Summary:

- Microsoft Corporation’s landmark win in antitrust lawsuits has allowed it to make large acquisitions and diversify its business.

- OpenAI, a prominent AI firm, is facing turmoil with the firing of its CEO and potential employee exodus to Microsoft.

- Microsoft’s financial results show strong revenue growth, particularly in its cloud business, but its lofty valuation poses a risk.

lcva2

Microsoft Corporation (NASDAQ:MSFT) is the second largest publicly traded company in the world. The company also holds status with Apple (AAPL) as an old-wave tech company, versus newer entrants such as Meta Platforms (META) and Alphabet/Google (GOOG). Most importantly, the company went through landmark antitrust lawsuits against the U.S. government just over 20 years ago.

The company’s win in those lawsuits, when it had a more commanding share of the market, has protected its ability to make large acquisitions in recent years. That, combined with the company’s focus on diversifying from its core business, has helped it dramatically. As we’ll see throughout this article, its brilliance is once again on display.

Microsoft OpenAI

The OpenAI debacle continues.

CEO Sam Altman, arguably the most recognizable face in in artificial intelligence, was recently fired from his position as CEO of OpenAI, arguably the most recognizable artificial intelligence firm. Rumor is that he had no clue he was going to be fired until beforehand, as the board alleged he was untruthful in his communication with them.

Investors and employees rebelled. Investors first tried to reinstate him, but that seemed to have failed, after the ex-CEO of Twitch was made CEO Sunday. To date, two interesting developments have taken place. First, >95% of employees have signed a letter stating they would leave if the board doesn’t resign. The board shows no signs of resigning.

Interestingly enough, signatories to the letter include Ilya, the 3rd co-founder, and board member who was originally part of letting Sam Altman go. These are top tier employees in an exciting field, they have job offers anywhere they want. Microsoft has allegedly agreed to hire all of them, and maintain their compensation, while other CEOs such as from Salesforce (CRM) have put out offers.

Secondly, the largest investor of OpenAI, Microsoft, has had Sam allegedly agree to start working at a new venture along with cofounder #2 Greg. We don’t see an outcome here where Microsoft isn’t massively strengthened. Best case scenario for Microsoft: OpenAI dissolves and all the employees start working for Microsoft, essentially enabling it to acquire the startup for free.

Worst case scenario, in our view, is that Sam returns to OpenAI with Microsoft not just the preferred partner of the company overall, but of each of the employees. Regardless here, it’s clear that Microsoft is a leader not just in AI but also in commercializing AI and bringing it to customers for long-term customer profits.

Microsoft Financial Results

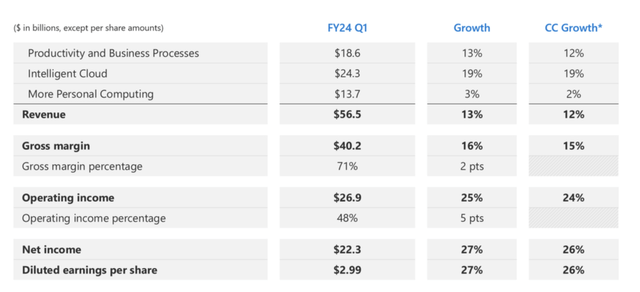

The company’s fiscal Q1 financial results were incredibly strong, supported by the company’s financial focus and gross margins.

Microsoft Investor Presentation

The company earned $56.5 billion in quarterly revenue, a 13% YoY increase, slightly supported by constant-currency growth. The company’s gross margin was 71%, an astounding margin that increased by 2% YoY, helping financials to improve dramatically. At the end of the day, the company had $40.2 billion in gross margin, which it improved to $22.3 billion in net income.

Growth at the bottom line was much more than growth at the top line, helping to highlight the company’s financial strength. The company’s annualized EPS is $12 / share, coming out to a P/E of ~30, a relatively expensive ratio. A 3% free cash flow (“FCF”) yield needs continued growth to justify.

Microsoft Business Performance

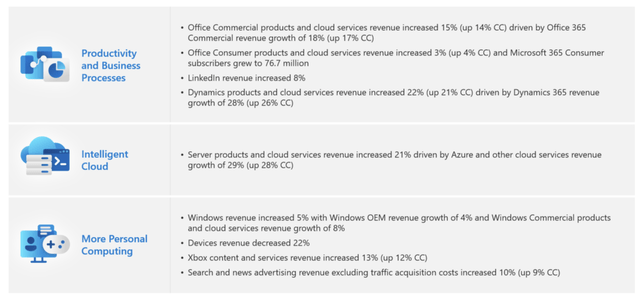

The company’s overall performance was supported by strong performance within its individual segments.

Microsoft Investor Presentation

The company’s office commercial product was 15% revenue increase, with Office 365 up 18%. We see this support as being due to the company’s integration of OpenAI and the associated scalability offered to companies. The company’s consumer products saw much smaller growth, which isn’t particularly surprising given the cost.

The company’s cloud business was among the largest sources of growth. Growth remains rapid here as the company is the only cloud company to combine strong cloud offerings with a massive enterprise sales team and software portfolio. Overall growth in Azure and cloud revenue was up 29% for the company.

The company’s personal computing business was weaker. Its acquisition of Activision Blizzard closed roughly a month ago, for just a hair under $70 billion. Xbox content and services revenue was the bright spot here, increasing by 13%, and we expect additional strength. Search and advertising revenue increased as well by double-digits.

Microsoft Lofty Valuation

Microsoft’s cost is that it trades at a lofty valuation. As discussed above, the company has a P/E of roughly 30. For the long-term, we’d expect a more reasonable FCF to be in the high-single digits. However, the company has 3 sources of growth that we think can contribute to its ability to drive future returns.

1. AI

Artificial Intelligence is new and it’s the hot kid on the block. The problem with any new technology though is how to utilize it. Microsoft’s strong corporate relations and integrated software mean that it can provide those services to customers through Copilot and more. That makes those customers much more likely to use Microsoft’s artificial intelligence.

Being the biggest bankroller and having intellectual property rights to OpenAI, the hottest company in the sector, helps as well.

2. Custom Chips

Microsoft already owns Azure, the second largest cloud computing business. Now the company has announced that it’s launching custom artificial intelligence chips designed in-house. Not only will that significantly help the company’s margins for Azure, but it could also open up new markets for the company given its market strength.

3. Apple Google Search Lawsuit

Every year, Apple gets $10s of billions to make Google the default search engine for Safari. That market dominance has long helped cement Google’s position, and it has put Bing in a tough position of playing second fiddle. That’s important given that Google search continues to represent the majority of Google’s profits. That deal is now the subject of a lawsuit that could unravel it.

Should it unravel, that would be a strong opportunity for Bing to sweep in and grow.

Thesis Risk

The largest risk to our thesis is growing competition. The company is one of the few in the world to operate in an industry where its competition has multi-trillion dollar market caps, 10s if not 100s of thousands of intelligent employees, and $10s of billions in annual profit. The company’s competitors are looking to take its dominant positions in gaming, compute, AI, etc.

Should these competitors succeed, the company’s ability to grow into its valuation will become much tougher.

Conclusion

Microsoft has an impressive portfolio. The company has taken advantage of minimal antitrust concerns to rapidly acquire new business. Unlike other tech companies that have attempted to build home-grown businesses in popular categories, like Netflix and gaming, the company has found it much easier to acquire the businesses.

Acquisitions such as Activision Blizzard for almost $70 billion, LinkedIn for $26 billion, GitHub, Skype, etc., have made the company well positioned in certain fields or given it access to completely new fields. We expect, supported by a number of immediate term catalysts, Microsoft Corporation’s performance to support its valuation and drive long-term returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.