Summary:

- Microsoft beat consensus estimates on both revenues and margins, albeit by a lower degree than the median average. But the guidance outlook has disappointed.

- Q4 FY23’s earnings call set a bullish tone for Microsoft’s relative strength as it continued gaining share in multiple product categories.

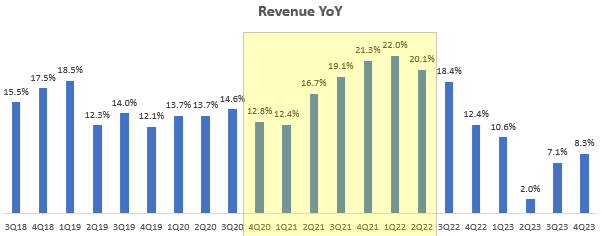

- From an absolute growth perspective, MSFT stock is facing headwinds in Azure, ad-spending, and gaming. It is not the same as the high growth times of 2020-2021.

- The stock is still trading at valuations near the 2020-2021 period. One can argue it is due to the promising AI opportunity. However, management indicated that material monetization is still a while away.

- Whilst I am a long-term Microsoft bull, I believe the valuations demand a neutral/hold stance as I anticipate the stock to perform in line with the market.

Microsoft Holds Annual Shareholder Meeting Stephen Brashear/Getty Images News

Update

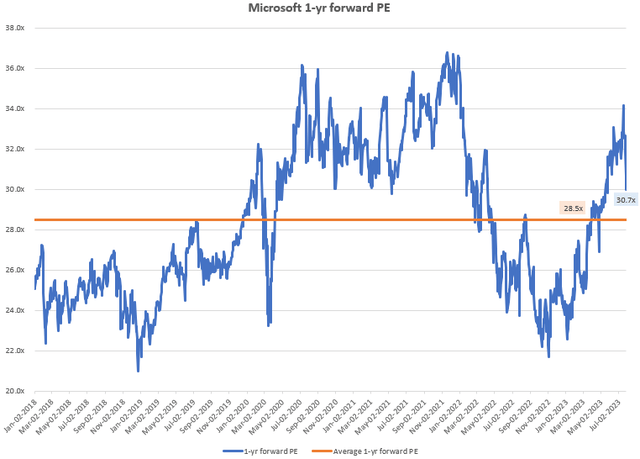

In my last article on Microsoft (NASDAQ:MSFT), I shared the long term bullish case for Microsoft as I explored the AI growth opportunity and momentum in the company. I thought the company was worth buying even at a 29.9x 1-yr fwd PE, which corresponded to a 5.4% premium to the average since 2018.

But shortly after publication of the article, I updated my view from a ‘buy’ to a ‘neutral/hold’ as I thought the stock was not as attractive from a valuations point of view. At the time of this update, the original ‘buy’ stance generated alpha of 1.20% with Microsoft gaining +1.75% vs the S&P 500 (SPY) (SPX) (VOO) gaining +0.55%.

Q4 FY23’s results continue to keep me bullish on the fundamental story. However, the valuations are even more expensive now, which is why I retain my ‘neutral/hold’ stance.

A look at results vs expectations

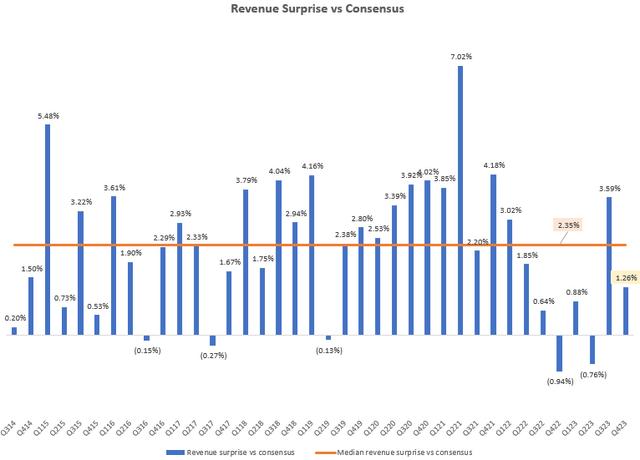

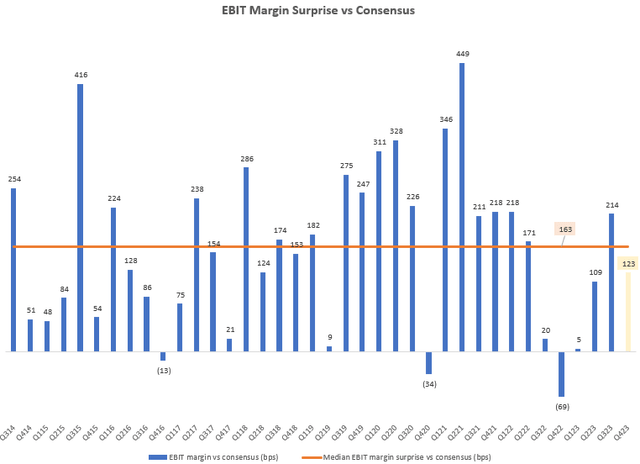

Microsoft has a strong track record of consistently beating consensus expectations. And Q4 FY23 was no different, although the extent of the beat was lower for both revenues and EBIT margins compared to the median since Q3 FY14, when Satya Nadella took over as CEO:

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis) EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

Prints below the median surprise levels for revenues could indicate a slower demand environment in some cases. Indeed, management affirmed that clients’ cloud-optimization (a euphemism for cutting of cloud spends) trends continue on:

As expected in Azure, we saw a continuation of the optimization and new workload trends from the prior quarter.- CFO Amy Hood in the Q4 FY23 earnings call

CEO Satya Nadella added that these headwinds are expected to continue on for another couple of quarters.

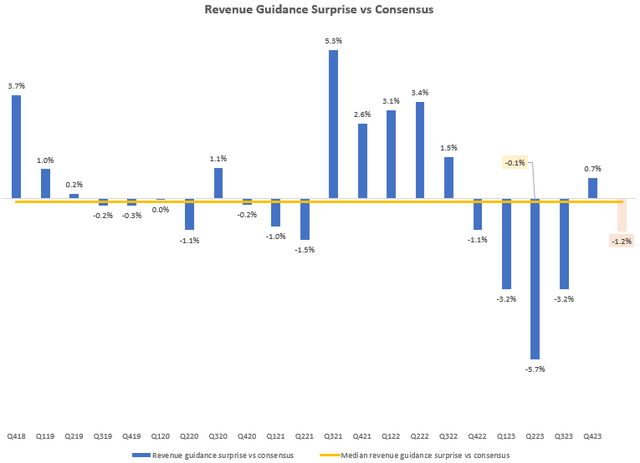

The revenue guidance for Q1 FY24 fell 1.2% short of expectations:

Revenue Guidance vs Expectations (Capital IQ, Author’s Analysis)

This is believed to be the main driver for a 5.77% correction in the stock post-earnings.

The business continues to get better

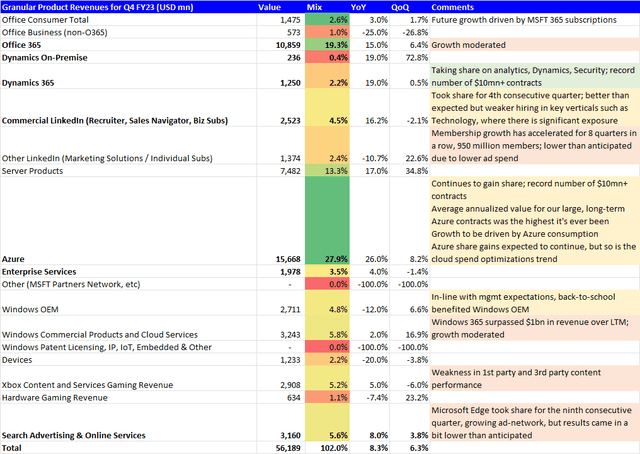

Although it is facing some headwinds in certain segments, Microsoft continues to systematically improve its market position. Here is my the summary of the key numbers and comments across different product segments:

Granular Product Revenues Read-Through for Q4 FY23 (Company Filings, Author’s Analysis)

The total adds up to 102% due to an aggregate of rounding errors. Microsoft gained share in the bolded product categories.

In the earnings call, management was very focused on sharing details about the promising AI opportunity and relative market share gains across segments. This may encourage investors to believe things are more bullish from an absolute perspective than they seem. However, I think it is important to acknowledge two nuances here to keep the bullish enthusiasm in check:

First, this quote by CFO Amy Hood in the Q4 FY23 earnings call (emphasis added):

Even with strong demand and a leadership position, growth from our AI services will be gradual as Azure AI scales and our copilots reach general availability dates. So for FY ’24, the impact will be weighted towards H2.

This is the company telling the market to calm down with the AI hype; monetization will occur, but not as soon as everyone expects.

Second, don’t ignore that absolute growth headwinds exist in the business, specifically in Azure cloud spend optimizations, lower ad-spends and weaker gaming revenue performances.

Valuations keep me on the sidelines

I am bullish on the longer-term AI potential and my belief that Microsoft is poised to be a big winner of that mega-trend. But valuations also matter:

Microsoft 1-yr fwd PE (Capital IQ, Author’s Analysis)

Currently, Microsoft trades at a 1-yr fwd PE of 30.7x, which implies a 7.7% premium to the longer term average since 2018. So the situation now is a bit more expensive than in my last update, when the premium was 5.4%. When I marry this with the fact that there is some cautiousness about near-term absolute demand momentum in Azure (the biggest revenue contributor with a 27.9% revenue mix) and later-than-expected monetization of AI services, I hesitate to declare the stock a ‘buy’.

Takeaway

I am still bullish on Microsoft long-term, but at the same time, I recognize that whilst Microsoft’s business is getting better on a relative market share basis, not all segments on all cylinders on an absolute basis as it was in 2020-2021:

YoY Revenue Growth (Company Filings, Author’s Analysis)

Yet, the valuations are at a similar range. One can argue that this is due to the promising AI growth potential. However, reset some expectations of the market when they said that AI services monetization will occur more gradually. Hence, I give Microsoft a ‘neutral/hold’ stance for now.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.