Summary:

- The AI boom has legs to go.

- Microsoft is well-positioned to be an AI winner.

- Broad-based share gains are likely to continue.

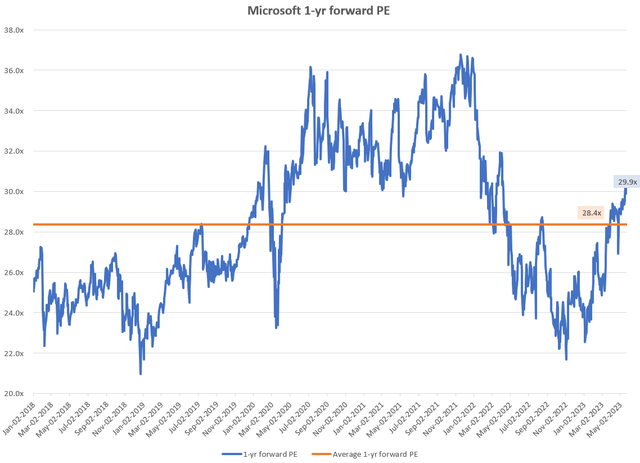

- Microsoft is trading at a 29.9x 1-yr fwd PE, which is at a modest 5.4% premium to its average multiple since 2018; an acceptable price given the rosy prospects ahead.

- I intend to phase in the buys over a period of weeks to potentially capture a discount buying opportunity enabled by market whipsaws.

Jean-Luc Ichard

Thesis

I think Microsoft (NASDAQ:MSFT) has a strong headstart in the current AI boom. I am fundamentally bullish on the stock for 3 key reasons:

- The AI boom has legs to go

- Microsoft is well-positioned to be an AI winner

- Broad-based share gains are likely to continue

The AI boom has legs to go

With the release of publicly available generative AI technologies, 2023 so far has been characterized by an AI boom. Some people say the amount of chatter and excitement resembles some euphoria. Indeed, there is some evidence that this may be true. For example, the mentions of AI in earnings calls is up 75% YoY, with much of the name-dropping occurring in an arguably superficial and tangential way. Bank of America (BAC) analysts posit that AI is in a ‘baby bubble’.

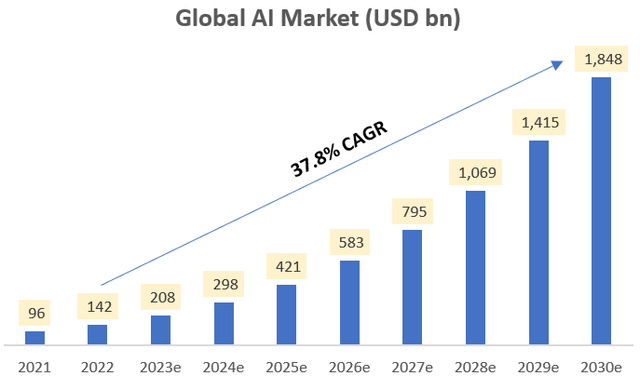

I agree that there seems to be some frothiness right now. However, a look at the longer term expectations shows large underpenetrated potential that provide ample room for genuine growth. The overall global artificial intelligence market is expected to grow handsomely at almost 38% for the rest of the decade:

Global AI Market Size (Next Move Strategy Consulting, Author’s Analysis)

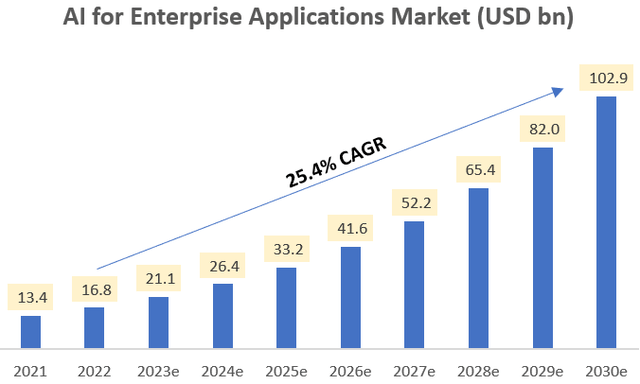

Microsoft’s exposure is geared mostly via enterprise applications. This market too is expected to grow at a 25% CAGR till 2030:

AI for Enterprise Applications Market Size (Precedence Research, Author’s Analysis)

I believe this would naturally carry attractive opportunities for the beneficiaries of these trends. In terms of businesses with enterprise applications exposure, I think cloud infrastructure providers (hyperscalers), which enable organizations to collect enterprise-wide data and rent computing power to find insightful patterns for business decision making with the use of AI and analytics are well-positioned. This is because in the rent vs buy computing power decision, I anticipate the demand for the former to dominate as this gives enterprises more flexibility and agility by converting the investment requirement from a large capex commitment to an opex spend. In a recent AI deep dive, Jefferies analysts shared the same view.

Microsoft is well-positioned to be an AI winner

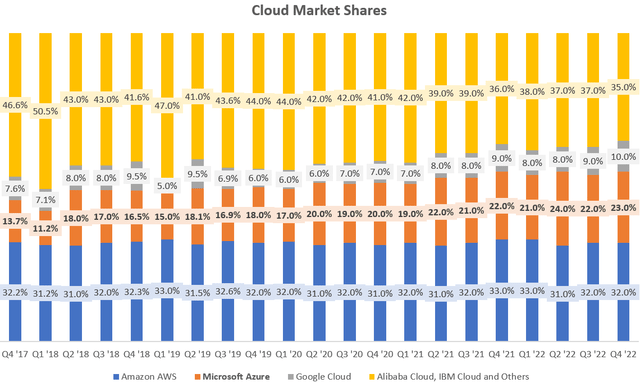

Cloud Market Shares (Canalys, Author’s Analysis)

Microsoft’s Azure cloud platform has 23% market share. Since the onset of COVID-19, Azure has grown faster than Amazon’s (AMZN) market leading AWS, having increased market share from 13.7% in Q4 CY20 to the current 23% level giving it a firm 2nd place position. In contrast, AWS’ market share has remained stagnant at around 32%.

Microsoft’s position as a cloud provider is augmented by its 63% market share in desktop operating systems and a host of enterprise application enterprise application products focused on consumer and office productivity as well as gaming. I think such deep penetration to everyday use-cases give the company an ideal launchpad to carve a dominant position in the new AI technologies. Its partnership with OpenAI and NVIDIA is another bonus to accelerate its AI innovation.

Now every major technology company will (truthfully) claim themselves to be veterans of AI applications. One way to ascertain who is truly the innovation leader is by looking at the number of world class patents. On this measure, Microsoft has held the top spot for many years according to Econsight.

Broad-based share gains are likely to continue

In the Q3 FY23 earnings call, management consistently highlighted broad-based market share gains:

We have seen share gains in Azure, Dynamics, Teams, Security, Edge and Bing as we continue to focus on delivering high value as well as new innovative solutions to our customers, including next-generation AI capabilities.

– CFO Amy Hood in the Q3 FY23 earnings call, Author’s bolded highlights

In other parts of the call, CEO Satya Nadella also noted share gains across all categories of business applications and the LinkedIn hiring business.

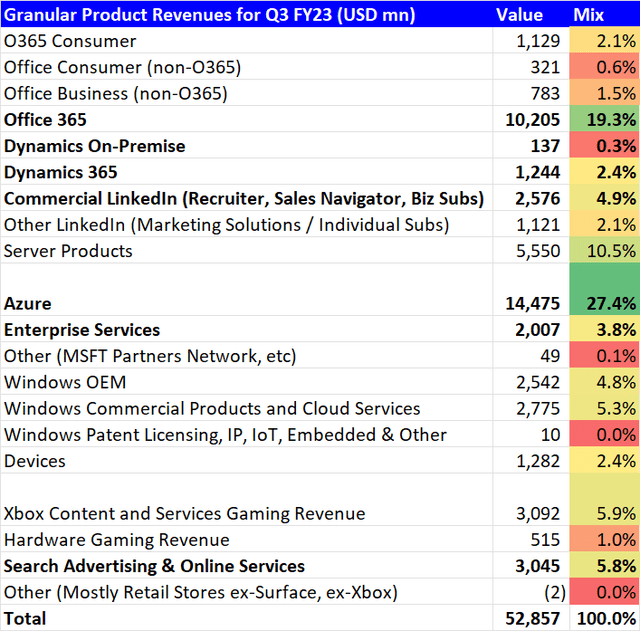

Bolded below are the product segments that have been called out for having market share gains:

Q3 FY23 Product Revenues Split (Company Filings, Author’s Analysis)

Altogether, the categories that gained market share total 63.5% of the overall revenues of $52.9 billion for Q3 FY23.

I anticipate this traction to continue as I don’t see anything on the horizon to oppose this momentum. Management has remarked similarly:

Overall, our outlook has many of the trends we saw in Q3 continue through Q4. In our largest quarter of the year, we expect customer demand for our differentiated solutions, including our AI platform and consistent execution across the Microsoft Cloud to drive another quarter of healthy revenue growth.”

– CFO Amy Hood in the Q3 FY23 earnings call, Author’s bolded highlights

Valuation and positioning

Microsoft 1-yr forward PE (Capital IQ, Author’s Analysis)

Microsoft is currently trading at a 1-yr forward PE of 29.9x, which is at a small 5.4% premium to the average multiple since 2018. I believe this is a satisfactory valuation for buys given strong outlook ahead.

However, in today’s choppy market, I intend to phase in my buys over a few weeks’ time to potentially capture any opportunities to buy at a deeper discount.

Rating: ‘Buy’

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.