Summary:

- We look at Microsoft Corporation’s prospects for Azure earnings growth amid the AI revolution.

- Most investors are convinced now that Microsoft Azure’s AI solutions will continue to see strong demand growth, but investors also need to appreciate Microsoft’s supply-side initiatives to drive profitability growth.

- Microsoft has made some additional savvy moves to grow market share over rivals Amazon’s AWS and Google Cloud.

Loren Elliott/Getty Images News

With the AI revolution well under way now, Microsoft Corporation (NASDAQ:MSFT) Azure proved its superior ability to capitalize on the opportunity by delivering the fastest growth rate last quarter, relative to its main cloud rivals. Microsoft has confirmed the growing demand for cloud computing to power AI-driven workloads. At the same time, Microsoft is also making considerable progress on the supply-side to deliver AI infrastructure in an increasingly cost-effective manner, conducive to profit margin expansion, and thereby strengthening the Bull case for the stock. We maintain a “buy” rating on the stock.

In our previous article covering Microsoft Azure, we recommended buying the dip in Microsoft stock. Data is the fuel behind generative AI innovations, and the growing demand for Microsoft’s new data management solution, Microsoft Fabric, offered a promising leading indicator into cloud customers’ ambitions to build AI applications on the Microsoft Azure platform. Now the stock has recently recovered from the slight dip from a few months ago, with little room left for multiple expansion at the current valuation. Though the latest earnings report and analyst call offered insights into Microsoft’s promising prospects for profitability growth, strengthening the bull case for the stock.

The “Intelligent Cloud” segment, which includes Azure, continues to be main source of revenue and profits for Microsoft. Azure’s growth re-accelerated in Q1 FY24 to 28% (in constant currency), making it the only cloud provider to witness re-acceleration in revenue growth.

The Azure OpenAI service now boasts over 18,000 customers, compared to 11,000 last quarter. In fact, Microsoft is the only major cloud provider able to reveal how many customers are using its AI-centric cloud solutions.

Nevertheless, investors are already convinced that demand for Microsoft’s AI solutions is growing, and will continue growing for the foreseeable future. But what investors also need to appreciate is Microsoft’s initiatives on the supply-side of the equation to drive profitability growth.

On the Q1 FY2024 Microsoft earnings call, CEO Satya Nadella shared:

“the approach we have taken is a full stack approach all the way from whether it’s ChatGPT or Bing Chat or all our Copilots, all share the same model. So in some sense, one of the things that we do have is very, very high leverage of the one model that we used — which we trained, and then the one model that we are doing inferencing at scale. And that advantage sort of trickles down all the way to both utilization internally, utilization of third parties”

So what does he mean by all that?

Multiple applications are being powered by a single large language model [LLM], namely OpenAI’s GPT-4 model. This includes Microsoft’s own applications like Bing Chat and its range of Copilots, as well as third-party developers choosing to use this model to power their own applications through the Azure OpenAI/ Azure AI platforms.

The growing use of the popular GPT-4 model among cloud customers, as well as the growing use of Microsoft’s own GPT-powered services like Copilot, brings multiple advantages to the cloud provider.

It enables Microsoft to scale its AI infrastructure more easily. The prevalent use of a single AI model simplifies the process of infrastructure management, allowing for greater cost efficiencies that are conducive to profit margin expansion. Moreover, the high cost of training the model can be amortized over the multiple AI applications using it, improving the return on investment, as the different revenue streams from the model exceed the cost of training it. These forms of advantages are the “very high leverage” Nadella is referring to in the citation earlier.

As more and more applications run on this single AI model, the greater the scalability of the model becomes, leading to incremental cost efficiencies. Now these resulting cost efficiencies can be leveraged in two ways. Either they can be passed onto the cloud customers to offer more competitive pricing and take market share, thereby driving revenue growth. Or alternatively, Microsoft can absorb these cost savings themselves, conducive to profit margin expansion for shareholders. Microsoft could also find a middle ground between these two approaches, benefiting investors either way.

CFO Amy Hood went onto say on the earnings call that:

“In addition, what Satya mentioned earlier in a question, and I just want to take every chance to reiterate it, if you have a consistent infrastructure from the platform all the way up through its layers, then every capital dollar we spend, if we optimize revenue against it, we will have great leverage, because wherever demand shows up in the layers, whether it’s at the SaaS layer, whether it’s at the infrastructure layer, whether it’s for training workloads, we’re able to quickly put our infrastructure to work generating revenue.”

By having a consistent infrastructure across all of its layers, from the platform to the silicon (i.e., chips), developers can write code that is portable across all of the layers, which enhances the flexibility of its infrastructure for Microsoft to quickly adapt to new use cases. Therefore, Microsoft Azure is optimally positioned to capitalize on shifting demands for its infrastructure, from training AI models to building new software applications, realizing revenue-generation opportunities for shareholders.

Risks to consider

Microsoft has certainly been investing considerably behind optimizing its main GPT-4 model across the stack. Though it can be risky being so heavily invested in OpenAI’s LLM by increasingly optimizing the infrastructure around it. While GPT-4 is undoubtedly one of the best and most popular AI models on the market, the generative AI revolution is only getting started and could give rise to another more powerful and popular AI model from another tech company, which cloud customers may end up preferring over GPT-4.

Furthermore, given that all of Microsoft’s generative AI-focused software applications, such as Bing Chat and Copilot, are based on this single model, any competitive developments in the industry (i.e., a rival introducing a better model) could affect the competitiveness and demand of all these Microsoft applications, as well as the popularity of the applications built by Azure AI customers.

Now on a positive note, CEO Satya Nadella did mention on the earnings call that aside from its main model (GPT-4), cloud customers are also using other open source models available through Azure:

“That doesn’t mean we don’t have people doing training for open source models or proprietary models. We also have a bunch of open source models.”

This is essential for diversification, and enables Microsoft to stay a bit more agile to evolving customer needs.

Is Microsoft stock a buy?

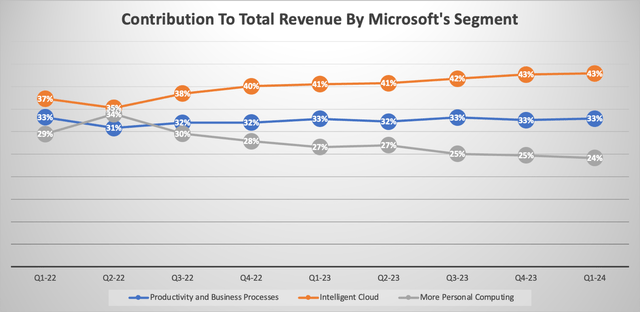

Microsoft’s Intelligent Cloud segment, which includes Azure, continues to be the largest source of revenue for the software giant, making up 43% of total revenue last quarter.

Nexus, data from company filings

It is also the largest source of profits, as Intelligent Cloud made up 44% of Microsoft’s operating income over the same period.

The Microsoft Azure unit is also the earliest beneficiary of the AI revolution relative to other segments, as businesses worldwide need extensive cloud computing power to build their own customized AI models and applications. Hence Microsoft’s cloud business will continue to be the most important driver of the stock.

The cloud industry’s market size is expected to grow to $1.5 trillion by 2030, implying a compounded annual growth rate of 14.1% between now and then. The generative AI revolution this decade will indeed be a key driver of this growth, including the need for organizations to migrate from on-premises computing to cloud computing in order to be able to take full advantage of the generative AI-related solutions available through the various cloud providers.

In fact, on Amazon’s Q3 2023 earnings call, when discussing the growth prospects for AWS, the executives estimated that “about 90% plus of the global IT spend” is still on-premises. Hence there is still a large penetrable market for the cloud providers as these organizations with on-premises computing migrate to cloud computing.

Though while cloud competitors like to trumpet the total addressable market growth potential, Microsoft Azure has actually been making some savvy moves to induce customers from smaller rivals to migrate from on-premises to Azure, as CEO Satya Nadella proclaimed on the last earnings call:

“We are the only other cloud provider to run Oracle’s database services, making it simpler for customers to migrate their on-prem Oracle databases to our cloud. Customers like PepsiCo and Vodafone will have access to a seamless fully integrated experience for deploying, managing, and using Oracle database instances on Azure. And we are the cloud of choice for customers’ SAP workloads too. Companies like Brother Industries, Hanes, ZEISS, and ZF Group all run SAP on Azure.”

Therefore, not only is Microsoft well-positioned to win in the era of AI through exclusive access to the industry-leading AI model (OpenAI’s GPT-4), but these partnerships with Oracle and SAP strongly position Microsoft to further capitalize on the shift from on-premises to cloud computing, enabling Azure to take even more market share.

It comes as no surprise, then, that out of the three major cloud providers, Microsoft Azure witnessed the fastest revenue growth rate of 28% (constant currency) last quarter.

Furthermore, on the last earnings call, CFO Amy Hood revealed that:

“Microsoft Cloud’s gross margin percentage increased slightly year-over-year to 73%, a point better than expected, primarily driven by improvements in Azure.”

Given the initiatives discussed earlier relating to the scaling of its AI infrastructure, Microsoft is strongly positioned to continue expanding its profit margins through cost efficiencies, to the benefit of shareholders.

Additionally, on the last earnings call, the CFO also shared:

“what we’re committed to doing is making sure it’s highly leveraged and making sure you see the same growth in revenue. And I think on occasion, you may see something pick up 1 or 2 points and the other one not quite get there, but the point is, it’s going to be very well paired because of the choices we’ve made over the past, frankly, numerous years, to get to a point where that infrastructure is consistent.”

Microsoft has been striving to better align its cost structure with its revenue growth, and has designed its infrastructure so that every dollar spent translates to a proportionate increase in revenue with a reduced time lag. So when Microsoft engages in increased capex, it is less likely to suppress profit margins, which is what the market would usually expect. Instead, Microsoft should be better positioned to sustain profitability, if not grow its profit margins, depending on how well it is able to drive revenue growth through its investments. This ultimately improves the EPS growth outlook and returns on investments, augmenting the appeal of Microsoft stock as an investment security.

Now in terms of valuation, Microsoft stock trades at a forward P/E of over 32x, which is well above its 5-year historical average of nearly 30x. Now there is an argument to be made for the stock to deserve being re-rated to a higher valuation multiple in the era of AI, given the tech giant’s leadership position and promising growth prospects through selling generative AI-centric solutions.

Hence, a more sensible valuation metric to assess Microsoft stock’s valuation would be the forward Price-Earnings-Growth [PEG] ratio, which measures how fairly the stock is priced relative to expected future earnings growth rates. This metric essentially allows for stocks with higher projected EPS growth rates to trade at higher forward PE multiples. A stock trading at a PEG ratio of 1 is considered a fairly valued stock.

Though it is important to acknowledge that high-quality stocks rarely trade at fair value, and instead tend to trade at a premium to fair value. Markets tend to assign a premium valuation based on factors such as balance sheet strength, dominant market position and competitive moats.

Microsoft stock is currently trading at a forward PEG ratio of 2.35, which is significantly above fair value. Though keep in mind that Microsoft stock has historically tended to trade at a significant premium to fair value, with a 5-year average forward PEG of 2.26, given the safe-haven nature of the stock. Hence realistically, the stock is unlikely to trade near a forward PEG of 1, especially considering its leadership position in the AI race now.

Microsoft is also trading at a premium to its main cloud rivals, with Amazon trading at a forward PEG of 1.95, and Google trading at 1.47. Though there are good reasons for Microsoft stock to deserve a premium valuation relative to its competitors. Microsoft Azure is proving to be better positioned than AWS and Google Cloud to capitalize on the AI revolution, which was evident in its superior growth rate last quarter, and Nexus believes Microsoft Azure’s growth rate will continue to accelerate. Furthermore, aside from the cloud segments, Microsoft’s other core segment, ‘Productivity and Business Processes’, also offers promising growth prospects through generative AI advancements, particularly amid the recent broader rollout of Copilot. Comparatively, Amazon and Google’s core segments, e-commerce and search advertising, have yet to offer a compelling growth story amid the generative AI revolution. Therefore, Microsoft deserves to trade at a premium to its two main rivals.

Now there are two main drivers of stock price performance, earnings growth and valuation multiple expansion. With the forward PEG ratio being above the 5-year average, Microsoft stock is undoubtedly richly valued, with the prospects for multiple expansion limited from here. Nonetheless, we are maintaining a “buy” rating on Microsoft stock, given the promising earnings growth prospects through Azure, and Copilot-powered productivity apps, which keeps the bull case strong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.