Summary:

- Microsoft is still reporting great results and all three business segments are contributing to growth.

- Despite Google introducing Gemini, MSFT can rely on its economic moat and will most likely continue to perform well in the year to come.

- Despite expecting high growth from the Company in the years to come, the stock seems to be the most expensive it has been in years and may not be a great investment.

lcva2

In my last article, I stated that Microsoft Corporation (NASDAQ:MSFT) is not hyped but overvalued. The company most likely belongs to those stocks where investors are expecting artificial intelligence to have a huge positive impact. Since then, the stock returned about 7% and therefore slightly outperformed the S&P 500 (SPY).

It seems like I have been wrong about Microsoft in the last few quarters – and especially since my article in January 2023 titled “Buying Opportunity In The Making” the stock returned almost 60%. Back then, I was rather cautious about the stock and did not think it was a good investment. Looking back, it probably would have been better to buy at this point and not wait for even lower stock prices. In my article at the beginning of the year, I expected lower earnings per share for Microsoft, but the company continued to grow its earnings per share: Back then the trailing twelve months earnings per share were $9.03 and increased to $10.36 right now.

But in the following article, I will argue once again that Microsoft is rather expensive and probably not a great investment right now – despite solid results and still growing top and bottom lines.

Valuation Multiple Expansion

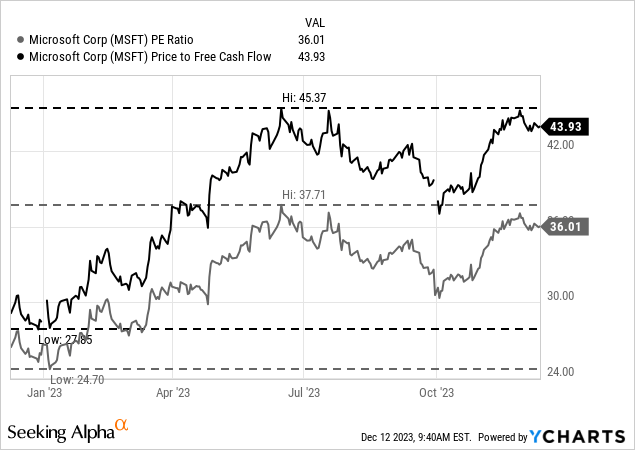

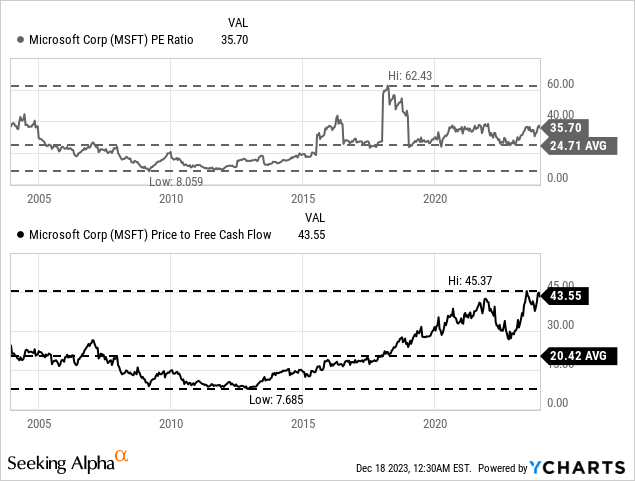

Higher earnings per share certainly justify a higher stock price, but when looking at the price-earnings ratio as well as the price-free-cash-flow ratio we see much higher valuation multiples.

During the last twelve months, valuation multiples expanded for Microsoft, and this also contributed to the stock price performance. In January 2023, the stock was trading for a P/E ratio of 25, and during the last twelve months, it expanded to 36 times earnings. P/FCF also expanded from 27 times free cash flow in January 2023 to 44 times free cash flow right now.

And the stock price action during 2023 is telling me that I was wrong about Microsoft during the last twelve months. But the questions remain: Should we still buy Microsoft today? And am I wrong about Microsoft for the mid-term (next few years)?

Quarterly Results

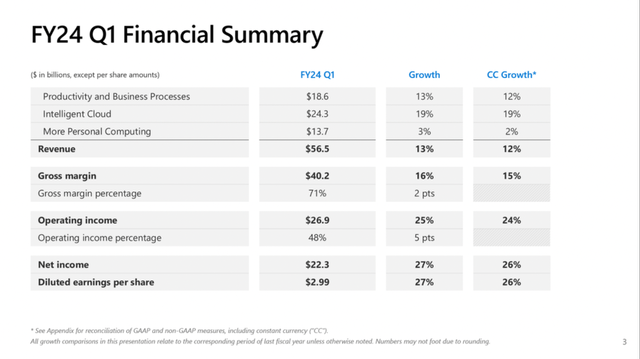

To answer the question if Microsoft is still a buy today, we can look at the last quarterly results. At the end of October 2023, Microsoft announced its first quarter results for fiscal 2024 and the company is continuing to report great results.

Total revenue increased from $50,122 million in the same quarter last year to $56,517 million this quarter – resulting in 12.8% year-over-year top line growth (in constant currencies, growth was 12%). Operating income increased from $21,518 million in the same quarter last year to $26,895 million this quarter – resulting in 25.0% YoY growth. And finally, diluted earnings per share increased 27.2% year-over-year from $2.35 in Q1/23 to $2.99 in Q1/24. Free cash flow in Q1/24 was $20,666 million and compared to $16,915 million in the same quarter last year this is an increase of 22.2% year-over-year.

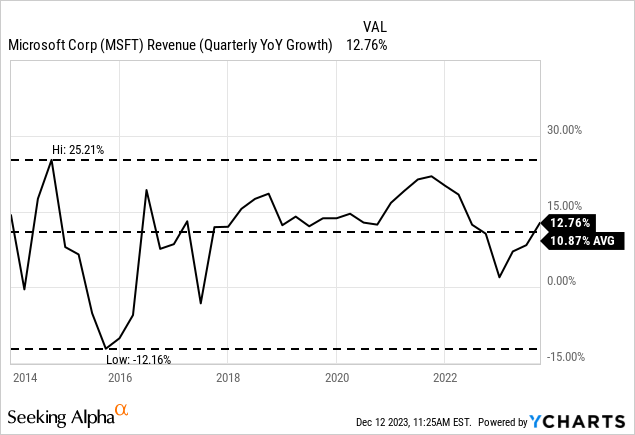

And while almost 13% top line growth is still great and certainly a high growth rate, year-over-year growth has slowed down since early 2022. However, growth rates have also rebounded again in the last few quarters and are now in line with the average of the last 10 years.

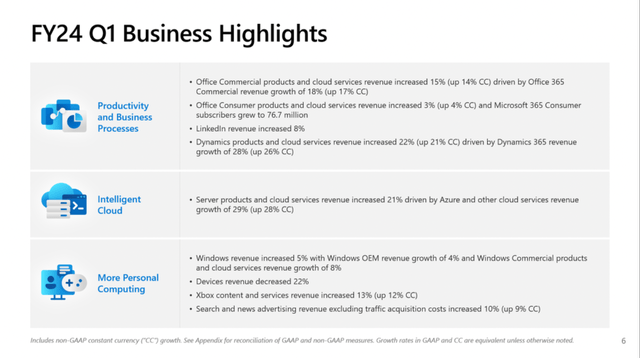

When looking at the different segments all three contributed to growth. And while “More Personal Computing” increased revenue only 3% year-over-year (2% in constant currency), revenue from “Productivity and Business Processes” increased 13% YoY and revenue from “Intelligent Cloud” increased 22% (up 21% in constant currency).

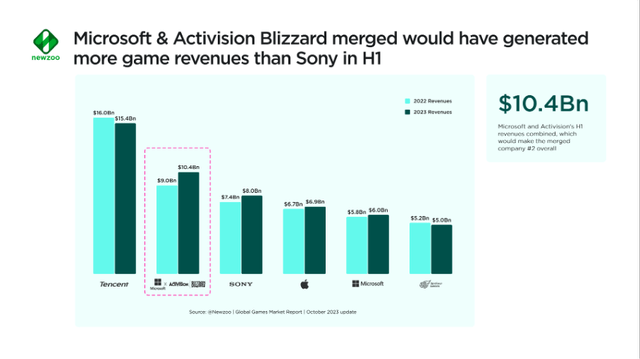

In my last article about Microsoft, I already mentioned that the acquisition of Activision Blizzard might be close to an end – as many signs were pointing in that direction. Now, Microsoft reported that the acquisition was closed on October 13, 2023.

Activision Blizzard will add about $9 billion in sales to Microsoft and more than $2 billion in net income. And as Newzoo pointed out, Microsoft and Activision Blizzard will generate about $20 billion in sales annually and Microsoft is now number 2 in games – behind Tencent (OTCPK:TCEHY), which is still a clear leader.

Microsoft Copilot

During the earnings call, CEO Satya Nadella talked a lot about Microsoft Copilot:

With Copilots, we are making the age of AI real for people and businesses everywhere. We are rapidly infusing AI across every layer of the tech stack, and for every role and business process to drive productivity gains for our customers.

He also gave several different examples during the earnings call where Copilot is implemented already and how Microsoft is making progress. Aside from Microsoft Copilot being implemented in many everyday business applications like Microsoft Word or Excel or the Sales Copilot, developers are profiting from the GitHub Copilot. According to management it should become an everyday assistant:

Now on to the future of work. Copilot is your everyday AI assistant, helping you be more creative in Word, more analytical in Excel, more expressive in PowerPoint, more productive in Outlook, and more collaborative in Teams. Tens of thousands of employees at customers like Bayer, KPMG, Mayo Clinic, Suncorp, and Visa, including 40% of the Fortune 100, are using Copilot as part of our early access program.

When listening to the earnings call, it seems like every major business is using at least parts of Microsoft Copilot. Aside from 40% of the Fortune 100 using Copilot as part of the early access program, management also stated that more than 73% of the Fortune 1000 use three or more of Microsoft’s data solutions today.

On the other hand, it is not surprising as the Windows operating system and Microsoft Office are deeply embedded in many businesses and part of the everyday working routine. And businesses already using these Microsoft products will also use new AI applications Microsoft is offering. This is part of Microsoft’s wide economic moat making it such a great business and hard to attack.

Google Gemini vs ChatGPT

And so far, Microsoft has often been seen as the company having quite the edge when it comes to artificial intelligence due to its investment in OpenAI. Especially as ChatGPT is seen as the leading LLM application and – as I pointed out in my last article about Alphabet – has about 1.8 billion monthly visits (according to SimilarWeb). Bard on the other hand, had only about 270 million monthly visits (also according to SimilarWeb).

So far it seems like ChatGPT was the dominant LLM people were using, but maybe Google will be able to fight back with Gemini and be a real competition for Microsoft again. A few weeks ago, Alphabet (or to be more precise: Google) introduced Google Gemini which might be a real competitor to ChatGPT 4. And so far, analysts are quite optimistic and praised Google Gemini as significant innovation in generative AI and it could make a solid 2024. According to data from Google Trends, Google Gemini is generating a much lower search volume than ChatGPT. But we also must point out that Gemini is still in an early stage.

In my opinion, both companies will continue to keep the dominant position they already have. Aside from cloud – where Microsoft and Google are direct competitors with Microsoft Azure having a market share of 22% and Google Cloud having a market share of 11% – the two companies are not really going head-to-head. And both companies can be able to perform well in the future and when staying at the forefront of AI development they both will be able to keep their leading positions. And both companies should be able to take market shares in the generative AI market, which Bloomberg is expecting to become a $1.3 trillion market by 2032 (resulting in about 40% annual growth). In the article, Bloomberg is writing:

Moreover, rising demand for generative AI products could add about $280 billion of new software revenue, driven by specialized assistants, new infrastructure products, and copilots that accelerate coding. Companies like Amazon WebServices, Microsoft, Google and Nvidia could be the biggest beneficiaries, as enterprises shift more workloads to the public cloud.

Wide Economic Moat

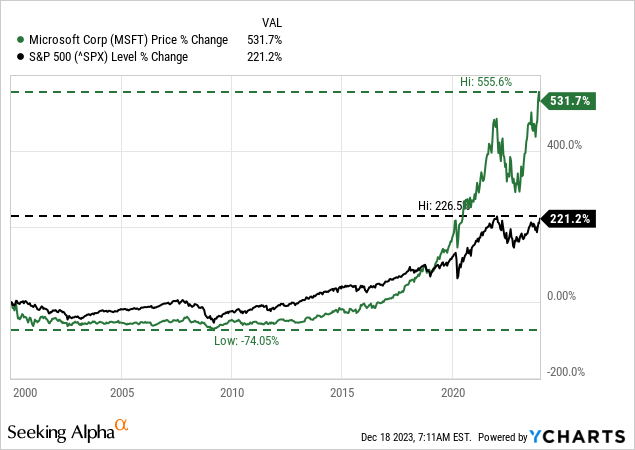

This seems to be a good time to point out again that Microsoft is a great business with a wide economic moat. Since its IPO, Microsoft outperformed the S&P 500 in an impressive way. But even when looking at the performance since January 2000 (probably the worst time to buy Microsoft) the stock still outperformed the S&P 500.

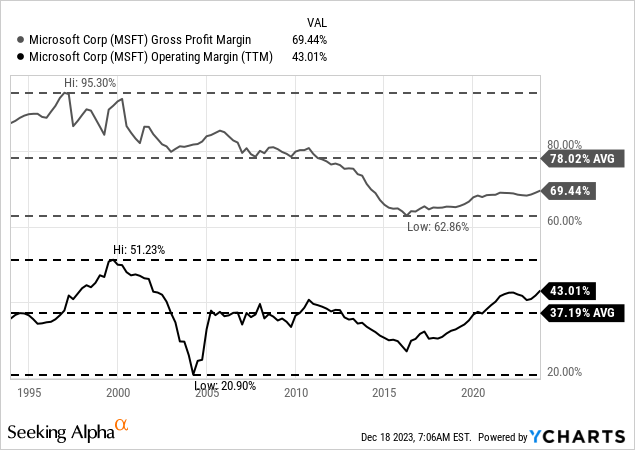

Aside from the outperformance of the stock, we can also look at the company’s margins over the last few decades. When looking at the gross margin we can see a constantly declining gross margin since the 1990s, which is actually not a good sign. However, we should point out that Microsoft had a gross margin above 80% until 2010 and in the 1990s reported even gross margins above 90%. Right now, there are only 23 companies (according to Finviz) listed in the S&P 500 with a gross margin above 80%. And with Microsoft introducing new products and expanding into new markets, it is not surprising that the business has to report lower gross margins.

But while the gross margin declined in the last few years, operating margin was rather stable and clearly improved again in the last few years. It is not even above its 30-year average and one of only 26 companies listed in the S&P 500 able to report an operating margin above 40% (once again according to Finviz).

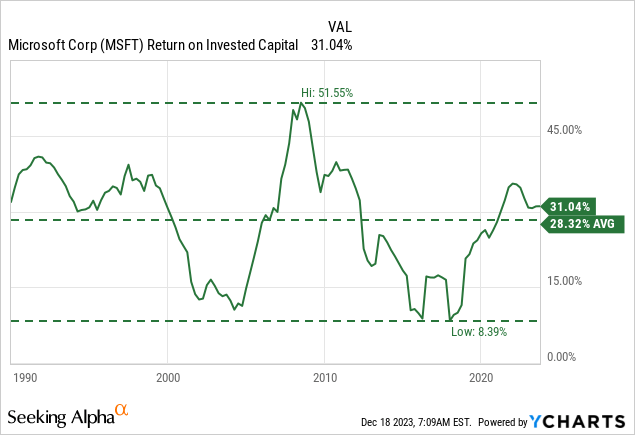

And aside from a stable (or even improving) operating margin, Microsoft is reporting high return on invested capital. While there have been times with the company’s RoIC was only in the single digits, these times have been brief and during the last 30 years Microsoft almost always reported a double-digit RoIC. The average RoIC in the last 30 years was 28.32% and right now, Microsoft can report above-average RoICs again. All in all, Microsoft clearly has a wide economic moat around its business.

Additionally, I assume that Microsoft Copilot could contribute to a widening of the already existing moat. By including more and more features in already existing applications, Microsoft is constantly increasing switching costs for customers. And we don’t know if users might try and switch to Google Gemini in the future, but right now ChatGPT seems to be the LLM everybody wants to use, and I assume Microsoft will profit from that. Being able to use OpenAI’s LLM in many different Microsoft applications might add to the already high switching costs of Microsoft.

Intrinsic Value Calculation

I already mentioned above that a huge part of the stock price performance in the last twelve months is the further expansion of valuation multiples, and the stock price performance should rather be driven by fundamentals. Of course, this is seldom the case – at least when looking at rather short timeframes of only a few months or quarters.

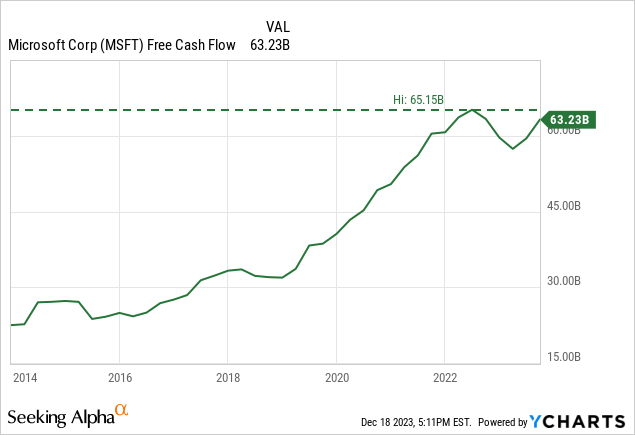

To get a better picture if a stock is overvalued or not, we can use a discount cash flow calculation to determine an intrinsic value for the stock. In case of Microsoft, we calculate with 7,462 million outstanding shares and – as always – a 10% discount rate. As basis for our calculation, we can take the free cash flow of the last four quarters which was $63,230 million.

In order to be fairly valued, Microsoft has to grow its free cash flow 14% annually for the next decade followed by 6% growth till perpetuity. And a growth rate of 14% annually for the next ten years might seem realistic for Microsoft. For starters, the company achieved a 14% CAGR for earnings per share in the last ten years. When looking at analysts’ expectations for the next ten years however, earnings per share are expected to grow only with a CAGR of 11.7% and this could be a first hint that Microsoft is overvalued.

I already mentioned above that Microsoft saw a valuation multiple expansion in the last twelve months, which is not a good sign. And when looking at valuation multiples in the last 20 years, we are currently seeing one of the higher P/E ratios (it has been higher a few times). When looking at the P/FCF ratio we are currently seeing the highest ratio in the last 20 years. The P/FCF ratio was higher in 2000 and the years before but trading for the highest P/FCF ratio of the last 20 years is not necessarily a good sign.

In my opinion, we should be more cautious and assume growth rates between 10% and 12% leading to an intrinsic value around $300 (or to be more concrete: a range between $280 and $320). Although we can argue for higher growth rates, I would be cautious about too high growth rates – especially as Microsoft is getting bigger and bigger, and growing at a high pace will get more difficult.

Conclusion

Right now, we have every reason to expect Microsoft to grow with similar high growth rates as in the last ten years. It also seems like Microsoft’s growth potential is broad-based and not just based on some kind of AI hype or short-term positive effect. And Microsoft clearly has a great business model and could be one of the long-term profiteers of the shift toward (generative) artificial intelligence.

But although the future seems bright – and maybe we should have bought the stock in January 2023 – I remain rather skeptical about Microsoft as an investment. To justify the current stock price, the company must grow at a high pace in the next ten years, and with the stock price being rather high (making share buybacks not as effective) and margins also being rather high (making further margin expansions rather difficult) I remain cautious and still rate Microsoft as a “Hold”. In my opinion, this is not the time to invest in Microsoft although an investment might pay off 20 years from now – like an investment in Microsoft in 2000 still paid off over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.