Summary:

- Microsoft could be nearing its biggest deal ever.

- A ramped-up investment in ChatGPT-creator OpenAI could result in a massive windfall.

- A ChatGPT-focused subscription business could lead to billions in annual income for Microsoft.

Jean-Luc Ichard

Microsoft (NASDAQ:MSFT) has a lot going for itself: the software company still dominates the software market and the Azure Cloud business is consistently gaining momentum, resulting in a level of free cash flow that is making Microsoft one of the most profitable companies in the world. While the company invests a lot of money into its office suite, hardware products and Cloud business, Microsoft’s $1B investment in OpenAI in 2019, now renowned for its viral artificial intelligence chatbot ChatGPT could result in a massive windfall in the future and give Microsoft an edge in the search market as well!

Microsoft is apparently negotiating a $10B investment in ChatGPT-creator OpenAI

In my past work, I highlighted two main reasons to buy shares of Microsoft: (1) The technology company offered investors a high degree of recession protection due to the fact that it is expanding its Cloud business rapidly and (2) Microsoft is earning a serious amount of free cash flow each quarter which provides down-side protection for the stock as well. In the third-quarter, as an example, Microsoft generated $16.9B in free cash flow which translated to an impressive free cash flow margin of 33.7%. Microsoft’s recession-resistant free cash flow is a very strong reason to buy the software company’s shares.

But with the recent hype about artificial intelligence-supported chatbot ChatGPT, investors have one more reason to buy shares of Microsoft. ChatGPT has made major waves in recent weeks due to the impressive results achieved handling complex search queries.

ChatGPT is owned by OpenAI, an AI-focused start-up founded by Elon Musk and Sam Altman that started as a non-profit in 2015. Microsoft made an investment in the company in 2019, investing $1B into OpenAI… which could lead to windfall profits in the future if AI technology is deployed at scale — for example through a subscription-based model that monetizes ChatGPT’s AI potential — and to a potentially larger deal between Microsoft and OpenAI.

Due to the extraordinary success of the public-beta version of ChatGPT, there is the possibility of a much larger deal for Microsoft. According to Semafor, Microsoft is in talks to invest $10B into OpenAI and the software company may get a 75% profit share until Microsoft recoups its investment. Once Microsoft makes back its money, the company would assume a 49% ownership stake in OpenAI… a company that could be worth much more than the $10B Microsoft is willing to invest.

From a financial point of view, Microsoft can easily afford to raise its stake in OpenAI. Microsoft had $22.9B of cash on its balance sheet as of September 30, 2022 so the technology company could increase its stake in OpenAI ten-fold without even blinking an eye.

ChatGPT could be a game-changer for Microsoft’s Search business

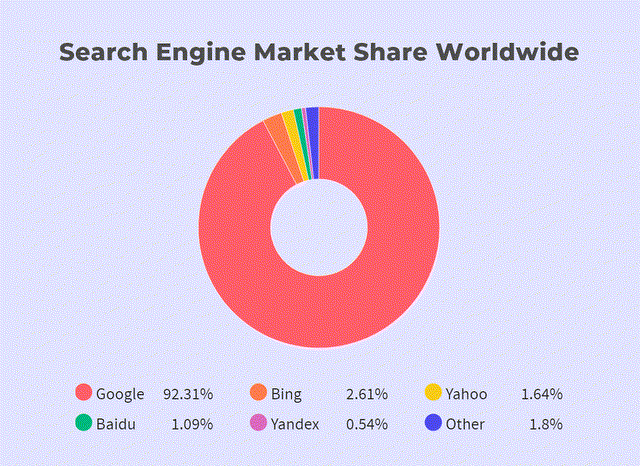

But the benefits for Microsoft regarding an increased investment in OpenAI could be much more significant in the longer term. ChatGPT could drive market share gains for Microsoft’s Search engine which is notoriously behind Google (GOOG). Alphabet-owned Google has a dominant market share in online Search (above 90%) and Microsoft’s Bing captures less than 3% of the Search market. The threat the AI bot poses to Google’s dominant market position was acknowledged by Google itself.

ChatGPT could change the game for Microsoft in the Search business by delivering better and more tailored results for users while driving engagement… which could result in a higher market share for Microsoft’s Search engine and better monetization results for advertisers. I believe Microsoft also has the opportunity longer term to leverage its AI capabilities by building a subscription model around ChatGPT.

The current ChatGPT version is free for the public, but users would likely be willing to pay for a subscription in order to harness the AI bot’s potential. ChatGPT could be used by (and ultimately substitute) software programmers, researchers, journalists, teachers, copyeditors and all kinds of writers. If ChatGPT proves to be the future of artificial intelligence, there could be millions of potential users that pay for a monthly ChatGPT subscription. ChatGPT is in such high demand that the website keeps crashing which indicates enormous monetization potential for any company that can get its hands on the technology.

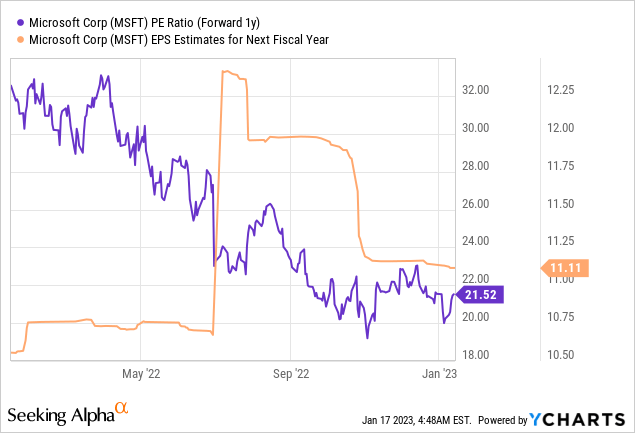

Microsoft is valued cheaply given its free cash flow prowess

Shares of Microsoft are valued at a forward P/E ratio of 21.5 X despite generating free cash flow margins above 30% and owning one of the most promising Cloud businesses (Azure) in the industry. Microsoft is expected to grow its earnings 16.4% in FY 2024 and the company is likely to continue to see continual momentum in its Cloud segment. Despite the recent buzz around ChatGPT and talk about a higher investment in OpenAI on the part of Microsoft, shares of the software company have hardly moved in recent weeks.

Risks with Microsoft

The PC market is slowing down rapidly and lower device shipments are set to impact Microsoft’s Personal Computing segment in a negative way. A weaker USD also poses a challenge since Microsoft achieves a significant portion of its sales — about 48 % in Q3’22 — outside of the US. Moderating Azure segment top line growth due to weakening adoption of Cloud solutions by the corporate sector is also a possible risk factor for investors.

A risk with Microsoft’s ramped-up OpenAI investment is that it fails to meet high expectations and that it does not deliver a monetizable product. In the worst case, Microsoft would have to write off its entire investment, but given Microsoft’s strong balance sheet and free cash flow, I don’t see this is a big risk for the software company.

Final thoughts

The investment in and success of ChatGPT is a homerun for Microsoft and it is potentially a much bigger deal than investors may realize. The company already had the foresight to make a relatively small $1B investment in OpenAI in 2019, but a $10B investment would really make this a big bet on the ascendancy of artificial intelligence. A ramped up investment in OpenAI may also boost Microsoft’s competitiveness in the Search market… which is where Bing is trailing hopelessly behind Google. Microsoft’s investment in OpenAI could be worth billions more than what the company is investing and a creation of a subscription-based monetization model may add billions a year to Microsoft’s bottom line!

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.