Summary:

- Microsoft is gaining the upper hand against Google as the AI battle intensifies.

- Microsoft sees a higher potential for monetization as it embeds its Copilot across its products, gaining share against its rivals.

- Google consolidated DeepMind and Google Brain recently, as their intense rivalry has given the AI initiative to Microsoft.

- Microsoft remains well-primed to lead the AI arms race.

- With MSFT’s valuation surging further into increasingly expensive zones, the risk/reward is unattractive.

David Becker

The Microsoft Corporation (NASDAQ:MSFT) AI hype train has moved into full throttle as momentum buyers piled further into MSFT following its recent earnings release.

As such, MSFT is on track to re-test its April 2022 highs, as CEO Satya Nadella intensified the battle against his hyperscaler rivals, Google (GOOGL) (GOOG) and Amazon Web Services or AWS (AMZN) further.

Accordingly, Nadella is confident that “Azure has the most powerful AI infrastructure” in the market. As such, the company has seen significant growth in adoption by companies of its AI services over the past quarter.

Management highlighted that Azure OpenAI service has gained “more than 2,500 customers, up 10x quarter-over-quarter.” As such, Microsoft’s aggressive approach to winning the cloud computing battle through its generative AI infrastructure is gaining significant momentum.

Wall Street analysts are generally optimistic about Microsoft’s approach. Wedbush sees Microsoft “to be leading the tech AI arms race.” Microsoft has infused its AI advantage into its leading products, encouraging adoption and share gains

Microsoft’s approach has been so successful that even Meta Platforms (META) CEO Mark Zuckerberg declared recently that he “expects generative AI to have an impact on every one of Meta’s apps and services.”

Hence, we aren’t surprised that momentum buyers have rushed into MSFT, seeing the potential for a decisive breakout that could bolster its recovery further.

Notably, Microsoft’s successful partnership with OpenAI has forced Google to combine DeepMind and Google Brain into a single unit, codenamed: Google DeepMind.

DeepMind CEO Demis Hassabis is reportedly close to Google co-founder Larry Page, as DeepMind has regularly fought for independence and against interference from Google management.

Therefore, Google’s AI reorganization has demonstrated that Google has likely lost the initiative to Microsoft due to its “intense rivalry” in furthering its AI ambitions. As Stratechery’s Ben Thompson aptly articulated:

Google’s AI dynamics are challenging because the company is mainly trying to protect its position. Microsoft is focused on future gains, while Google is focused on potential losses. – Stratechery

The Redmond-based Microsoft is also moving toward monetizing its AI services, as analysts parsed the revenue uplift from its leadership against its arch-rivals.

Management accentuated that the company is looking to “increasingly monetize” its copilot, embedded across its tech stack. As such, Microsoft focuses on adding “a lot of value and productivity improvement,” proving the use cases for its customers as they optimize their spending.

Hence, Microsoft is astutely using its AI tools to help its customers consolidate their cloud spending and vendors. Moreover, Microsoft has an ace up its sleeve, as a former leading AWS executive was reportedly no longer bound by his non-compete agreement with Amazon.

Insider reported recently that Charlie Bell (rumored to have lost the AWS CEO role to Adam Selipsky) is ready to be “unleashed” by Microsoft against Amazon.

Bell brought on his Amazonian culture to help improve Microsoft’s cybersecurity product development cadence. Accordingly, Insider reported Bell was instrumental in developing Security Copilot, “which took only a matter of months to go from idea to launch, a much faster timetable than is typical at Microsoft.”

Little wonder Nadella seems satisfied with the advantage that Microsoft is gaining in its security segment, helping the company to gain momentum amid the current vendor consolidation.

As such, Nadella highlighted that Microsoft “once again took share across all major categories,” demonstrating the company’s solid execution.

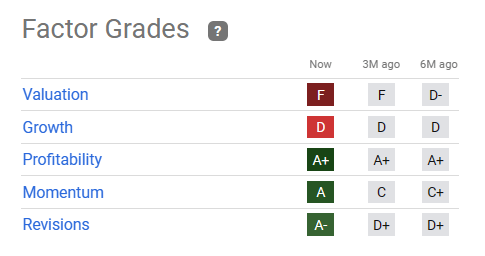

MSFT quant factor ratings (Seeking Alpha)

As a result of the post-earnings surge, MSFT’s valuation is looking increasingly unattractive.

Seeking Alpha Quant reflected an F grade for MSFT, the worst possible. Hence, investors who didn’t buy MSFT at its peak pessimism levels previously shouldn’t jump on board now.

We also assessed that MSFT’s price action looks highly unconstructive now, as momentum buyers are looking greedy, going into FOMO mode.

With that in mind, dip buyers are encouraged to continue staying on the sidelines and ignore chasing the upward surge.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, META, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!