Summary:

- Microsoft Corporation’s robust ecosystem, double-digit revenue growth, and expanding EBITDA margins underscore its strong business fundamentals and strategic positioning.

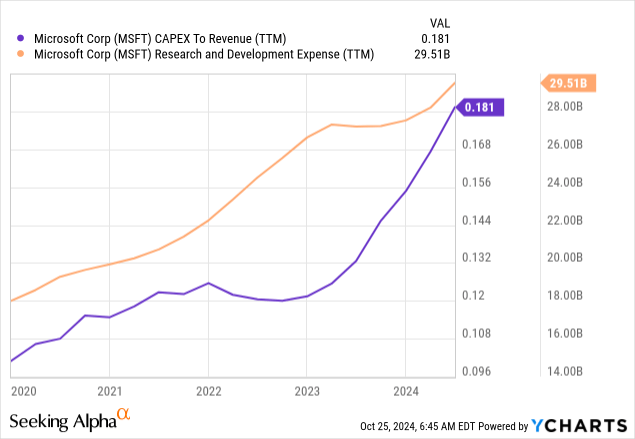

- Increasing R&D and CAPEX, along with strategic AI partnerships, reinforce Microsoft’s industry leadership and growth potential.

- The upcoming earnings release, with achievable consensus targets, could serve as a positive catalyst for Microsoft’s share price.

- Valuation analysis suggests a fair share price of $574, indicating a significant 35% upside potential for Microsoft stock.

photobyphm

Introduction

The last time I have covered Microsoft Corporation (NASDAQ:MSFT) (NEOE:MSFT:CA) was in early April when the share price was at $418. The current share price is just slightly higher at around $425. Thus, the stock has under-performed the S&P 500 Index (SP500) since April. Nonetheless, I remain bullish due to a powerful set of catalysts.

Despite its scale, Microsoft continues to achieve double-digit revenue growth and expanding EBITDA margins, underscoring the strength of its business. This success is driven by a unique ecosystem of services that creates unparalleled value for users, enhancing customer loyalty and reducing acquisition costs. In this thesis, I am not focusing heavily on Microsoft’s exceptional role in the global AI shift (because I did it in the previous one). Instead, I emphasize the company’s ongoing efforts to secure its AI positioning.

Microsoft’s increasing R&D and CAPEX, along with strategic partnerships like the $30 billion AI fund with BlackRock (BLK) and NVIDIA (NVDA), reinforce its industry leadership. With a strong earnings history and achievable consensus targets for the upcoming quarter, there is another potential positive catalyst. The valuation is attractive, and I am inclined to reiterate a “Strong Buy” rating.

Fundamental analysis

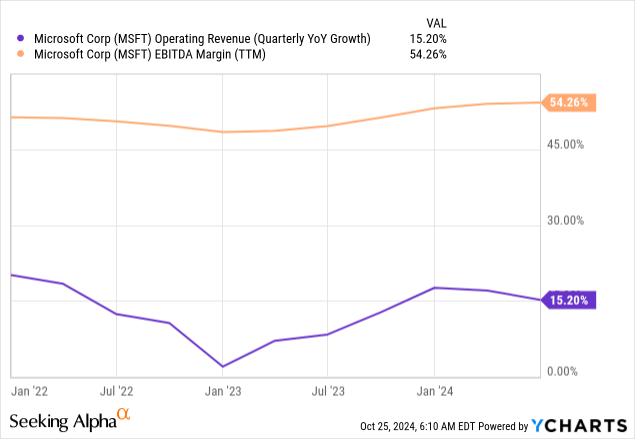

Despite Microsoft’s hyper-scale and market cap of more than $3 trillion, its revenue continues to grow by double-digit percentages. The EBITDA margin also shows steady growth, which is a strong positive signal.

In my opinion, there are several strong reasons why Microsoft continues keeping investors happy with its improving financial performance. The number one reason is Microsoft’s ecosystem that ensures its intact moat and absolutely unique strategic positioning. The integration between Productivity & Business Processes and Cloud offerings provides a comprehensive solution for both individuals and enterprises. Microsoft’s ability to seamlessly integrate its services gives the company several competitive advantages.

First, a cohesive ecosystem creates unparalleled experience for users, which boosts customer loyalty. With high loyalty among existing customers, the company can focus resources on attracting new ones. Second, having a suite of offerings that are seamlessly integrated makes cross-selling easier as benefits for customers are obvious. Third, when customers use several products of a company, it highly likely increases switching costs for them. With strong customer loyalty, high switching costs, and solid cross-selling potential, Microsoft can reduce customer acquisition costs, benefiting the bottom line.

Microsoft’s ability to build a unique ecosystem that ensures its strategic strength is driven by the company’s commitment to growth and development. The company’s R&D budget is rapidly increasing, as is its CAPEX to revenue ratio. To me, this clearly indicates that management is laser-focused on developing new drivers of growth and sources of value creation for shareholders.

Cloud and artificial intelligence (“AI”) are the hottest technological topics at the moment. The company quite frequently announces that it plans to invest in data centers across the world, which is a strong indication that the company sees compelling opportunities in this space. In addition to investing in data centers directly, the company recently teamed up with BlackRock and Nvidia to set up a $30 billion AI infrastructure fund.

This move appears strong for two solid reasons. First, BlackRock is the world’s largest asset management firm by AUM, and Nvidia is the leading supplier of AI processors. Partnering with such prominent companies underscores Microsoft’s status as an IT superstar. Second, Oppenheimer analysts note that data center demand outpaces infrastructure. This suggests that aggressively investing in data centers is sound, as the demand for computing power exceeds supply. That being said, AI tailwinds are expected to remain strong for a while, which is certainly beneficial for Microsoft.

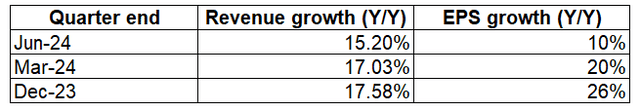

Microsoft’s upcoming earnings release is another reason why I am optimistic. The earnings release is expected to go live on October 30 post-market, which is quite close. If we look at Microsoft’s earnings history since September 2019, there were only two quarters when the company fell short of consensus forecasts. Past success is not a guarantee, but I prefer a company with a strong earnings history over one that consistently disappoints investors with earnings below consensus. Another reason to be bullish is that consensus projections look doable: a 14.2% YoY revenue growth, and a 3.72% non-GAAP EPS growth. I think that these growth targets are achievable based on the below table summarizing growth during the previous three quarters.

As a result, we see a powerful trio of catalysts. Microsoft’s unparalleled ecosystem and business mix enable it to capitalize on strong AI tailwinds, likely leading to a strong upcoming earnings release. As a Microsoft bull, I appreciate this symphony of catalysts!

Valuation analysis

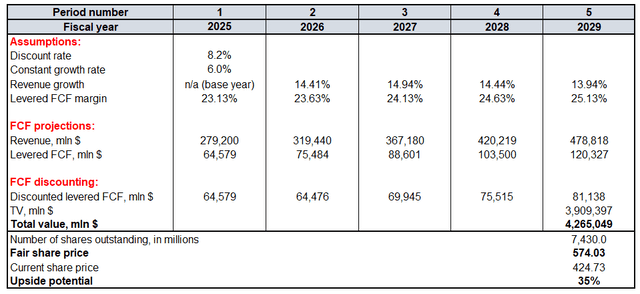

My previous discounted cash flow (“DCF”) model for MSFT suggested that the stock’s fair share price was around $480. Since the environment is dynamic and Wall Street analysts constantly revise their growth projections, I must update the DCF model with new input data.

Using WACC for Microsoft’s DCF model looks not reasonable to me because the company’s below $100 billion total debt is immaterial compared to the above $3 trillion market cap. Therefore, I use an 8.2% cost of equity as a discount rate. FY 2025-2027 revenue assumptions are from consensus because this forecast represents the median opinion of at least 25 Wall Street analysts, which makes it a reliable source. For years after FY2027, a steady revenue growth rate yearly decrease is incorporated. The TTM levered FCF margin is 23.13%. Since Microsoft’s ecosystem helps in driving down customer acquisition costs, I expect the company to improve its FCF margin by at least 50 basis points every year. Due to Microsoft’s unparalleled positioning to absorb AI tailwinds, I reiterate the same 6% constant growth rate for the terminal value (“TV”) calculation.

The updated fair share price is $574, significantly higher than the previous estimate of$480. Two main drivers contribute to this growth. First is the discount rate. Previously, I used an 8.5% rate. The 30 basis point decrease seems conservative compared to the Fed’s September 50 basis point interest rate cut. The second driver is the base year. In early April 2024, we only had two quarters of MSFT’s FY2024 behind us, making FY2024 the base year. In the updated DCF, FY2025 is the base year, with all the actual revenue growth of 2024 already recorded. These changes to the DCF seem reasonable to me, bolstering my high conviction in the updated fair share price.

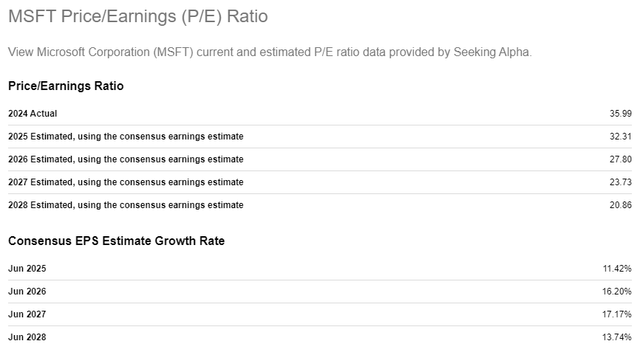

The projected by consensus P/E ratio contraction for the next five years also reinforces my confidence in MSFT’s undervaluation. The schedule of projected forward P/E ratio contraction is provided above.

Mitigating factors

I think that the upcoming earnings release can be a solid positive catalyst for the stock price. But success is not guaranteed here, and there is a relatively fresh example. MSFT released its previous quarter’s earnings on July 30, and the stock gained only 0.4% since then. This weakness cannot be explained by the weak stock market overall because the S&P 500 index gained almost 7% over the same period. The stock’s YTD performance is also modest compared to the S&P 500. Therefore, the market appears not to agree with my optimism.

The above chart is important to understand the dynamic and potential reasons behind MSFT’s recent underperformance versus the S&P 500. There was a global outage of Microsoft’s services on July 19, and we see that the stock outperformed the S&P 500 before July. Although the outage was not due to Microsoft’s fault, it seems the market became more cautious about MSFT following this event.

There is also a significant risk related to Microsoft’s business itself. While the company’s ecosystem creates solid growth opportunities, it also attracts increased antitrust scrutiny. In June, Microsoft faced a more than $2 billion antitrust charge for bundling its Teams service with the Microsoft Office suite. Although the charge is not material compared to Microsoft’s scale, such intense scrutiny might limit its ability to further expand its ecosystem.

Conclusion

Microsoft’s fundamentals are strong, and I am optimistic about the upcoming earnings release, which could serve as a solid catalyst for share price growth. The stock is attractively valued, with a 35% upside potential, which seems like a gift for a company like Microsoft.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.