Summary:

- Microsoft is the second-largest company in the world for a reason, as the company’s products and services are irreplaceable and enjoy sticky, fast-growing demand.

- The bundling strategy of Microsoft is notorious for its power to disable competitors and force customers to expand their relationships with Microsoft.

- Satya Nadella has mastered the company’s bundling power. Under his leadership, Microsoft’s stock became an eight-bagger as the company intensified its focus on subscription and cloud-based offerings.

- The company’s Q3-23 results showcased Microsoft’s strength, as Azure outperformed AWS by a significant margin, and search & advertising gained market share as well.

- Even after a 29.0% surge YTD, Microsoft still trades below my fair value estimate of $363.4 per share. Thus, I rate MSFT stock a Buy.

wdstock

Microsoft Corporation (NASDAQ:MSFT) is the second-largest company in the world for a reason. The company provides essential services and products for individuals and businesses in data, AI, search, advertising, networking, connectivity, cloud, infrastructure, security, gaming, and productivity. By leveraging its bundling power, Microsoft continues to take market share from giants like Amazon (AMZN) and Alphabet (GOOG) while it destroys smaller competitors like Zoom (ZM).

Led by Satya Nadella, Microsoft became an eight-bagger and still remains efficient and focused on its shareholders’ interest. I estimate the following years will be just as good, and rate the stock a Buy.

Introduction

Microsoft is the second-largest company in the world and provides indispensable tools to workers, learners, and businesses. The company’s bundling approach is based on its vast variety of solutions that are a necessity in modern life.

Led by Satya Nadella, arguably one of the best CEOs in history, Microsoft built a cloud-based empire on its way to becoming the second company to reach a $2Tn market cap, beating Alphabet to the punch.

While some argue Microsoft’s offerings are not the best among alternatives in each of their segments, the company’s value proposition as a relatively cheap and convenient one-stop-shop for enterprises and individuals is the main ingredient in Microsoft’s recipe for success.

Company Overview

Microsoft was founded in 1975 and employs 221,000 workers worldwide. The company aggregates its businesses under three reported segments: Productivity and Business Processes; More Personal Computing; and Intelligent Cloud.

The Productivity and Business Processes segment mainly consists of Office, which includes Excel, PowerPoint, Word, and Outlook, for commercial customers and individual consumers; Microsoft Viva, which is an employee experience platform that provides management solutions and insights; Office Security; LinkedIn, which is a professional social network upon which Microsoft provides talent and sales solutions, marketing, and premium subscriptions; and Dynamics 365, which is a set of cloud-based applications that mainly provide ERP and CRM solutions. Most of the segment’s revenues are derived through subscription-based arrangements, which provide a steady stream of recurring revenues.

Under More Personal Computing, Microsoft aggregates the Windows operating system; Devices, including the Microsoft Surface computer and PC accessories; Gaming, which consists of Xbox hardware and gaming content (both first and third party); and search and news advertising, which mainly includes revenues from the Bing search engine.

The Intelligent Cloud segment consists of server products and cloud services, including Azure, SQL Server, Nuance, and GitHub; and, enterprise services, which include support and consulting.

Overall, Microsoft participates in the following categories – Data & AI; Apps & infrastructure; Business applications; Cyber security; Professional networks; Digital & application development; Search, news, and advertising; Gaming; and Electronic devices.

Financial Overview

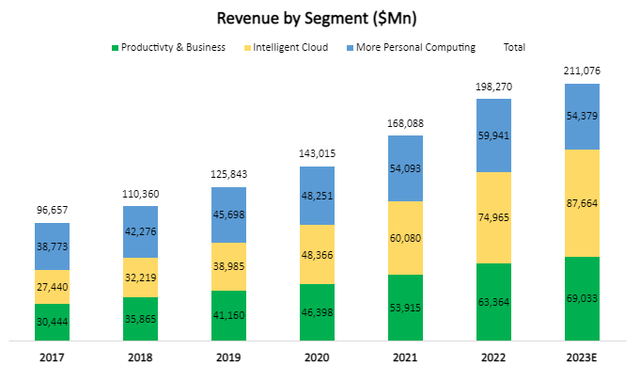

Created by the author using data from Microsoft’s financial reports (10-K); 2023 numbers are estimated based on Q1-Q3 actuals and management’s guidance for Q4.

As we can see, in 2020 Intelligent Cloud became the largest segment of Microsoft in terms of sales, led by growth in Azure, which we will discuss later. Overall, each and every segment have experienced sequential growth between 2017-2022, with CAGRs of 15.8% in Productivity & Business, 22.3% in Intelligent Cloud, and 9.1% in More Personal Computing. In 2023, growth is expected to continue in the two major segments. More Personal Computing is expected to decline by approximately 9.3% due to significant headwinds in devices, gaming, and Windows OEM, as a result of macroeconomic pressures and pulled-forward demand during the pandemic.

Microsoft Fiscal Q3-23 Earning Release

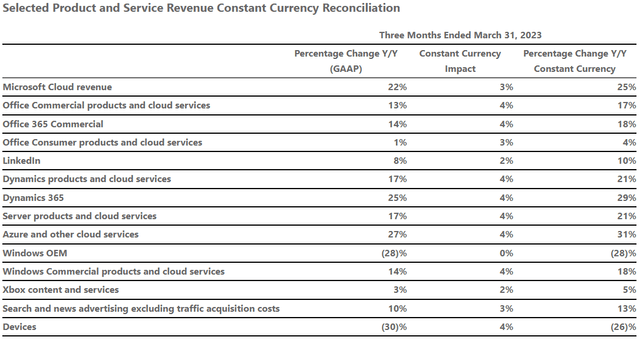

Looking at Q3-23 results broken into individual products and services, we can see that devices and Windows OEM are the only items that are experiencing declines, while most of the other products and services grew by double digits.

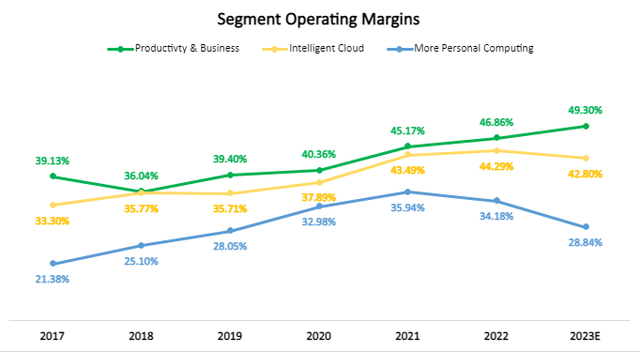

Created and calculated by the author using data from Microsoft’s financial reports (10-K); 2023 numbers are estimated based on Q1-Q3 actuals and management’s guidance for Q4.

According to current analysts’ consensus, Microsoft is expected to report a relatively small 1% EPS decline in FY23, as declines in More Personal Computing will be mostly offset by revenue growth in the other two segments, and by a margin expansion in Productivity & Business. All in all, we can see a clear upward trend with Microsoft’s margins, as the company remains efficient and disciplined while it continues to innovate and gain market share. Efficient innovation has been the constant theme under Satya Nadella’s leadership, which we will now discuss.

Satya Nadella’s Tenure

On February 2014, Satya Nadella was announced as the third CEO of Microsoft. Under Nadella’s leadership, Microsoft made its major transition to cloud computing and intensified the company’s focus on subscription-based services. During his tenure, Microsoft completed the acquisitions of Minecraft, LinkedIn, and GitHub, released Microsoft Teams, and built the OpenAI relationship.

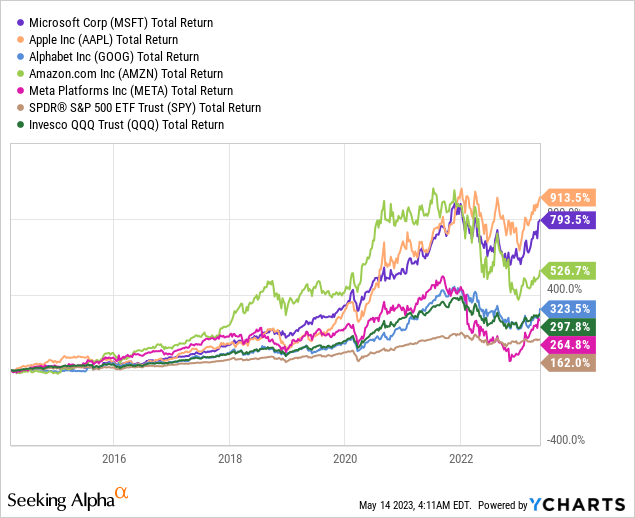

Generally, everything Satya Nadella has done was a success, leading Microsoft to handily beat all of its big-tech rivals except Apple, and outperform the S&P 500 (SPY) and the Nasdaq (QQQ) by a significant margin.

9 years since the announcement, Microsoft’s revenues increased 2.4X, EPS increased 3.6X, and the stock became an eight-bagger. I think it’s safe to say Satya Nadella did pretty well so far, and, he doesn’t sound like he’s slowing down either.

I strongly encourage investors to listen to his opening remarks during the last earnings call and see for themselves just how enthusiastic and knowledgeable he is regarding each and every segment of the Microsoft empire. And, very importantly, he puts significant focus on operational leverage, efficiencies, and his shareholders’ interest, unlike some of his peers.

The Bundling Power

We were all lured by a bundling campaign at least once in our life. Some simple examples are cable and phone; cars and improvements; flight tickets and hotel transportation; the list goes on and on.

But, the best way to illustrate Microsoft’s bundling power, in my view, is using a McDonald’s (MCD) meal deal. Imagine you arrive at the food court in your mall. Now let’s say the food court has a wide variety of options, some from unknown brands, some from better-known brands, and, there’s a McDonald’s.

Right at the beginning we all understand that McDonald’s recognizability will naturally position it as one of the top options. You know what you’re getting, and if you’re not feeling adventurous, you probably want to eat somewhere you trust.

So, you approach the counter and decide to order a Big Mac. Now, the person who’s taking your order asks you if you want a meal combo, that includes a drink and fries. That’s the McDonald’s “bundle”. Would you prefer to order just the Big Mac, and go get your fries from a specialty fries shop? Would you prefer to order just the Big Mac and go get a cheaper soda from the wholesaler that’s on the first floor?

Well, Microsoft is sort of the McDonald’s of cloud-based solutions. As enterprises and consumers seek a solution like Excel, it would make a lot of sense to bundle it with PowerPoint, Word, Teams, and Outlook, instead of turning to two or three different vendors. This is also true for the more complex parts of the business in security and infrastructure, as well as gaming and content.

Microsoft’s strategy dates back to the first days of the computer when Microsoft bundled its Windows operating system with its Internet Explorer browser and set technical restrictions on the abilities of PC manufacturers and users to uninstall the browser and use other programs. A more recent illustration of this strategy was demonstrated by Microsoft Teams, as the company leveraged its Office distribution and bundled it with Teams, leading competitors like Slack (CRM) to file legal complaints and Zoom to lose significant market share.

Putting aside the moral aspects of the bundling strategy or its fairness, I think it’s one of the strongest competitive advantages of Microsoft and in the market overall. The company provides essential solutions and leverages its market presence with existing solutions to continuously expand its offerings, creating a competition-crushing flywheel.

Taking Down Giants & Shooting At The Right Targets

With its large variety of businesses, Microsoft competes with many noteworthy competitors. In search and business applications, the main competitor is Google, with Google Workspace, and there are also smaller competitors like monday.com (MNDY) and Asana (ASAN); In cloud infrastructure, the main competitor is obviously Amazon with AWS, and Google Cloud as well; In gaming, there’s Sony (SONY); In devices, there’s Apple (AAPL), Dell (DELL), Logitech (LOGI) and many more; In networking, there’s Meta (META) and professional marketplaces like (FIVR); and in connectivity, we already discussed Slack and Zoom. The list goes on and on and on.

Competition is always a hurdle, but it’s not only competition. Playing in so many fields could quickly turn a successful company into a discombobulated inefficient organization, and cause management to lose sight of shareholder interest. My best example here would be Amazon, a company with amazing core businesses that spend billions of dollars on media, healthcare, and EVs, while investors see profits fade away.

With Microsoft, that is clearly not the case. Although there aren’t obvious synergies between gaming and LinkedIn, or between Office and search, Microsoft is able to leverage cross-selling and cost synergies to build profitable operations, and, most of the targets it is shooting at make sense within the company. Taking the Activision (ATVI) deal as an example, there’s a material difference between the lucrative video-game industry and the struggling media industry which Microsoft doesn’t participate in, unlike Google, Amazon, or Apple.

Cloud – Taking Market Share From Amazon

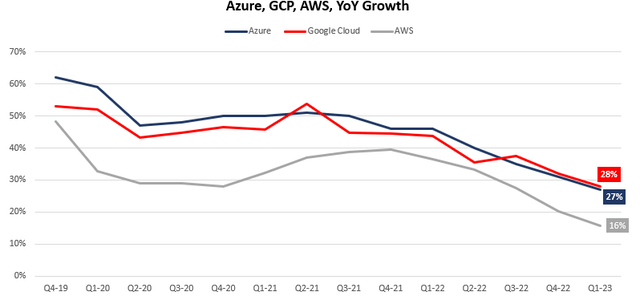

The three main players in cloud infrastructure are Microsoft with Azure, Amazon with AWS, and Google with Google Cloud. As of Q1-23, Amazon is still the largest in terms of sales, with $21.4B. Google Cloud is the smallest, with $7.5B, and Azure is estimated to be at around $14.5B.

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q1-23 is Microsoft’s fiscal Q3-23.

Naturally, due to its size, AWS is growing at the slowest pace. However, Q1-23 (Microsoft’s Q3-23) signaled a significant advantage for Azure, as Microsoft grew almost at par with Google, despite being almost twice as large. Moreover, during the last twelve months, Azure outperformed AWS not only in pace but also in terms of net dollars. In Q1-22, Azure’s sales were estimated at $11.4B, whereas AWS had revenues of $18.4B. By Q1-23, Azure grew by $3.1B, whereas AWS grew by $2.9B.

So, Microsoft is taking market share from Amazon, and this trend is expected to continue in Q2-23. The following are Microsoft’s expectations for the quarter:

In Azure, we expect revenue growth to be 26% to 27% in constant currency, including roughly 1 point from AI services.

— Amy Hood – Microsoft’s CFO, Fiscal Q3-23 Call

Whereas Amazon is seeing a much more significant slowdown:

In AWS, net sales were up 16% year-over-year. […] Given the ongoing economic uncertainty, customers of all sizes in all industries continue to look for cost savings across their businesses, similar to what you’ve seen us doing at Amazon. As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1“.

— Brian Olsavsky – Amazon’s CFO, Fiscal Q1-23 Call

Search – Taking Market Share From Google

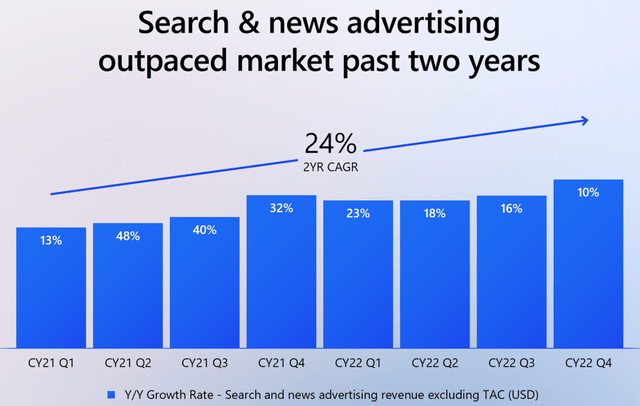

Let me begin with an important disclaimer – I have no doubt Google will remain the significant leader in search in terms of market share for the foreseeable future. However, this doesn’t mean Microsoft doesn’t have significant upside with its search business, as the company estimates that every 1 point of search advertising market share gained equals an incremental $2B in revenue. And so far, the company is on great pace.

Microsoft New AI-powered Bing and Edge Conference Presentation

The trend is continuing in Q1-23, as Microsoft’s search and news advertising grew by 10%, whereas Google Search has only grown by 1.3%, although it’s important to note that the latter is still significantly larger.

Search and news advertising revenue ex TAC increased 10% and 13% in constant currency, including 2 points from the Xandr acquisition. Results were driven by higher search volume with share gains again this quarter for our Edge browser globally and Bing in the U.S.

— Amy Hood – Microsoft’s CFO, Fiscal Q3-23 Call

Valuation

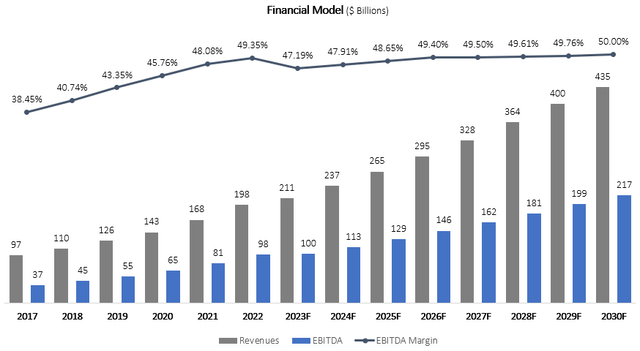

I used a discounted cash flow methodology to evaluate Microsoft’s fair value. I forecast the company will grow revenues at a 10.8% CAGR between 2023-2030, based on growth in the company’s core operations, continued market share gains in cloud, and growth acceleration in search, news, advertising, gaming, and devices. My projections are pretty much in line with the consensus but are significantly below Microsoft’s past 6-year CAGR of 14.9%.

I project EBITDA margins will increase incrementally up to 50.3% in 2030, as margins in Intelligent Cloud and More Personal Computing recover to their historical averages.

Overall, my assumptions result in EBITDA growth slightly above revenue growth, reflecting operational leverage and recovery in segments that are experiencing temporary headwinds like ads and gaming.

Created and calculated by the author based on data from Microsoft’s financial reports and the author’s projections

Taking a WACC of 7.6%, I estimate Microsoft’s fair value at $363.4 per share, which represents a 17.6% upside compared to the market price at the time of writing. This valuation reflects a forward P/E multiple of 32.6 based on my EPS projection for 2024, which is in line with the current multiple Microsoft trades at, and slightly above its 5-year average.

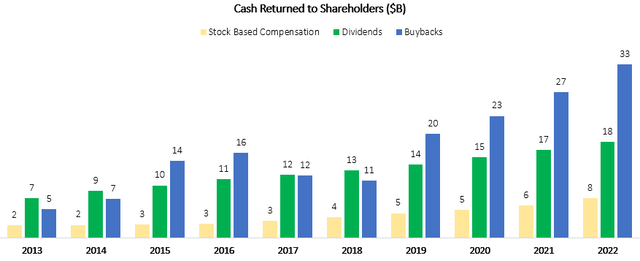

Dividends & Buybacks

Microsoft is a natural constituent in dividend growth portfolios. The company has raised its dividend for 18 consecutive years and has bought back 11% of its shares outstanding since June 2013.

Created and calculated by the author using data from Seeking Alpha

Between 2013-2022, the company increased its dividend at an 11.4% CAGR and returned a cumulative $252B to shareholders, net of stock-based compensation. At the beginning of 2013, Microsoft’s market cap amounted to approximately $225B. So in essence, if you bought the stock around January 1st, 2013, you would have gotten 112% of your investment via cash returns from the company alone.

Risks

This is a tricky one. Microsoft has a net cash position of $56B, so there’s no leverage risk here. Additionally, Microsoft’s positioning with its core businesses is arguably unbreakable, which means a major deterioration in its results is also a low probability.

That leaves us with the only real risk I can think of, which is valuation. Microsoft is currently trading approximately 10% above its 5-year average multiple, after a 29.0% surge YTD. Although I think Microsoft’s existing operations more than justify the current valuation (as can be understood by the limited attention I gave to AI in the article), I believe that there are significant expectations from the company to deliver on the AI front, as well as continue to grow at a high pace in cloud and gain market share.

We’re already seeing regulatory pressures regarding AI, with countries like Italy going as far as suspending ChatGPT for a few days. Moreover, we can see that Google is shifting gears after an embarrassing beginning with Bard. In my view, ChatGPT created a great buzz, and there’s potential for some share gains in search, but the real upside of AI will come with the Copilot, as Microsoft integrates it into Office and Azure, building an even stronger competitive advantage. So, overall, I can’t say the stock is extremely undervalued, which means there’s always the risk of a downturn. However, over the long term, I strongly believe that current expectations are more than achievable for the company.

Another point we need to address is the Activision acquisition. As it currently stands, the $69B acquisition is expected to get approval from the EU, was blocked in the UK, and is still in discussion in the U.S. As I’m not a legal expert, I’m not going to bet on whether the deal gets made or not. However, I will address the business implications. First, if the deal does get blocked, Microsoft will have to pay an immaterial $3B amount as compensation to Activision. Besides that, the company’s current gaming businesses shouldn’t be affected. The real impact here is that Microsoft won’t be able to leverage the Activision portfolio to enhance its gaming presence, and it won’t enjoy the accretive profits which it could have generated if the deal happened to close. The consequence will probably be enhanced buybacks and larger dividend growth, as the company built a significant net cash position in preparation for the deal. So, not that worrisome for shareholders, some might argue even beneficial.

Conclusion

In my view, Microsoft is a must-have in every long-term portfolio. Microsoft’s solutions are irreplaceable, with sticky and fast-growing demand. Led by Satya Nadella, the company is profitably conquering more and more market share in many parts of its business and efficiently innovates despite its size. Thus, I rate Microsoft stock a Buy, with a price target of $363.4 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.