Summary:

- Microsoft has strong fundamentals and good growth prospects, driven by Cloud and AI.

- While its recent operating momentum has decelerated, this is mainly related to cyclical issues.

- It’s in a good position to benefit from AI across its product portfolio, being a strong reason for a higher valuation in the future.

Jean-Luc Ichard

Microsoft (NASDAQ:MSFT) has reported a growth slowdown recently, but over the long term, its growth prospects remain good, of which Cloud and AI are key. Its current valuation is attractive and a multiple expansion may be possible, driven by Microsoft’s AI integration across its products and services.

Business Overview

Microsoft is one of the world’s largest companies measured by its market value of over $2 trillion, a large size that is supported by its leadership position in the technology sector that is hard to challenge. Its business is well spread across several technologies, offering its products and services to individuals, enterprises, and governments, across the globe.

Throughout its history, the company has evolved from being a software company to a business mix offering a much wider range of services and applications. For example, Microsoft nowadays also offers hardware, such as tablets or entertainment consoles (Xbox), plus its cloud business is also another important business segment.

This means that Microsoft is exposed to several growth trends, including commercial IT spending, video games, remote working, and more recently Artificial Intelligence (AI). While the company has been exposed to AI for some time, this has been more in the spotlight recently, due to ChatGPT’s rapid success and Microsoft’s sizable investment in OpenAI. While the monetization of this investment may take some time to happen, this opens a new potential growth source over the long term, being therefore positive for Microsoft’s investment case.

Cloud and Artificial Intelligence

Microsoft’s business profile has changed considerably in recent years, and one segment that has increased in a significant way its weight on the overall group has been the cloud segment. This trend was supported by the continuous growth of the digital economy, a secular growth trend that Microsoft is set to benefit from, as the company offers several technologies and applications that enable individuals, corporations, and governments to operate in the digital space.

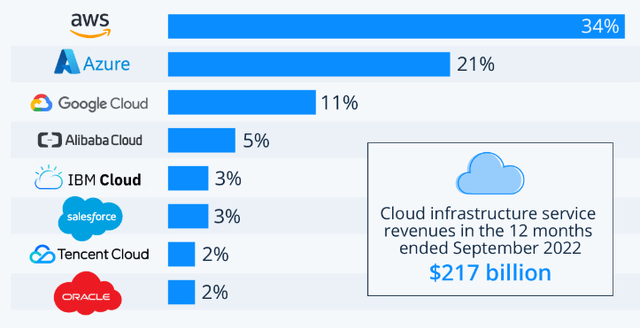

The move of datasets to the cloud has also been a major growth trend over the past few years, which bodes quite well for Microsoft’s growth as the company is the second-largest cloud infrastructure provider, after Amazon (AMZN). As shown in the next graph, Microsoft Azure has a global market share of about 21%, within an industry that is currently generating an annual revenue of about $217 billion according to Statista.

While the cloud industry is already quite large, its growth prospects are very good over the next decade, given that it’s projected to grow at a compounded annual growth rate of about 14% from 2023 to 2030. This means that Microsoft’s Azure revenue pool is very likely to maintain a positive growth trend over the coming years, even assuming that its market share remains relatively unchanged in the near future.

Indeed, the cloud industry is quite concentrated, given that the top three players hold a combined market share of about 66%, being a competitive advantage over smaller players. Moreover, the three top companies are among the largest companies in the world and have enormous financial resources, enabling them to invest considerably in infrastructure and new technologies, making their leadership position very hard to challenge.

This also explains why Microsoft continues to invest meaningfully in data centers and other infrastructure and technologies, justifying relatively high research & development (R&D) and capital expenditures. In its last fiscal year, Microsoft’s R&D expenses amounted to $24.5 billion, representing some 12% of its total revenue, while its capex was close to $24 billion.

This clearly shows that Microsoft’s investments are huge and this financial firepower is a great competitive advantage for the company to maintain a leadership position in the technology industry, including cloud and other segments. This also represents to a large extent a barrier to entry, as other companies don’t have the same financial resources to invest like Microsoft does, which means Microsoft’s position in the technology industry should not be at risk for the foreseeable future.

In addition to its already strong position across the technology industry, Microsoft is also well positioned to benefit from the rise of AI, both through its own initiatives and acquisitions performed recently. Approximately a year ago, Microsoft closed on the acquisition of Nuance Communications, a cloud and AI software provider with healthcare and enterprise AI experience, further enhancing Microsoft’s position in the field.

Beyond that, while AI applications have been around for a long time, since ChatGPT’s launch back in November, investors have been quite excited about it, as it showed how AI has evolved into mainstream applications that can be used by millions, or potentially billions, of people worldwide.

Microsoft was quick to recognize its potential and announced a $10 billion investment over several years in OpenAI, the creator of ChatGPT and DALL-E. Microsoft’s goal was to integrate its AI capabilities within its own product suite, something it has already done into its Bing search engine, Azure, and office tools.

While it’s difficult to quantify how much revenue and earnings Microsoft will be able to gain from this integration, Microsoft’s strategy is to use AI as a competitive advantage over its peers, which can potentially make it the largest tech company over the next few years. For instance, while Alphabet’s (GOOGL) Google search engine continues to be the most used nowadays, by leveraging AI Microsoft can gradually gain market share over its competitor, and increase its revenues coming from advertising.

In the cloud segment, AI can also be a game changer for the company to win market share, as Amazon is the market leader but Microsoft is growing more rapidly and this trend can accelerate in the coming quarters, as Microsoft has integrated ChatGPT in Azure to further differentiate its cloud offering to competitors.

Financial Overview & Valuation

Regarding its financial performance, Microsoft has a strong growth history and its business has an outstanding cash generation capacity. Indeed, over the past six fiscal years (ends in June) its revenues increased at an annual growth rate of about 14%, which is quite good for a company of a large size like Microsoft.

More recently, Microsoft’s operating momentum remained quite strong, as the company was able to report record revenue in FY 2022, reaching more than $198 billion and representing an increase of 18% YoY. This growth was supported across its business, even though Intelligent Cloud was the segment reporting higher growth, with revenue increasing 25% YoY to $75 billion. This means that Cloud represented close to 38% of total revenue during the last fiscal year, showing that Microsoft is increasingly more exposed to Cloud and this trend is not expected to change in the next few years.

Its gross margin amounted to $135.6 billion, up by 17% YoY, and due to good cost control, the company’s operating income increased by 19% YoY, to $83.4 billion. The bottom line was $72.7 billion (+19% YoY), and its EPS was $9.65 (+20% YoY).

Beyond very good levels of profitability, Microsoft’s cash generation was also quite strong given that its operating cash flow was $89 billion in FY 2022, which was more than enough to finance its capex. Together with a strong balance sheet, Microsoft’s strong financial position is clearly a key support for the company to sustainably return excess capital to shareholders.

During the last FY, its capital return strategy didn’t change much, as the company both distributed dividends and performed share repurchases.

Its current quarterly dividend is $0.68 per share, an increase of nearly 10% from the previous quarterly dividend, leading to an annual dividend of $2.72 per share. However, at its current share price, Microsoft’s dividend yield is lower than 1%, which is not particularly attractive considering other income options, both in the stock market and other lower-risk alternatives.

Regarding share repurchases, the company spent more than $28 billion buying back its stock, an increase of 22% from the previous year. While this is a sizable capital return policy, due to Microsoft’s large market value, it only represents about 1.4% of its market capitalization, thus it’s not likely to have a great impact on its share price.

More recently, due to a tough macroeconomic background that has affected all growth companies, Microsoft’s growth has slowed down considerably which is justified more by external factors rather than being a sign of some fundamental weakness.

In the last quarter (Q2 FY 2023), Microsoft’s revenue was $52.7 billion, an increase of only 2% YoY, while its operating income declined by 8% YoY to $20.4 billion. Its net income was $12.4 billion, a decline of 12% YoY. Despite this slower growth, its Microsoft Cloud maintained a strong momentum with revenue up by 22% to $27.1 billion, which means its weight on total revenue increased to more than 51% in the past quarter.

Going forward, Microsoft’s growth is not expected to rebound sharply in the short term, as companies continue to cut IT spending and consumers are also cutting expenses due to higher cost of living, a background that is expected to result in annual revenues related to FY 2023 of about $208 billion. This represents an annual increase of only 4.9%, the slowest growth over the past five fiscal years.

Despite this slowdown, the Street expects revenue growth to recover thereafter, forecasting annual sales of close to $300 billion by FY 2026, which means revenue growth should increase by close to 13% annually after FY 2023.

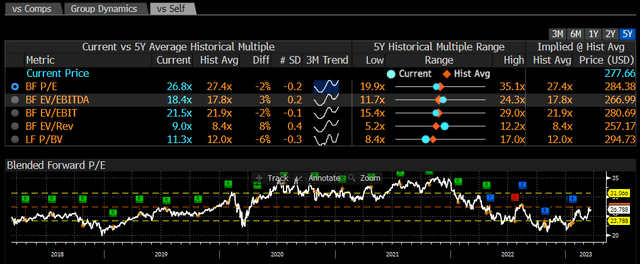

Despite Microsoft’s recent growth slowdown, its valuation is close to its historical average, as shown in the next graph, given that its shares are currently trading at 26.8x forward earnings, while its historical average over the past five years is 27.4x.

This means that Microsoft’s declining momentum is not worrying the market, as it’s more cyclical-related rather than structural, and the company’s fundamentals remain strong. Moreover, while it may be too early to see the impact of AI integration in its products, this is expected to be a strong support for Microsoft’s revenue and earnings growth in the next few years, which should justify a higher valuation multiple in the future, compared to its historical range.

Conclusion

Microsoft is a great company in the technology sector, with strong fundamentals and an impressive financial profile, plus its growth prospects are also good due to its exposure to Cloud and, more recently, the integration of AI within its product suite.

Furthermore, its shares are somewhat undervalued right now as it is fully caught up in the AI hype of other more specific plays. This bodes well for long-term investors that want to have exposure to this secular growth theme through a reasonably valued stock.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.