Summary:

- We remain buy-rated on Microsoft, anticipating an AI payoff in 2025.

- Our belief is that Microsoft’s next leg of material outperformance will come from its heavy AI-related investments turning into AI monetization.

- We think the company is uniquely positioned to stand on that leg next year due to its positioning with Copilot sticky integration and better Azure growth as macro headwinds ease.

- We expect Microsoft to be an outperformer for 2025.

PM Images/DigitalVision via Getty Images

We’re maintaining our buy rating on Microsoft (NASDAQ:MSFT), but updating our investment thesis. The stock fell after reporting its Q4 results, showcasing a top and bottom beat but weaker Azure growth. For the quarter, the company reported a 15% Y/Y increase in revenue to $64.73B vs. expectations of $64.39B, with the top business segment, Intelligent Cloud, generating $28.52B, up 19% Y/Y but missing expectations of $28.68B. Our belief is that Microsoft traded lower because the stock is “priced for perfection,” meaning there’s no room for soft guidance, particularly considering Microsoft’s leading position investing in OpenAI and its heavy AI-related capex spend that followed. So, it didn’t cut it when management reported revenue guidance of $63.8B to $64.8B for the next quarter vs. the consensus of $65.07B. Microsoft’s Azure revenue guidance was a pain point in particular, with management forecasting Azure revenue to grow 29% Y/Y compared to previous expectations of 30% to 31% growth and consensus expectations of 30% growth. The 29% also comes as a disappointment considering Azure plus other cloud services’ revenue growth track record for FY24 at 29% in Q1, 30% in Q2, and 31% in Q3.

It all comes back to AI monetization. Of that 29% growth, Microsoft attributed 8% to AI services; Satya Nadella noted that Microsoft’s “share gains accelerated this year driven by AI,” while Amy Hood stated that Azure AI service demand remained higher than current capacity. Hood’s commentary seems to be a confirmation of a healthy appetite for AI, but also a disclaimer to the unclear timeline for seeing AI monetization. Our belief is that Microsoft’s next leg of material outperformance will come from its AI-related investments turning into AI monetization, and we think the company is uniquely positioned to stand on that leg next year due to its positioning with Copilot with the anticipated AI PC adoption and better Azure growth.

Copilot’s Direction

Let’s break down the first point with Copilot and AI. Copilot is Microsoft’s chatbot integrated throughout its Office 365 suite of applications. Microsoft’s Windows, in which Copilot is integrated, is the dominant desktop operating system or OS in the world, with a 72% market share. This almost automatically positions Microsoft ahead in the AI PC market because it already has the killer app with the right positioning. Microsoft noted that “Copilot+ PCs are the fastest, most intelligent Windows PCs ever built. With powerful new silicon capable of an incredible 40+ TOPS (trillion operations per second),” and AI PCs are anticipated to meet that benchmark for Copilot. There’s still limited visibility on when the AI PC moment will ignite. Our outlook is that Microsoft’s Windows End of Life, or EOL, which will reach the end of support in mid-October 2025, will trigger the upgrade cycle and higher commercial adoption for Copilot.

Microsoft is also not staying static with Copilot; Microsoft’s 2024 release wave 2 is coming with the latest updates and new features to be released from October 2024 through March 2025. The new releases include AI-supported features such as prioritize an inbox for Outlook, Copilot pages, and new security features for Windows 11. Microsoft is building out its ecosystem, mainly for commercial customers, and the Microsoft 365 app will be the main entry point for accessing Copilot. We think Copilot Pages could be particularly attractive for enterprise customers. It’s a new business-oriented AI that allows for multi-player AI collaboration on the same document. The appeal is that “Copilot Pages will allow users to use the Copilot chatbot and plug its answers onto a new page, so several users can edit them simultaneously.” We expect Microsoft to better monetize Microsoft 365 Copilot, which costs around $30 per month, with new features and AI PC moments in 2025.

Big question on high AI spend

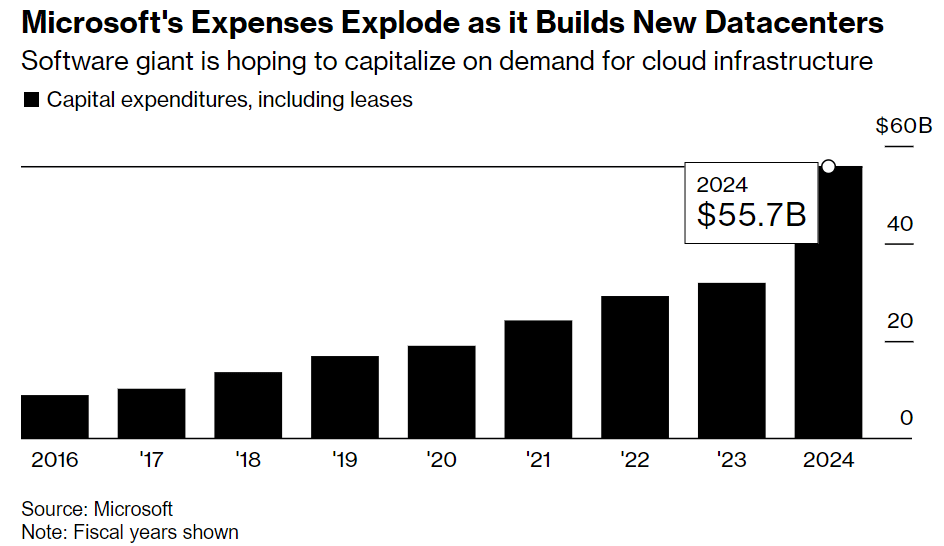

Microsoft’s capex spend has been heavily oriented toward AI infrastructure. Early this week, Microsoft and BlackRock announced they’re teaming up on “one of the largest efforts to date to bankroll the build-out of data warehouses and energy infrastructure behind the boom in artificial intelligence,” seeking “$30 billion of private equity capital over time for the strategy.” The company also has had a strong upward trend in capex spend since the AI boom, reaching a whopping $19B in Q4. The following chart outlines Microsoft’s capital expenditures each year, showcasing the significant jump in spend this year. Investors are getting more eager to “understand the timing between the capex investments and the yield on those investments,” as Keith Weiss noted in the Q&A section of the earnings call. Weiss’ question becomes all the more pressing considering management’s outlook on Azure revenue growth for the next quarter.

BloombergTech

We think concerns over the AI payoff are temporary and deem the heavy AI investments necessary for Microsoft to keep up with arguably its biggest competitor on this front, Amazon’s (AMZN) AWS. Our belief is that Microsoft is on track to show that return on investment to investors in 2025. We base this on its cloud computing position, with 85% of the Fortune 500 running on Azure, and its standing with Copilot and OpenAI, as well as management’s efforts to better its competitive position against AWS. The company announced that they will be re-organizing reporting segments for the first time for a “better apples-to-apples comparison between Azure and AWS.” The market is anticipating Azure to surpass $200B by 2028, which would estimate the Azure segment at $62B as of the end of June vs. AWS at $105B. We think the anticipated $200B is achievable if management plays their cards right, and part of that is capex spend.

AI is also increasing traction for Azure already. Microsoft’s Azure AI customers are piling in, at over 60,000, up 60% Y/Y, with a growing average spend per customer compared to customers using other platforms. Intelligent Data Platform saw a 50% Y/Y increase in use from Azure AI customers for the quarter. This goes to say we think AI efforts will also turn into better Azure revenue growth and, by extension, better top-line growth in 2025 as macro headwinds weigh less on enterprise budgets and as AI PC moment arrives.

Valuation and Word on Wall Street

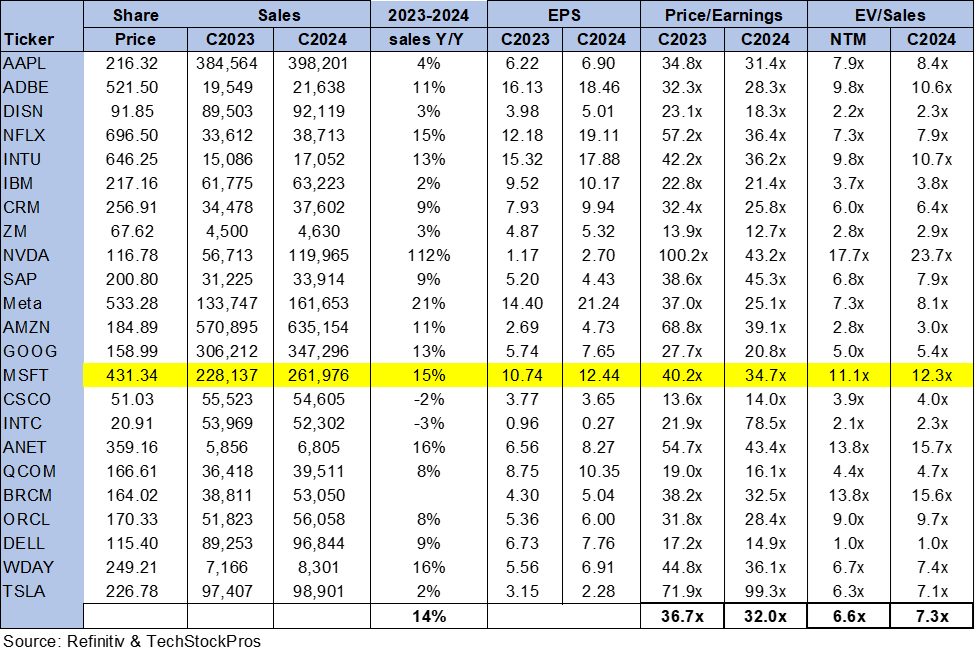

Microsoft is expensive relative to the large-cap peer group. On a P/E basis, the stock is trading at 34.7x C2024, compared to a peer group average of 32.0x and its previous ratio of 30.8 from mid-December. The stock trades at 12.3x EV/C2024 sales, much higher than the peer group average of 7.3x, and expanded from its ratio of 10.5 in mid-December, when we last wrote on the stock. The market is definitely pricing in future earnings growth based on the AI growth narrative, but we think Microsoft is one of the few names that will be able to achieve that growth.

The following outlines MSFT’s valuation against the peer group.

TechStockPros

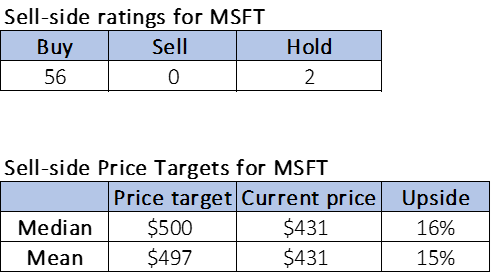

Wall Street is shifting to a more bullish sentiment on Microsoft. Of the 58 analysts covering the stock, 56 are buy rated, and two are hold rated. The stock’s current price hovers around $431 per share. The median sell-side price target is $500, and the mean is $497. Granted, Microsoft trades at premium multiples that’ve expanded over the past nine months, but the company’s price targets and upside potential have also expanded relative to this, to a potential 15%-16% upside from a potential 9%-12% upside at a stock price of $372. The following outlines Wall Street’s sentiment on the stock.

TechStockPros

What to do with the stock?

Microsoft validates investor confidence in the stock with the newly announced $60B stock-buyback program. We continue to expect Microsoft to be an outperformer for 2025. In our opinion, we still haven’t hit the ah-ha moment in terms of Copilot monetization. However, we’re seeing green shoots there, with management noting, “The number of people who use Copilot daily at work nearly doubled quarter-over-quarter” in the fourth quarter of FY24. We think Microsoft’s position and heavy AI-oriented spend will put the company under investor scrutiny to see a return on AI but will also better position the company for outperformance in a healthier interest rate environment in 2025, which should boost Copilot adoption and reaccelerate Azure growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.