Microsoft Fiscal Q4 2023 Quick Takes: Copiloting The AI Paradigm Shift

Summary:

- Microsoft Corporation exited fiscal Q4 2023 with an impressive double beat, with results underscoring the benefits of its first-mover advantage in the advent of mainstream demand for generative AI solutions.

- The results continue to bring to light Microsoft’s core bullish themes – namely, its market leadership in key software segments, and robust fundamental performance maintained by multiple growth drivers.

- And the emerging AI theme is expected to further reinforce the sustainability of Microsoft’s long-term growth and profitability trajectory.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) is up 47% this year, driven primarily by market optimism over its leadership in capitalizing on the emerging AI growth frontier. The stock is also a core contributor to the more than $5 trillion worth of gains in the tech-heavy Nasdaq 100-Index (NDX) gauge this year, underscoring market confidence in Microsoft’s mission-critical role in supporting the development and deployment of AI technology across the economy.

The software giant reported a double beat for the fiscal fourth quarter, with management staying optimistic over Microsoft’s roadmap for capitalizing on incremental AI opportunities entering fiscal 2024, underpinned by burgeoning interest in its expanding slate of related offerings across software and cloud. Looking ahead, we expect AI to remain a key focus area at Microsoft as the nascent technology represents a key driver of renewed high-margin sales growth over the longer term. This is already corroborated by meaningful margin expansion observed exiting F4Q23, and is expected to further bolster the durability of the stock’s valuation premium and compensate for transient macroeconomic-driven sensitivities in its core consumer-facing businesses (e.g., gaming, devices, advertising, consumer software).

AI in Software

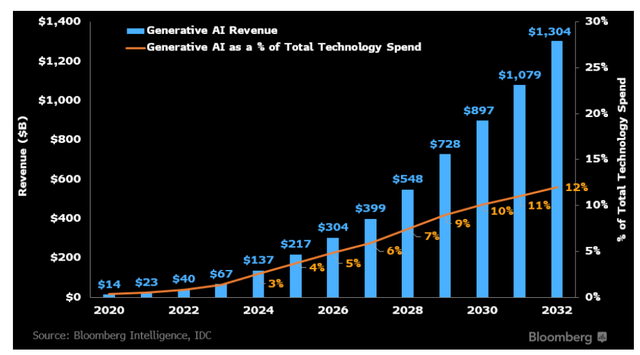

The advent of generative AI and burgeoning interest in ensuing applications such as conversational AI chatbots has unleashed a transformative change across the economy, leaving no industry untouched. It is no surprise now that the budding subfield of AI is expected to be a core driver of TAM expansion for Microsoft. Recent preliminary research on prospective demand for generative AI technology estimates a $1.3 trillion opportunity by 2032, representing expansion at a 45% 10-year CAGR. And Microsoft is poised to become a key beneficiary of the new growth frontier – not only because of its first-mover advantage in addressing consumer and enterprise demand for the technology, underpinned by its investment in OpenAI, but also because of the ensuing need for “infrastructure necessary to train AI systems,” referring specifically to Azure (discussed further in later sections).

The emerging tailwinds are corroborated by Microsoft’s outperformance existing fiscal 2023, and bolstered by management’s optimism over the nascent technology’s longer-term prospects heading into fiscal 2024 and beyond, despite the challenge of looming macroeconomic uncertainties.

Organizations are asking not only how – but how fast – they can apply this next generation of AI to address the biggest opportunities and challenges they face -safely and responsibly…We remain focused on leading the new AI platform shift, helping customers use the Microsoft Cloud to get the most value out of their digital spend, and driving operating leverage.

As discussed in detail in a previous coverage on the stock, Microsoft’s unmatched market leadership in key software segments, and its ability to maintain robust fundamental performance in defiance of the law of large numbers over the years, have been key drivers to its shares’ resilience through both risk-on and risk-off market climates. Despite the sprawling size of its business, alongside maturity and saturation in the adoption of its core productivity software, Microsoft’s commitment to diversifying its portfolio of growth drivers and addressing the ever-evolving technology needs of its end market users, have continued to reinforce investors’ confidence in its ability to generate a sustained long-term trajectory of profitable growth.

The company has maintained steady expansion at a double-digit CAGR in recent years through organic means alone across its core businesses that count Office 365, Azure and gaming, despite some post-pandemic wind-off in the demand environment, blighted by mounting macroeconomic uncertainties. And its latest outperformance – particularly in the productivity and business and intelligent cloud segments – underscores the prospects of generative AI integration across Microsoft’s core software offerings in reinforcing renewed growth at a similar breakneck pace in the coming years.

Specifically, Copilot – the generative AI assistant found across Microsoft’s suite of cloud-based software spanning cybersecurity, customer relationship management, productivity and coding tools – is emerging as the source of Microsoft’s next stage of growth. In addition to Copilot solutions across security, CRM, coding, and other productivity capacities (previously discussed in detail here), the latest introduction of Microsoft 365 Copilot incorporates generative AI across all of the Office apps:

- Copilot in Word: Copilot can save time and resources by providing initial drafts and real-time editing features beyond fixing grammar and typos to enhance the quality of written content. Copilot in Word is also capable of providing feedback on writing ideas, as well as other mechanical services such as paraphrasing, shortening and rewriting content.

- Copilot in PowerPoint: A text prompt to Copilot can be swiftly converted into a full PowerPoint presentation. The AI-enabled feature can build on “relevant content from [an existing] document.”

- Copilot in Excel: Copilot can help “analyze trends and create professional-looking data visualizations in seconds,” addressing productivity needs across most enterprise environments looking to optimize their cost structures.

- Copilot in Outlook: Copilot features include drafting, summarizing, and sorting emails, reducing work times allocated to clearing inboxes.

- Copilot in Teams: Copilot helps summarize meeting discussions, and lists and distributes action items to relevant meeting participants.

- Copilot in Power Platform: Copilot in Power Platform stands at the core of automation. The AI-enabled feature can transform an “idea to working app in minutes,” addressing increasing demand for hyper-automation across enterprise end markets.

- Business Chat and Copilot System: The feature consolidates data and apps across the organization to drive insights used in powering Microsoft 365 Copilot features. The combination of Microsoft 365 Copilot and Copilot System allows enterprise users to access generative AI capabilities and solutions catered to their specific needs without limitations to data access due to security concerns.

In the latest development, Microsoft has unveiled a higher-than-expected subscription price point for Microsoft 365 Copilot, underscoring robust demand and pricing power for the service. This is expected to drive a more evident positive impact on its financial results – particularly in Office Commercial products and cloud services, Microsoft Cloud, Office 365 Commercial, and Dynamics 365 revenue growth, which has stayed rangebound during the past two quarters – in the second half of calendar 2023, complementing our previous expectations for a second half weighted year.

The add-on offering – which amplifies the existing Microsoft 365 suite of productivity apps with generative AI capabilities – will cost an extra $30 per month per user on top of the $12.50 to $57 monthly rate that consumer and enterprise users already pay for base Microsoft 365 offerings. This compares to the $10 monthly rate charged for GitHub Copilot introduced in 2021, which uses generative AI to automate codes for the development of new programs. With a paid subscription base of close to 400 million for Microsoft 365, adjacent revenues stemming from Copilot take-rates are expected to drive a generous margin of growth for the software giant in the coming years.

Previous industry estimates based on an anticipated Microsoft 365 Copilot subscription pricing in line with the $10-range observed for GitHub Copilot had yielded “as much as $48 billion in extra annual revenue within the next four years” at Microsoft. But the latest pricing strategy disclosed underscores multiples of that figure once Microsoft 365 Copilot adoption accelerates following its public availability, which is in line with CFO Amy Hood’s recent optimism that the new AI products will become the company’s “fastest business to hit $10 billion.”

Just some back of the napkin math based on approximately 380 million Microsoft 365 subscribers, 100% adoption rate of Copilot would equate to an annualized incremental revenue opportunity of more than $136 billion. Admittedly, it will take some time for all active Microsoft 365 subscribers to become monetizable on the Copilot add-on option, but just a nominal 2% take-rate, which takes into additional consideration of potential customer discounts, could add more than $2 billion to annual Microsoft 365 revenue, underscoring significant future growth opportunities given the industry is still in the early innings of implementing their respective generative AI strategies.

And the prospects can be further corroborated by burgeoning IT spending intentions for generative AI solutions in the coming years. Generative AI is expected to grow from a nominal portion (< 3%) of corporate IT spending budgets to more than 10% by the end of the decade. And Microsoft’s tie-up with OpenAI is expected to remain a core competitive advantage, with GPT-4 currently recognized among software developers as the “most powerful” LLM in the market that is “least prone to hallucinations.”

With Microsoft 365 Copilot being an “enterprise ready AI” solution, Microsoft once again presents itself as being at the forefront of addressing demand across key software segments.

AI in Azure

Burgeoning interest in generative AI is poised to generate incremental demand for supporting infrastructure and computing capacity. Specifically, revenue opportunities stemming from demand for AI facilitating infrastructure alone is expected to top $380 billion by 2032, accounting for almost a third of the $1.3 trillion estimated IT spending relevant to the nascent technology over the next ten years. And Microsoft has kicked off capitalization of related opportunities to a strong start, thanks to its first mover advantage acquired through its prescient tie-up with OpenAI in 2019.

The introduction of OpenAI’s ChatGPT, which catapulted generative AI into mainstream adoption, is gradually narrowing the gap in market share between Azure and public cloud leader Amazon Web Services (AMZN). Specifically, Azure’s ability to provide its cloud customers with access to the GPT LLMs that power ChatGPT, alongside the reputation it has gained relevant to the emerging technology, has launched its longer-term growth prospects closer to rival AWS’ leadership, stemming previous industry concerns of a macro-driven slowdown in the near-term due to a cautious IT spending environment, saturation and increasing cloud spend optimization trends. In a recent sentiment check performed by RBC Capital Markets, Azure was highlighted as the “primary cloud vendor” at 38% of respondents amid an ongoing multi-cloud adoption trend, besting AWS’ 19% share, highlighting the incremental tailwinds stemming from generative AI in accelerating migrations to Microsoft’s solutions. This is in line with Azure’s resilient growth in the high 20% range exiting fiscal 2023 despite ongoing macroeconomic uncertainties and the ensuing impact on the broader enterprise IT spending environment, as well as management’s optimism for better capture of AI opportunities heading into fiscal 2024 as discussed in the earlier section.

In addition to bolstered penetration into enterprise cloud spend intentions, Azure’s lead in the provision of generative AI solutions and infrastructure support could further its share of related government opportunities. The cloud and software giant is currently one of three companies alongside AWS and Palantir (PLTR) with IL6 clearance from the Defense Information Systems Agency, addressing security requirements to provide nascent, yet critical, technology solutions for classified public agencies across the U.S. federal government, enabling deeper penetration across AI opportunities in government verticals. This is further corroborated by Microsoft’s latest provision of advanced LLM access for the U.S. government via Azure Government Cloud. Public agencies can now access the most advanced GPT-4 and its predecessor GPT-3 via Azure OpenAI Service on the Government Cloud, which is separate from the enterprise cloud, supporting various government endeavours ranging from defense to healthcare without compromising on data security concerns lingering around the training and use of generative AI technologies.

Pairing the expanding cloud TAM across both the private and public sectors unleashed by generative AI for Azure, with other industry tailwinds such as optimization and growing adoption of multi-cloud strategies as previously discussed, Microsoft’s cloud computing segment is expected to emerge as a clear growth and profit leader in the industry over the coming years. This is expected to complement investors’ optimism over Microsoft’s market leadership in key software segments, its robust fundamental performance corroborated by a sustained trajectory of growth and margin expansion, as well as its maintenance of multiple core growth drivers, as leading bullish themes for the stock.

Headwinds to Consider

AI tailwinds aside, Microsoft’s latest results continue to shed caution over near-term macroeconomic challenges to its consumer-centric More Personal Computing segment, which hosts its gaming, Windows, advertising and other devices sales. Specifically, the segment’s core Windows licensing revenue remains in declines exiting fiscal 2023, though improving meaningfully from the prior quarter, underscoring tepid demand still amid the uncertain consumption backdrop. Despite industry expectations for a recovery in the consumer electronics market – particularly smartphones and PCs – in the second half of the year, recent economic data points to a modest one.

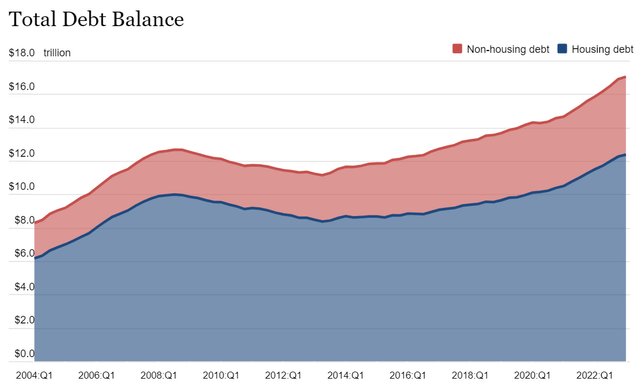

U.S. economic conditions remain on shaky grounds, with the combination of rising credit card debt, elevated borrowing costs, and persistent inflation weighing on consumption. Specifically, American household debt (including mortgage, auto, student, and other non-housing loans) are surging toward new records, with credit card borrowings staying elevated while delinquencies are also on the rise, implying net disposable income that is rapidly falling into the negatives.

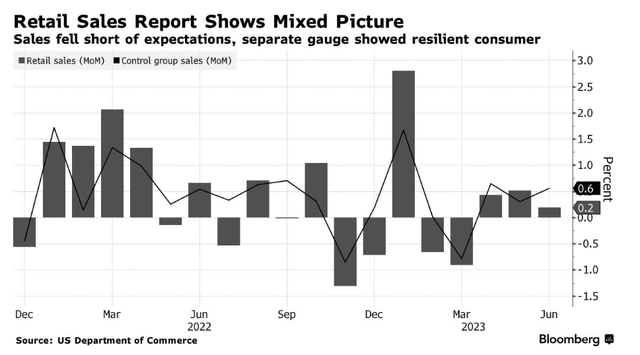

The restart of student loan payments coming October, following a multi-year moratorium announced during the pandemic, is expected to crimp consumption further by diminishing monthly disposable income by as much as $9 billion on a monthly basis or $100 billion on an annualized basis. This spells a bleak backdrop for the recovering PC market, which could lead to persistent modesty in MPC segment performance as transient macro headwinds continue to play out. This is consistent with the latest retail sales data, which showed only modest growth – particularly for consumer electronics – that underperformed consensus estimates, underscoring “growing signs of stress” in the consumer that could further complicate the MPC segment’s near-term prospects.

In addition to weakened demand for consumer electronics and supporting Windows licensing, similar headwinds are expected for Microsoft’s advertising business, given the industry’s inherently macro-sensitive nature. Both LinkedIn and search and news advertising revenue growth have decelerated to the single-digit percentage range during the June quarter, despite growing interest in the reimagined Bing search engine with ChatGPT functions. While the integration of generative AI capabilities into Bing Search has put the search engine and related advertising back on the map, the cautious ad spending environment amid low visibility into forward macroeconomic conditions remains a headwind to consider.

There are also uncertainties over Microsoft’s gaming aspirations, given ongoing regulatory hurdles on its proposed $69 billion acquisition of Activision Blizzard, Inc. (ATVI). Despite recent positive developments over addressing the antitrust concerns raised by regulators across Microsoft’s core operating regions spanning the UK and the U.S., uncertainties remain over the extent of which the anticipated growth synergies stemming from the business combination would be realized. Related news developments could also inject additional company-specific volatility on top of broader market-driven influences to the stock’s performance in the near term.

The Bottom Line

We had predicted earlier in the year for a tale of two halves at Microsoft in calendar 2023. And the company’s latest results underscore in line progress with optimism for continued resilience across both its top- and bottom-lines heading into fiscal 2024, supported by proven advancements in capturing the new growth frontier enabled by the AI paradigm shift. This taken together has reinforced Microsoft’s competitive advantage in sustaining its long-term growth and profitability trajectory – a key bullish thesis underpinning the stock’s prospects.

Under the currently uncertain macroeconomic climate, blighted by persistent inflation, surging borrowing costs, and impending recession risks, Microsoft’s resilience supported by robust AI demand and adequate expertise to address them, alongside its generous profit margins bolstered by a competitive first-mover advantage in addressing next-generation technology demands, are expected to remain value accretive factors for the stock over the longer-term. The latest results highlight AI, in particular, as a significant driver of Microsoft’s long-term investment thesis, considering how the emerging growth trend positively alters the scope of the tech giant’s TAM across both software and cloud going forward.

While the stock’s immediate post-earnings response was marked by slight declines contrary to Microsoft’s robust F4Q23 results, we expect the continued realization of longer-term AI market opportunities through its broad portfolio of mission-critical software and cloud offerings to remain value accretive, and drive incremental upside potential towards the highly coveted $3 trillion market cap threshold within the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!