Summary:

- Microsoft’s AI initiatives, including the availability of OpenAI’s GPT-4 in Azure, OpenAI Service and the introduction of Azure AI Studio can potentially drive significant growth and expand valuation multiples.

- The integration of NVIDIA’s AI Enterprise software into Azure Machine Learning provides customers with a wide range of AI frameworks and tools, strengthening Microsoft’s position in the market.

- Microsoft’s strong profitability and free cash flow profile, along with its AI advancements, position the company to maintain its leadership and capitalize on future AI opportunities.

da-kuk

Investment Thesis

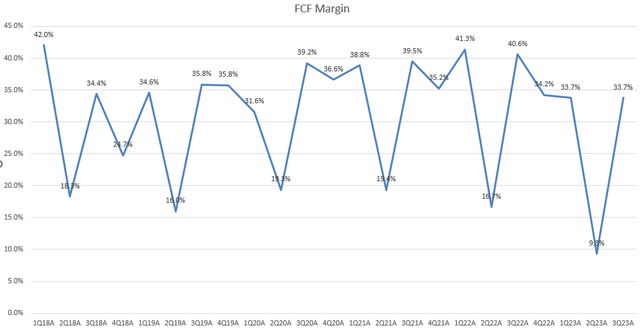

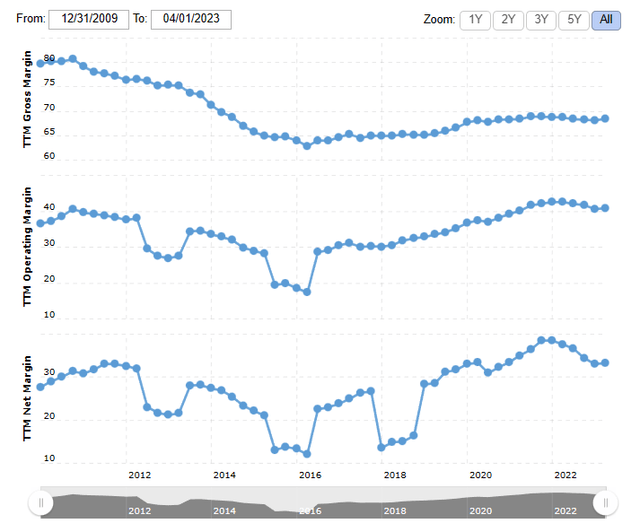

Microsoft (NASDAQ:MSFT), as a big tech company with a market dominance in many areas, has a strong AI strategy that covers the entire software industry. In 2023, they are making announcements along with other companies, showing that generative AI will have a significant impact on enterprise technology. This means it will make interactions easier, automate tasks, and foster greater creativity. I believe the company has many advantages such as data collection, scalability, financial strength, and a strong position in the enterprise market. For example, the company has consistently maintained 30% FCF margin and 40% operating margin on average in the past 3 years.

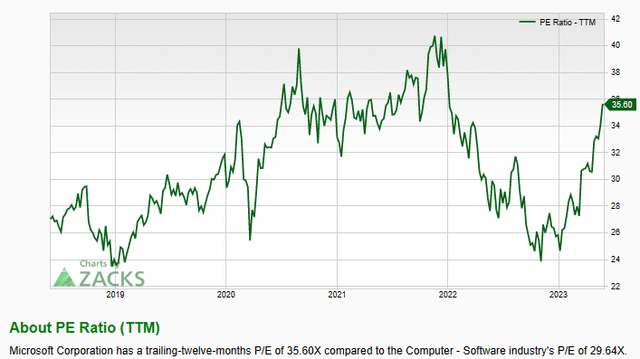

Although I think the valuation is somewhat stretched, trading at 36x P/E TTM, I remain bullish on the stock. I believe that a series of new AI initiatives will reignite the company’s growth potential and lead to an expansion in its valuation. I will discuss the recent announcements that contribute to my bullish view.

Developing AI Is Not Cheap

Since the debut of ChatGPT in November 2022, everyone is talking about AI right now. It seems like every company is eager to talk about their AI-related plans and how it will drive their stock growth, and then their stocks go up. However, they have to move fast. I believe companies with strong profitability and FCF profiles, such as MSFT, are well-positioned to sustain their presence in the game in the long term.

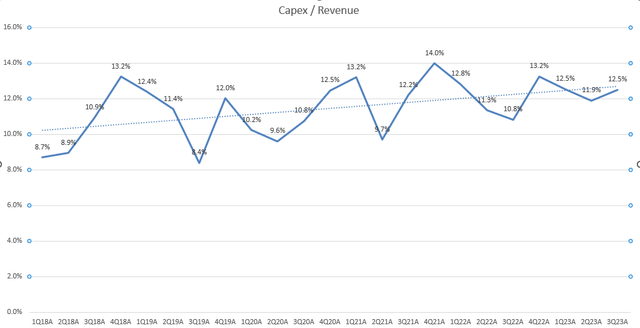

There’s a lot of hype around AI right now, in my opinion. I believe that there may be heavy capital expenditure (capex) associated with implementing AI, but it might not contribute much to total revenue in the near term. As shown in the tables, MSFT’s capex/revenue has been rising in the past four years, indicating increased investment in those growth opportunities, likely including generative AI. Moreover, MSFT’s FCF margin has been slightly declining YoY in 2Q FY2023, falling below the single-digit territory for the first time since 2018. However, I believe that AI will eventually lead to strong earnings and FCF growth in the long run, which is why I also think investors are willing to pay a higher price for it right now. However, we need to cautiously monitor these upfront costs.

Windows Copilot

On March 16th, Microsoft introduced Windows Copilot, a new feature that aims to make using our PC easier. According to the Windows Blogs, it’s being called the first PC platform to offer centralized AI assistance. With Windows Copilot, you’ll have a consistent taskbar across different programs, making it simpler to switch between them. You can even use plugins to enhance non-Microsoft apps. The CEO Satya Nadella stated:

“With our new copilot for work, we’re giving people more agency and making technology more accessible through the most universal interface – natural language.”

In addition, Windows revenue generates higher profit margins than Azure, which plays a significant role in supporting the company’s profitability. I believe that the recent updates introduced by MSFT will bring additional value to users, especially developers. The chart below clearly demonstrates that MSFT has been consistently maintaining healthy margins, with expansions in its operating margin and net profit margin since FY2018.

More Plugins

MSFT has announced plans to open its internal app development platform to third-party developers. This move is aimed at encouraging developers to create a majority of the copilots worldwide. The foundation of this platform is based on Language and Learning Models (LLMs), which are accessible through Azure OpenAI Service and Azure Machine Learning. Developers can utilize the recently open-sourced Semantic Kernel kit to integrate LLMs with programming languages and for orchestration. Once copilots are built, new plugin capabilities will enable them to interact with APIs of other software, making them more useful. The company considers plugins as the bridge connecting copilots with the broader digital world. These plugins will follow the open standard introduced by OpenAI and will also be accessible for Microsoft copilots in Bing Search, Microsoft 365, Windows, and Dynamics 365.

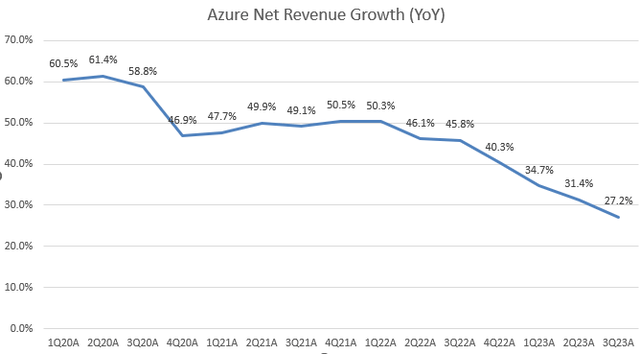

Azure

According to the article from the Microsoft website, OpenAI’s GPT-4 is now available for general use in Azure OpenAI Service. Developers can rely on Azure AI Studio to apply models like GPT-4 to their own data. The platform also supports plugins to connect with external data sources. Several new tools and features have been introduced, including Azure Machine Learning Prompt flow for easier prompt construction, Azure Cognitive Search for enterprise search applications, curated foundation models in Azure Machine Learning, and Azure AI Content Safety for content detection and assigning severity scores. Most of these features are currently in the preview stage.

In addition to these updates, NVIDIA (NVDA) has integrated its AI Enterprise software into Azure Machine Learning. This integration allows users to access over 100 AI frameworks, pre-trained models, and development tools on the platform. NVIDIA is also committed to providing high-performance GPUs for training and inference in Azure. Therefore, Azure plays an important role in Microsoft’s AI advancements, and the company expects significant benefits from the adoption of generative AI over time.

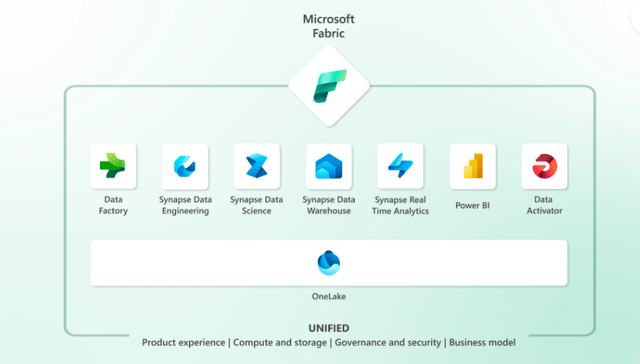

Microsoft Fabric

On May 23rd, Microsoft introduced Microsoft Fabric, a Software-as-a-Service (SAAS) solution that integrates its existing analytics products, including Data Factory, Synapse, Power BI, and Data Activator. The goal is to provide unified capacities to the fragmented data services found in organizations. By consolidating these, MSFT intends to simplify the integration and management process, reducing complexity and costs associated with using multiple vendors’ offerings.

The Fabric platform includes seven core workloads, covering various aspects such as data transformation, pipeline building, engineering, data science, warehousing, streaming, visualization, and monitoring. Customers will have the option to purchase universal compute credits that can be utilized across any service, providing greater flexibility and mitigating the risk of unused capacity. The company states,

“With this all-inclusive approach, customers can create solutions that leverage all workloads freely without any friction in their experience or commerce. The universal compute capacities significantly reduce costs, as any unused compute capacity in one workload can be utilized by any of the workloads.”

Customers have the ability to create their own conversational language experiences by combining Azure OpenAI Service models with their own data. They can then publish these creations, expanding the functionality of the Azure OpenAI Service. This allows customers to customize and personalize their conversational AI applications according to their specific needs, resulting in a more unique user experience.

Conclusion

In sum, MSFT’s AI initiatives, such as the availability of OpenAI’s GPT-4 in Azure OpenAI Service and the introduction of Azure AI Studio, are expected to significantly drive the company’s top-line growth potential and expand its valuation multiples. Therefore, it’s not surprising that its P/E multiple has been expanding since the start of the year. Furthermore, the integration of NVIDIA’s AI Enterprise software into Azure Machine Learning provides customers with a wide range of AI frameworks and tools. With these strengths, MSFT is poised to maintain its leadership and capitalize on the opportunities presented by AI in the future, especially considering the company’s strong profitability and free cash flow profile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.