Summary:

- MSFT bears are turned off by Microsoft’s recent lack of success in playing the guidance game.

- But for genuine investors (as opposed to guidance game scorekeepers), MSFT looks quite strong.

- Although many are now wary about AI, the reality is that it’s likely to turn out better than many realize.

- MSFT’s strength in enterprise and enterprise cloud is likely to make it an AI winner.

- But investors will need to withstand occasional episodes of angst by guidance-game devotees who demand perpetual perfection.

RudiHulshof/iStock via Getty Images

I’m going to write a book someday. I swear to God, I’m really going to do it. I’ve got the title: “Things I’ve Seen Washing Windows.”

Oh. Wrong book idea.

Those were among the lines I had shortly after coming on stage in The Witness. That’s a one-act play by Terrance McNally. I played a window washer. This was in a circa-1970 Ohio State University theatrical production.

Here’s the new book I’m considering: “Monroe Milstein: Investment Guru.”

Forbes celebrated him through a 2006 article entitled Rags to riches in the rag trade. I knew him later in his life as CEO of Burlington Coat Factory. Today, its known as Burlington Stores (BURL).

I covered the company for a while back in the 1990s. The guidance game that’s so prevalent today was starting then to come into its own.

You may be unfamiliar with the term. But you know the script. It requires companies to run, and handily win footraces against guidance and analyst estimates.

Did the company grow 87.3% year to year? Who cares! If analysts expected 88.9%, look out below.

The popular media loves this. That’s about eyeballs. And spectacular draws in plenty.

The data providers also love it. The greater the obsession, the more estimates-related data they can sell, the bigger the prices they can demand.

Investors accept the game because the media and data providers coached us to assume this is how it is.

But the late Mr. Milstein was a businessman. He didn’t know or care about the guidance game.

He lived in a different world… the business reality.

That became especially apparent in one memorable conference call back in the day. Many details faded from my memory. But one episode became etched forever in my mind.

Analysts were going hard at the CFO about weak same store sales that month. (Back then, the company conducted monthly calls.)

The poor guy was running out of answers… Imagine a live interview in which you’re repeatedly asked “Were you always incompetent, or did you just now become inept?”

Finally, Milstein, who had been sitting silently, jumped in. Speaking with his thick Eastern European accent, he said….

Gentlemen I’ve been in this business for more than 40 years. We’ve had good months and we’ve bad months. This was a bad month.

Silence!

None of the analysts who’d been haranguing the CFO had anything to say. Milstein and the CFO politely wound down call.

That was a powerful lesson.

The real world is not like an Excel spreadsheet. In the latter, precision can be made to reign supreme. Reality is more often than not slopy.

Trends zig and zag. Some months or quarters are great. Others are less so. Sometimes customer orders are brisk. Other times, they’re less so.

That’s especially so among big enterprise customers. They have their own investors and analysts to deal with. They, too, try to meet or beat the guidance they gave.

But in truth, to real investors, this stuff fades away. Eventually, investors look back and realize the fuss was no more significant than a pimple on an elephant.

Understanding all this, seeing the world through the Milstein lens, makes it clear that Microsoft (NASDAQ:MSFT) bears are obsessing over a pimple. In truth, the company has lately been, still is, and looks highly likely to remain, an AI powerhouse.

Today’s AI is Far More Primitive and Needs Much More Work Than Many Realize

Actually, I explained in my July 24, 2024 Dell (DELL) write-up that Artificial Intelligence doesn’t truly exist.

Computers are stupid. They never have, can’t and never will think. (I even quoted

ChatGPT 4o, the AI poster child, as a source for this!)

Everything comes down to combinations of “1” or “0.” Those stand for electric current being “on” or “off.” Even ChatGPT admitted that humans program everything.

What we’ve been calling AI is really the same old tasks improved by more, better, and faster.

But despite how much progress we’ve made with more, better and faster, we’re still stuck in the AI equivalent of the Paleolithic era.

If you haven’t already been struck by this in real life, you’re luckier, or less active, than most.

Consider automated customer support.

This is an important use of AI. Don’t take my word for it. Believe ChatGPT 4o.

When I posed that question, it answered…

Yes, virtual customer service is indeed a major application of AI. AI-powered virtual assistants and chatbots are increasingly used by businesses to handle customer inquiries, provide support, and even facilitate transactions. These systems use natural language processing (NLP) and machine learning to understand and respond to customer queries effectively, improving efficiency and customer satisfaction. They can handle routine tasks, provide information, and even learn from interactions to enhance their performance over time.

Presumably, we’re supposed to be impressed by reference to NLP.

I, however, took greater notice of the last sentence. ChatGPT admitted that these virtual agents must still “learn from interactions to enhance their performance over time.”

My translation… Virtual assistants stink and still need an insane amount of development and refinement. (In AI-speak, that includes “training.” That assumes hardware and code.)

Just a few minutes before writing this, I tried to ask my mortgage servicer for copies of lost closing documents it should have received when it acquired the loan. The AI could only tell me how to get monthly statements.

How about your experiences. How many times have you “spoken” with a virtual agent before you got frustrated started screaming “other” or “operator” into the handset?

Unless you’re a professional road tester, would you dare get into a robo-taxi? Or would you wait until the industry spends gazillions more to make the AI ready for prime time?

Bloggers, PowerPoint jockeys and app sellers tell us how wonderful AI is. I, an ordinary guy who touches it in the real world, know that’s not so. I strongly suspect you know it too.

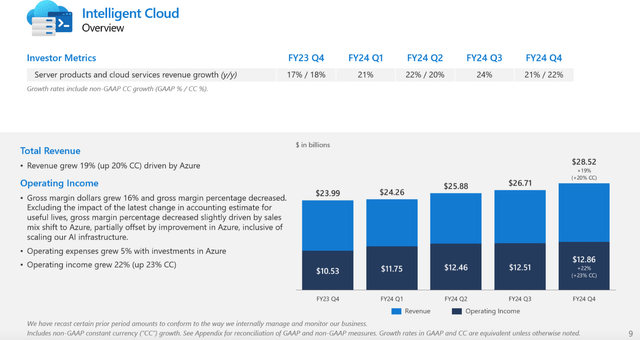

Enterprises that pay for MSFT’s Intelligent Cloud Azure cloud services know it. They aren’t necessarily saying so to the press. But they are speaking loudly and clearly in their rush to throw money at MSFT to buy more processing power.

That prompts us to take …

A Fresh Look at MSFT’s Latest Quarter and its AI Situation

I’ll sum it up in one word… Amazing,

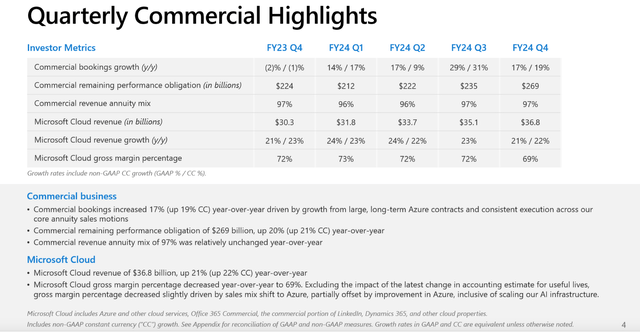

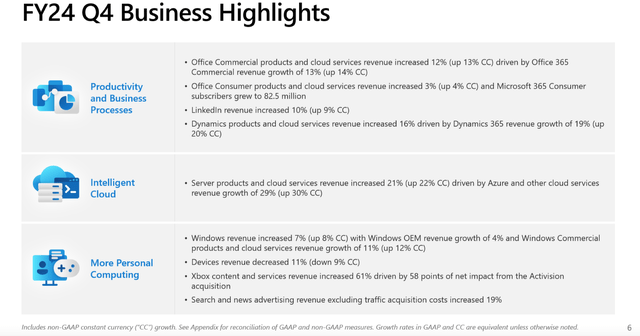

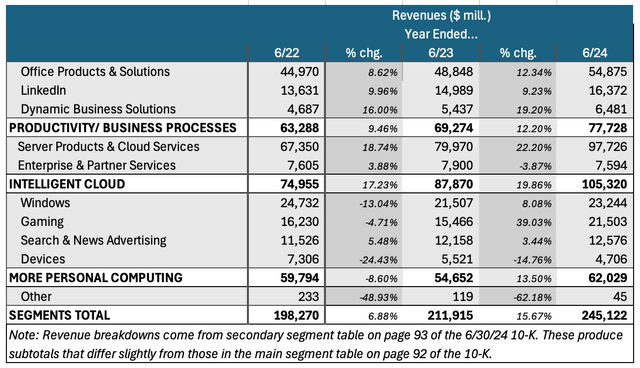

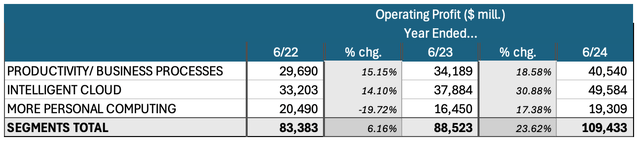

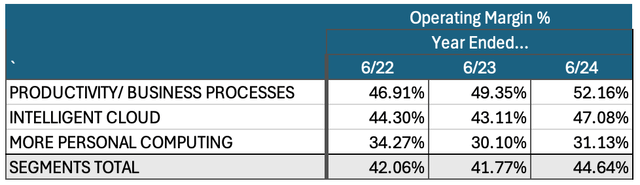

The images below provide a quick summary. (I focused more on Intelligent Computing. That’s where the AI build-out is most directly monetizing.)

If you look closely, you’ll see that the latest (fourth fiscal) quarter was a tad less wonderful than the third quarter.

That’s OK. It’s life. It’s business. Think about Monroe Milstein, not fantasies of perfection.

The big picture is what really counts. On AI, MSFT management was as clear as clear can be on the latest (7/30/24) earnings call…

The company is not overbuilding. It’s building to address customer need (“demand signals”). And right now, it’s capacity constrained. Consider this, from CFO Amy Hood on the latest call:

[T]he pace at which we fill those builds with CPUs or GPUs will be demand-driven. And so if we see differences in demand signal, we can throttle that investment on the CPU side, which we’ve done for I guess, a long time at this point, as I reflect, and we’ll use all that same learning and demand signal understand to do the same thing on the GPU side. And so you’re right that you could see relatively consistent revenue patterns and yet see these inconsistencies and capital spend quarter-to-quarter.

CEO Satya Nadella likewise referred to the “demand signal” when describing developer-oriented offerings like GitHub and GitHub Copilot:

I would say – and obviously, the Azure AI growth, that’s the first place we look at. That then drives bulk of the CapEx spend, basically, that’s the demand signal because you got to remember, even in the capital spend, there is land and there is data center build, but 60-plus percent is the kit, that only will be bought for inferencing and everything else if there is demand signal, right? So that’s, I think, the key way to think about capital cycle even.

The asset, as Amy said, is a long-term asset, which is land and the data center, which, by the way, we don’t even construct things fully, we can even have things which are semi-constructed, we call [cold] (PH) shelves and so on. So we know how to manage our CapEx spend to build out a long-term asset and a lot of the hydration of the kit happens when we have the demand signal.

There is definitely spend for training. Even there, of course, we will only be scaling training as we see the demand accrue in any given period in time. So I would say it’s more important to manage, to capture the opportunity with the right product portfolio that’s driving value.

And right now, demand is very strong. Here, again, is Hood:

[W]e are constrained on AI capacity. And because of that, actually, we’ve, to your point, have signed up with third parties to help us as we are behind with some leases on AI capacity. We’ve done that with partners who are happy to help us extend the Azure platform, to be able to serve this Azure AI demand.

Compare those remarks with what Alphabet (GOOGL) CEO Sundar Pichai said on that company’s 7/23/24 call:

[W]e are at an early stage of what I view as a very transformative area and in technology when you are going through these transitions, aggressively investing upfront in a defining category, particularly in an area in which in a leveraged way cuts across all our core areas our products….

[W]hen we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing. We clearly — these are infrastructure, which are widely useful for us. They have long useful lives and we can apply it across, and we can work through that. But I think not investing to be at the frontier, I think definitely has much more significant downside.

GOOGL gave voice to the very thing that rightfully worries the bears… whether companies, gripped by FOMO (Fear of Missing Out) are building more than the world needs.

It makes sense to see two very different takes for MSFT and GOOGL.

Both companies are arguably equal in terms of investment-community stature. Both are so-call Magnificent 7 mega-caps.

But they aren’t identical, even within AI.

As I discussed in my June 13, 2024 GOOGL article, GOOGL is a titan where MSFT is a shrimp. That’s search advertising.

But the roles reverse in the cloud. MSFT, together with Amazon.com’s AWS unit, are the industry’s giants. GOOGL, on the other hand is, as I labeled it, a “pipsqueak.”

(And within the Microsoft-AWS duopoly, AWS tends to be less expensive. It’s favored by first-time and small- and mid-size users. MSFT, however, is big among enterprise customers. That’s especially so for enterprises that are already hooked on its other products and appreciate its willingness to serve hybrid cloud-premises environments.)

The bottom line here: I don’t accept GOOGL as a serious authority on the AI build-out.

AI is about doing more things, doing them better and doing them faster than we’ve ever seen or imagined. There are lots of companies working to make that possible.

MSFT’s Intelligent Cloud unit plays a major role in helping enterprise AI developers develop, train (i.e., refine) and operate models. I take it much more seriously than tiny wannabe FOMO Google Cloud as the more serious indicator.

Now, let’s consider what’s important and what’s not in MSFT’s numbers…

The Pimple on the Elephant Versus the Whole Elephant

Given the Street’s generational obsession with the pimple (the guidance game), let’s check MSFT’s report card.

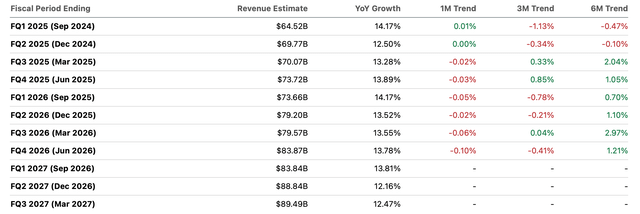

We don’t have direct data on guidance. But we can infer the Street’s reaction to it through the way analysts revised estimates based on what they learned.

Here’s how Quarterly EPS Estimates changed over the past one, three and six months.

Here are the Quarterly Sales Estimate revisions:

Actually, these aren’t disasters. But recall investors’ strictness in demanding upward revisions. Note, too, the Street’s apparent rubric change that now demands stronger upward revisions.

Fortunately for MSFT stock, it didn’t tank after it reported the quarter. But there’s been enough bearish rhetoric to push it down, along with many other tech and AI issues.

Clearly, MSFT is only a meh guidance-game player.

Turning now from the pimple to the whole elephant reveals a much better picture.

Here are the latest quarterly figures.

As per my usual practice, I don’t compare anything to earlier estimates. Prefer to see the numbers in the context of larger trends.

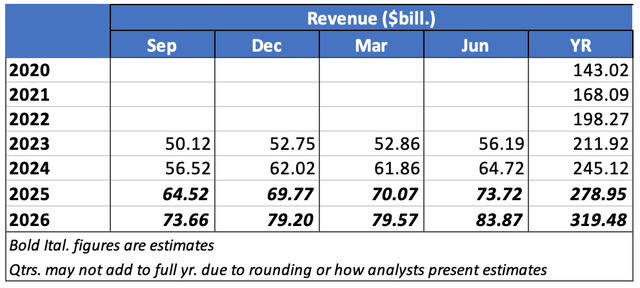

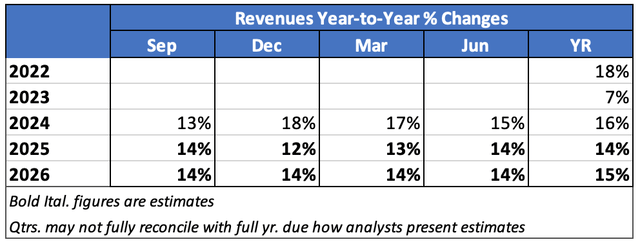

Here’s the revenue situation.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

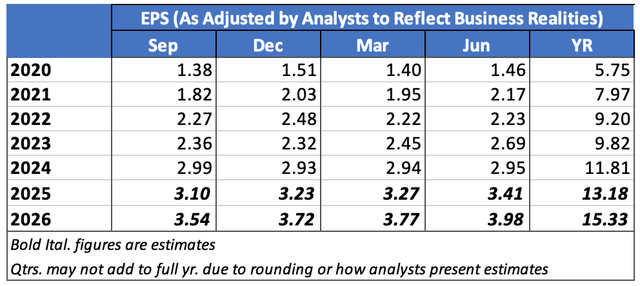

And here are the EPS trends.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

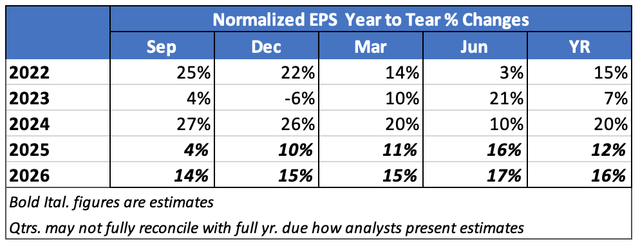

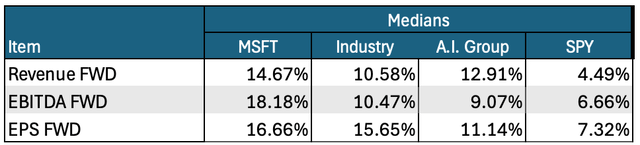

Now let’s look at some annualized growth rates.

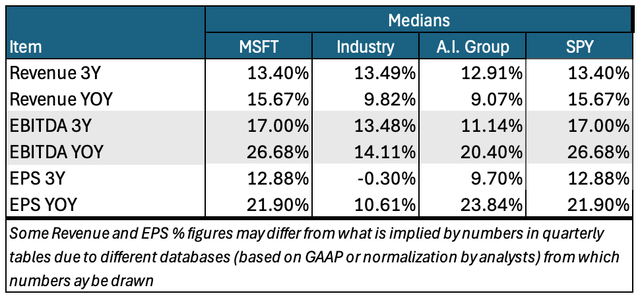

As is usual for charts, I compare company figures to benchmark medians. These aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.

And based on standard practice, I compare MSFT to the holdings of the SPDR S&P 500 ETF (SPY). I also sow industry medians. In this case, we’re looking at the Systems Software industry.

That’s a reasonable industry for comparison. But it’s not the only possible peer group.

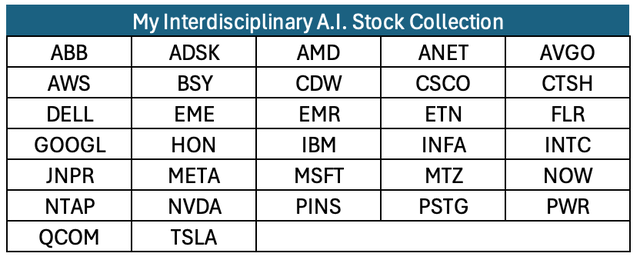

So, I created what I call an A.I. Group. I hand-picked 32 stocks that seem, to me, to be reasonable plays om the progress of AI. It draws from a variety of industries.

Here are the tickers I used.

(You may think of some, or many, I omitted. Feel free to make suggestions in the comments. I think it’s worthwhile to keep refining this list for future use.)

Here now are summaries of past annual growth rates.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

And here are forward-looking growth expectations.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Perhaps the most striking observation from these tables involves what we don’t see. We’re not seeing wild crazy super-duper growth rates.

I’d describe these percents as pretty good. And we’re seeing reasonable, albeit imperfect, consistency.

These numbers don’t inspire me to beg for airtime on a major network. I’m not dying to urge everybody to invest all they have in MSFT, to the exclusion of all else.

This is good. In fact, for investors who fear bubbles, as ,many now do, this is great.

Extremes are rarely sustainable. (That’s how bubbles burst. Extreme growth or extreme forecasts deflate.)

That said, MSFT is hardly a non-grower. AI is for real. And starting in the late teens, it’s been contributing handsomely to MSFT corporate wealth.

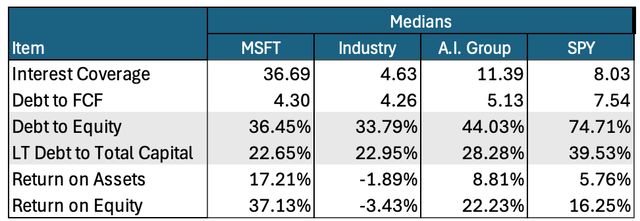

Here’s a fundamental picture of MSFT.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Again, that terrific. And it’s not depicting a bubble-like extreme.

You may wonder about the 30+ percent Return on Equity (ROE). This, for MSFT, is not an extreme.

I downloaded a 30-year spreadsheet from Microsoft Corp (MSFT) Stock Price & 30 Year Financial Data | GuruFocus. From that, I calculated, for this company, a 34.6% 10-year average ROI, a 34.8% 20-year average ROI, and a 31.8% 30-year average ROI.

Meanwhile, MSFT’s segment data shows its strongest businesses are its largest.

Author compilation based on pages 92-93 of 2024 10K Author compilation based on pages 92-93 of 2024 10K Author compilation based on pages 92-93 of 2024 10K

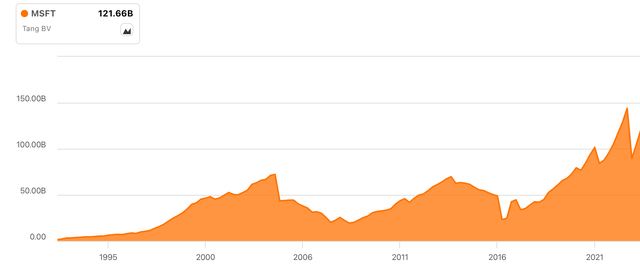

Finally, here’s a long-term chart tracing MSFT’s tangible book value.

This means a lot.

Quarters come and quarters go. Ultimately, though, we want to see wealth accumulation. Tangible book value shows just that.

It’s not an esoteric or stale accounting idea. It’s a tally of accumulate “retained earnings” over time. (See my July 28, 2024 MU write-up for more on this.)

This pattern analysis (I’ll bet ChatGPT can’t replicate it!) depicts reasonable business-like participation in a growing field. It’s a far cry from any sort of tulip-bulb like mania.

Risk

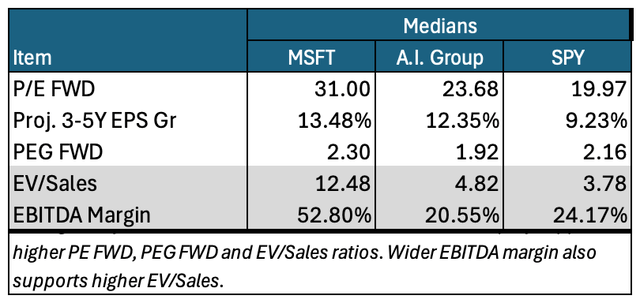

As with many of today’s most promising companies, valuation is a key risk. Below, I’ll discuss this specifically for MSFT.

General business conditions pose risk.

MSFT isn’t in danger of falling off a cliff. But no company, MSFT included, is immune against the possibility customers may slow the pace of spending.

Management here gets this. That’s why discussion of spending plans refer to “demand signals.”

But the Street is another matter. Oh, that darned guidance game…

In the short term, that hits stocks. So, to own MSFT, you’d have to be willing to endure occasional turbulence.

Along those same lines is AI-sentiment risk. Scary rhetoric attracts attention. The more bears remind folks of the 2000 internet bubble that burst, the more attention they get. That’s so even if analysis and comparisons are flawed.

The market’s most recent experience shows that MSFT shareholders will have to tolerate periods of Sentiment risk.

What to do About MSFT Stock

The stock looks expensive.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

(Notice that I didn’t bother to show these industry medians. There are enough Systems Software firms with poor fundamentals and whacky data points to skew even median figures.)

But MSFT’s high P/E FWD and PEG FWD are reasonable considering the Proj. 3-5Y EPS Gr.

At first glance, EV/Sales seems stratospheric.

But that’s acceptable for a perennially high margin business like MSFT. I explain more valuation theory in my May 28, 2024 NVDA article.

So, MSFT’s valuation may superficially look bubble-like. But given relevant fundamentals, that’s really not so.

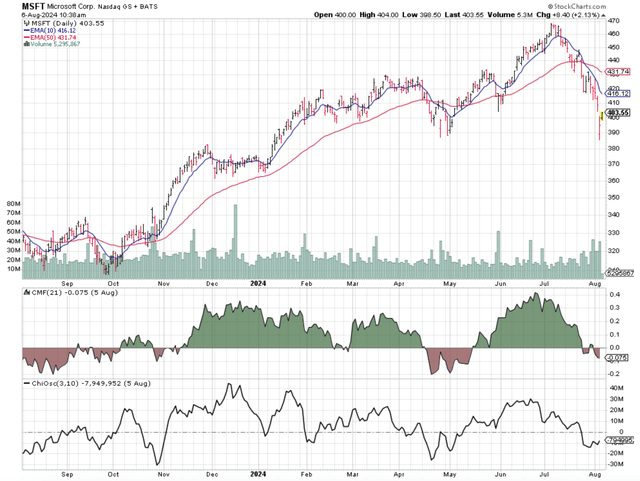

Meanwhile, as with many stocks, even good ones, the chart shows the impact of ongoing negative sentiment.

MSFT fares badly under everything I consider. The price tumbled through the 10-day and 50-day exponential moving averages (EMA). And the 10-day went below the 50-day.

The Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO) measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both slid moderately below neutral. Sellers being slightly more motivated than sellers is a headwind against the stock.

The one bright spot is the very last price bar. It marks a U-turn from what had been a relentless slide.

Note, though, that similar chart patterns are now widespread. Much of the bearishness is market-based. MSFT isn’t being singled out.

I’m not an expert market timer. So, as I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market, but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market, but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating MSFT as a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.