Summary:

- Microsoft’s search momentum is outpacing Google, with Bing gaining share for the tenth consecutive quarter.

- Bing’s integration of generative AI and chatbot functions is helping to differentiate it from Google search, allowing them to serve people in their leisure, like on Meta platforms.

- Microsoft’s traction with AI-powered advertising solutions and Azure AI services is driving growth in search advertising revenue and cloud-based search on Bing.

FinkAvenue

Investment Thesis: Microsoft’s Search Momentum Are Hurting Google

The latest quarterly results from Microsoft (NASDAQ:MSFT) highlight its increasing momentum in search and online advertising; the company leverages AI to boost engagement as a core strategy to pull market share from Google (GOOGL). According to the Q1 2024 Earnings Call, overall revenue rose 13% to $56.5 billion, showcasing Microsoft’s push into the next era of search and computing. With Bing making major advances in the space of enterprise and their partnership with Meta coming to fruition, Microsoft is cornering Google out of the search market removing many of the use cases and reasons people use Google every day. The effects are real, with Microsoft leveraging an AI powered Bing to take browser and internet search away from Google this year.

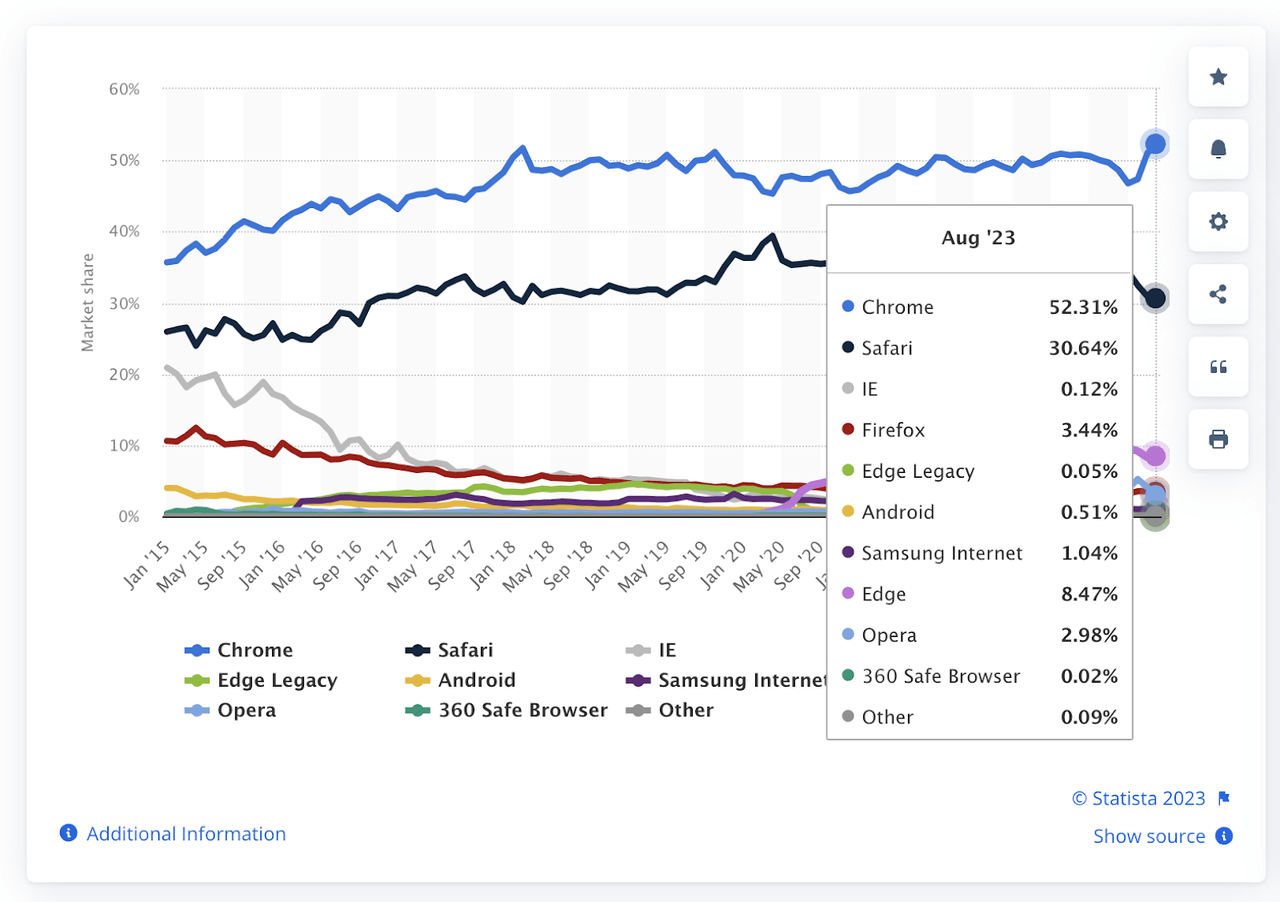

Bing Gains Share Powered by AI Capabilities (Through Edge) – Google is losing ground

Bing’s search share (through Microsoft Edge) has increased for the tenth consecutive quarter. This reflects improving competitiveness versus Google search with ChatGPT functions helping to power this. While this share is small (8.47% in August), this is up from 6.91% at the start of the year and a growth of 22%.

A key driver is Microsoft’s integration of generative AI into Bing on the Edge platform. The chatbot-enhanced Bing search experience has already garnered 1.9 billion conversations, enabling more personalized and relevant answers (Q1 2024 Earnings Transcript). By leveraging these innovations, Microsoft seeks to differentiate Bing and solidify its position as a leading search engine that is continuing to evolve with new features.

In FY Q1, Microsoft expanded Bing AI features to include Dall-E image generation which produced 1.8 billion images. The company also brought Bing AI to new endpoints like Meta’s (META) chat platforms (FY Q1 2024 Earnings Transcript). By rapidly expanding integrations, Microsoft aims to progress Bing AI and weave it into people’s digital experiences. Bringing the search engine with powerful OpenAI features to where people are (Meta products) removes many of the reasons people use Google.

Imagine if ChatGPT can plan your trip, your Facebook account with META browsed the internet and social media, and your Microsoft products scrape the web for you? Wow.

The additions showcase Microsoft’s technical prowess in generative AI while illustrating the company’s strategy of proliferating Bing AI across platforms. These AI capabilities are helping Bing chip away at Google’s search dominance. Microsoft is positioning its chat-powered, contextual search as differentiated and ahead of competitors.

Browser Market Share August 2023 (Statista)

Robust Search Advertising Momentum

Beyond gains in search share, Microsoft saw search advertising revenue rise 10% excluding traffic acquisition costs (10Q). Growth was driven by higher search volume and Edge browser share gains (Q1 2024 Earnings Transcript).

Despite economic uncertainty impacting the ad market, search has remained resilient for Microsoft. The focus on AI-powered advertising solutions that connect marketers to customer intent is paying off.

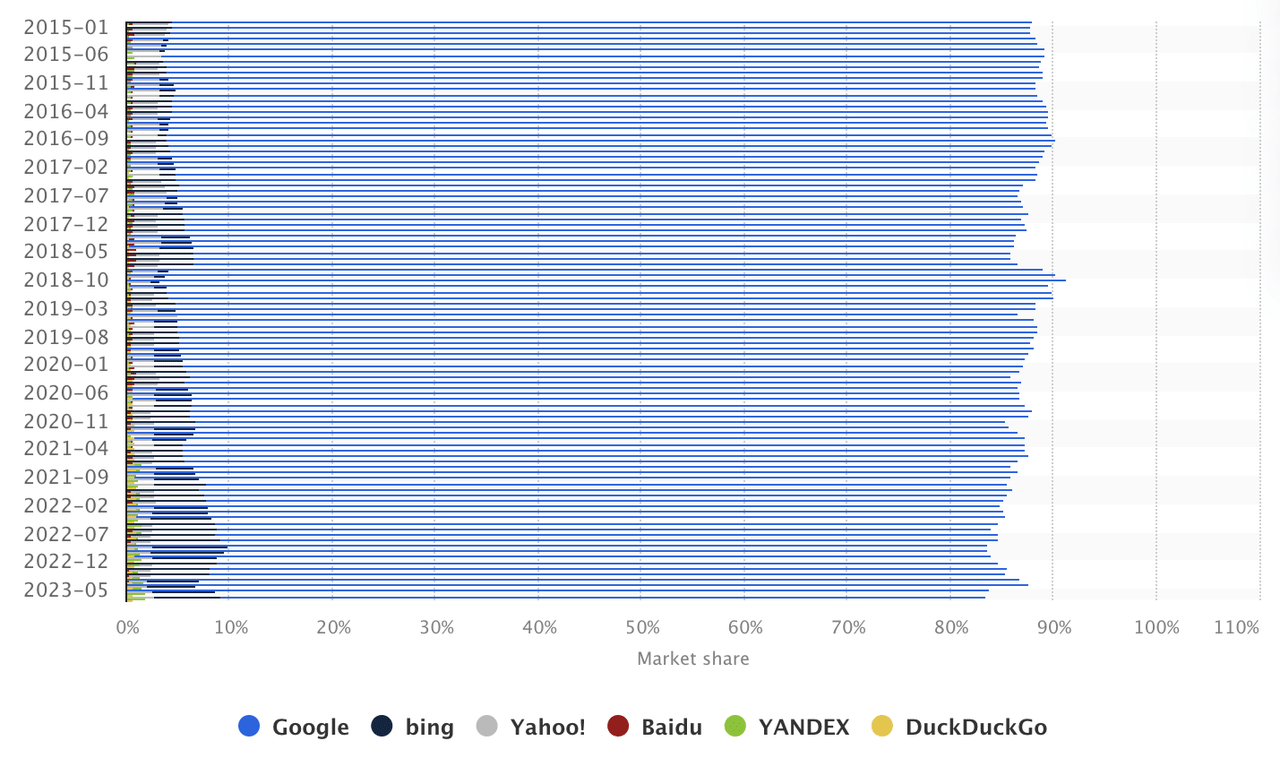

Microsoft noted strong demand from companies integrating its ad tech to enhance chat commerce experiences. It’s no mere coincidence that Google harbors concerns about competitors. This is vividly demonstrated in the ongoing antitrust trial, where evidence highlighted Sundar Pichai’s readiness to allocate a staggering $18 billion/year to maintain Google as the default web browser on Apple devices. For a significant period, Google held sway over the market share, reaching its peak in 2018 at an impressive 91.46%, a prominence that has since receded to 83.49% as shown in the figure below. With Bing gaining share, Microsoft’s search ad business should continue taking wallet from Google Ads.

Search Engine Market Share (Statista)

AI Infusion Fuels Enterprise Search on Bing (Allowing Market Share Gains)

In addition to search ads and direct search market share, Microsoft is pulling Bing into their enterprise tools for a unique value proposition. To compete in the cloud search category (and win in enterprise as a whole), Microsoft is leveraging strengths in AI infrastructure and generative models. For instance, Azure AI powers Bing’s chatbot and other capabilities. Similarly, Bing is powering AI based search in Microsoft enterprise products.

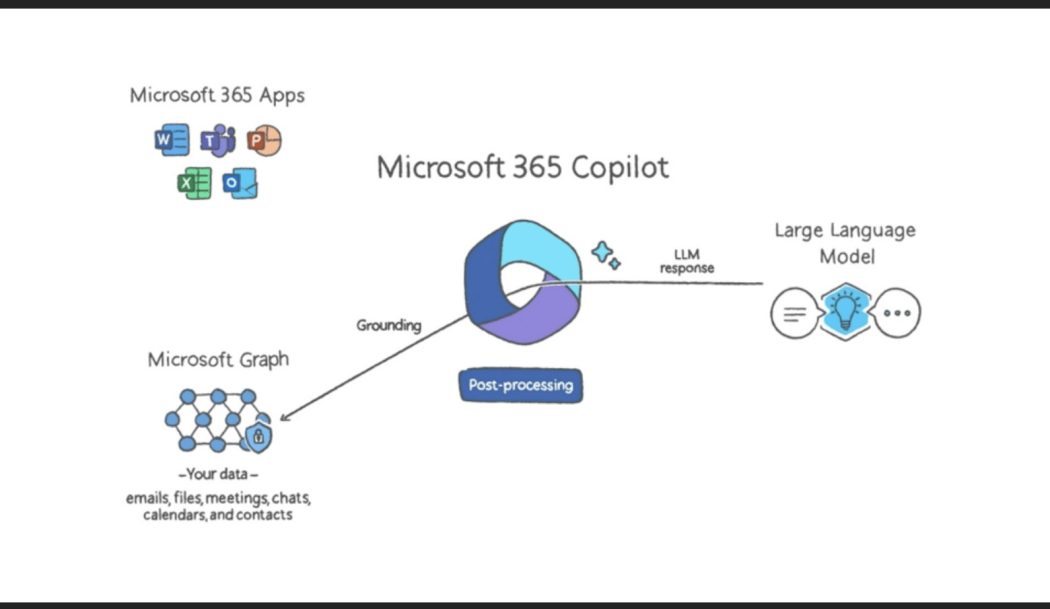

Management called out strong uptake of Azure AI services as enterprise AI integration rises. Microsoft’s unified AI platform spanning cloud and edge devices gives it an advantage as search shifts to the cloud (Q1 2024 Earnings Transcript). The applications have been utilized internally and by third party clients, not to mention additional training through open-source models. This adoption will accelerate on November 1st when Microsoft fully rolls out Office 365 Co-Pilot. These Co-Pilot searches will be powered (in any case with web data) by Bing. This will further erode Google’s market share.

Additionally, the powerful adoption of AI-infused offerings, like Copilot, underscore management’s efforts to tap into the next major wave of computing.

Satya Nadella, Microsoft’s CEO, added:

Our Copilot in shopping, people can find more tailored recommendations and better deals. We’re also expanding to new endpoints, bringing Bing to Meta’s AI chat experience in order to provide more up-to-date answers, as well as access to real-time search information. – Q1 2024 Earnings Transcript

As mentioned before, Microsoft 365 Copilot with AI enhances the search and discovery across Word, Outlook and other workplace apps, which is conveyed in the model below. These synergies demonstrate Microsoft’s AI-first approach. The below system will be adapted to add in internet search data as well.

Microsoft Co-Pilot System (PC Mag)

Imagine if an investment banker never had to search the internet again to get the growth rate statistics on a market he or she was modeling? Imagine if a knowledge worker (consulting, marketing, etc) never had to search Google again for a stat for their powerpoint. Rather, Co-Pilot (through Bing) just gave you the stat no questions asked. That’s the power of Bing with enterprise. The effects will be damaging for Google.

Outlook: Sustaining Search Momentum with Azure

In Fiscal Q1, Microsoft expects continued growth for search advertising ex-traffic acquisition costs as Bing engagement climbs. Azure revenue growth is forecasted to be stable sequentially. The key with Azure is that this cloud service (due to an AI integration) now will work as a top of funnel way to get more search on Bing. This will create a self-perpetuating cycle. All of Microsoft’s AI software tools in Azure are powered by Bing, meaning as Azure grows, Bing will too.

On this note, Microsoft CFO, Amy Hood, added:

Revenue will continue to be driven by Azure, which, as a reminder, can have quarterly variability primarily from our per-user business and from in-period revenue recognition, depending on the mix of contracts. In Azure, we expect revenue growth to be 26% to 27% in constant currency with an increasing contribution from AI. Growth continues to be driven by Azure consumption business, and we expect the trends from Q1 to continue into Q2. – Q1 2024 Earnings Transcript.

Bing’s chat-based interface and integration with Microsoft’s productivity stack provide differentiation as it battles Google. Microsoft’s search progress reflects durable momentum, not just a short-term ChatGPT boost.

I’d even argue ChatGPT has become as much a verb as someone saying “just Google it.” People are now (almost as likely to say) “Ask ChatGPT.” A lot of people don’t want to search, they simply just want the answer.

Risks

While Microsoft is making excellent strides and Bing is likely set to dominate going forward, Google will not ignore this. Critics to the Microsoft thesis will note that Google has been training their own AI suite for the latter part of 2 decades and is rolling out Project Magi, their response to the AI wave. However, I think Google risks becoming the next Kodak. Kodak had gotten much of the innovation in the digital camera and photo sharing trends correct, but failed to fully lean into it and embrace it as a company. That means they were stuck and too invested in their old processes, business models, and products in order to evolve. Google will have to do a drastic 180 change and an all hands on deck moment in order to adapt. A drastic 180 degree move will be costly, but necessary for the company. This could weigh on the stock price and bring unnecessary risk to an investor’s portfolio now, in my opinion.

The Big Takeaway: Sustaining Leadership Comes Down to Execution

Ultimately, Microsoft’s ability to grow its search business comes down to relentlessly improving search relevance, expanding content, and driving cloud-based adoption.

There’s still a long runway ahead in the generative AI space. But Microsoft’s unified AI approach and cloud-edge infrastructure position it well to innovate quickly.

If Microsoft can execute on search, through its other products, it can solidify leadership in the next frontier of search. But it will take consistent focus on delighting users and out-innovating Google. This quarter’s results suggest Microsoft is on the right path. If Microsoft keeps this strategy and execution up, the long run potential for the stock looks promising.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox is the Co-Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.