Summary:

- Microsoft delivered a strong revenue and earnings sheet for FQ3’23 last week.

- The software company saw 7% year-over-year growth in revenues and growth reaccelerated quarter over quarter.

- Free cash flow margins drastically improved and Microsoft returns a high percentage of its FCF to shareholders.

- Microsoft’s shares broke out to the upside and are not expensive in my view.

Jean-Luc Ichard

Microsoft (NASDAQ:MSFT) submitted a convincing earnings scorecard for its third fiscal quarter last week that led to a sizable top and bottom-line beat. Microsoft also posted a fundamental improvement in its free cash flow margin which crossed 30% again in FQ3’23 and the company saw a re-acceleration of growth quarter over quarter as well. As a result, Microsoft’s shares soared last week and broke out to the upside. Since shares are still not expensive and Microsoft is a very free cash flow-strong software company, I believe the risk profile is still favorable for investors, especially those that want to invest in a rapidly growing cloud business!

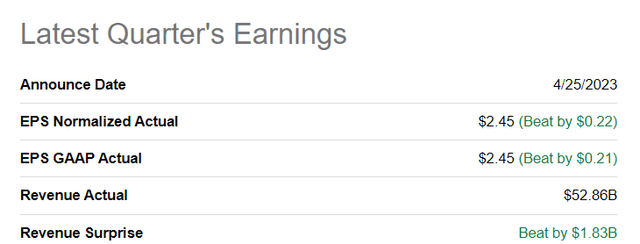

Solid beats on the top and bottom line

Microsoft’s FQ3’23 earnings sheet was solid as the company delivered stronger revenues and earnings than expected. Microsoft earned $2.45 per share in the first quarter on revenues of $52.86B. Revenues were $1.83B higher than expected, and Microsoft’s revenue momentum indicates that EPS could rise for the coming quarters as well.

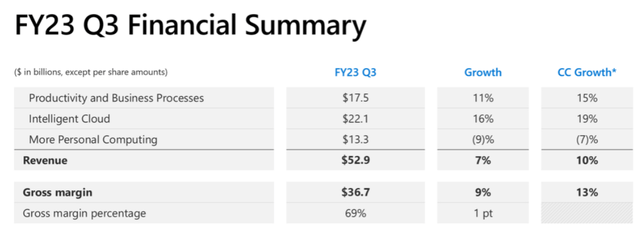

Microsoft is seeing a re-acceleration of growth

The biggest takeaway from Microsoft’s FQ3’23 earnings sheet was that the company is seeing a return of growth in its top line, which is highly encouraging after the company’s results have shown signs of weakness lately. This weakness was due to slowing post-pandemic demand for consumer electronics in the second half of last year, but also moderating growth in the important Cloud business.

Microsoft posted 7% year-over-year growth in FQ3’23 compared to just 2% in FQ2’23. In the previous quarter, Microsoft suffered from falling chip demand as consumers upgraded their IT equipment during the pandemic, resulting in shrinking demand for processors. The re-acceleration of growth that occurred in Microsoft’s third fiscal quarter is encouraging and indicates improving fundamentals in Microsoft’s core businesses.

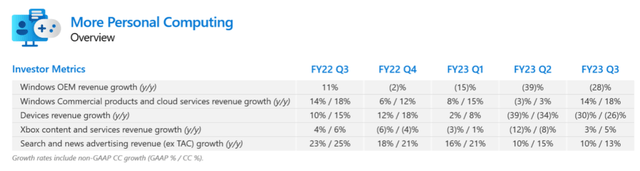

While the Personal Computing segment continued to struggle due to weak consumer demand for computers, laptops, and tablets in the last quarter, it appears that the pain in Microsoft’s hardware-related business is easing. Windows OEM revenues declined 28% year over year in FQ3’23 as the market and demand situation for personal computers remains challenged, but the decline was not nearly as high as it was in the previous quarter, which is when Microsoft saw a 39% decline in Windows OEM sales. Devices revenue growth fell 30% year over year in FQ3’23, but the slowdown is decelerating as well: in FQ2’23, Microsoft saw a 39% revenue contraction. If the state of the personal device market improves in 2023, I can see a strong revenue rebound in the Personal Computing business.

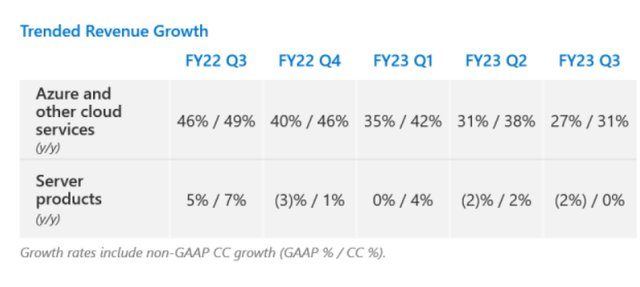

A key growth driver for Microsoft is the Cloud business, which is driven chiefly by the company’s Azure Cloud service that helps companies scale their business transformations. Intelligent Cloud grew revenues by 16% year over year in FQ3’23 and the growth rate decreased slightly from 18% in FQ2’23. However, Azure is still growing rapidly with an FQ3’23 segment top-line growth rate of 27% (31% in constant currencies) and Azure remains the second-largest Cloud service provider in the marketplace with a share of 23%.

Azure is a key asset for Microsoft and crucial for driving the company’s top-line growth going forward. What I like about Azure is that the business operates independently from the PC shipment market, meaning consumer demand is less important for the segment than corporate spending on IT infrastructure. Over the long term, I believe companies will continue to invest heavily in their ability to scale their businesses, which is why I like Microsoft’s Intelligent Cloud segment. With a market share of more than 20%, Microsoft also has the potential to catch up to Amazon’s AWS, which currently has a market share of about 33%.

A top reason to buy Microsoft: free cash flow strength, high FCF return ratio

At the end of the day, nothing matters more for any company in any industry than the ability to generate a ton of free cash flow. Because free cash flow can be returned to shareholders as share buybacks or as dividends, it is the most important performance metric for any company.

Microsoft generated $17.8B in free cash flow on revenues of $52.9B in FQ3’23, which translates to a free cash flow margin of 33.7%, showing a major improvement over the prior quarter when Microsoft’s FCF margins dropped off due to the downturn in the PC market.

Microsoft returned more than half of its free cash flow to shareholders in the last quarter: the company spent $4.6B of its FCF to buy back shares and $5.1B to pay dividends. In total, Microsoft returned $9.7B of cash to shareholders, or 54%.

|

$billions |

FQ3’23 |

FQ2’23 |

FQ1’23 |

FQ4’22 |

FQ3’22 |

Y/Y Growth |

|

Revenues |

$52,857 |

$52,747 |

$50,122 |

$51,865 |

$49,360 |

7% |

|

Cash Flow From Operating Activities |

$24,441 |

$11,173 |

$23,198 |

$24,629 |

$25,386 |

-4% |

|

Capital Expenditures |

($6,607) |

($6,274) |

($6,283) |

($6,871) |

($5,340) |

24% |

|

Free Cash Flow |

$17,834 |

$4,899 |

$16,915 |

$17,758 |

$20,046 |

-11% |

|

Free Cash Flow Margin |

33.7% |

9.3% |

33.7% |

34.2% |

40.6% |

– |

(Source: Author)

Microsoft’s valuation

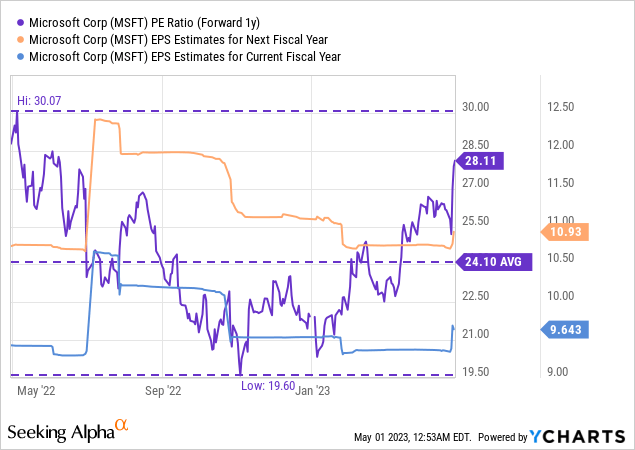

Microsoft has suffered from the slowdown in the PC business last year, and the last quarter once again showed that device shipments declined due to excess inventories and a post-pandemic drop-off in demand. However, EPS estimates for Microsoft have trended up lately, indicating that the market expects the situation to improve. Analysts currently expect Microsoft to report $10.93 per share in earnings next year, showing 13% year-over-year growth. Microsoft is currently trading at a forward P/E ratio of 28.1X, and the stock broke out above its 1-year average P/E ratio lately as well.

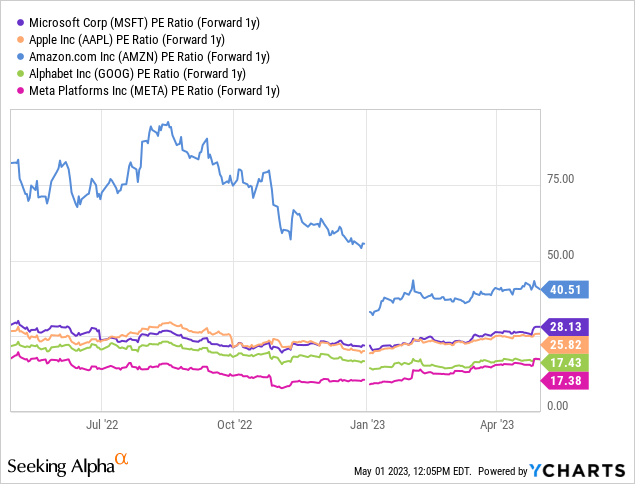

Compared against other FAANG stocks, Microsoft has a high P/E ratio, but valuations for Alphabet (GOOG) (GOOGL) and Meta Platforms (META) have compressed due to their reliance on the advertising market… which went into a slump in the second half of 2022. Because of Microsoft’s more diversified business and enormous free cash flow strength, I believe Microsoft’s shares really aren’t that expensive, with a P/E ratio of 28X.

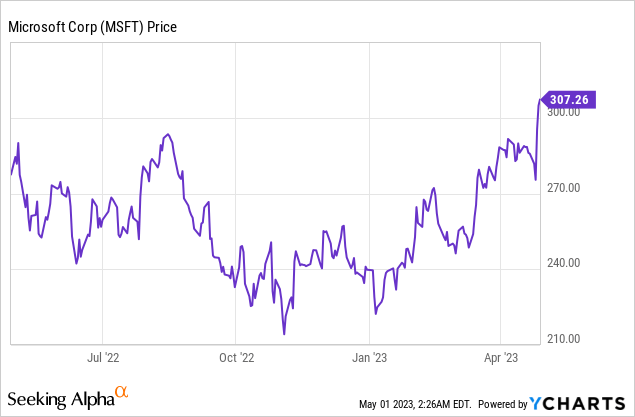

Another reason why I don’t believe Microsoft is expensive is because the company is generous with buybacks and spends billions of dollars each quarter to repurchase its shares. Because of Microsoft’s re-acceleration of growth, strong FCF, and revenue beat, shares of Microsoft have broken out to the upside last week and reached a new 1-year high… and I believe this rally has momentum.

Risks with Microsoft

From a commercial point of view, I would say that the biggest risk for Microsoft is a slowdown in the Intelligent Cloud and Azure businesses, which are the company’s growth drivers. So, any slowdown that occurs here is likely going to weigh heavily on Microsoft’s consolidated top-line growth. If Microsoft’s Cloud growth decelerates, Microsoft could find itself in a position in which it can only grow its top line in the low single digits, which would hurt the firm’s margins, free cash flow, and valuation factor.

Final thoughts

Microsoft delivered a strong earnings sheet for FQ3’23 that saw a fundamental improvement in the company’s free cash flow margin, strong buybacks, a re-acceleration of top-line growth, Cloud strength, and easing pain in the Personal Computing segment. As a result, Microsoft’s shares rightfully broke out last week and reached a new 1-year high. Since shares of Microsoft are still reasonably valued with a P/E ratio of 28X, I believe investors have a lot of reasons to buy MSFT. The risk profile remains skewed to the upside, in my opinion!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.