Summary:

- Microsoft delivered impressive growth during Q1 earnings, starting 2024 off strong.

- The Activision acquisition is expected to be immediately accretive to the company, and is expected to deliver positive growth to the devices segment which was down the last two quarters.

- The stock is up more than 200% and as the company continues to repurchase shares, this may entice MSFT to conduct a stock-split in the foreseeable future.

- Although the stock is up nearly 36% in the last year, it still offers a double-digit upside to its price target.

Jean-Luc Ichard

Introduction

There are some stocks you can hold onto through any situation. Whether it be a recession, inflation, pandemic, or just sour sentiment in the overall market. One that everyone knows and fits the bill is Microsoft (NASDAQ:MSFT). Ask my girlfriend about MSFT, she swears by it. The company only started paying a dividend 20 years ago but has been around for almost four decades. And while many dividend stocks have been hammered over the last year, MSFT has kept on climbing, up nearly 34%, and 17% in the last 6 months. Because of this, it may entice MSFT to split the stock as it has done many times in the past. Many are expecting a recession in the coming months and this stock is the perfect addition if one comes to fruition. It is the perfect blend of dividend growth and capital appreciation, and every investor should consider holding MSFT.

Why Microsoft Is The Perfect Stock

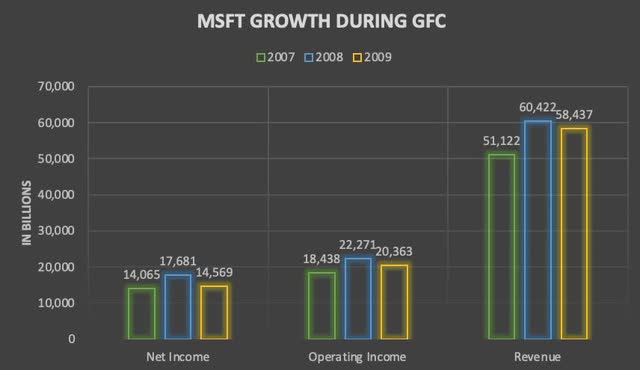

Looking at a company’s financial metrics during the GFC tells you a lot about the business. While many businesses struggled, cut the dividend, and experienced steep price declines, MSFT continued to post growth with the exception of 2009. To me this is very important because the GFC was not a garden recession, or mild one like the one expected in 2024.

And although MSFT did experience a drop in price, the company continued to show resiliency during the 18 months. Their price declined by nearly 38% but they managed to post double-digit growth in revenue, operating & net income from 2007 to 2008. Revenue grew 18% from $51.1 billion to $60.4 billion. Net & operating income grew 21.6% and 25.13% respectively over the same time period. However, MSFT did experience a decline across all three in 2009, the year the recession was declared over.

Despite the drop in ’09, the company got right back to its growth phase growing revenue to $62.4 billion and net & operating income to more than $24 billion and $18.7 billion in 2010.

So, if the economy does slip into a recession, I expect MSFT to navigate the rough seas. Furthermore, they continue to invest back into themselves to grow the business with the recent acquisition of Activision, which was approved earlier this month. Management projects it to be immediately accretive to the gaming segment with Xbox content & services revenue expected to grow in the mid-to-high-50’s.

They also plan to invest $3.16 billion into Australia, making it the company’s largest investment in history in the country. This investment is expected to expand MSFT’s focus on A.I., cloud computing, and cybersecurity. And as AI becomes a focus for several businesses, I expect MSFT to be at the forefront of it. One reason for MSFT’s investment into Australia is they have less laws on rules & regulations in regards to A.I. In Q1 MSFT, reported it had introduced AI-driven features across all businesses. Additionally, the company signed a reported deal with Amazon (AMZN) worth $1 billion for its cloud productivity tools earlier this month. It is expected AMZN will par up to $1 billion over a 5-year span.

Dividend Track Record

Although the company’s track record isn’t as long as others like Coca-Cola (KO) or PepsiCo (PEP), they have a respectable record of 17 years of uninterrupted dividends, and 13 years of growth. Like I mentioned earlier, MSFT offers not only dividend growth, but capital appreciation as well, making it the perfect stock for any situation, good or bad. Since 2003 they have raised the dividend from $0.08 to the current $0.75, most recently raising it by 10% last month.

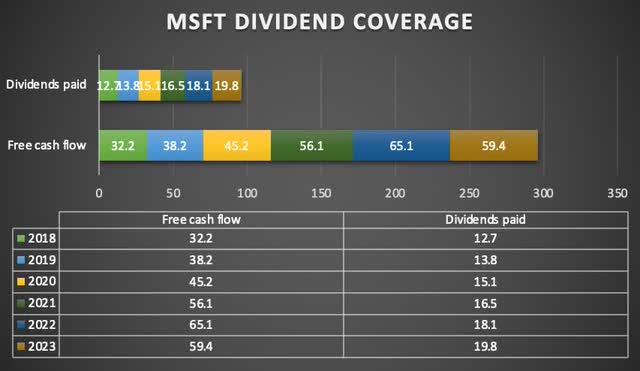

And although CAPEX has increase since last year with recent investments into AI, this is well covered by free cash flow. With large, well-known companies like Apple (AAPL), Disney (DIS), AMZN, & Alphabet (GOOG), investors are quick to invest without looking into the financials. This can cause some to get burned. And even with a company with a trillion-dollar market cap like MSFT, they aren’t spared from financial risks.

But MSFT has more than covered the dividend over the last few years and I expect them to continue for many years to come. Since 2018 MSFT had more than double the amount in free cash flow in comparison to dividends paid. Giving them a very conservative, average payout ratio of 33% over a six-year period. In Q1, MSFT’s FCF was up 22% year-over-year at $20.7 billion. That’s enough cash flow in a single quarter to cover the entire annual dividend amount!

Stock Split Coming Soon?

As previously mentioned, MSFT’s price has continued to climb over the last year. Even in the last 5 years the stock is up over 200%. For those who may not know, MSFT has a pretty rich history of splitting its stock. MSFT split the stock several times throughout the 1990’s and did their last, a 2-for-1 split almost 21 years ago. I don’t see this coming in the immediate near term as the company has to let the Activision acquisition work into the business and become accretive. With a current price of $333 at the time of writing, a stock split could entice more investors to buy the company. Both mega cap companies Alphabet and Amazon both conducted stock splits in the last year to entice a broader spectrum of investors.

I personally think once the environment stabilizes and market sentiment turns positive, this will push the stock even higher which could cause management to split the stock again. Since going public MSFT has conducted a total of 9 stock splits, primarily in the 1990’s. At the time of the last split, MSFT was trading at a price of $48.30, and after traded at a price of $24.96. In 2003, management stated they wanted to make the company more accessible to a broader range of investors, so one could be in the foreseeable future for the same reason. Additionally, they have been buying back shares over the past decade decreasing the share count on its balance sheet, putting themselves in a perfect position for a future stock split. And if that happens I will definitely be adding MSFT to my portfolio.

Strong Start To 2024

Microsoft reported Q1 earnings end of day on October 24th and experienced a pop in price due to the beat on the top & bottom line. They reported growth across all segments, with the exception of devices revenue which declined 22%. This was also down in Q4 by 20%. As Activision becomes accretive, I expect this segment to show positive numbers going forward. Another segment that was down in Q4 was Windows OEM revenue by 12% but this increased by 5% in Q1 with OEM revenue growth of 4%.

The top line beat analysts’ estimates by $1.95 billion at $56.5 billion, up $0.3 billion from Q4, and 25% year-over-year. while EPS beat by $0.34, coming in at nearly $3 ($2.99). This was up from $2.69 quarter-over-quarter and $2.35 a year ago. Net & operating income were also up 27% and 25% respectively. Most of this was driven by increases in Azure, Dynamics 365, and Microsoft Cloud services. Additionally, Microsoft 365 consumers grew by 14% from 67 million to 76.7 million. And the company expects to continue delivering healthy growth due to their commitment to lead the A.I. wave.

Valuation

MSFT’s dividend yield is slightly lower than its 5-year average of roughly 1% indicating it could be overvalued. In comparison to the average P/E of its two largest peers Oracle (ORCL) & ServiceNow, Inc. (NOW) at more than 54x, MSFT is attractively valued in my opinion. As previously mentioned, the stock is up almost 36% in the last year and one reason for this is economic uncertainty. As investor sentiment sours as recession fears grow, along with the FED conducting the fastest rate hike in history, stocks like MSFT & AAPL tend to become overvalued.

Risks

One risk the company faces is growing competition from peers like GOOG, AMZN, and APPL. As several businesses invest in the A.I. wave, this could affect MSFT going forward. Another risk is they could face a drop in FCF as CAPEX picks up with future investments in the A.I. space, but I don’t see this as a huge problem for MSFT as they have ample cash on the balance sheet to cover the dividend if that happens. If the economy falls into a harder-than-expected recession, this may impact finances going forward as interest expenses grow larger due to higher rates. The biggest risk in my opinion are class action lawsuits. Companies as large as MSFT and some of its peers are often hit with these and as they continue to implement AI into their business models. Additionally, Australia may implement stricter laws regarding A.I. in the future which could impact the company’s recent investment in the country.

Investor Takeaway

In short, MSFT is a globally recognized company that continues to find innovative ways to grow the business. Because of their resilience, this has caused the share price to increase double-digits even in the midst of its low-yield. MSFT’s current P/E and dividend yield indicates the stock may be overvalued but it still offers double-digit upside to its price target of almost $400. Additionally, as the company continues to repurchase shares they may conduct a stock split in the foreseeable future similar to AMZN & GOOG, making the stock more attractive to investors. Furthermore, investors with a long-term outlook should consider MSFT for its dividend growth and capital appreciation. Along with their conservative payout ratio and recession-resistant business model, I rate MSFT a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.