Summary:

- Microsoft delivered strong Q1 FY2025 results, exceeding expectations on both revenue and earnings.

- Commercial momentum remains solid, driven by robust demand for cloud and AI services and a disciplined approach to spending, which supports profitability.

- However, heading into Q2 FY2025, Microsoft faces temporary capacity constraints in its cloud operations and profit headwinds due to costs associated with AI-related investments, including OpenAI.

- Until capacity constraints stabilize, and Microsoft’s momentum re-accelerates, I expect investor sentiment to be choppy.

- Based on my updated residual earnings model, I estimate Microsoft’s fair value at approximately $355 per share, and I maintain a “Hold” rating.

jewhyte

Microsoft (NASDAQ:MSFT) reported strong Q1 FY2025 results, beating expectations on revenue and earnings. In summary, Microsoft’s commercial momentum is underpinned by strong demand across cloud and AI services, coupled with disciplined spending to enhance Microsoft’s profitability. Unfortunately, however, going into Q2 FY2025, Microsoft faces temporary capacity limitations in cloud and profit headwinds from financial impacts from AI-related investments (e.g., OpenAI). With that said, Microsoft is poised to see a re-acceleration in Azure’s growth only in the second half of FY25, as new capacity becomes available. However, until this happens, I expect investor sentiment to be choppy. Based on my updated residual earnings model, I now estimate that Microsoft stock should be valued at about $355 per share. I maintain a “Hold” rating.

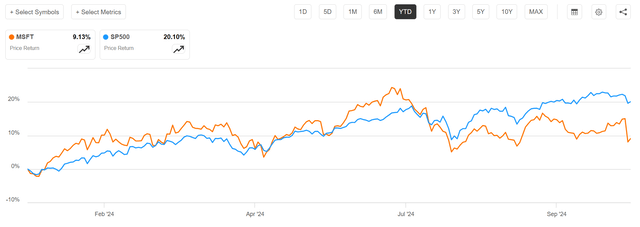

For context on share price momentum, Microsoft stock has underperformed the broader market this year: YTD, MSFT shares have risen about 9%, compared to a roughly 20% gain for the S&P 500.

Microsoft Reports A Solid Start Into FY 2025

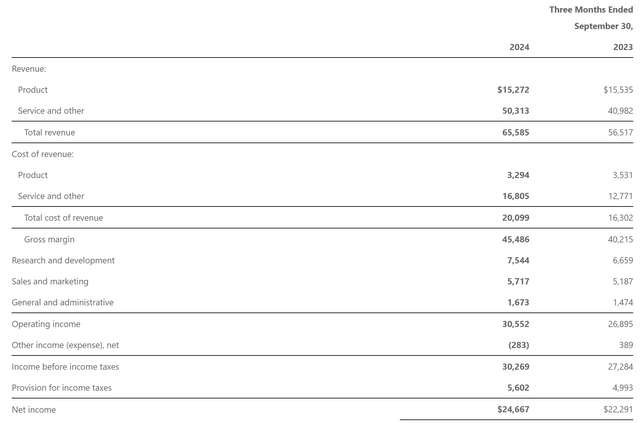

Microsoft’s reported a solid first quarter of 2025 (F1Q25) with results exceeding expectations on multiple fronts: During the period spanning from July through end of September, Microsoft generated $65.6 billion of revenues, up 16% YoY. Analyst consensus has expected revenues to be about $1 billion lower (1.5% beat). The strong topline performance was fueled by solid execution in its commercial segments, particularly within the company’s in cloud and productivity solutions. Indeed, a significant indicator of underlying demand strength was commercial bookings growth, which rose 23% YoY in constant currency. This acceleration—up from 19% in the previous quarter—was driven by large, long-term contracts, particularly within Azure, where Microsoft secured an increasing number of $100 million-plus deals.

Azure’s performance is increasingly becoming the key anchor of Microsoft’s growth story, as enterprises worldwide continue migrating to the cloud and adopting AI-driven capabilities. Azure’s 34% YoY growth in the first quarter, which slightly outpaced the company’s guidance, was underpinned by high demand for AI services. According to management commentary, AI contributed 12 percentage points to Azure’s growth rate this quarter. On that note, products like Azure AI and Microsoft’s Copilot (an AI-powered assistant within its Office suite) are driving demand, with AI revenue projected to exceed a $10 billion run rate by next quarter.

Interestingly, and also somewhat unfortunately, the high demand for Azure has outpaced Microsoft’s capacity, prompting supply constraints. For the upcoming fiscal second quarter (F2Q25), Azure growth guidance is set between 31-32% YoY, which would imply a slowdown vs. the past quarter. The company cited delays in expanding its data center capacity, pushing some growth potential into the latter half of FY25. Microsoft is actively working on expanding capacity, with a considerable portion of its $82 billion CapEx budget allocated to cloud infrastructure, setting up Azure for a stronger back half of the year.

Microsoft’s financial performance also reflects a disciplined approach to managing profitability, even as it scales AI investments. Indeed, Microsoft’s investments in AI and cloud are carefully structured to align with revenue-generating opportunities. For instance, the company’s CapEx is guided by expected returns from monetization, avoiding an “arms race” in large language model development. In other words, Microsoft aims to ensure that AI investment is directly tied to incremental revenue, rather than an open-ended expense.

Gross margins exceeded expectations in F1Q25, thanks in part to better-than-expected Azure margins. Operating margins, came in at 46.6%, 140 basis points above consensus, largely due to operating leverage. Operating profits were reported at $30.6 billion, up a robust 14% from the $26.9 billion in the same period one year prior.

Navigating Short-Term Hurdles…

Despite solid commercial momentum carrying into the next quarter, Microsoft faces some near-term challenges. F2Q25 revenue and EPS guidance came in slightly below expectations, which will likely pressure investor sentiment over the next few months. The somewhat disappointing guidance was primarily due to lower projections in consumer-driven segments such as gaming and devices, areas peripheral to Microsoft’s commercial thesis but impacting the overall earnings outlook. Additionally, Azure’s capacity constraints mean growth will temporarily decelerate before rebounding in the latter half of FY25, as discussed in the previous section of this article.

Some aspects of the guidance are also slightly more difficult to unpack: For instance, another noteworthy factor impacting Microsoft’s near-term financials is its stake in OpenAI. Losses related to this investment, stemming from equity method accounting, are expected to reduce EPS over FY25 and FY26. Microsoft recorded a $683 million loss in the first quarter and anticipates a $1.5 billion impact in F2Q25 due to OpenAI’s growing expenses. Although this investment is central to Microsoft’s AI leadership strategy, it represents a drag on profitability that will persist until FY26 when these losses are expected to stabilize.

… To Strengthen Long-Term Prospects

I am bullish, however, that Microsoft’s emphasis on AI with related investments will eventually pay off. Conversations I had with COOs of smaller and mid-sized companies suggest that the integration of AI into Azure and M365 (Microsoft’s Office suite) is accelerating, as Microsoft aims to automate more of enterprises’ operational tasks. This may eventually build into a vast revenue stream with high gross margins.

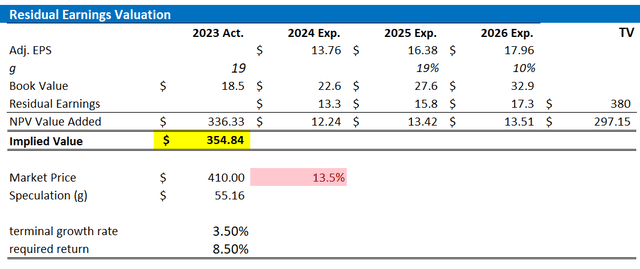

Valuation Update: Target Price At $355

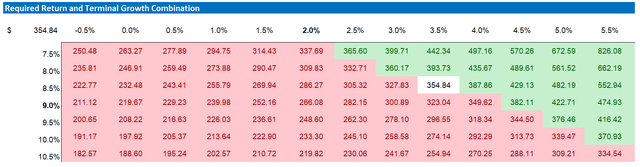

Building on Microsoft’s FY 2025 Q1 earnings report, which slightly exceeded expectations, I’ve revised my earnings outlook for Microsoft through calendar year 2026. I now project EPS of approximately $13.8 for CY 2024, $16.4 for 2025, and $18 for 2026, which reflects a plus 10% delta compared to my estimates from August this year. At the same time, however, I maintain a 3.5% terminal growth rate beyond 2026, as well as an 8.5% cost of equity assumption. With these updated EPS estimates, I now calculate a fair implied share price for Microsoft at $355. This suggests the stock may be overvalued relative to my base-case scenario, though investors should keep in mind the sensitivity of this valuation to cost of equity and terminal growth rate assumptions (see details below).

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Here also the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Investor Takeaway

Microsoft delivered strong Q1 FY2025 results, exceeding expectations on both revenue and earnings. The company’s commercial momentum remains solid, driven by robust demand for cloud and AI services and a disciplined approach to spending, which supports profitability. However, as it heads into Q2 FY2025, Microsoft faces temporary capacity constraints in its cloud operations and profit headwinds due to costs associated with AI-related investments, including OpenAI. That said, Azure growth is expected to pick up again in the second half of FY25 as additional capacity comes online. Based on my updated residual earnings model, I estimate Microsoft’s fair value at approximately $355 per share, and I maintain a “Hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.