Summary:

- No matter how much you love Microsoft’s business, its high P/E and P/S multiples can be concerning.

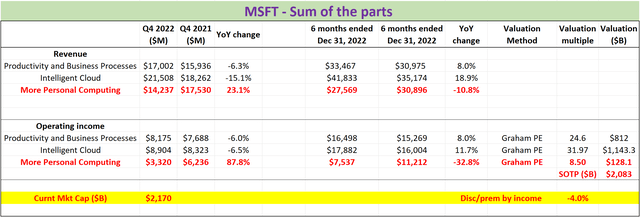

- However, a closer analysis via a sum of the parts (“SOTP”) shows the valuation multiples are not as high as on the surface.

- Its current market price is within 4% of its fair value. As such, the valuation risks are not as high as the P/E and P/S multiples suggest on the surface.

- In the meantime, Microsoft’s partnership with OpenAI has the potential to ignite a new wave of growth.

lcva2

Thesis

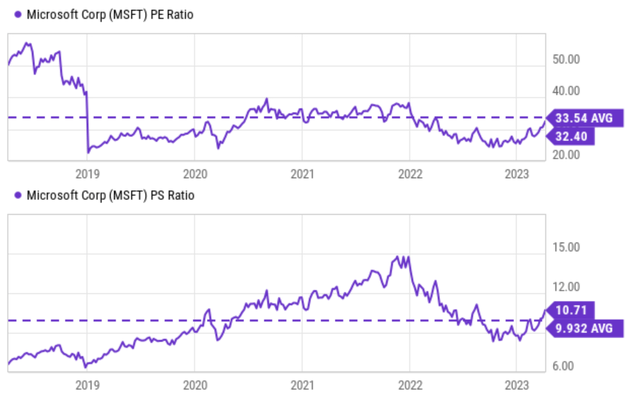

Microsoft (NASDAQ:MSFT) has been a frequent topic in our marketplace service, frequently inquired about by our members. And recently, the questions have been more or less centered on the concern of its high P/E and P/S multiples as shown in the chart below. And readers were wondering if it is time to sell the shares. Indeed, its P/E currently hovers around 32.4x as shown in the top panel, a quite elevated level in comparison to its own historical average and also the overall market valuation. In contrast, the S&P 500 is valued at about 22x P/E only. And its P/S ratio is even more elevated at 10.7x, not only higher than its historical average but also almost 5 times higher than the S&P 500’s 2.4x PS.

Under this context, the thesis here is to examine MSFT’s segments more closely. So that we can perform a sum of the parts (“SOTP”) analysis to gauge its valuation risks. You will see that SOTP results show that its market price is actually very close to its fair value (within about 4%). At the same time, MSFT keeps enjoying superb profitability and also is well-poised to capitalize on the new wave of growth to be ignited by the integration of OpenAI technologies. As such, my conclusion is that there is really no reason to sell at these multiples.

Part 1: Productivity and Business Processes

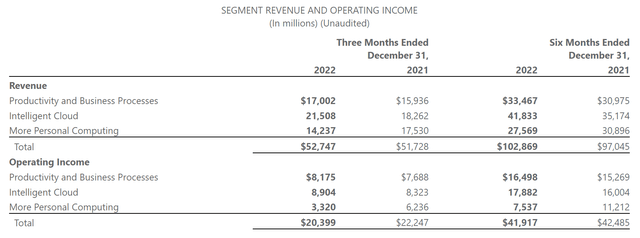

Since we will use a SOTP approach, let’s review its business segments first. The main parts of the MSFT business are summarized in the table below. As seen, they consist of 3 parts: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Next, we will examine these parts one by one.

Its first segment, the Productivity and Business Processes segment, suffered a YoY decline in the 4th quarter on both the top and bottom lines. More specifically, total revenues declined by 6.3% on a quarterly basis and operating income declined by 6.0%. The weakening global PC demand and seasonality is the main cause to blame. Once we look at the numbers on a six-month basis, the segment actually posted decent growth rates of 8.0% as seen.

Source: Author based on Seeking Alpha data

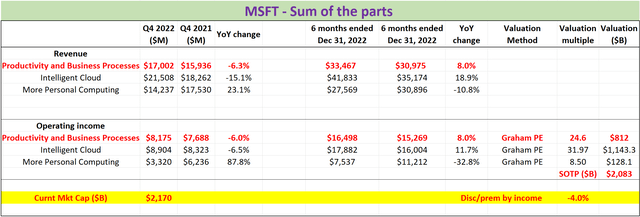

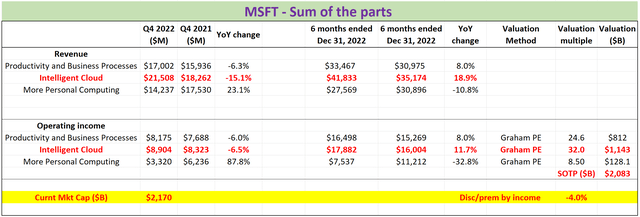

The remainder of the SOTP analyses is based on the so-called Graham P/E. Graham suggested that the fair P/E for a “defensive stock” should be around 8.5 plus twice the expected annual growth rate. And the Graham P/E should apply well to MSFT, one of the most established and defensive stocks.

Using this approach, you can see that its Productivity and Business Processes segment should be worth about 24.6x P/E based on the YOY growth rates of its operating income on a 6-month basis. And this P/E in turn leads to a valuation of $812B for this first segment.

Microsoft: Intelligent cloud

The next part is the Intelligent Cloud Segment (“ICS”). The ICS is not only the largest but also the segment that is projected to generate the highest growth going forward. The segment has suffered a speed bump in the last quarter also, suffering a decline of 15.1% in revenues and a decline of 6.5% in operating income. However, once we compute the growth rate on a 6-month basis to remove some of the seasonality (and the tough comparison for Q4 2021), the ICS indeed has generated the highest growth rates among all 3 segments on both lines. To wit, its total sales grew at an annual growth rate of 18.9%, and its operating income at 11.7%.

Applying the Graham P/E to this segment shows a multiple of 32x P/E, as seen in the chart below. And this P/E in turn leads to a valuation of $1,143B for the ICS.

Looking forward, Microsoft’s partnership with OpenAI has the potential to ignite the next frontier of growth. MSFT has made a sizable investment, around $10 billion, in OpenAI, the organization that launched ChatGPT (Chat Generative Pre-trained Transformer). The partnership has the potential to rival current search engines and create new monetization opportunities in the cloud space. As such, I am optimistic that the robust growth could continue and that the 32x P/E could be justified.

Source: Author based on Seeking Alpha data

Microsoft: More Personal Computing

The 3rd part is also the smallest segment, the More Personal Computing (“MPC”) segment. The MPC segment not only is the smallest one but also has the lowest operating margin. Its operating margin was around 27% based on the financials in the past 6 months, compared to 49% and 42% for the first two segments analyzed above.

At the same time, the MPC is also the one that is most sensitive to seasonality and also macroeconomic changes. Lately, the company has been dealing with issues like slowing demand for personal computers. And as a result, you can see the large YOY changes for this segment in the past few quarters. To wit, the segment’s total revenues declined YoY by 10.8% on a 6-month basis and operating income declined by 32.8%.

Due to its lower margin and negative growth rates, a Graham P/E of 8.5x is applied to this segment. In Graham’s view, this is the P/E for a terminally stagnating business. And this P/E puts the MPC segment at a valuation of $128B.

Source: Author based on Seeking Alpha data

Final results, risks, and conclusion

Based on the above analyses, it’s straightforward to add up the parts and arrive at a total valuation of $2.08 trillion for the whole company as shown in the table above. As of the time of this article, MSFT’s market valuation was at $2.17 trillion, only about 4% above the SOTP analysis.

I don’t see any structural risks to the business at this point. The issues mentioned above are all temporary and near-term in my view, such as the slowing demand for personal computers in the recent quarter, the slowing demand in the digital ad space, and also its need to lay off about 10k employees. A possible fundamental risk involves its ongoing acquisition of Activision.

Currently, the transaction faces a roadblock, a lawsuit filed by the Federal Trade Commission (“FTC”). The lawsuit challenges the $69 billion deal due to concerns of stifling competition in the game market. MSFT could make Activision’s games exclusive to its Xbox.

All told, I see the above risks to be either temporary or relatively minor under the overall scheme of things. The $69 billion acquisition, if fails, won’t negatively impact any of MSFT’s main segments (estimated to be worth more than $2 trillion) in any material way. As such, my final conclusion is that MSFT’s current market price is actually quite close to its fair value, and the valuation risks are not as high as the P/E and P/S multiples suggest on the surface.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.