulations faster than its competitors,” given its remote direct memory access or RDMA network.

Alibaba (BABA) Cloud also launched its ChatGPT-style chatbot, which is “aimed at businesses across all sectors to embrace intelligence transformation.” Hence, cloud computing companies are in a fast-evolving AI race to grab market share from one another through breakthrough generative AI development.

As such, Microsoft has astutely leveraged the AI hype train, which has seen investors piling their bets on companies such as Nvidia (NVDA), AMD (AMD), and even C3.ai (AI).

As a result, MSFT has gained nearly 33% from its lows in January through its recent highs, as momentum buyers anticipate a breakout on a possible re-test of MSFT’s August highs.

However, investors hampered by the fear promulgated by the tech pessimists in the financial media at the end of 2022 likely missed out on the upside.

Some previously pessimistic investors could be attracted by the robust outperformance to turn bullish now, joining the bandwagon of investors piling into the AI-driven momentum.

However, we must caution investors that MSFT is no longer attractive if they decide to turn bullish now. Moreover, its price action has also re-tested significant resistance zones that could see market operators rotating out to take profit and cut exposure.

But does it make sense? Let’s take a look.

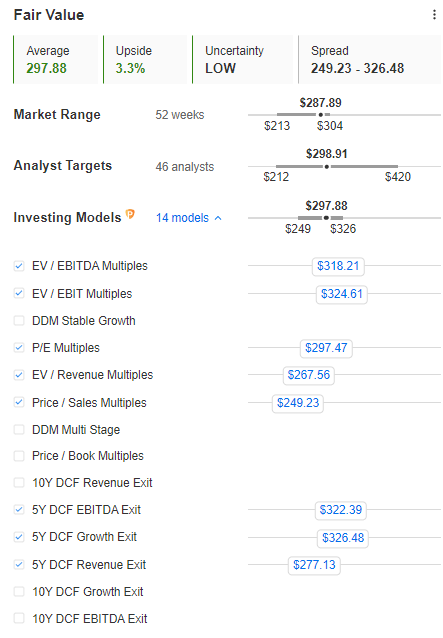

MSFT blended fair value estimate (InvestingPro)

MSFT’s blended fair value estimate suggests a 3.3% potential upside. Therefore, investors who add positions now don’t have a considerable margin of safety when sellers decide to cut exposure.

Trefis’ sum-of-the-parts or SOTP valuation framework also suggests that MSFT’s valuation is not attractive. It suggests a SOTP estimate of $288, with Microsoft’s Intelligent Cloud accounting for 40% of its valuation.

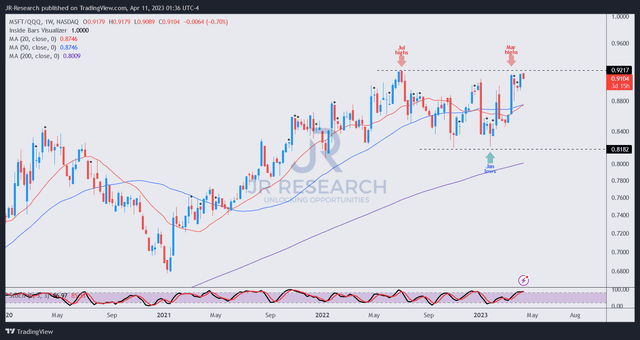

MSFT/QQQ price chart (weekly) (TradingView)

As seen above, while MSFT outperformed the Nasdaq since its lows in January, the recovery has been rapid, leading to a spike in momentum in mid-March.

Hence, underlying sector rotation to Nasdaq’s leading stocks like MSFT has been pretty stunning as investors poured in their bets.

However, we assessed that the upward momentum in MSFT/QQQ has stalled over the past month, hovering close to the resistance zone of last year’s July highs.

From the price action perspective, we parsed that the reward/risk points to the downside. As such, MSFT’s unattractive valuation and price action are in sync.

Therefore, investors who have not added more positions should consider holding back their buy trigger.

Rating: Hold (Revised from Buy)

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL, BABA, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!