Summary:

- Microsoft’s stock is trading at an excessively high multiple and currently carries a negative equity risk premium, which is unsustainable in the long run.

- The company’s Q3 FY2024 report showed strong growth in total revenues and diluted EPS, driven by an acceleration in Azure Cloud and healthy growth across the business.

- Despite positive financial performance, Microsoft’s stock is grossly overvalued, and its 5-year expected CAGR returns fall well short of our investment hurdle rate.

- Is Microsoft a buy, sell, or hold after its Q3 FY2024 report? Read on to find out!

Jean-Luc Ichard

Introduction

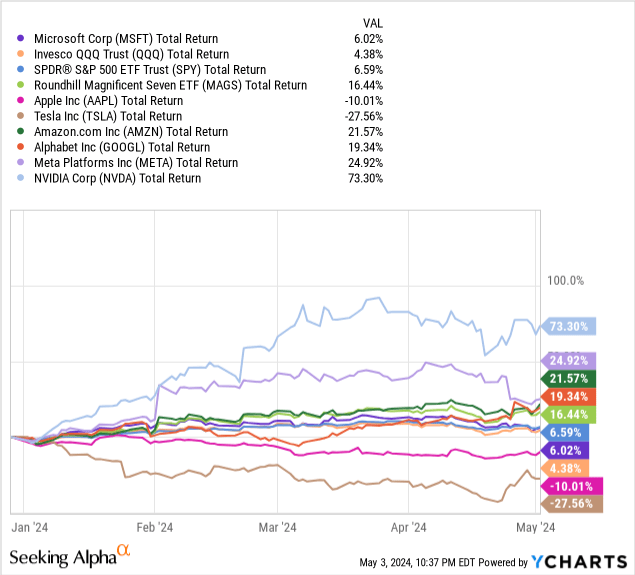

Despite showing robust financial performance in recent quarters, Microsoft Corporation (NASDAQ:MSFT) has largely performed in line with broad equity indices such as the S&P 500 (SPX)(SPY) since the turn of the year.

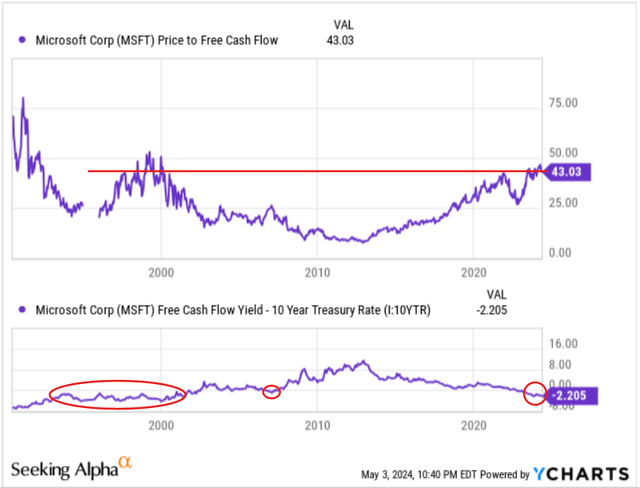

As you can see on the chart above, the “Magnificent 7” basket has already lost the likes of Tesla (TSLA) and Apple (AAPL). With market generals losing momentum one after the other, I believe it is only a matter of time before Microsoft’s richly valued stock takes a real hit. After all, MSFT stock is currently trading at a bubblicious multiple of ~43x P/FCF (FCF yield of 2.3%), a multiple observed at the peak of the 2020-21 liquidity bubble and during the dot-com bubble (late-1990s/early-2000s).

With treasury yields hovering in the 4-5% range, Microsoft currently carries a negative equity risk premium, which is a violation of the immutable laws of money. Based on current pricing, Mr. Market is essentially betting that Microsoft stock has lower risk than the US government. Yes, we have a fiscal deficit spending (national debt spiral) problem, and Microsoft is a proven free cash flow compounder; however, Microsoft is not the US government in the sense that it cannot tax the populous, and it cannot print money out of thin air. Hence, a negative equity risk premium is simply unsustainable, and sooner or later, Microsoft’s equity risk premium will need to turn positive.

Now, this anomaly can heal through a price/time correction in Microsoft stock and/or a drop in long-duration treasury yields. However, with inflation re-accelerating back up in recent months, long-duration treasury yields have soared higher and the Fed has been forced to stick to “higher interest rates for longer” policy. Like it or not, the longer monetary policy stays restrictive, the higher the probability of a painful price correction in Microsoft stock (and the broader equity markets in general).

In today’s note, we will review Microsoft’s Q3 FY2024 report and re-evaluate the long-term risk/reward for MSFT stock using our valuation model.

Analyzing Microsoft’s Q3 FY2024 Numbers

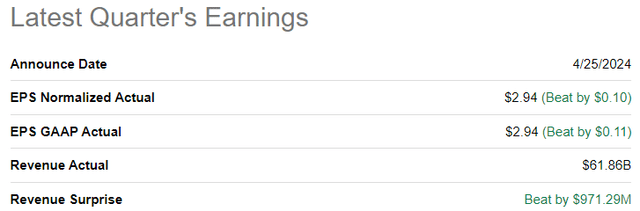

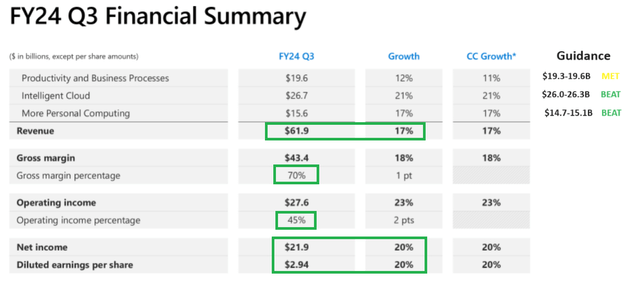

For Q3 FY2024, Microsoft reported total revenues of $61.86B (+17% y/y, vs. est. $60.89B) and diluted EPS of $2.94 (+20% y/y, vs. est. $2.84) to soar beyond consensus estimates, with Azure Cloud serving as a major driver of growth at the software tech giant.

Microsoft Q3 FY2024 Results (Seeking Alpha) Microsoft Q3 FY2024 Earnings Release

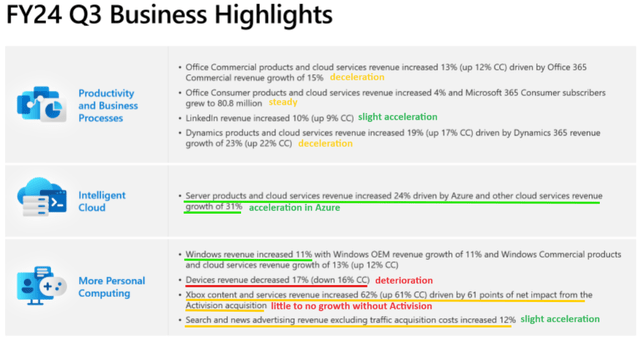

An acceleration within its Azure Cloud business to 31% y/y growth was the biggest highlight from Microsoft’s Q1 report, with Satya Nadella & Co. giving credit to AI for generating a seven-point uplift in Azure’s growth during the Q3 FY2024 earnings conference call (transcript). Overall, Microsoft’s Intelligent Cloud segment grew by +21% y/y to $26.7B.

While Microsoft’s cloud strength took all the plaudits (deservedly so), the “Productivity & Business Processes” and “More Personal Computing” segments also delivered healthy growth in Q3 FY2024 despite showing mixed internal performance, as highlighted below.

Microsoft Q3 FY2024 Earnings Release

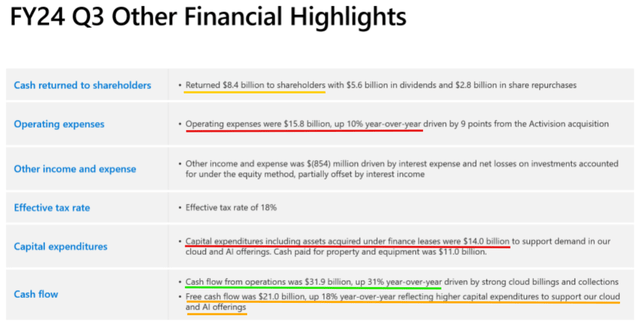

During Q3 FY2024, Microsoft’s operating expenses grew by +10% y/y while the revenue growth rate moderated to +17% y/y. Consequently, Microsoft generated $31.9B in cash flow from operations and $21B in quarterly free cash flow in Q3. From these free cash flows, Microsoft returned $8.4B to its shareholders in the form of share repurchases ($2.8B) and dividends ($5.6B).

Microsoft Q3 FY2024 Earnings Release

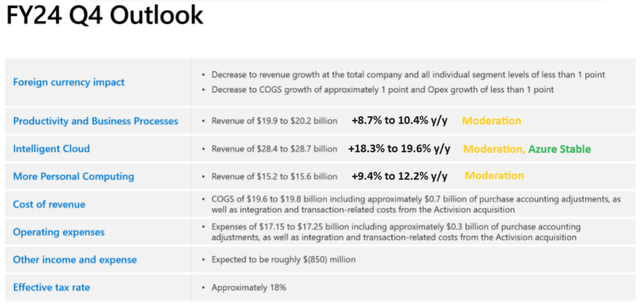

For Q4 FY2024, Microsoft’s management provided softish guidance that missed consensus street estimates, with all three of Microsoft’s revenue segments projected to experience modest growth deceleration ahead. Furthermore, management warned about an uptick in operating expenses and AI CAPEX spending for the upcoming quarter (and 2025).

Microsoft Q3 FY2024 Earnings Release

With Microsoft’s operating expenses estimated to grow by +13.3-13.9% in Q4 FY2024 (roughly in line with the projected revenue growth rate of +12.9-14.7%), Microsoft’s operating leverage (margin expansion) story could be about to hit a snag.

Overall, Microsoft’s Q3 FY2024 report was stronger than expected, with Azure building further momentum as GenAI adoption increases. Let us now re-evaluate MSFT stock in light of these Q3 FY2024 numbers.

Microsoft Fair Value And Expected Returns

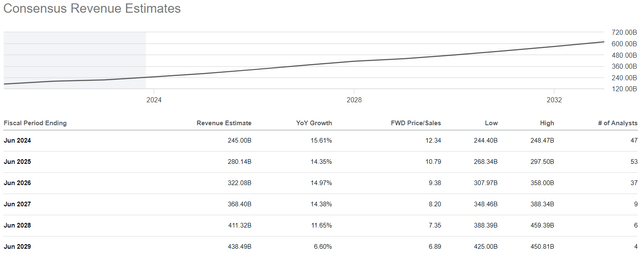

As evidenced by recent quarterly reports, Microsoft has real AI substance; however, this doesn’t change the fact that Microsoft is unlikely to experience explosive hypergrowth like what we have seen with the likes of Nvidia (NVDA) and Super Micro Computer (SMCI), given its massive scale. As per consensus estimates, Microsoft is projected to grow top-line numbers at low-double-digit rates for the next five years:

While “soft landing” is the consensus view in the investing world, a Fed-induced economic downturn cannot be ruled out just yet. However, for the purpose of this valuation exercise, we will ignore the possibility of a hard landing (recession) and assume a somewhat generous 12.5% CAGR sales growth rate for the next five years (which is greater than consensus estimates of 12.34%). Furthermore, I am baking in a good bit of margin expansion by assuming an optimized FCF margin of 35% (current FCF margin is ~30%).

Lastly, I am lifting our terminal growth rate assumption from 3% to 5% as a result of an improved outlook for Microsoft’s long-term growth prospects (including enhanced clarity over GenAI monetization).

Now, despite using aggressive assumptions for long-term growth and steady-state margins, Microsoft continues to look overvalued:

TQI Valuation Model (TQIG.org)

According to our valuation model, Microsoft’s fair value estimate is ~$320 per share (or ~$2.4T). With the stock trading at ~$406 per share, I now see a downside of -21% to fair value in MSFT stock.

Predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

Assuming a base case exit multiple of 20x P/FCF, I see Microsoft stock rising from ~$406 to ~$489 per share in the next five years at a CAGR of 3.77%.

TQI Valuation Model (TQIG.org)

Since MSFT’s expected return falls well short of our investment hurdle rate of 15% and the S&P 500’s long-term average return of ~8-10%, Microsoft stock is still a “Sell” at current levels under our valuation process.

Concluding Thoughts: Is Microsoft Stock A Buy, Sell, Or Hold Now?

Microsoft is an incredible company that’s delivering robust growth (and improving profitability) at scale; however, MSFT stock is extremely frothy, given its 5-year expected return is lower than risk-free government treasuries.

In my previous update on Microsoft, I wrote the following:

As you may know, I do not short individual equities. However, if I owned MSFT shares, I would make a tactical sale here and look for a better entry point through a price and/or time correction. From a fundamental perspective, Microsoft is performing well, but its stock has run up too far, too fast.

Source: Microsoft Q2 Review: A Case Of Good Not Being Good Enough

Since then, Microsoft’s stock has undergone a three-month-long time correction; however, the long-term risk/reward for MSFT remains unattractive. With long-duration treasury yields climbing during this period, Microsoft’s stock looks even worse than it did three months ago. Yes, the business is performing exceptionally well right now, but in the event of a hard landing, we could see Microsoft retracing to its fair value (and who knows, it could probably overshoot to the downside, like in previous economic downturns).

Key Takeaway: I rate Microsoft a tactical “Sell” in the $400s.

Thank you for reading, and happy investing! If you have any questions, thoughts, and/or concerns, please feel free to share them in the comments section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.