Summary:

- Last year, at the beginning of this AI revolution, Microsoft Azure was considered to be in the lead out of all the major cloud providers.

- There has even been speculation that Azure could eventually overtake Amazon’s AWS as the cloud leader.

- However, recent research suggests that the tables could be turning against Microsoft/ OpenAI and enable Amazon to sustain its dominance in the cloud market.

Justin Sullivan

It has been well over a year now since the generative AI revolution began, with semiconductor and cloud provider stocks being seen as the “picks and shovels” of this era. While Microsoft (NASDAQ:MSFT) Azure was initially considered to be in the leading position out of the major cloud service providers to benefit from this major technology shift, recent research suggests that it may be losing its edge, which could enable Amazon’s (AMZN) AWS to sustain its leadership position.

In the previous article on Microsoft, we simplified some of the jargon used by executives on the earnings call to help investors understand how Azure is positioned to generate long-term recurring revenue/profits amid the AI revolution. In the previous article on Amazon, we discussed the tech giant’s generative AI deployment opportunities on the e-commerce side. In this article, we discuss recent trends in how enterprises are adopting AI, and how they threaten to undermine future demand for Microsoft/OpenAI’s flagship GPT models, which is indeed the reason behind the downgrade of MSFT to a ‘hold’.

The initial bullish perception of Microsoft relative to Amazon

Before we delve into bearish developments, let us first revisit the initial bull case on MSFT and laggard perception of AMZN.

Last year, at the onset of this revolution, the market considered Microsoft Azure as the cloud provider that is best positioned to benefit from this major technology shift, thanks to its opportune partnership with OpenAI. Exclusive access to OpenAI’s GPT models has been considered Microsoft’s competitive edge so far in the AI race. On the other hand, while Amazon has also invested in AI startups like Anthropic, the tech behemoth has been considered to lag behind Microsoft so far in the AI race.

This advantage has certainly helped Microsoft attract more enterprise customers onto Azure, with CEO Satya Nadella proclaiming on the Q3 2024 Microsoft earnings call that:

More than 65% of the Fortune 500 now use Azure OpenAI Service.

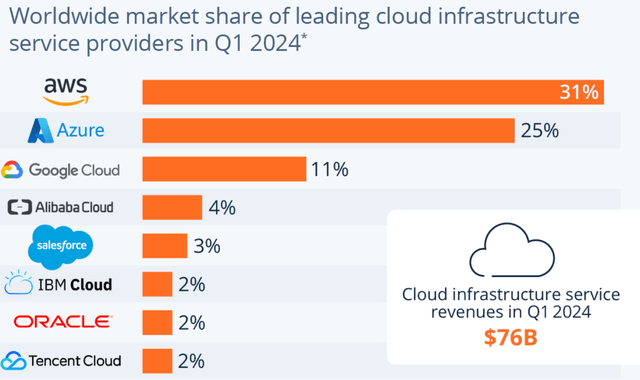

Microsoft has indeed been gaining market share in the cloud infrastructure market over the past several quarters. In Q1 2024, Microsoft Azure held a 25% market share, up from an average of 21% in 2022. While Amazon’s AWS had a 31% market share last quarter, below its “long-standing market share band of 32-34%”.

Synergy Research Group, Statista

In fact, there has even been speculation that Microsoft Azure could surpass Amazon AWS as the largest cloud provider at some point, thanks to the popularity of OpenAI’s Large Language Models (LLMs), using which enterprises could build their own chatbots/assistants on Azure.

However, new trends are forming in terms of how enterprise customers are seeking to deploy generative AI for their own businesses, which could undermine Microsoft’s competitive edge over Amazon, and hinder the chances of Azure overtaking AWS as the largest cloud provider in the world.

The reality check on Azure vs. AWS

Venture capital giant Andreessen Horowitz recently released a research report, interviewing and surveying executives of Fortune 500 companies, to assess how enterprises are working to deploy generative AI. The report found that:

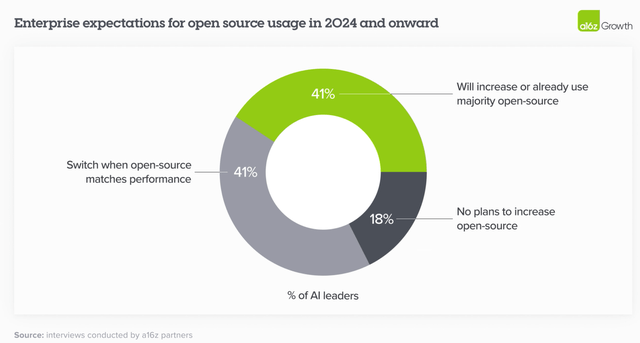

We estimate the market share in 2023 was 80%-90% closed source, with the majority of share going to OpenAI. However, 46% of survey respondents mentioned that they prefer or strongly prefer open source models going into 2024. In interviews, nearly 60% of AI leaders noted that they were interested in increasing open source usage or switching when fine-tuned open source models roughly matched performance of closed-source models. In 2024 and onwards, then, enterprises expect a significant shift of usage towards open source, with some expressly targeting a 50/50 split-up from the 80% closed/20% open split in 2023.

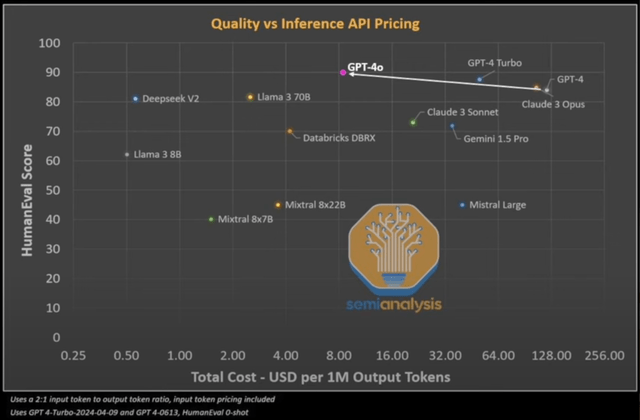

This research piece is further corroborated by studies revealing how open-source models, such as Meta’s Llama models, are catching up quickly in terms of performance, while the rate of performance improvements for OpenAI’s closed-source models is slowing (though improving on cost efficiency).

This poses a big risk to future Microsoft Azure revenue and profitability growth if demand for OpenAI’s GPT models indeed decline going forward amid increased preference for open-source models.

On the Q1 FY2024 Microsoft earnings call back in October 2023, CEO Satya Nadella had shared the extent to which Microsoft has benefitted from the growing use of OpenAI’s models both internally and externally, yielding higher returns on AI infrastructure investments:

the approach we have taken is a full stack approach all the way from whether it’s ChatGPT or Bing Chat or all our Copilots, all share the same model. So in some sense, one of the things that we do have is very, very high leverage of the one model that we used — which we trained, and then the one model that we are doing inferencing at scale. And that advantage sort of trickles down all the way to both utilization internally, utilization of third parties

In a previous article, we had simplified what the CEO meant by those remarks. Here’s an excerpt from that article explaining how Azure benefits from this approach:

It enables Microsoft to scale its AI infrastructure more easily. The prevalent use of a single AI model simplifies the process of infrastructure management, allowing for greater cost efficiencies that are conducive to profit margin expansion. Moreover, the high cost of training the model can be amortized over the multiple AI applications using it, improving the return on investment, as the different revenue streams from the model exceed the cost of training it.

Indeed, the popularity of the GPT models has yielded great benefits for Microsoft up till now, with the company boasting an attractive operating profit margin of 45% last quarter, much higher than Amazon’s company-wide operating margin of 10.7%. Although, these scale-driven profitability improvements may not last for shareholders if OpenAI’s models become less prevalent among Azure customers.

Now even though Microsoft still remains heavily dependent and invested in OpenAI, the software giant is wisely diversifying by also offering open-source models from other companies like Meta, Mistral and Cohere, recognizing that OpenAI’s closed-source models may not be fit for all enterprise purposes.

Although, Azure would still be losing its competitive differentiator here over AWS as GPT models decline in popularity.

Amazon’s AWS also offers access to these open-source models (on top of Anthropic’s closed-source models), as CEO Andy Jassy highlighted on the Q1 2024 Amazon earnings call:

In the last few months, Bedrock’s added Anthropic’s Claude 3 models, the best-performing models in the planet right now; Meta’s Llama 3 models; Mistral’s Various models, Cohere’s newest models.

Consequently, it would reduce the need and likelihood of cloud customers migrating their data from AWS to Azure to use OpenAI’s GPT models, if enterprises can instead find suitable open-source models on AWS. This undermines the rate at which Microsoft can continue to take market share from Amazon.

Having the largest cloud customer base, AWS is the largest repository of data in the public cloud market. This serves as an important moat factor, as migrating data and workloads from one cloud provider to another can incur high switching costs. Amazon will indeed strive to leverage the stickiness of its cloud platform to discourage migrations to Microsoft Azure, and now additionally benefitting from the growing prevalence of open-source models that are available ubiquitously.

While Microsoft/OpenAI are responding to the rising popularity of open-source models by improving the cost efficiency and pricing of their proprietary models, it may not be enough to counter this competitive threat.

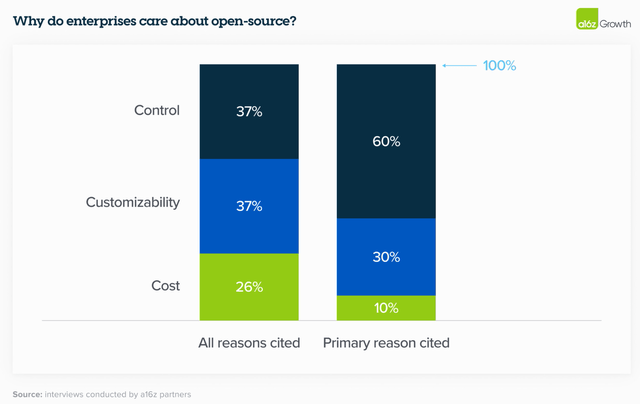

As per the research report from Andreessen Horowitz, when enterprises were asked why they were gaining a preference for open-source models, a whopping 90% of enterprises cited either “Control” (60%) or “Customizability” (30%) as the primary reason.

For context, “Control” relates to “security of proprietary data and understanding why models produce certain outputs”, and “Customizability” refers to the “ability to effectively fine-tune for a given use case”.

Given these advantages that open-source models offer over closed-source models, the appeal of OpenAI’s LLMs may not last long for Microsoft Azure. And the preference for open-source models is likely to grow even further from here.

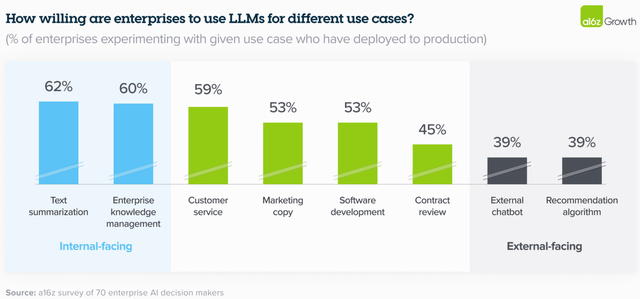

In fact, the same report from Andreessen Horowitz revealed that while most enterprises are deploying LLMs for internal use cases like text summarization or in-house assistants in 2024, they are much less likely to roll out AI-powered features like customer-facing chatbots, given the ongoing concerns around “hallucination” risks.

Looking beyond 2024 when enterprises do seek to deploy external chatbots for customer use, they could be more likely to opt for open-source models which grant them optimal control and customizability, in order to protect their brand image and avoid any embarrassing customer interactions through chatbots.

Hence, the demand outlook for Microsoft/OpenAI’s closed-source models seems to be dimming, undermining the threat Azure poses to AWS’s dominant cloud market share.

Risks and counterarguments to bearish thesis

Now, despite these bearish developments, there are still reasons to remain bullish on Microsoft that could drive the stock price higher.

Microsoft/OpenAI are moving ahead faster than Amazon is catching up: While open-source models are rising in popularity, enterprises are still willing to use closed-source models as well, “with some expressly targeting a 50/50 split”, as cited earlier in the article. And Microsoft/ OpenAI are still ahead of Amazon/ Anthropic in the closed-source space.

This is indeed a fast-paced market, with OpenAI launching a much more powerful, multi-modal AI model called “GPT-4 omni” or “GPT-4o” last month, opening up the possibility for developers to build “agentic” applications through the Microsoft Azure platform.

On the other hand, Amazon was already struggling to catch up to Microsoft/ OpenAI’s dominance via its Anthropic partnership, as the GPT models continued to be more popular than the Claude models. Now with OpenAI raising the bar even further by enabling incredible “agent-like” capabilities through its latest model, it could indeed better position Azure to continue taking market share from AWS, while Amazon tries to catch up through its Anthropic partnership, or by forging new partnerships with other promising AI startups.

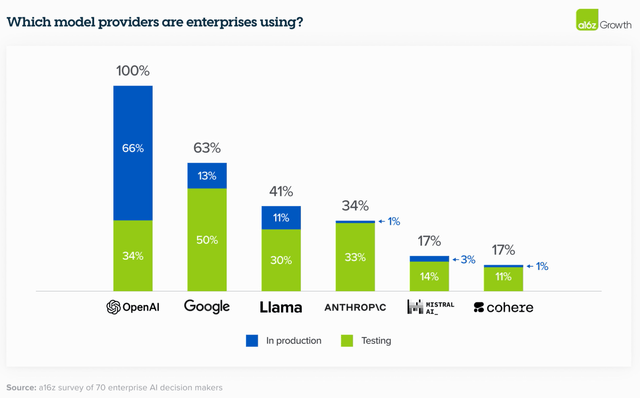

Microsoft/OpenAI’s GPT models have the highest “in production” rate, while Amazon-partner Anthropic’s models lag: While enterprises are expressing increased interest in open-source models, the research report from Andreessen Horowitz also found that, in terms of deployment to production, more enterprises are deploying OpenAI’s models to production than they are with open-source models from companies like Meta and Mistral AI.

Rate of AI model deployment into application production (Andreessen Horowitz)

Two-thirds of surveyed enterprises have deployed OpenAI’s GPT model to the production of their own applications, which is not only higher than the rate at which open-source models are being deployed, but also higher than the other closed-source models, like the Claude models from Anthropic that are available on both Amazon’s AWS and Google Cloud.

Hence, Microsoft has been successful at converting model testers into inferencing revenue as more enterprises decide to run customized AI applications on the GPT models. On the other hand, Amazon’s key AI partner Anthropic has barely converted model testers into application-building workloads.

That being said, Andreessen Horowitz’s research report also revealed that:

Most enterprises are designing their applications so that switching between models requires little more than an API change. Some companies are even pre-testing prompts so the change happens literally at the flick of a switch, while others have built “model gardens” from which they can deploy models to different apps as needed.

So while Microsoft/OpenAI’s models may be in the lead right now in terms of enterprise users moving to production, the cloud giant could struggle to build a moat based on this lead, given that enterprises are savvily keeping their switching costs low to enable smoother transitions from one model provider to another.

It’s a fast-moving market where new editions of LLMs are rolling out at a rapid pace from various providers, so enterprise customers are reluctant to lock themselves into using a single model provider in order to avoid missing out on new innovations and/or performance enhancements from other model providers.

This gives Amazon’s AWS a fighting chance to potentially convert initial OpenAI model users into customers of either open-source or closed-source models offered exclusively on AWS. In fact, just recently “Amazon announced a commitment to invest $230M in AI startups, in the form of Amazon Web Services credits”, as a way to expand the range of AI models/services offered on its platform and defend its dominant cloud market share.

Financial Performance and Valuation

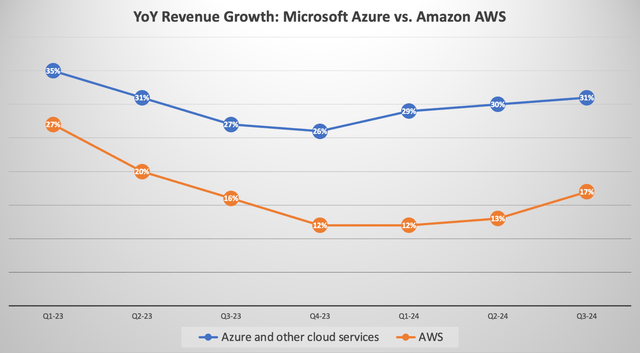

Both Microsoft Azure and Amazon’s AWS have seen revenue growth accelerate over the past few quarters, thanks to the increased cloud computing power needed for generative AI.

Nexus, data compiled from company filings

Azure continues to grow at a faster pace than AWS, given that it is still smaller than the market leader. Azure’s growth rate has also accelerated faster than AWS thanks to its exclusive access to the most popular AI model on the market, which has enabled it to grow its market share to 25% last quarter.

That being said, the pace at which it can continue taking market share from AWS may slow down going forward, amid the increasing preference for open-source models over closed-source models.

Moreover, open-source models are priced at cheaper rates than closed-source models like OpenAI’s GPT models and Anthropic’s Claude models. Hence, increased demand for open-source models instead of closed-source models could indeed subdue top-line revenue growth prospects for both Microsoft and Amazon.

Now in terms of profitability, AWS’s operating margin jumped to 37.6% last quarter, while Microsoft does not disclose the operating profit margin for Azure separately. Instead, the company only provides the operating margin for the ‘Intelligent Cloud’ unit as a whole, which currently stands at 47%.

Both companies have signaled greater capex spending ahead to build out the AI infrastructure needed to run AI workloads. Although both tech giants have been working to limit the impact on profit margins by successfully driving greater cost efficiencies.

For example, Microsoft CFO Amy Hood highlighted on the last earnings call that:

Operating income increased 23% and operating margins increased roughly 2 points year-over-year to 45% … driven by the higher gross margin noted earlier and improved operating leverage through continued cost discipline.

…

we expect FY2025 capital expenditures to be higher than FY2024… We will also continue to prioritize operating leverage. And therefore, we expect FY2025 operating margins to be down only about 1 point year-over-year, even with our significant cloud and AI investments

While Amazon’s company-wide operating margin expanded to 10.7% in Q1 2024, from 3.7% last year, also thanks to improved cost discipline across the company.

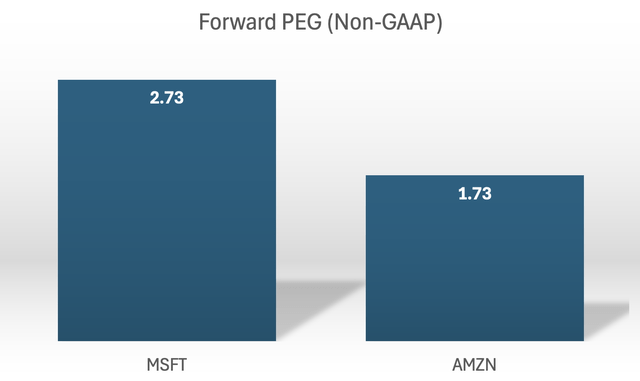

Now in terms of the valuation of MSFT relative to AMZN, Microsoft stock currently trades at a Forward PE of over 37x, while Amazon stock trades at over 40x.

While AMZN may appear slightly more expensive than MSFT, it is important to also take into consideration the expected future earnings growth rates. Stocks with higher EPS growth rates can command higher valuation multiples.

The EPS FWD Long Term Growth (3-5Y CAGR) for Microsoft is 13.72%, notably lower than that of Amazon at 23.45%.

Now, adjusting each stock’s forward PE multiple by these expected EPS growth rates would give us the forward PEG ratios.

For context, a forward PEG ratio of 1 would imply the stock is trading at fair value. However, tech giants with powerful moats and promising growth potential indeed tend to trade at a premium relative to fair value.

Nexus, data compiled from Seeking Alpha

Microsoft stock trades at a much more expensive valuation than Amazon stock, once we take expected earnings growth rates into consideration.

One of the key reasons why the market has assigned such a premium valuation to MSFT is indeed its exclusive access to OpenAI’s popular GPT models. Although, as discussed, open-source models are likely to gain greater prevalence relative to closed-source models going forward, undermining Microsoft stock’s ability to continue commanding such a lofty valuation relative to Amazon stock.

Therefore, I am downgrading Microsoft stock to a ‘hold’, while Amazon stock remains a ‘buy’. A forward PEG closer to MSFT’s long-term average of around 2 could make the stock a more reasonable ‘buy’. Or alternatively, the company would need to demonstrate strong AI-driven growth in its other segments ‘Productivity and Business Processes’ and ‘More Personal Computing’ to justify a higher valuation. But for now, the MSFT stock is a ‘hold’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.