Summary:

- It has been 10 months since I published my first Article on MSFT. Since then, the stock has appreciated by 28.3%, 4% shy of the S&P 500.

- I believe investors shouldn’t worry about the increased CapEx investment because demand for AI Azure is still strong, and Satya Nadella has a proven track record.

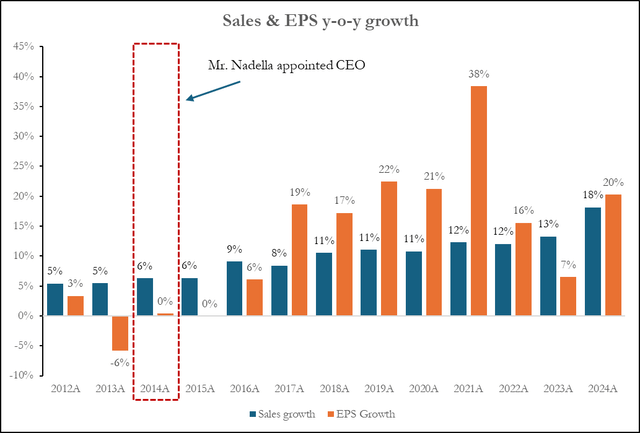

- Satya Nadella turned MSFT from a mature company in 2014 to a growth company delivering double-digit top and bottom line results.

- On a multiple basis, MSFT is trading at the same level it did last year despite improving margins, a better growth profile, and ongoing demand.

lcva2

Intro & Thesis

It’s been almost a year since I initiated my coverage of Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA). Since then, the stock has appreciated by 29.3%, just 4% shy of the S&P 500’s return of 33%. Usually, I prefer not to post quarterly updates for companies that get a lot of coverage, such as MSFT because seeking alpha analysts do a good job of analyzing the quarterly results. But I feel now is the right time to post an update regarding my investment thesis given the recent FY2024 results, Google Antitrust case, and most importantly, investor concerns given the recent increase in CapEx spending.

In my first article, management was a core principle of my buy thesis because the current CEO Satya Nadella has been successful at transforming MSFT from a mature business to a growth company delivering double-digit top and bottom line results. He did this by investing in innovative services, and I believe we are now in a similar situation where MSFT must invest in its infrastructure to capitalize on the surge in demand for Azure AI. If the company just sits on their hands, they’re essentially leaving money on the table and allowing their competitors take their launch.

Additionally, I view the current valuation as attractive because MSFT is essentially trading at the same multiples it did about a year ago following the recent decline in the share price. This doesn’t make sense to me given that the demand for MSFT services such as Azure AI has been surging, margins have improved, and growth is still on the table.

Why I’m not worried about CapEx increase?

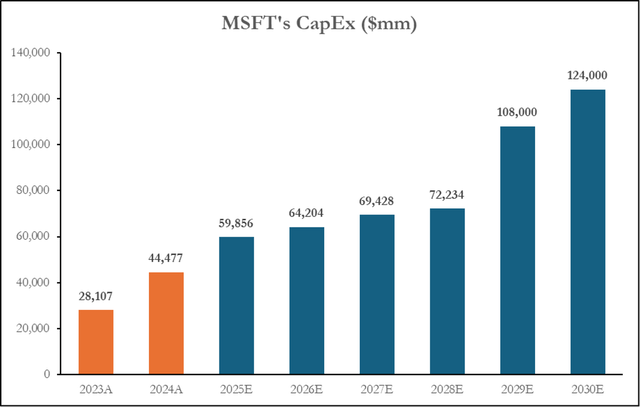

MSFT increased their capital expenditures by 55% in Q4-24 and almost doubled them in FY2024 from $28.1 billion to $44.5 billion. The company said they expect CapEx to remain elevate in 2025 but didn’t say how much, but I was able to pull analyst estimates for the upcoming six years. I would suggest to only focus on the next 2-3 years because anything more than that could be hard to predict.

My initial reaction to the increase was why so much, especially since MSFT is a software company but as I did more research I arrived at the conclusion that this is far from a bad investment because of two reasons: First, demand is out there and MSFT needs to upgrade their infrastructure to capitalize on it. Second, I trust the management team and if they believe this increase is necessary, I do too, given their proven track record and equity ownership in the firm.

For the past few quarters, Management has been saying that they are constrained on AI, meaning the current infrastructure at MSFT isn’t equipped to a level where they can handle the surge in demand for Azure AI, which is why the company had to contract third parties such as Oracle to help them deal with the issue. Amy Hood, the CFO, said the following in their Q2 earnings call:

we are constrained on AI capacity. And because of that, actually, we’ve, to your point, have signed up with third parties to help us as we are behind with some leases on AI capacity. We’ve done that with partners who are happy to help us extend the Azure platform, to be able to serve this Azure AI demand.

So an investment to expand the AI infrastructure (build data centers) is necessary because who in their right mind would rather share profits with a third party. Additionally, AI services are highly profitable and the more third-party companies MSFT contracts, the more money they stand to lose. Amy Hood stated that investment made in Cloud and AI in 2025 can be monetized for the next 15 years.

Cloud and AI related spend represents nearly all of total capital expenditures. Within that, roughly half is for infrastructure needs where we continue to build and lease datacenters that will support monetization over the next 15 years and beyond.

The real question to answer is, will this demand still be here in 5 or 10 years’ time? I don’t have a crystal ball, but with a high degree of certainty I will say yes because Cloud offers a really sound proposition for enterprises. If they switch to a cloud-based infrastructure, then they can easily scale their business and minimize cost. If you add Azure AI, then efficiency can jump through the roof. Additionally, in Q4-24 Commercial bookings increased by 17% driven by large long-term Azure contracts, further showing that demand is still here.

MSFT is also not the only company that expects CapEx spending to remain elevated in the near future. Numerous tech companies have echoed a similar statement. Below are a few quotes from tech executives from CY Q2 24 earning calls.

“I think the overall view on AI investment is we have to invest” – AMD CEO

“we currently expect significant CapEx growth in 2025” – META CFO

“The risk of under-investing is dramatically greater than the risk of over-investing” – GOOG CEO

“Capital investments to be higher in H2 24” AMZN CFO

Another reason I believe the increased investment is far from a bad decision is because of management’s track record. Investors shouldn’t forget that when Mr. Nadella was appointed CEO in 2014. The company wasn’t growing top and bottom line at double digits consistently. The CEO before him, Steve Ballmer, had made numerous mistakes, but the one that stands out the most was the Nokia acquisition completed in 2014 for $7.2 billion, which caused major shareholder dilution via impairment charges.

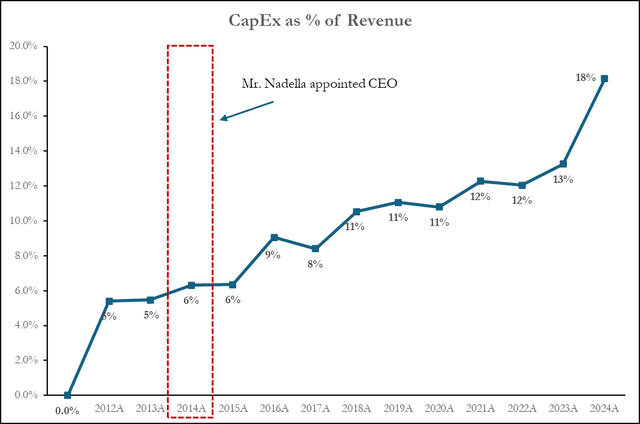

In 2015, Mr. Nadella decided to sell Nokia for $350 mm and completely exit the smartphone business. He started investing heavily in MSFT’s cloud infrastructure, resulting in a substantial CapEx increase. As you can see from the chart below. MSFT’s CapEx as % of revenue nearly doubled in just four years after Mr. Nadella was appointed CEO. Intelligent cloud now makes up 43% of total revenue and 45% of the total operating income.

CapEx margin did increase by a lot during Mr. Nadella’s leadership, but so did revenue and EPS. In fact, EPS and Sales have compounded at an annual rate of 13% and 10% since 2014.

What I’m trying to say is that although I’m not a shareholder of MSFT, I trust the management team and investors should too, given the strong track record. Additionally, Both Satya Nadella Amy Hood have significant equity in MSFT, aligning their view with shareholders. Satya Nadella owns more than 800,000 shares valued at over $300 million as of May 2024. Amy Hood also owns 445,859 shares of the company worth over $187 Million.

Google Antitrust Case

On Monday, August 5th, GOOG shareholders were hit with some concerning news. A federal judge ruled that Google violated antitrust law by spending billions of dollars to create an illegal monopoly. This ruling doesn’t mean google search will lose its dominant position in the near future. Google has said they plan to appeal this decision, which can take years, but cracks in the armor are starting to show and MSFT stands to benefit dearly.

In fact, CEO Satya Nadella testified in Google’s antitrust case in 2023, saying how hard it was to strike a deal with Apple to replace Google as the default browser. Now, MSFT’s search engine Bing is not as superior as Google’s but if the opportunity presents its self I’m highly confident that management will pour billions in investment to improve it.

One thing to keep in mind is that search engines are highly profitable. Let’s consider a hypothetical scenario. In 2023 Google made $175 billion just from its search engine. According to InformationWeek, Google search engine’s profit ratio is around 75%. If MSFT was able to take 5% of the $175 billion, and assuming a similar profit margin, we could be looking at ~$7 billion in recurring income.

The 5% can easily double if MSFT is able to secure a deal with AAPL to be the default search engine for their products. Google’s exclusive contract with Apple will be in place until 2026, which isn’t that far. It will be very interesting to see what happens come renewal time.

FY2024 Results

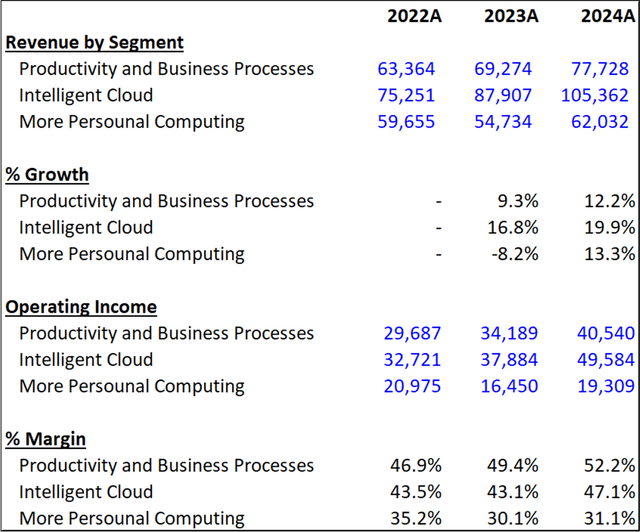

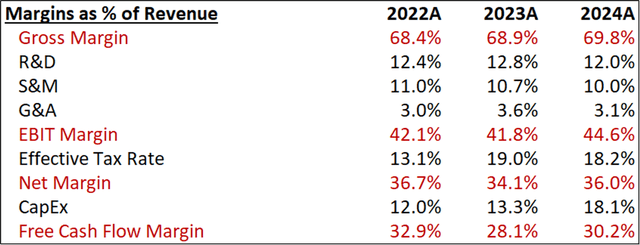

Let’s start by analyzing the top line in performance for 2024. Revenue from all three segments increased. Not only that, margins for each division improved as well, with intelligent cloud jumping by more than 400 bps. This is to be expected seeing that cloud sales grew by nearly 20% surpassing $100 billion.

Personal computing, on the other hand, recovered in 2024 in terms of sales and profitability. This was driven by an 8% growth in windows, 39% in gaming (mainly from the ACTV Acquisition), and 3% in advertising offset by a 15% decrease in devices.

As for the productivity and business processes, revenue grew by 12.2% driven by strong growth in Office 365 products, 9% increase in LinkedIn revenue, 4% in consumer office products, and 19% increase in Dynamics products and cloud services.

Turning to profitability, margins across the board improved due to the strong growth in the cloud segment. Gross margin was up by 90 bps, EBIT margin by 380 bps, and net margin by 290 bps. Most importantly, free cash flow margin increased by 215 bps despite the 58% ramp up in CapEx.

The balance sheet remains healthy with strong liquidity (1.27x quick ratio), robust interest coverage standing at 44.8x, and a decent amount of leverage with a 0.02x Net Debt/EBITDA. Additionally, free cash flow increased by 25%. All in all, the results were solid, and I expect the company to report similar results in Q1-25.

Attractive Valuation

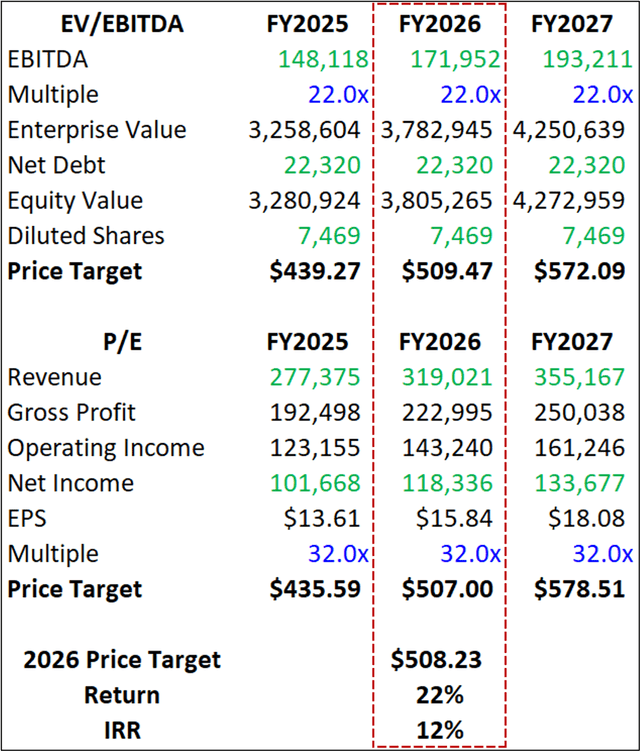

Last time I valued MSFT. I used a DCF, but this time I decided to take a different approach and value the company using a 50/50 mix of P/E and EV/EBITDA. I arrived at a price target of $508 by the end of FY2026, implying a 22% return from the current price of $415.

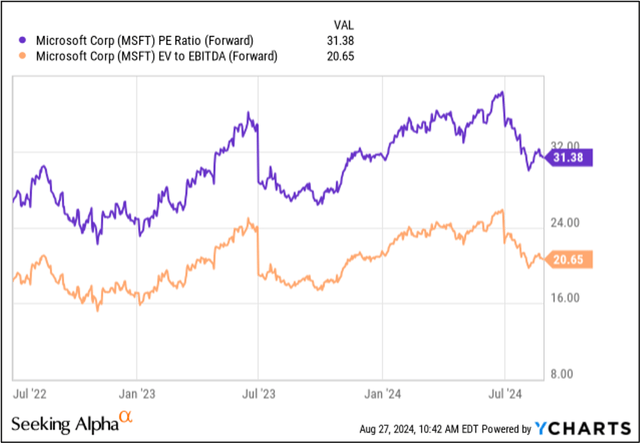

From the graph below, you can see that MSFT is essentially trading at the same multiples it did a ~13 months ago. Now, if the company’s sales or margins took a hit then maybe it will be justified, but as you’ve seen from my margin analysis above, that’s not the case. I believe the news of CapEx increase and 2% miss on cloud revenue was the reason for the decline you see below, but I also believe it’s an overreaction by the market.

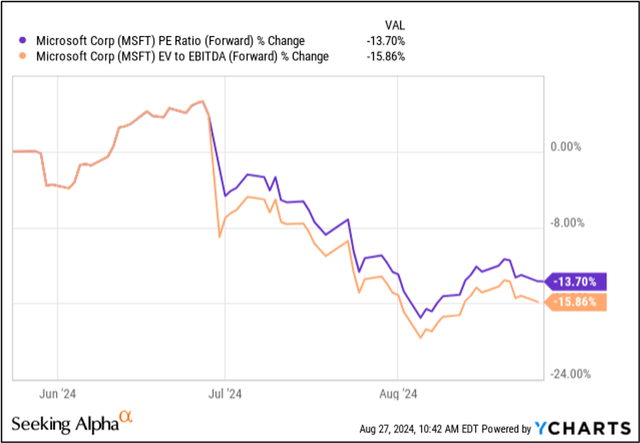

I believe MSFT should be valued at least 22.00x EV/EBITDA and 32.00x P/E because the business is not only in a good shape, but it’s also better than it was back in June 2023. If we take a look at a different graph, you can see that multiples have contracted by roughly 13% in the past month or so due to 17 EPS revisions to the downside by analysts.

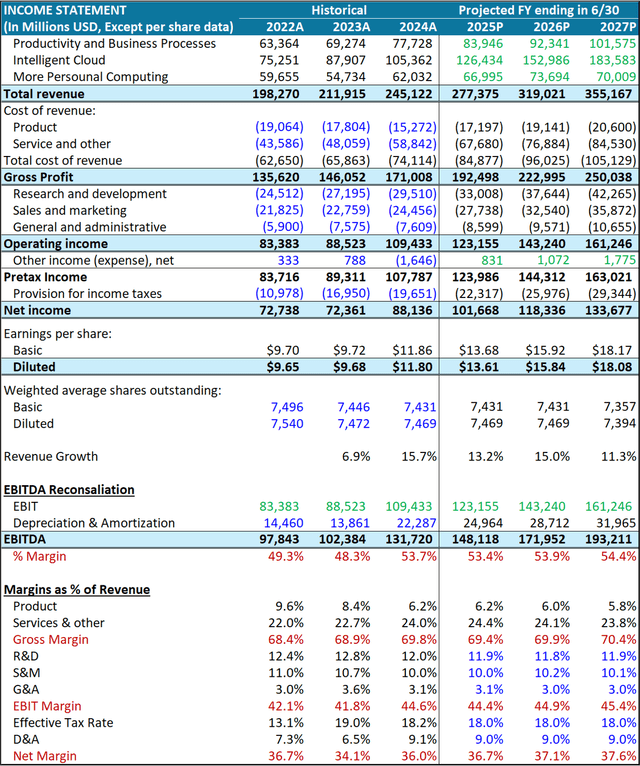

Using a 32x P/E on a $15.84 EPS and 22x EV/EBITDA on ~$172 billion EBITDA, I arrived at a price per share of $508 by end of FY2026. I assume revenue will grow at a CAGR of 13.2% for the next three years, underpinned by 20.3% in cloud, 9.3% in productivity and processes, and 4.3% in more personal computing. For 2026, I have an EBITDA margin of 53.9%, EBIT margin of 44.9%, and Gross margin of 69.9%. The main driver for margin expansion in my model is cloud growth and economies of scale. Below is my forecasted income statement and valuation methodology.

Investment Risks

Risks to my thesis are minimal because MSFT is a diversified company with a high retention rate, but lower growth in Azure can definitely send the stock price tanking. Post Q4-24 results, aside from the CapEx increase, the stock declined by roughly 7% in after-hours trading due to a 2% miss on cloud revenue expectation. Aside from that, I would say risks can include failed M&A activity meaning overpaying for an asset or a company, which can lead to impairment charges and dilution in shareholder value.

Bottom Line

The takeaway from this write-up is that investors shouldn’t put too much emphasis on the recent CapEx increase and a 2% miss on cloud growth. One has to zoom out and look at the bigger picture. When dealing with AI and Cloud, markets that can revolutionize business as we know it, it is best to be overinvested than underinvested. I view the 12% multiple contraction in the past month as too aggressive, and I believe the market will re-rate MSFT to trade at a reasonable multiple between 32-34x P/E once investors realize the long-term potential of the business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.