Summary:

- Despite a recent dip in the stock price, Microsoft Corporation continues to be a BUY based on a strong history of delivering alpha, paired with an updated 5-year target price.

- The Nasdaq is currently in an 8.2% correction, with the chip sector down 19.4% and Nvidia down 26.3%.

- Microsoft beat earnings estimates but had soft cloud business guidance, resulting in a stock price dip.

- Microsoft’s past performance has consistently beaten the S&P 500, with a 5-year target price of $771 per share, showing 84% upside potential.

jetcityimage

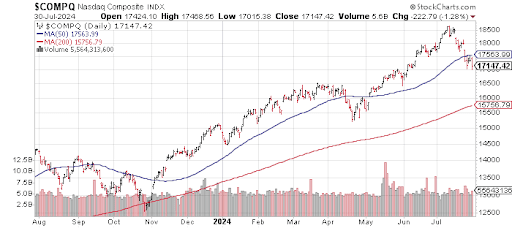

The market, especially the chip and AI sectors, have been anxiously awaiting earnings reports from some leading tech stocks. The Nasdaq is currently in the midst of an 8.2% correction since its all-time high set just a mere three weeks ago on July 10.

Stockcharts.com

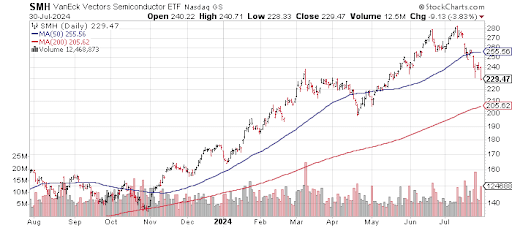

During that time, the chip sector, as measured by the VanEck Semiconductor ETF (SMH), has been hit even harder with a correction of 19.4%.

Stockcharts.com

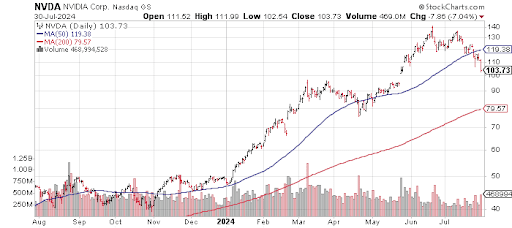

Additionally, one of the main leading stocks in the market, Nvidia Corporation (NVDA) stock is down by a whopping 26.3% during that same time.

Stockcharts.com

Have the fundamentals of the tech stocks-and more importantly, the chip stocks-changed drastically? Or is this just a routine round of profit-taking following a torrid run of these stocks during the first half of 2024? I anticipate we will learn much more about the current state of the core tech stocks as we see more earnings reports this week.

Microsoft Corporation (NASDAQ:MSFT) was the second notable tech stock, after Alphabet (GOOG) (GOOGL), to report earnings during this Q2 2024 earnings season. Alphabet’s earnings last week were sub-par and did not help the current correction in the Nasdaq.

Microsoft’s earnings beat its top and bottom-line estimates, but its guidance on cloud business came in a little soft, resulting in a dip in the stock price. As of Tuesday, July 30, The stock was down over 7% at the beginning of the after hours session, but recovered a fair amount during the nighttime session, but was still down 3% with about 2 hours before the market opened.

Just after market close on Tuesday, July 30, Microsoft reported earnings that beat by $0.02 and sales that beat by $260 million. Overall, revenue grew by 15% versus the same quarter last year and earnings grew by 10%, which are still impressive growth numbers for a $3.14 trillion behemoth. Microsoft remains a Best Stock Now as opposed to the stodgy old-growth giants of yesteryear like IBM, Intel (INTC), and AT&T (T), to name a few.

Current Analysis of Microsoft

Let’s begin our current analysis of Microsoft by looking at their past performance. If you are seeking alpha, past performance is a good place to start. If the company has a history of delivering alpha, it is more likely to continue on the path.

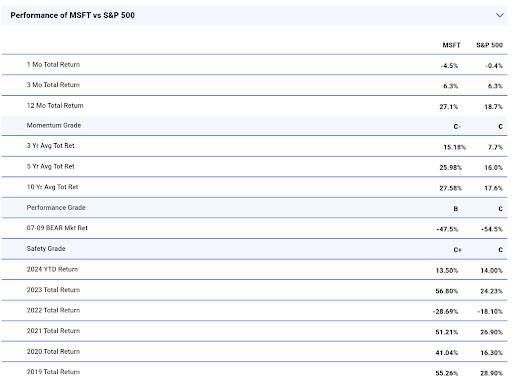

Here is the performance of Microsoft versus the S&P 500 over the short term (one year or less), intermediate (3-5 years), and long term (5-10 years).

Best Stocks Now App

As illustrated by the graphic above, the company has handily beaten the S&P 500 over the last 1, 3, 5, and 10 years. It has demonstrated its ability to steadily deliver alpha over the years, and earning it a high ranking among the 5,340 stocks in my database.

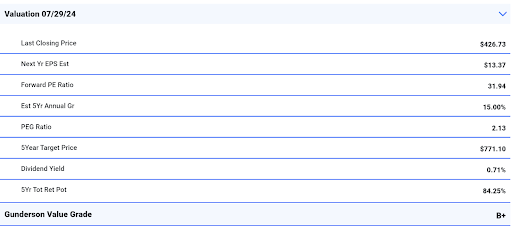

Now the question is, can they continue to deliver alpha going forward? Let’s look at a 5-year valuation for some guidance on finding an answer to that question.

Best Stocks Now App

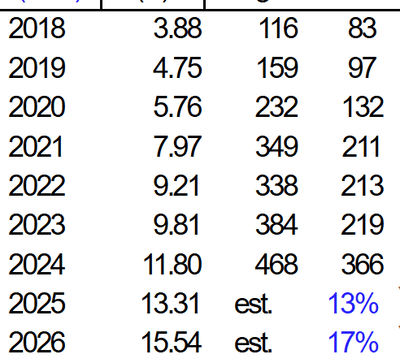

I begin with this year’s EPS estimate of $13.31 per share and next year’s estimate of $15.54 per share.

MarketSmith & FactSet Research

Notice how the company has consistently grown its earnings over the last five years. Also notice how the stock price follows those earnings. An elementary rule to learn in the market is that stocks and indexes follow earnings.

The consensus on the street, according to FactSet Research, is for Microsoft to continue to grow its earnings by an average of 16% per year over the next five years. I am at 15% per year.

Using those assumptions and applying an appropriate multiple for the stock, which I’ve determined to be 33X, this yields a 5-year target price of $771 per share. This gives the stocks just over 84% upside potential over the next 5 years. Which is still satisfactory and meets my criteria of 75% or more upside potential while also giving a good risk to reward ratio and decent margin for error.

In my Best Stocks Now strategy of stock selection, I consider both past performance and valuation. This looks both backwards and forwards. Using my proprietary formula, Microsoft still meets my strict criteria. We continue to own the stock in both our Premier Growth and Dividend & Growth Portfolios. These are two of the five portfolios that I offer in my premium service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 24 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, Dividend & Growth, and Best Bonds Now. These portfolios have done very well since their 1/1/2019 inception.

Both our Premier and Ultra-Growth Portfolio were up over 30% in 2023.

JOIN NOW to get daily “live” buys and sells, and weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on almost 6,000 securities, a daily chat room (mon-fri), and a daily live radio show (mon-fri.)!