Summary:

- Microsoft is releasing its Q1 FY 2024 earnings on October 24, with reasonable analyst estimates, but doubts about exceeding them due to stagnant enterprise IT spending.

- The Gen AI trend is promising, but it’s unlikely to significantly impact earnings in the upcoming Q1, and cloud growth may continue to slow.

- The Personal Computing segment faces challenges, and Microsoft’s investments in AI could hinder cash distributions to shareholders.

- Given these factors, it’s advisable to approach Microsoft’s earnings with a ‘Hold’ rating and not expect an aggressive upside.

FinkAvenue

Microsoft (NASDAQ:MSFT) is scheduled to open books for its Q1 FY 2024 earnings on October 24th after the market closes. Although analyst consensus estimates are reasonable, I doubt that Microsoft will beat expectations. Investors should consider that Microsoft major commercial driver, enterprise IT spending, has not really picked up in the September versus June quarter, suggesting little room for growth and earnings upside on group level. Moreover, while Microsoft remains well positioned to capture the Gen AI tailwind, there is little indication that makes me believe that upside has been captured already in the past September quarter. As suggested by Morgan Stanley’s CIO survey, Gen AI should not be a major growth contributor until early 2024 at best.

I understand that investors feel bullish on Microsoft stock, certainly also as a function of Gen AI tailwinds. However, going into Q3 earnings, I advise to not play for aggressive upside, as I see Microsoft’s earnings print broadly in line with muted analyst projections. Consequently, I assign a ‘Hold’ rating.

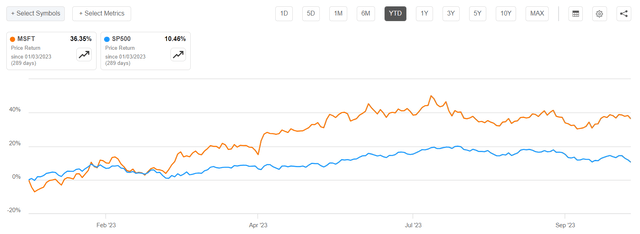

To provide context, Microsoft’s stock has demonstrated strong performance since the beginning of 2023, delivering year to date gains of approximately 36%, outperforming the S&P 500 (SP500) by a factor of 3x.

Microsoft Q3 Earnings Preview

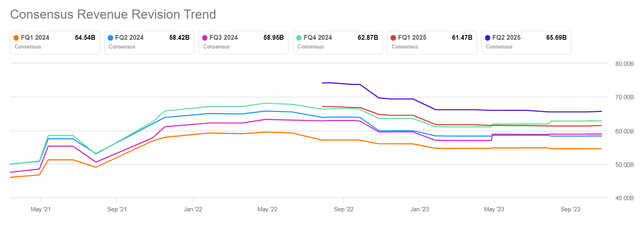

Based on data collected by Seeking Alpha as of October 21st, 38 analysts have provided their projections for Microsoft’s Q1 FY 2024 results. The estimates for total sales span a range of $53.87 billion to $55.35 billion, with an average estimate of $54.54 billion. Taking the average as a reference point, it suggests Microsoft’s Q1 sales may grow by approximately 8.8% compared to the same quarter in 2022.

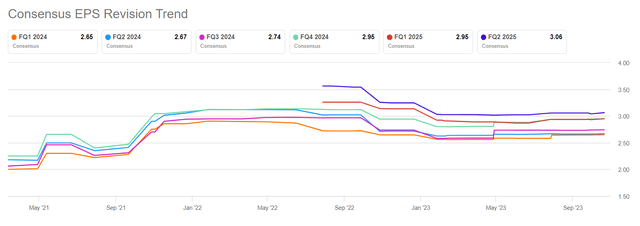

With regard to profitability, Microsoft’s earnings per share are estimated in the range of $2.60 to $2.71, with an average of $2.65, suggesting a double digit 12.7% year over year growth.

Commenting on revenue and earnings projections, I would like to point out that FY 2024 Q1 estimates have not really moved much since the end of the June quarter. And compared to respective estimates projected a year ago, expectations still remain depressed by 5-10%. This indicates that analyst sentiment is still quite bearish on global enterprise IT spending, despite the new product verticals enabled by Gen AI.

Cloud Growth Likely Continue To Slow

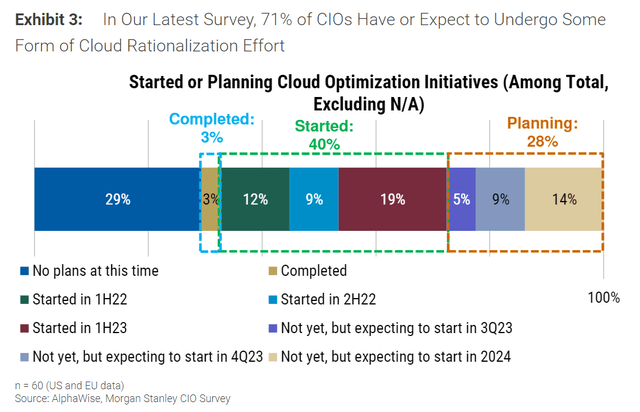

Microsoft’s Azure, as well as the broader Cloud industry, has now seen quite a few consecutive quarters of slowing growth; and Q1 FY 2024 is unlikely to change this trend. Investors should consider that Microsoft itself has previously guided Q1 Azure YoY growth in the 25-26% range, which could indicate a slowdown of as much as 200 basis points versus the June quarter. In that context, the CIO survey conducted by Morgan Stanley in October is broadly confirmatory of management guidance. Overall, CIOs continue to promote cost optimization in their IT budgets. And only 3% of respondents have completed said projects. Accordingly, although we might be in a late stage of the IT budget optimization cycle, we are not yet there yet in Q1 FY 2024. (Morgan Stanley Research: 1Q24 Preview – Mind the Ramp Please, dated October 17).

On AI, it is true that most CIOs show great interest in the technology, with about 66% of respondents seeing some impact of innovations on AI. This is up materially from 45% reported in the January quarter. In that context, Microsoft is well-positioned and poised to capture a significant tailwind from Gen AI induced budget adjustments to IT. However, only 11% of the CIOs have said that they expect AI projects to start within 2023. So, investors are well-advised to count this tailwind out for Microsoft’s upcoming Q1 FY 2024 report. That said, according to Microsoft management, the company expects Azure growth to receive only a 2 percentage point boost from Azure AI Services, which is already included in the growth guidance discussed above.

For the broader Intelligent Cloud segment, which includes Azure, Microsoft’s guidance anticipates revenue in the range of $23.3-23.6 billion, suggesting a 15-16% YoY growth for the segment.

Personal Computing Still Dragging Along

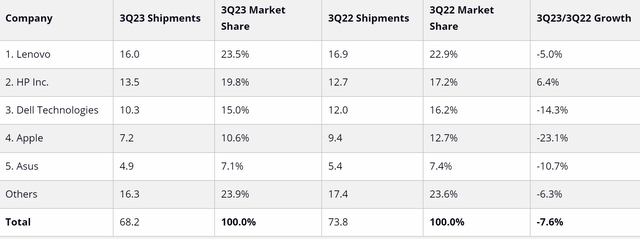

Another drag on Microsoft’s upside is found in the company’s Personal Computing segment, which continues to suffer from depressed consumer demand and high inventory/ consumption activity accumulated in the aftermath of COVID. As a result, management’s Q1 guidance anticipated a low-to-mid teens annual revenue decline, including a 5% negative impact from back-to-school inventory buildups moved into Q4. In line with management guidance, analyst consensus projects roughly a 11% revenue drop in Q1 FY 2024 revenue for the segment, according to data compiled by Refinitv. However, when management presented the Q1 FY 2024 estimate, the industry expected 4-5% YoY contraction. But the latest IDC Q3 2023 numbers suggest that the contraction may have been worse than feared, projecting an 8% YoY contraction in PC units shipments.

IDC Quarterly Personal Computing Device Tracker, October 9, 2023

In that context, it is worth pointing out that IDC does not see a recovery before 2H 2024, with Jitesh Ubrani, research manager for IDC’s Mobility and Consumer Device Trackers, commenting:

The PC industry is on a slow path to recovery as a device refresh cycle and end of support for Windows 10 will help drive sales in the second half of 2024 and beyond. In the meantime, the PC industry will unfortunately experience more pain

The slowness in the industry is giving the supply chain an opportunity to explore procurement and production options outside China and this will likely remain a key issue going forward, second only to the advancement of AI within PCs.

A likely similar muted backdrop may have persisted for Microsoft’s gaming unit around the XBox, pressured by bearish consumer sentiment for device spending.

I See In-Line Reporting For Productivity and Business Processes

Microsoft has provided revenue guidance for the Productivity and Business Processes segment in the range of $18.0 billion to $18.3 billion. This projection suggests a growth rate of 9-11% YoY. Personally, I do not see any reason to doubt this guidance, as the details on the segment’s product portfolio are quite reasonable; Firstly, in terms of Office-related products, the company expects Office 365 Commercial revenue growth to reach 16% in constant currency. This reflects a minor sequential deceleration of approximately 100 basis points; Secondly, for on-premise Office products, Microsoft predicts a percentage point decrease YoY in the low twenties, while Office Consumer products are expected to achieve growth in the low-to-mid single digits. Regarding LinkedIn, the company percentage point YoY revenue growth in the low-to-mid single digits, broadly in line with the projections given by other advertising competitors, notably Meta Platforms (META) and Google (GOOG). Finally, for Dynamics, Microsoft sees revenue growth in the mid to high-teens, in line with most recent trends

Investments Likely To Drag On Cash Distributions

With all the hype relating to AI, and related innovation potential, investors should not forget that this upside requires investments. And investments may impact Microsoft’s ability and willingness to allocate capital to shareholders. Specifically, I would like to point out that in Q4 FY 2023, Microsoft has guided for plans to incrementally increase its capital expenditures each quarter throughout the fiscal year 2024, starting from a base CAPEX of $10.7 billion. This should likely bring CAPEX to a $48-50 run rate by end of 2024. In that context, Microsoft did point out that the planned CAPEX increase is largely associated with AI initiatives.

To highlight the extent of Microsoft’s investments, I point out that Nvidia (NFDA) recently disclosed in its 10-Q filing that approximately 22% of its revenue in the second quarter of fiscal year 2024 is attributed to one single large cloud service provider. Needless to say, given the scale of the contract and the connection to AI, it is most likely that Microsoft is this customer (in my opinion, Google Cloud lacks the scale, and Amazon lacks the AI focus). But even if Microsoft is not the customer, the company may likely need to spend a similar amount of investment in the future.

Now, given that Nvidia’s reported total revenue of $13.5 billion in the July quarter, it is suggested that this cloud provider (Microsoft) spent about $2.97 billion with Nvidia, up 3x from the comparable spending of the unnamed customer one year prior. If this indeed indicates that Microsoft procured nearly $3 billion worth of Nvidia GPUs and related equipment during the July quarter, this underscores a substantial expansion of GPU infrastructure at Microsoft. While this investment points to robust demand for AI technologies and may serve as a positive signal for the AI industry long-term, it is mostly a cash-binding headwind for the upcoming Q1 FY 2024 reporting.

Investor Takeaway

Microsoft is set to announce its Q1 FY 2024 earnings in context of a hyped Gen AI environment, but analysis suggests that investors expectations shouldn’t be set too high. The company’s major driver, enterprise IT spending, hasn’t shown significant improvement between the June and September quarters, potentially limiting earnings upside. And while Microsoft is well-positioned to benefit from the emerging Gen AI trends, there’s little to indicate this has already impacted the September quarter. This makes it prudent to approach Microsoft’s earnings report with a ‘Hold’ recommendation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.