Summary:

- Microsoft Corporation announces its 14th consecutive annual dividend increase, setting the annual dividend at $3/share.

- While the yield is almost laughable, I urge investors to look at the overall package.

- The Microsoft ecosystem is built to last and will likely be around for decades.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) has just announced its annual dividend increase as Seeking Alpha has reported here. This marks the company’s 14th consecutive annual dividend increase and now places the annual dividend at $3/share, which is exactly what I had predicted in my dividend increase preview. However, the point is not to toot my horns but to check how healthy Microsoft’s dividend looks for the long term. I know what you are thinking: it is either (1) why does Microsoft need to be checked? or (2) who cares about the <1% yield? I am addressing #1 directly below while #2 is addressed throughout the article.

One of my favorite TV characters, Mrs. Marie Barone from the wildly successful sitcom Everybody Loves Raymond uttered many gems throughout the nine seasons. One of my favorite lines, “A good mother checks” was uttered by her in response to her elder son claiming he doesn’t smoke. Similarly, a good investor checks. How frequently one does that may vary depending on the underlying stock and company but check you must. Annual dividend increases offer the ideal check-points in my opinion for strong companies like Microsoft, like the annual wellness visits that is recommended for everyone, even healthy individuals.

I have a history of analyzing Microsoft’s dividend increases and with the latest increase in mind, it is time to get Microsoft on the examining table. For ease of comparison, I am going to follow the same structure as my 2022 article. Before that, for the record, my most recent Microsoft coverage was ahead of the company’s Q4 earnings where I warned the stock was a bit pricey, although I expected strong numbers from the company. Since then, Microsoft stock has lost about 5% compared to the market’s 1.70%.

Without further ado, let us now review Microsoft’s dividend increase.

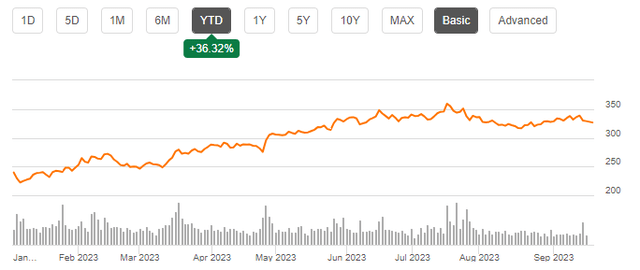

New Yield: The new annual dividend of $3/share gives Microsoft a yield of 0.92%. This is a bit lower than the 1.12% after 2022’s dividend increase. This is entirely due to the stock’s near 35% run since September 2022. The yield is undoubtedly puny compared to the stock’s potential to grow but with a 10% dividend increase when it has room to pay as much as 50% without breaking a sweat, Microsoft is actually telling the market “We’ve got better plans”.

Payout Ratio: Despite 14 consecutive years of dividend increases, Microsoft’s payout ratio based on forward EPS is sitting pretty at 27%. This is up a hair from the 26% in 2022 but over the long term (backward looking), this has dropped from 46% in 2014 to 27% in 2023. No wonder, the company is confident about reinvesting in itself for higher future returns than paying shareholders immediately.

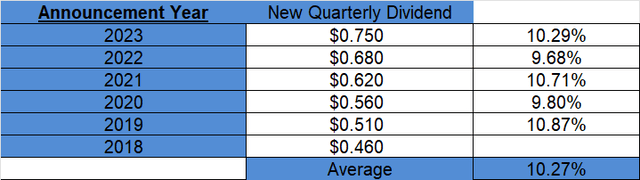

Dividend Growth Rate (DGR): At the time of the 2014 article linked above, Microsoft’s 5-year dividend growth rate ranged between 10% and 25%, a fairly wide range I’d say. During last year’s review, it was evident that the dividend growth rate was getting into a tighter range, between 9.52% and 10.87%. Now, the range is even tighter, between 9.68% and 10.87%. In short, the dividend increases are getting more predictable over time and that is good news for investors who need predictable dividend income.

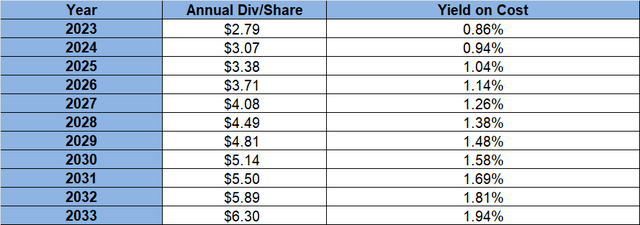

Extrapolation: To keep things consistent with the 2022 article, the table below assumes a dividend growth of 10%/yr for the next 5 years and 7%/yr for years 6 to 10. This still seems very conservative given the room in payout ratio, plus the expected double-digit earnings growth rate. The yield on cost doubles in this time span but once again, before you laugh, (1) these are very conservative estimates (2) the dividend coverage is extremely strong and (3) the stock has more going for it, as covered below.

Forward-Looking Thoughts and Conclusion

- The biggest difference between last year’s review and this year’s review has nothing to do with the dividend at all. It is the stock’s 35% run since September of last year. That not only makes the dividend yield smaller than it already is but also makes a “Buy” recommendation harder. The stock is clearly in a holding pattern here after reaching all-time highs in July.

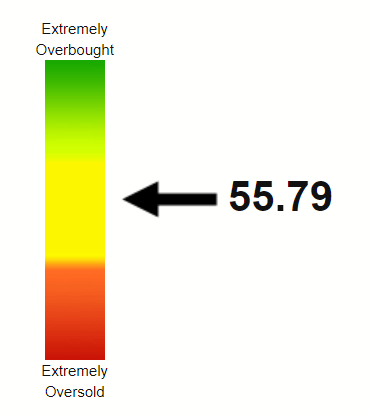

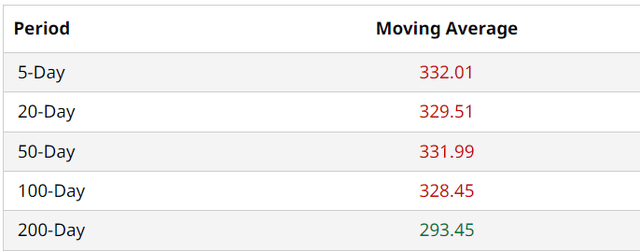

- That the stock is in a holding pattern is confirmed by its technical indicators as well. For example, a Relative Strength Index [RSI] of 55 shows the stock is neither overbought nor oversold and that the market is waiting on a direction. However, based on the moving averages where Microsoft stock has gone below all but the all important 200-Day moving average, I am willing to bet there is at least a bit more downside in the short to medium term before the stock finds solid support.

MSFT RSI (stockrsi.com) MSFT Moving Avgs (Barchart.com)

- Bringing our focus back to the dividend, if earnings grow at 15%/yr as expected, the earnings per share will be at $22 in 5 years. Even if the payout ratio stays at the current lowly 27%, that would give investors an annual dividend of ~$6 per share. That would represent an exact double from the current $3/share. Do yourself a little favor and don’t look at only the current yield when it comes to strong companies. Those who bought the old “lost decade” Microsoft stock are now sitting pretty with yield on cost above 12% ($3 based on the $25 range that the stock appeared to have been stuck in forever). I am not suggesting such returns are guaranteed in the future but to look at the overall package.

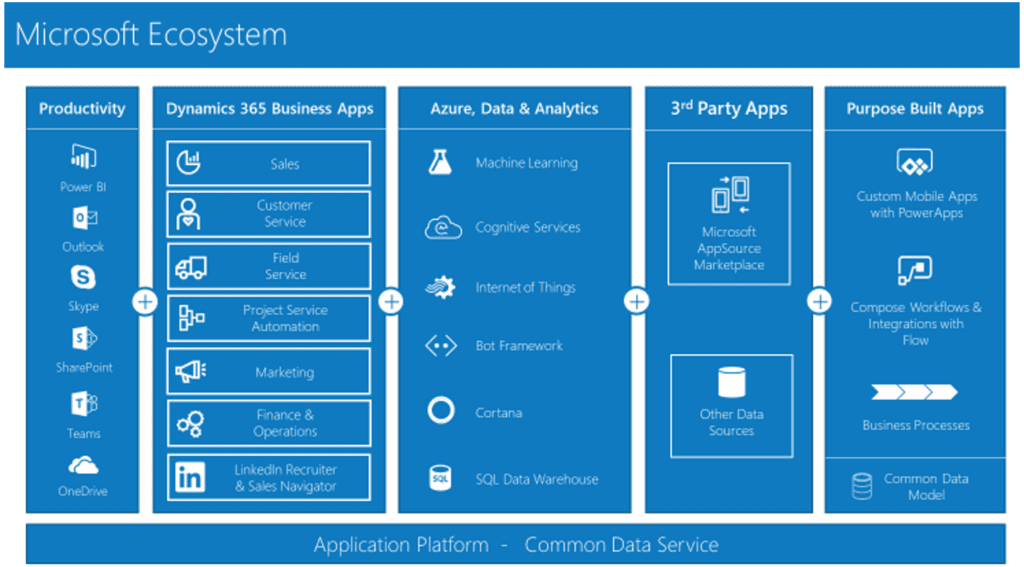

- Speaking of “lost decade”, there is a reasonable case to be made that Microsoft is entering another lost decade after a spectacular recovery from the previous one. I cannot predict the future nor technological disruptions. But I can say with reasonable certainty that the Microsoft ecosystem is large, strong, and wide enough for the company to not only survive but thrive during bad times for the economy (think gobbling up smaller companies at better prices, for example). After all, it did survive many catastrophic events including the 1987 market crash, the dot-com bubble, 2007-08 financial crisis, and the Steve Ballmer era, which lasted 14 years as a coincidence with the company’s 14th annual dividend increase today.

MSFT Ecosystem (microsoft.argano.com)

- To summarize, I still believe Microsoft, the company has it all when it comes to personal and enterprise computing needs. And Microsoft, the stock has it all when it comes to the world of investing: current income (albeit small) and enormous potential for capital and dividend growth. The only thing against the stock right now is the overall market being in slumber along with the stock’s valuation. Microsoft remains a “Strong Hold” here. Here’s hoping the 14-year-old has a long life. How long? I don’t know but if I am forced to pick one technology company from today that will be around the longest, I will pick Microsoft.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.