Summary:

- The article discusses Microsoft’s FQ2 2023 and Alphabet’s full-year 2022 earnings, cash flows and recent events. I highlight the most important pillars in the two companies’ economic moats.

- I will present my estimates for Microsoft’s and Alphabet’s actual free cash flow and critically discuss stock-based compensation expenses.

- I will perform discounted cash flow-based valuation analyses that make sense of current stock prices and provide an understanding of what is currently being discounted.

- In addition, I present sensitivity analyses to get a good understanding of what should happen to valuations if cash flow forecasts deviate upward or, heaven forbid, downward.

DNY59

Introduction

It’s undeniable that both Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) occupy a significant part of our daily lives and routines.

Take a look at your smartphone (assuming you don’t own an iPhone), open a Google search or watch a YouTube video, and you’ll quickly understand why Alphabet has a wide economic moat. The company is a technological leader in machine learning, offering cutting-edge technology “for free” to end users, benefits from significant network effects, and has built a huge advertising-focused ecosystem. Many other “bets”, as Alphabet likes to call them, are not widely known but could represent the next home run for the $1.3 trillion company.

Similarly, turn on your computer (assuming you don’t have a Mac), and you open the door to Microsoft’s vast ecosystem. It starts with the Windows operating system, but it doesn’t end with the Office suite or LinkedIn’s market-leading recruiting and networking offerings. MSFT’s rapidly growing cloud offerings, which enable smooth and incremental adoption, are certainly the future growth driver, as I’ll explain. Since Nadella took the helm in 2014, much has changed for the better at Microsoft, and there seems to be no stopping the nearly $1.9 trillion company.

In this article, I will give my opinion on the recent results of the two giants – Microsoft already reported its second quarter results last week, on January 24, while Alphabet released its full-year figures only yesterday. I will present my estimates for Microsoft’s and Alphabet’s actual free cash flow and critically discuss stock-based compensation expenses. I will also outline what investors are currently pricing into the two stocks, from the perspective of a conservative, dyed-in-the-wool value investor.

Microsoft – FQ2 2023 Earnings Recap And Full-Year Expectations

Microsoft reported solid earnings for the second quarter of fiscal 2023 (which ended Dec. 31, 2022), largely in line with consensus expectations, against the backdrop of a weakening economy and coming out of the pandemic. In most of the past four years, the company has far exceeded analysts’ estimates and missed expectations only once, when it announced fiscal 2022 results. Earnings surprises have been declining since the second quarter of 2020 (Figure 1), and analysts have also lowered their short- and long-term expectations. For a value investor who prefers to invest on the basis of tangible current cash flows rather than overly rosy growth forecasts, this is a welcome development.

Figure 1: Microsoft [MSFT] earnings surprise in percent (obtained from Seeking Alpha’s stock quote page – earnings tab)![Microsoft [MSFT] earnings surprise in percent](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754248882246954.png)

Taking a step back and looking at the far less easily managed revenue (compared to earnings per share), Microsoft reported $52.75 billion for the quarter, slightly below the consensus estimate, with double-digit declines in its More Personal Computing (MPC) segment, more than offset by growth in its Productivity and Business Processes (PBP) and Intelligent Cloud (IC) segments.

Revenue in the PBP segment grew by 7%, mainly due to the solid performance of Office 365. At constant exchange rates, growth would have been quite stable compared to previous quarters, but I consider exchange rate fluctuations a cost of doing business in the case of Microsoft (and Alphabet) – two companies that offer their solutions globally.

While Office 365 Commercial revenue was up 11%, Office Commercial revenue was down 30% – Microsoft is doing a good job of migrating users to subscription-based offerings, showing the strength of its economic moat. It’s no exaggeration that Microsoft Office is a de facto monopoly, with an ever-growing feature set and strong network effects. Anyone who works at a financial institution or in a laboratory environment is familiar with the numerous external functions that take advantage of Microsoft Excel’s functionalities, such as those offered by SAP (SAP), FactSet (FDS) and Bloomberg. Otherwise more or less tedious database queries are greatly simplified with such plug-ins. Also due to the fact that Microsoft offers the latest and greatest functions increasingly only to subscribers of the Office 365 suite, the purchase of permanent licenses is becoming less and less interesting.

While Office accounts for about a quarter of Microsoft’s current revenue, LinkedIn and Microsoft’s enterprise resource planning (ERP) suite Dynamics and Dynamics 365 account for the remainder of the PBP segment’s $17 billion in quarterly revenue (32% of total revenue). LinkedIn, with its more than 600 million users, is undoubtedly the most important professional networking and recruiting tool, underscored by solid revenue growth of 10% in the second quarter. Dynamics faces significant competition from other established ERP vendors such as SAP, Salesforce (CRM) and Oracle (ORCL), but also grew 13% in the second quarter. I believe it will be difficult to quickly develop Dynamics into a widely trusted and accepted solution, given how deeply ERP software is ingrained in companies. However, Microsoft’s very extensive ecosystem should make it relatively easy to build trust with ERP managers over the long term. Offering solutions to “try on” should build trust and help to gradually take market share from the competition.

IC segment revenue grew 20% year-over-year in Q2, and the slowdown is visible on both a GAAP and constant currency basis. However, considering the quarterly revenue of $21.5 billion (41% of total revenue), 20% growth is certainly spectacular. The growth is mainly due to Azure and other cloud services, and to a lesser extent enterprise services, while server product revenue declined slightly. Using Office as an example, it is easy to understand Microsoft’s moat and pricing power also in this context, as most users choose not to use free and open source software that works well and is supported. In the case of server software, this is less visible to the end user, but even here, free and well-supported solutions (based on Linux) are not used as broadly as paid Windows Server solutions.

Nevertheless, cloud-based solutions are the growth driver of the future, and Microsoft is doing a great job of driving demand for hybrid solutions, making it very easy for customers to adopt cloud-based services incrementally via Azure. The gradual move to Infrastructure or even Platform as a Service will help many customers who have already built trust in Microsoft’s more traditional products overcome a variety of hurdles and save big one-time expenses. The lock-in potential is huge, but of course it’s important to remember that Microsoft is competing with Amazon’s (AMZN) Web Services (AWS) and also Google’s Compute Platform. In this context, I believe Microsoft has a solid advantage due to its presence on most computers and the trust and popularity that comes with it. Also, the recent announcement by Microsoft and OpenAI to expand their partnership makes me even more confident that IC is Microsoft’s growth engine. Microsoft is the exclusive cloud provider of OpenAI, and Azure’s OpenAI service was recently made generally available. ChatGPT support will follow shortly, as Nadella explained on the earnings call.

Finally, MPC segment revenue fell 19% year-over-year to $14.2 billion (27% of total revenue). This decline, shocking at first glance, is quite understandable given the pandemic-related increase in demand for hardware and, consequently, Windows OEM licenses. Nonetheless, the segment is an important factor strengthening the company’s moat – after all, most PCs run Windows. Of course, Apple’s PC operating system has its fans and the company boasts a solid user base, but Windows is – by far – the dominant player. As an aside, the MPC segment also includes gaming revenues, so Activision Blizzard (ATVI) will be consolidated into that segment if the acquisition goes through. With revenues of $9 billion and free cash flow of $1.5 billion, adjusted for stock-based compensation (2021 figures), ATVI is certainly no small player and will likely bolster Microsoft’s presence in this space. The $69 billion transaction value is undoubtedly substantial, but certainly easy to digest given Microsoft’s cash and short-term investments of nearly $100 billion at the end of Q2 2023.

On the SG&A front, Microsoft reported an increase in spending of about $1 billion, largely due to the decision to eliminate about 10,000 positions and pay related severance. The decrease represents about 5% of the total workforce of 221,000 employees at the end of FY2022 (p. 8, fiscal 2022 10-K). This data, along with Alphabet’s (see below), confirms that even the unstoppable tech giants are feeling the need to cut costs in a more challenging economic environment and (in Alphabet’s case) due to disproportionately high personnel costs.

On a consolidated basis, revenue was up 2% year over year, and for the full year, analysts expect Microsoft to grow revenue by 5% – things clearly seem to be slowing down, at least temporarily (Figure 2). Cash flow from operations declined 23% year-over-year, primarily due to higher cash expenses, working capital effects, and changes in unearned revenue. Stock-based compensation was approximately $600 million (or 34%) higher year-over-year, likely and largely due to employee terminations.

Figure 2: Microsoft’s [MSFT] full-year revenue and year-over-year growth rates (own work, based on the company’s fiscal 2016 to fiscal 2022 10-Ks and the consensus estimate according to Seeking Alpha)![Microsoft's [MSFT] full-year revenue and year-over-year growth rates](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754249171148229.png)

My regular readers know that I adjust free cash flow (FCF) for stock-based compensation expense (see discussion below) and normalize FCF for working capital movements (“normalized free cash flow” – nFCF). Microsoft’s nFCF is expected to decline somewhat in fiscal 2023 due to the impact of working capital and higher stock-based compensation expense, and investors can likely expect the company to generate $55 billion (Figure 3), representing a current nFCF yield of approximately 3%.

Figure 3: Microsoft [MSFT] – comparison of conventionally obtained free cash flow and normalized free cash flow (own work, based on the company’s fiscal 2016 to fiscal 2022 10-Ks, the FQ2 2023 10-Q and own estimates)![Microsoft [MSFT] - comparison of conventionally obtained free cash flow and normalized free cash flow](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754249627160256.png)

Alphabet – Full-Year 2022 Earnings Recap

Alphabet reported its full-year 2022 results on February 02, 2023. Year-over-year revenue growth of 10% was solid and in line with consensus. The deceleration of revenue growth is understandable given the unsustainably large boost due to the pandemic and less enthusiastic advertising action (Figure 1).

Figure 4: Historical revenue of Alphabet [GOOG, GOOGL] and year-over-year growth rates (own work, based on the company’s 2015 to 2021 10-Ks and the full-year 2022 earnings release published on Feb. 2, 2023)![Historical revenue of Alphabet [GOOG, GOOGL] and year-over-year growth rates](https://static.seekingalpha.com/uploads/2023/2/3/49694823-1675425005330992.png)

Full-year diluted earnings per share (EPS) were $4.56, down 19% year-over-year on a GAAP basis. The company is obviously feeling the impact of the strong dollar, as evidenced, for example, by a 3, 3, 5 and 6 percentage point difference in revenue growth in Q1, Q2, Q3 and Q4 2022, respectively. GAAP operating margin was 26% in 2022, down five percentage points year-over-year, but Alphabet is finally listening and starting to reduce its disproportionate cost base – employee costs are by far the company’s largest expense. During the company’s third quarter earnings conference call, CFO Porat announced that Alphabet will slow the pace of hiring in 2023. That’s hardly surprising, considering Alphabet’s workforce has grown from an already sizable 156.5k at the end of 2021 to over 190k at the end of 2022 – an increase of nearly 22%, in a year marked by anything but a rosy economic outlook. So I wouldn’t call it a surprising update, but on January 20, 2023, CEO Pichai announced a workforce reduction of about 12,000 positions, or more than 6% of the workforce.

However, Alphabet also found another way to strengthen its operating margin – in the press release, the company announced a change in the estimated useful life of its servers and certain networking equipment to six years. Doing so will reduce depreciation for 2023 by about $3.4 billion, and applying these “cost savings” to the 2022 numbers would improve operating margin by 120 basis points. As an aside, I noticed that troubled Intel (INTC) also announced that it has increased the estimated useful life of certain production machinery and equipment from five to eight years (sic! – p. 4, 2022 earnings release). Although the changes were almost certainly coordinated with Alphabet’s and Intel’s auditor, I still leave the conclusion to the reader.

The change in depreciation of already acquired assets does not change cash flow, of course, apart from tax effects. Alphabet’s operating cash flow was flat year-over-year, but due to significantly higher capital expenditures, free cash flow was $60 billion, or 10% below 2021. Normalizing FCF for working capital movements and, importantly, adjusting for stock-based compensation, Alphabet generated 32% less cash for its shareholders than a year ago. Stock-based compensation increased 26% year-over-year to a staggering $19.4 billion. Those who remember my earlier analysis of Alphabet may recall that I did not adjust FCF for stock-based compensation, but rather for net payments related to stock-based award activities. In this article, I used conventional stock-based compensation for comparability with Microsoft, although this is a somewhat more conservative approach (see next section for a detailed discussion).

Figure 5 shows the same cash flow comparison as for Microsoft and highlights the significant impact of stock-based compensation. Free cash flow on a normalized basis peaked in 2021, and it will likely take some time to recover given the lagging effects due to severance payments, slower growth given weaker advertising spending, and higher investments in AI and other cloud-based growth projects.

Figure 5: Alphabet [GOOG, GOOGL] – comparison of conventionally obtained free cash flow and normalized free cash flow (own work, based on the company’s 2015 to 2021 10-Ks, the full-year 2022 earnings release published on Feb. 2, 2023, and own estimates)![Alphabet [GOOG, GOOGL] - comparison of conventionally obtained free cash flow and normalized free cash flow](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754250357190914.png)

Google Services Results

In terms of segment results, Google advertising saw a 3.6% decline in revenue compared to the same quarter last year (YouTube ads -7.8%, Google network -8.9%, Search etc. -1.6%). With quarterly revenue of $42.6 billion, Google Search is Alphabet’s top revenue driver (56% of total revenue in Q4). With a market share of over 80%, Google undoubtedly dominates online search. Similarly, it dominates web browsing via Chrome with a 65% market share.

I occasionally compare Google’s search results with those of its competitors (especially Bing and Yahoo). The quality of Google’s results (including image search and reverse image search) never ceases to amaze me – as does the way Google connects its various service offerings like Maps, YouTube, Play Store, Finance, etc. Rightly, Google Search is the got-to avenue for advertisers. In this context, it is also worth mentioning Google’s DoubleClick platform, a programmatic service that enables the purchase of, for example, ad impressions in advance.

Similar to Microsoft Windows for stationary PCs and laptops, Android powers most mobile devices. Through its Android franchise, Google captures a significant portion of the mobile search market. It benefits from network effects through the Play Store, and of course the linking of mobile search results with other service offerings is very elegantly implemented.

Google collects a lot of data and is extremely adept at this task. More importantly, the company is constantly inventing new ways to draw conclusions from the data it collects, ultimately resulting in new ways of monetization.

YouTube ads contribute about 10% of Alphabet’s revenue. Growth has been somewhat disappointing, but that seems reasonable coming out of the pandemic. Personally, I’ve noticed that Google has been much more aggressive with YouTube ads lately. Ad revenue should pick up in the future, and I think Alphabet can position itself even more aggressively given its prime position with content creators and with YouTube being the go-to service.

While I don’t think the lock-in effects are as strong as in Microsoft’s ecosystem, they still shouldn’t be underestimated. The sheer size of Google’s network (not necessarily in terms of usage, but in terms of user base and data volume) seems impossible to replicate, so I doubt Google’s position with advertisers can change much.

The U.S. Department of Justice is likely similarly “excited” about Google’s status with advertisers, having filed a second antitrust lawsuit to break up the ad business. While investors’ fears are justified in principle, in reality such a breakup is likely to be difficult and will, in the worst case, lead to a spin-off. But admittedly, many of the things we have become accustomed to would either slow down, lose quality, or become unavailable. It’s not a nice thing to move down a rung on the technological ladder.

Google Cloud Results And Other Bets

Quarterly cloud revenue increased 32% to $7.3 billion, or 9.6% of total quarterly revenue. The segment is still losing money, but I wouldn’t underestimate Alphabet’s cloud offerings at all. Granted, Amazon and in particular Microsoft are the leaders in this segment, but the network effect of Google’s already quite diverse offerings strikes me as significant. The technological expertise of Google’s software engineers (particularly in machine learning algorithms) is well known, so it is only reasonable to expect further features in its cloud platform that will prove useful to a wide range of businesses. Of course, this assumes that Google is able to continue to retain and attract talent.

Other Bets generated quarterly revenue of $226 million and, with a quarterly operating loss of $1.6 billion, obviously remains a money pit. Currently, Alphabet is exploring smart home technology (Nest), improved Internet access (Fiber), self-driving cars (Waymo), improving health (Verily), and even “curing” aging (Calico). Many of these “bets” are visionary and could give Alphabet a first-mover advantage. However, the cash burn of this segment should be kept in mind as it impacts Alphabet’s overall profitability. Nevertheless, as cost savings and efficiency improvements have finally become a management priority, I doubt we will see overly aggressive spending in this segment going forward.

A Word On Stock-Based Compensation Expense

In principle, stock-based compensation is a wonderful way to align the interests of management and employees with those of common shareholders, provided the vesting periods are long enough. In this context, it is worth noting Alphabet’s CEO Pichai’s recently announced new compensation package. An increasing portion of the package consists of performance stock units (PSUs, i.e., 60% instead of the previous 43%), which are tied to an also increased performance requirement. Pichai was granted two tranches of PSUs worth $63 million, which vest based on shareholder returns achieved over the next two and three years, respectively.

While the sheer size of the compensation package is open to critical debate, that is not something I want to go into in this article. What I do want to emphasize is the importance of considering SBC in determining free cash flow – the basis of a discounted cash flow valuation (see next section). Some argue that SBC expense is a non-cash expense and therefore rightly added back to net income when calculating operating cash flow. However, at some point, shares must be repurchased with cash to offset the dilution from exercised stock options. I routinely deduct SBC from free cash flow to account for future repurchase costs. Of course, this is not entirely correct from an accounting perspective, but I’d rather be approximately right than exactly wrong, to paraphrase physicist Enrico Fermi.

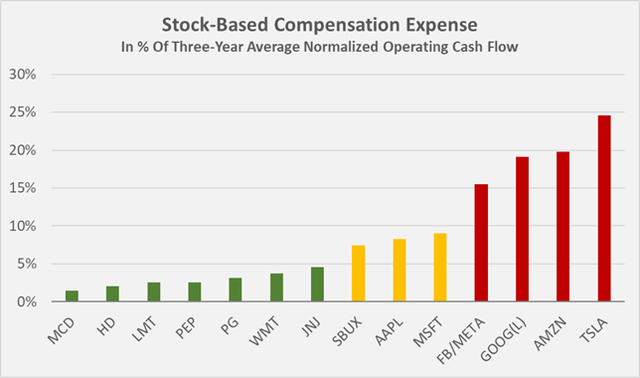

When comparing Microsoft and Alphabet, the sheer difference in SBC as a percentage of operating cash flow (normalized relative to working capital movements, nOCF) becomes clear. Alphabet is “right up there” with other tech giants Meta Platforms (META), Amazon and, of course, Tesla (TSLA). On average, the four companies allocate 20% of their nOCF to SBC. Microsoft’s SBC is similar to Apple’s (AAPL) and Starbucks’ (SBUX), at about 8% and 9% of nOCF, respectively. Other well-known companies such as Johnson & Johnson (JNJ), The Home Depot (HD), Lockheed Martin (LMT), and PepsiCo (PEP), which I have covered more or less recently, have fairly modest stock-based compensation (Figure 6).

Figure 6: Stock-based compensation at selected companies, in percent of three-year average normalized operating cash flow (own work, based on the respective company’s most recent 10-K)

The magnitude of SBC at Alphabet, and to a lesser extent at Microsoft, also becomes clear when comparing cash spent on share buybacks over the past six (fiscal) years with the decline in the weighted average number of shares outstanding. Alphabet and Microsoft spent $119 billion and $133 billion, respectively, on buybacks, while shares outstanding declined by only 2.2% and 5.9%, respectively. The difference becomes even more interesting when considering that Alphabet spent an amount on buybacks equivalent to about 9% of its current market cap, or 7% in the case of Microsoft. Of course, SBC is responsible for the rather inefficient share buybacks, but I concede that when a company like Alphabet announces a $70 billion buyback program, it gets investors’ attention – certainly a staggering amount, at least in absolute terms.

As overly generous SBC (through which wealth is transferred from shareholders to management and eligible employees) is finally being scrutinized by investors (in addition to the generally quite “generous” compensation at tech giants), Alphabet and Microsoft have begun cutting back on related expenses. Given that share buybacks are becoming more costly due to the impending excise tax, an excessive SBC would further strain the FCF actually available to common shareholders. From this perspective, too, a reduction in SBC seems at least plausible. Nevertheless, I think it is important to continue to account for SBC when valuing companies – the worst that can happen is that investors err to the conservative side in their assessment.

Valuation Of Microsoft Stock And Alphabet Stock

Because of Microsoft’s and Alphabet’s strong offerings, which enable us to fulfill everyday tasks (leisure and work related), I believe both belong in a broadly diversified portfolio. Shares of Microsoft and Alphabet are down 18% and 29%, respectively, from their 52-week highs. But has enough market capitalization already been shaved-off to qualify them as solid value investments? Recency bias is hard to control, and we should keep reminding ourselves of this common pitfall on a regular basis.

Morningstar rates Microsoft as a four-star opportunity with a fair value estimate (FVE) of $310 and Alphabet as a five-star opportunity with a FVE of $160. Valuations based on historical (adjusted) operating earnings suggest that Microsoft stock is still quite expensive (P/E of around 28, Figure 7), while Alphabet is more reasonably valued with a P/E of around 23 (Figure 8).

One could argue that fear of regulatory intervention and Google’s high dependence on advertising revenues – which will come under pressure in an economic downturn – are responsible for the valuation difference. At the same time, it should not be forgotten that Microsoft’s strong growth in the cloud space is also likely to suffer in a downturn, as will revenue from Windows OEM licenses, Office licenses and subscriptions, and hardware sales. Personally, I believe that Microsoft’s ecosystem is more mature than Alphabet’s, that it is:

- highly trusted in the professional space

- offers a range of products and services with significant lock-in effects

- is more recession-resistant

- and benefits from more pronounced network effects.

Therefore, I believe a modest valuation premium is appropriate and would view both as either similarly fairly valued or similarly overvalued from an adjusted operating earnings per share perspective.

Figure 7: FAST Graphs chart for Microsoft stock [MSFT] (obtained with permission from www.fastgraphs.com) Figure 8: FAST Graphs chart for Alphabet stock [GOOG, GOOGL] (obtained with permission from www.fastgraphs.com)![FAST Graphs chart for Microsoft stock [MSFT]](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754251339168882.png)

![FAST Graphs chart for Alphabet stock [GOOG, GOOGL]](https://static.seekingalpha.com/uploads/2023/2/3/49694823-1675425156536477.png)

However, my regular readers know that I attach great importance to free cash flow, as it always ultimately comes down to cold, hard cash. Granted, both are true cash machines, but given the extraordinary events since 2020, I think it is only fair to use the average free cash flow of the last three years as a conservative starting point for valuation. In addition, I have normalized free cash flow with respect to working capital movements and also backed out stock-based compensation expense for the reasons already stated.

For Microsoft’s discounted cash flow (DCF) valuation, I used a three-year average normalized free cash flow of $55.8 billion based on my own estimate for fiscal 2023 ($55 billion, excluding SBC). I used the weighted average diluted shares outstanding in Q2 2023 and a cost of equity of 9%. Going forward, I have assumed that analysts’ revenue estimates for the next ten years translate directly into FCF growth, which could be considered overly optimistic. However, it should be remembered that cash flow from subscription-based models tends to be weak initially and becomes stronger as lock-in effects solidify. Moreover, such approaches scale very well. Growing investments in AI cannot be quantified, of course, but they will naturally dampen free cash flow growth in earlier years.

The cash flow profile (discounted/undiscounted) is shown in Figure 9. Note that the terminal value is not shown due to its size of $529 billion (discounted), or about 37% of total discounted cash flows. The DCF model is, of course, very sensitive to growth far in the future. Therefore, I have used rather conservative growth assumptions for the 10+ year period.

The DCF model indicates a fair value per share of $193, suggesting that the stock is overvalued. To better understand the model sensitivity, a simplified DCF analysis is shown in Figure 11 (at the end of this section) comparing fair values under different scenarios. To justify the current price of $260, Microsoft would need to grow its three-year average FCF at a terminal rate of over 6% in perpetuity.

Figure 9: Discounted cash flow valuation of Microsoft stock [MSFT] (own work, based on the company’s fiscal 2021 and 2022 10-Ks, the FQ2 2023 10-Q and own estimates)![Discounted cash flow valuation of Microsoft stock [MSFT]](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754292135606062.png)

For Alphabet’s DCF valuation, I used a three-year average normalized free cash flow of $41.1 billion, the weighted average diluted shares outstanding in the fourth quarter of 2022, and a cost of equity of 9%. I modeled analysts’ revenue expectations for the next ten years and my own – conservative – estimates for beyond, assuming a direct translation to free cash flow. This may sound quite conservative, considering that Alphabet intends to increase its margins in the near future by cutting costs. On the other hand, major investments in AI (Alphabet is working on LaMDA, MUM and PaLM projects to counter ChatGPT) should of course be considered. The cash flow profile (discounted/undiscounted) is shown in Figure 10, again excluding the terminal value ($453 billion, discounted), which represents about 39% of the total discounted cash flows. It is clear that the DCF model, like Microsoft’s, is very sensitive to growth far in the future, so I consider my conservative long-term growth assumptions to be prudent.

Alphabet’s DCF model indicates a fair value per share of $91, suggesting that the stock is overvalued. To give you a better understanding of model sensitivity, a simplified DCF analysis comparing fair value in different scenarios is shown in Figure 11. Similar to Microsoft, Alphabet would need to grow its free cash flow by 6% per year in perpetuity to justify its current share price at a 9% cost of equity.

Figure 10: Discounted cash flow valuation of Alphabet stock [GOOG/GOOGL] (own work, based on the company’s 2020 and 2021 10-Ks, the full-year 2022 earnings release published on Feb. 2, 2023, and own estimates) Figure 11: Discounted cash flow sensitivity analyses for Alphabet stock [GOOG/GOOGL] and Microsoft stock [MSFT] (own work, based on the data mentioned in Figure 9 and Figure 10).![Discounted cash flow valuation of Alphabet stock [GOOG/GOOGL]](https://static.seekingalpha.com/uploads/2023/2/3/49694823-16754295689037235.png)

![Discounted cash flow sensitivity analyses for Alphabet stock [GOOG/GOOGL] and Microsoft stock [MSFT]](https://static.seekingalpha.com/uploads/2023/2/3/49694823-1675429522369047.png)

Conclusion – Have We Seen Peak Cash Flow?

Undoubtedly, Microsoft and Alphabet both have a very wide economic moat and both have built a solid ecosystem that benefits from network effects and scales very well. However, I think Microsoft’s ecosystem is more mature and better anchored in commercial aspects. In the cloud space, Microsoft is ahead, and I am confident that it will continue to build trust and expand its deep customer relationships thanks to its hybrid solutions. That said, I wouldn’t underestimate Alphabet’s growth trajectory either, but I am wary of its disproportionate reliance on advertising revenue, which makes earnings somewhat more sensitive to economic cycles.

Alphabet’s free cash flow peaked in 2021, which is easy to understand given the pandemic and its associated impact, and a decline was expected in 2022. I doubt we have seen “peak cash flow” at Alphabet, given the cost-cutting initiatives (finally!) and the still very small cloud business. Despite its cyclicality, the advertising business will most likely continue to show handsome growth due to Alphabet’s technological leadership and constant innovation. The feared breakup of Alphabet’s advertisement business should not be overstated. In the worst case, I believe, a spin-off would occur, which would of course limit synergy effects.

Microsoft is also likely to report weaker normalized free cash flow in fiscal 2023, due to some degree to higher stock-based compensation. However, considering that most of the SBC growth is due to headcount reduction, this should not be over-interpreted. SBC is much more modest at Microsoft overall – yet I’m glad to see the company keeping its costs under control. Also, in Microsoft’s case, I doubt we have seen “peak cash flow”. Microsoft’s prospects in cloud-based solutions are very good for the reasons I mentioned, and I think the investment in OpenAI and the rapid response and rollout of ChatGPT-related services is wise. Cash flows related to subscription services are also still at a fairly early stage.

That said, current valuations are far from cheap. I own a small position in GOOGL and will soon open a position in MSFT, as I explained in another article. However, I would like to see GOOGL around $90 and MSFT around $220, which I think are reasonably comfortable entry prices.

Thank you very much for taking the time to read my article. How did you like it, my style of presentation, the level of detail? If there is anything you’d like me to improve or expand upon in future articles, do let me know in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, MCD, HD, LMT, PEP, PG, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.