Summary:

- Microsoft’s shares have increased more than 10-fold since 2012, with the company’s dividend-per-share payout also soaring, due to its strong cash-based sources of intrinsic value.

- The company’s future expectations of free cash flow and strong net cash position are key drivers of its share price and dividend growth potential.

- Despite potential risks from deal-making, Microsoft’s strong position in artificial intelligence and cloud operations suggest continued strong growth, making it attractive to long-term investors.

- The high end of our fair value estimate range stands near $370 per share. The company yields ~0.8% at this time.

lcva2

By Brian Nelson, CFA

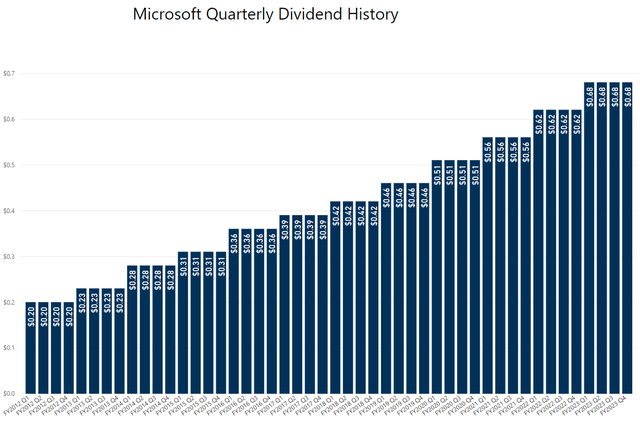

Microsoft’s (NASDAQ:MSFT) stock was written off for dead a decade ago. The company was thought of as a tech dinosaur with little potential for innovation. Many believed its best days were behind it. Shares just didn’t get any respect at the time, and many simply overlooked its tremendous dividend growth potential. Fast forward to today and Microsoft’s shares have gone up more than 10-fold since the beginning of 2012, while the company’s dividend-per-share payout has soared (see image below). With its large cap growth peer Apple (AAPL), Microsoft dominated the past decade, and we expect it to dominate this decade, too.

Microsoft’s dividend growth has been fantastic. (Microsoft)

Big cap tech and large-cap growth are the places to be, in our view, and Microsoft is a top weighting in this area. Most quantitative analysis points to areas such as small-cap value as one of the best areas for consideration, while income-oriented areas point to dividend growth strategies or high-yielding equities. However, the big issue for me with pursuing small cap value is that the quantitative support for that area is based on rather arbitrary fundamental analysis such as book value and backward-looking assessments. For dividend growth and income-oriented strategies, it’s important that readers understand that the dividend is capital appreciation that would have been achieved had the dividend not been paid. Investors can make their own dividend by selling stock.

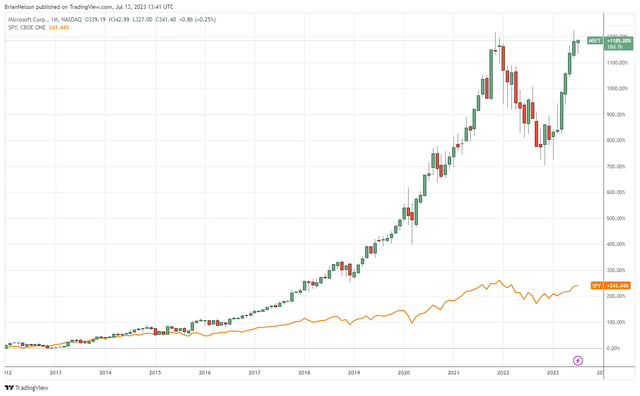

Microsoft’s shares have trounced the market for years. (Microsoft)

At Valuentum, we like to focus on cash-based sources of intrinsic value. Let’s talk about what those are. We believe that stock prices are a function of the discounted cash-flow model. What this means is that we think changes in future expectations of free cash flow are the primary determinant of share price changes, and therefore stock market returns. For companies that have ever-increasing expectations of future free cash flow, their stock prices should advance nicely over time. On the other hand, for companies where the market’s expectations of future free cash flow are continually reduced, its share price should suffer. In the case of Microsoft, the market continues to build in expectations for continued stronger future free cash flow, which is why shares continue to advance.

As you probably can gather, one of the key cash-based sources of intrinsic value is future expectations of free cash flow. Another key cash-based source of intrinsic value is net cash on the balance sheet. Net cash can typically be calculated by subtracting a firm’s total debt from its total cash position, with the result being what can be considered the firm’s net balance sheet position. A short-hand way of thinking about the intrinsic value of a company is looking at these two cash-based sources of intrinsic value. For example, the investor may ask themselves: What is the likelihood that future expectations of free cash flow will continue to be revised higher? If yes, then the share price could advance. Does the company have a strong net cash position such that there is an asymmetric risk/reward situation for investors in that bankruptcy risk is negligible. If yes, permanent downside may be limited.

Microsoft has been one of our favorite stocks for a while. Looking back at our work on Seeking Alpha, one of our first articles on Microsoft said it was a steal at the levels at that time, all the way back in October 2011. Why we liked Microsoft back then was pretty straightforward. The market wasn’t giving it credit for its cash-based sources of intrinsic value – what we thought were achievable future expectations of free cash flow as well as the net cash it held of the books. Microsoft had asymmetric upside potential at the time, given the lack of bankruptcy risk coupled with a story that could lead to tremendous revisions in future expected free cash flow – and a budding dividend growth story to boot.

Our Updated Valuation of Microsoft

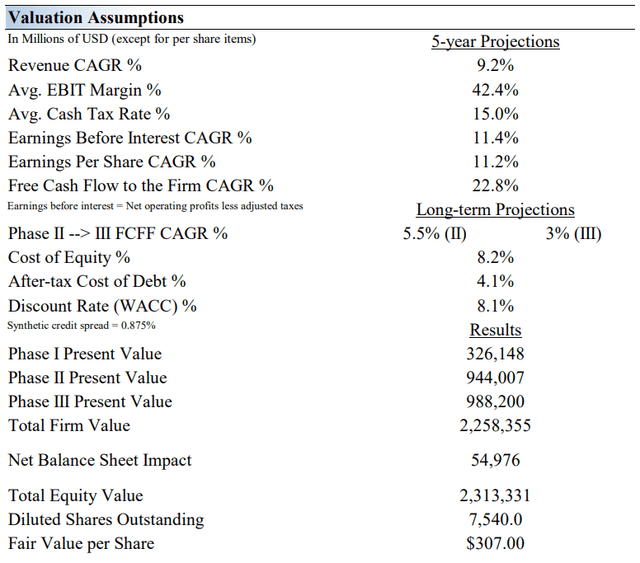

We still like Microsoft today for similar reasons, with the high end of our fair value estimate range standing near $370 per share these days. Previously, the high end had been $314 per share with the low end around $210 per share. Since our last update in April 2023, we’ve fine-tuned our valuation model with more optimistic assumptions with respect to artificial intelligence (AI) opportunities across Microsoft’s product suite.

As we noted in that article, it’s very difficult to explicitly model such AI-related growth, but we think it is reasonable to expect considerable up-selling and cross-selling opportunities related to AI in the coming years. These considerations were not included in the prior model but are in this one. Since that April note, shares of Microsoft have advanced roughly 20%, more than doubling the return of the S&P 500. We don’t think that Microsoft’s strong run is over by a long shot.

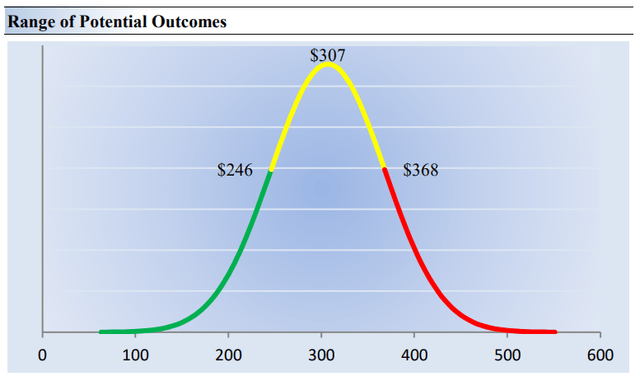

The high end of our fair value estimate range of Microsoft is nearly $370 per share (Valuentum) Our valuation assumptions of Microsoft. (Valuentum)

Although we estimate Microsoft’s fair value at about $307 per share at the moment (it was $262 per share in the prior April note), let’s talk about why thinking about value as a range of fair value outcomes is very important, and why we are emphasizing the high end of the fair value estimate range in our work of Microsoft.

First, our discounted cash flow process values each company on the basis of the present value of all future expected free cash flows, but every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers such as future revenue or earnings and resulting free cash flow, as examples. After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important concept worth emphasizing. If you knew everything about the future financials of the company as well as key macro information, you would be able to value the company with absolute certainty and so would everyone else. Why then would anyone ever pay a different price than that value, right? Therefore, under these parameters, the stock price wouldn’t change much. Why would it?

Now, let’s think about the market with all the varying opinions out there about future expected free cash flow. Some may think Microsoft is worth $370 per share based on their own free cash flow expectations, while others may think it is worth closer to $250. The assumptions within the DCF that drive these two fair value estimates may be quite reasonable, too. If Microsoft continues to execute, maybe $370 is the right answer; if Microsoft falters, perhaps it’s $250 per share.

This is how we think about a margin of safety or the fair value range we assign to each stock. In the graph of the fair value distribution of Microsoft, we show a probable range of fair values for Microsoft. In our opinion, we think the firm is very attractive below $246 per share (the green line), but quite expensive above $368 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

For optimistic investors like us, the high end of our fair value estimate range may be most appropriate. When we think of all the opportunities in artificial intelligence (AI) and how Microsoft has the lead with ChatGPT, it’s hard for us not to be excited about Microsoft, especially given the stickiness of Office and the potential behind its cloud operations. More importantly, ChatGPT may provide the catalyst for the market to continue to build in ever-increasing expectations of free cash flow, which is resetting its valuation higher.

Microsoft’s dividend growth potential is phenomenal. (Valuentum)

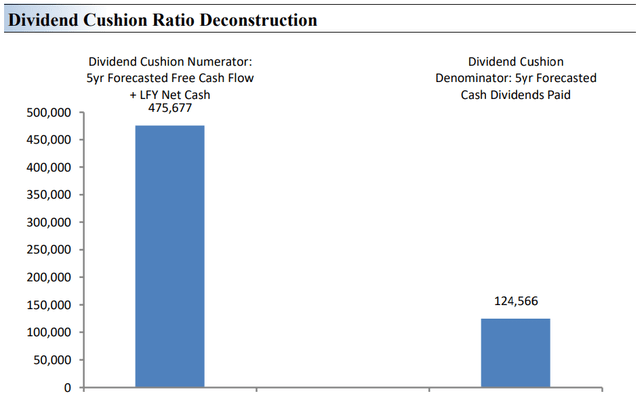

We talk about the Valuentum Dividend Cushion ratio frequently. The Dividend Cushion ratio sums up our expectations of a company’s free cash flow over the next five years and adds that to the company’s net balance sheet (net cash position) – left column in the image above. This is the numerator of the ratio. It then divides that sum by future expected cash dividends to be paid over the next five years – right column in the image above. That is the denominator of the ratio.

At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend. In the context of the Dividend Cushion ratio, Microsoft’s numerator is much larger than its denominator suggesting excellent dividend coverage in the future. We expect continued strong dividend growth at Microsoft, even as its pending Activision (ATVI) muddies the water a bit on the health of its balance sheet.

There are myriad risks to our thesis, but we don’t view any of them as tragic to our long-term thesis. First, if the equity markets face pressure, more generally, given Microsoft’s heavy weighting in various indices, shares of the company could face outsized pressure. While also providing opportunities, artificial intelligence also poses risks, particularly in the event that rivals encroach upon Microsoft’s existing product suite with technology that has yet to be developed. We like the company’s balance sheet a lot, but we’d prefer Microsoft to build businesses organically and not seek large acquisitions that could challenge its net cash position.

Finally, even though we don’t view our fair value estimate range of Microsoft to be that large, the low end of our fair value estimate range ($246 per share) can still be considered a fair valuation for the firm. However, if Microsoft’s shares were to approach those levels, many could grow very concerned about the long-term health of the company and maybe sell shares, further exacerbating any weakness in the stock. Said another way, given Microsoft’s fantastic run these past many years, profit-taking by those that have already made a bundle on shares could cause downside volatility in the stock.

Concluding Thoughts

All things considered, however, we continue to be huge fans of Microsoft. The company’s equity is supported by strong cash-based sources of intrinsic value, which also help to support its long-term dividend growth potential. Artificial intelligence is the catalyst to keep forward free cash flow expectations moving higher, in our view, and while deal-making could cloud its balance sheet a bit, we think the risk-reward for Microsoft’s shares remains firmly in the favor of long-term investors. We’re still big fans of shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.